Tweets....

UK Election items ....

Derek Gatopoulos retweeted

MineForNothing retweeted

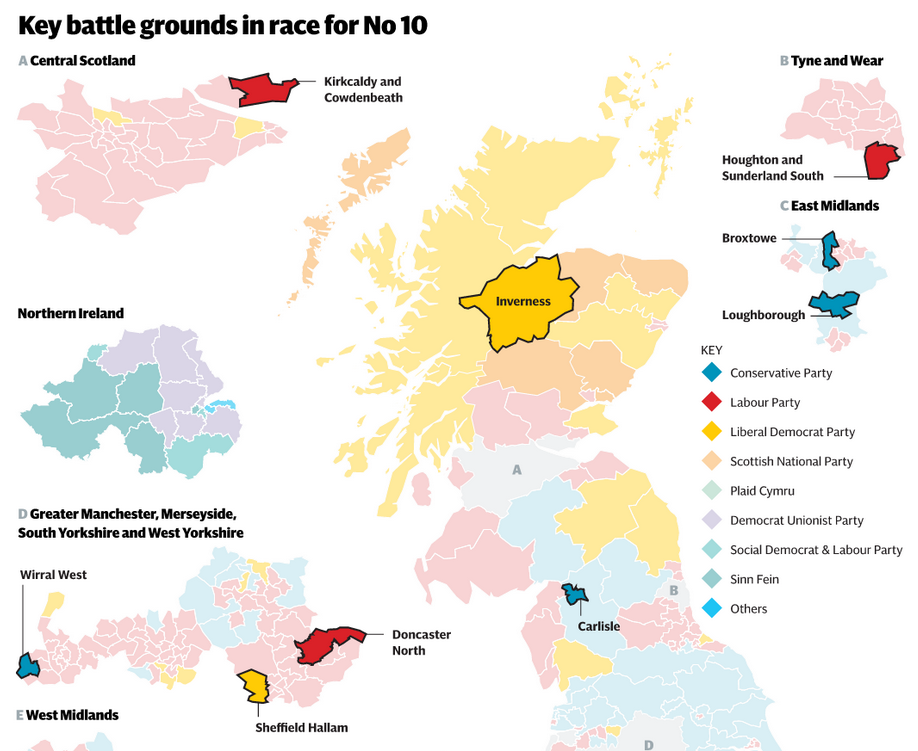

The 22 swing seats and key battlegrounds in the race for Number 10 http://www.telegraph.co.uk/news/general-election-2015/11588376/22-swing-seats-and-key-battlegrounds-in-the-race-for-10-Downing-Street.html … #GE2015

A single exit poll will be released at 10pm tonight. The poll is jointly commissioned by the BBC, ITV and Sky. #GE2015

Greece....

GREECE'S PUBLIC DEBT NOT SUSTAINAINABLE, GOVT SPOKESMAN SAYS

...more bailouts needed

GREEK GOVERNMENT SPOKESMAN SAYS LENDERS CAN'T EXPECT GREEK GOVT TO BACK DOWN ON EVERYTHING IN ORDER TO REACH A DEAL

GREECE WANTS TO CONTINUE SERVICING ALL OBLIGATIONS: SPOKESMAN

...better get another bailout then

GREECE SAYS WILL PRESENT MEASURES ONLY WHEN DEAL REACHED

"There is a strong feeling within Syriza that there should be a referendum on the final agreement between Greece and the institutions"

New fiscal measures aim to edge #Greece closer to deal with lenders. http://www.macropolis.gr/?i=portal.en.economy.2492 … #economy #ec #ecb #imf #eurogroup #markets

Including today's non-competitive bids of €262.5 mln, #Greece rolled over €1.4 bln 6-mon T-Bills at 2.97% this week. #economy #ec #ecb #imf

Eurogroup Chairman Dijsselbloem confirms to @lemondefr that "it's too early to expect a final agreement" at the 11 May Eurogroup. #Greece

ECB Executive Board Member Mersch: "There've been defaults in other monetary unions without political consequences". #Greece (@LaVanguardia)

The background behind the @atsipras @JunckerEU common statement. Why was it made. http://www.kathimerini.gr/814187

MERSCH CITES PARALLEL CURRENCY AS POSSIBLE GREEK MEASURE

....Mersch is ECB Executive Board member!!!

Broader Europe....

MineForNothing retweeted

FYI: ECB deposit facility usage increased to €123.15 billion from €103.383 billion tuesday.

MineForNothing retweeted

*SIEMENS TO CUT 4,500 JOBS AT UNDERPERFORMING UNITS

Frederik Ducrozet retweeted

Almost there

Who will bail out Germany?

Edward Hugh retweeted

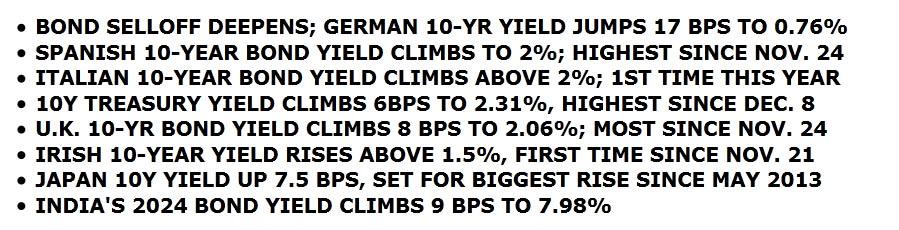

Bund crash draws all attention, but French bonds tumble as well. 10yr French yield jumps >1% for 1st time sine Dec.

Edward Hugh retweeted

#Bonds Extend Tumble as #Spain, #France Sell Debt Into Market Slump http://bloom.bg/1EbqQXE @worrachate @eshelouise

Edward Hugh retweeted

Bund sell-off becomes disorderly. 10yr yield now 18bps higher at 0.76%.

Edward Hugh retweeted

Panic selling in Bunds: Bund Future crashes.

Edward Hugh retweeted

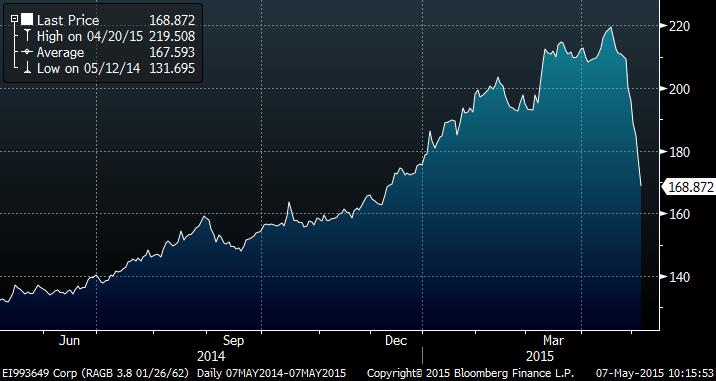

#Bonds #ECB #VaR hospital pass in long date #EUR bonds now a duration bloodbath, #Austria 2062 down 50 pts from high!

This morning

Global Bond Rout Sends Futures Tumbling, Bund Has Sharpest Two-Week Selloff In History http://www.zerohedge.com/news/2015-05-07/global-bond-rout-sends-futures-tumbling-bund-has-sharpest-two-week-selloff-history …

No comments:

Post a Comment