Tweets.....

Greece.....

Schauble - Varoufakis presser - highlights....

@SpiegelPeter @ekathimerini Here's an alternative view. Game is indeed on. http://coppolacomment.blogspot.co.uk/2015/02/what-on-earth-is-ecb-up-to.html … What if becoming weaker strengthens you?

Elsewhere in Europe....

Greece.....

Schauble - Varoufakis presser - highlights....

#Varoufakis "It's up to Eurogroup to come up with bridging program" #Greece

#Varoufakis when asked about the conditions in current programme that Greek gov't cannot fulfill: "I could go on forever."

VAROUFAKIS: "WE WILL DO EVERYTHING IN OUR POWER TO AVOID DEFAULT"

MNI: VAROUFAKIS: WE DON'T HAVE IMMEDIATE RIGHT TO IMPLEMENT PROGRAM

#Varoufakis: "Our proposal is that there should be a bridging program between now and May so we can agree new contract" #Greece

Once again, @yanisvaroufakis says #Greece will let current bailout lapse at end of month. Most important substantive statement yet.

WOW. Varoufakis compares Greece's condition to Germany before the rise of Hitler. Says Germany should be able to relate.

#Varoufakis "As we are suffering deflationary debt crisis, no other nation can understand us like the Germans" #Greece

Albert Broomhead retweeted

VAROUFAKIS: GRAND ERROR WAS SOLD VIA A LIST OF REFORMS; THAT FAILURE IS THE REASON WE ARE HERE TODAY

#Varoufakis "Greeks want to end indignity & Germans want to end having to end negotiating each twist and turn" #Greece

Schaeuble: "We agree to disagree"

Varoufakis "We didn't even agree to disagree"

This could be a long one #Greece

#Varoufakis "We didn't discuss Greece's debt schedule & haircut. We discussed how to end this seemingly never-ending crisis" #Greece

Schäuble: "We agreed the haircut is not on the agenda". #Greece #Varoufakis

Who lent the money again? German finance minister Schäuble says Greece is to blame for its problems, not Europe.

SCHAEUBLE SAYS HAVE GONE TO THE LEGAL LIMITS IN PROVIDING AID for insolvent banks

#Schäuble: A difficult question as to how Greece can access market financing without bailout programme - No agreement on this today.

#Schaeuble "If program were to be changed, there would be a need for an agreement for all parties involved" #Greece

#Schäuble: Cannot change some #eurozone polices without treaty changes - need the sovereign backing of voters (i.e. not to fiscal transfers)

Schäuble: Varoufakis has told me that the reversal of reforms is not decided. | Really?

I am sceptical of some of the measures announced by Greece, says Schäuble. Some measures don’t go in the direction we want to see.

#Schäuble: We respect the Greek voters - but we also respect the voters in other #Eurozone countries. #Greece

#Schaeuble "Some of the measures announced by Greek gov't are going in right direction: Taxes & fighting corruption" #Greece

#Schaeuble "#Greece has to cooperate with the three institutions that formed the program, the Commission, ECB & IMF"

Schäuble: #Greece belongs to the euro

Schäuble: We have agreed that roots of #Greece's problems lied in Greece itself not in Europe and not in Germany.

#Schäuble: I always remind my colleagues not to forget how difficult it has been for the Greek people.

Moscovici: We are expecting exact Greek proposals to find a way to keep Greece in eurozone & keep meeting its commitments ~@tconnellyRTE

Greece's Efimerida ton Syntakton calls ECB decision: "Psychological warfare by the ECB chief - Everything "staged by Berlin & Merkel govt."

Yes, I can confirm that the so-called bailout of #Greece was actually a bailout of largely #German #French banks - Public bailout of Private

#Greek reaction to ECB decision to restrict liquidity: Conservative paper Eleftheros Typos calls it - "The Draghi Bomb."

ECB’s Weidmann: Greece Decided to Stop Cooperating With Troika

Greece says eager for deal, but will not be 'blackmailed' http://reut.rs/1AvaJH7

#Greece | GREECE GOVT OFFICIAL SAYS ECB HAS RAISED CAP ON EMERGENCY FUNDING BY 10 BLN EUROS, BANKING SYSTEM IS PROTECTED

Germany wants new Greek rulers to ditch promises: document http://reut.rs/1DFf2NZ via @reuters

(Reuters) - Germany wants Greece's new left-wing government to go back on anti-austerity promises made in its first days in office and revert to economic policies its predecessors' agreed with international lenders, a document showed on Wednesday.

Greece promptly rejected such calls.

****

BullionStar retweeted

Paul Mason retweeted

To recap, Eurosystem funding of Greek banks (Dec est.):

<8bn GGBs (3.5bn T-bills)

25bn state-guaranteed bank bonds

17bn EFSF

+ others =56bn

#Greece Banks after minutes in session -23%

Banks with highest exposure to Greek debt:

Eurobank 20%

Piraeus Bank 2.1%

Credit Suisse 0.2%

Attica Bank 0.1%

Commerzbank 0.1%

Paul Mason retweeted

@paulmasonnews @Simon_Nixon @Dannyvis Not particularly chilled out - all the money that trickled back in in 30 months left again in two.

Presidential candidate expected to be announced next week http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_04/02/2015_546900 … #greece

Greece holds debt talks with Germany as ECB turns screw on Athens - live updates http://bit.ly/1xntGUX

ECB fires warning shot by refusing to accept Greek gov't bonds as collateral http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_04/02/2015_546901 … #greece

Denial not just a river in Egypt, apparently MT @ekathimerini: Greek Finance Min sez ECB decision aimed at Eurogroup http://ekathimerini.com/4dcgi/_w_artic …

"I'm sure Mr Schaeuble & any decent European agrees not right for Greeks to go hungry due to errors in tackling crisis" Varoufakis tells ARD

Emergency liquidity assistance for Greek banks: An explainer http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_05/02/2015_546908 … #greece

What the ECB's move on Greek government debt is really all about http://www.ekathimerini.com/4dcgi/_w_articles_wsite3_1_05/02/2015_546907 … #greece

"This is a systemic crisis & it has to be tackled systematically, not by pointing fingers at each other," Varoufakis tells ARD #Greece

"Greece is canary in mineshaft, which dies 1st because it's weakest but it is not responsible for toxic gases," Varoufakis tells ARD "Greece

"Only thing we're asking is not to be given ultimatum. We need until May to negotiate with partners," Varoufakis told ARD last night #Greece

End of waiver at the #ECB for Greece means Greek banks now how to convert over EUR 30bln of financing into more expensive ELA financing

Elsewhere in Europe....

GERMAN 2Y YIELD HITS RECORD-LOW -0.208% ON ECB GREEK BANK MOVE

BREAKING: Hollande, Merkel begin Kiev-Moscow 2-day #Ukraine peace plan tour http://on.rt.com/xthuaf

HRYVNIA EXTENDS LOSSES, WEAKENS 32% PER USD AFTER FLOTATION

Ukrainian Central bank raises overnight refinancing rate to 23% from 17.5%

Ukrainian Hryvna falls to 18.75 vs. US dollar.

Today is getting surreal: "IMF Said to Seek Limit to Ukraine Bailout Share as War Escalates" BBG

Draghi tells Tsipras "don't worry, it's ok: you still have ELA... which we will pull on Feb 28 unless you agree to our terms"

Mish's Global Economic Trend Analysis: ECB Revokes Greek Bonds as Collateral; ECB vs. Novices; Brass Knuckles via @po_st

Swiss Consumer Confidence Fell After SNB Cap Exit, Survey Finds http://www.bloomberg.com/news/articles/2015-02-05/swiss-consumer-confidence-fell-after-snb-cap-exit-survey-finds … via @business

Asia......

Edward Hugh retweeted

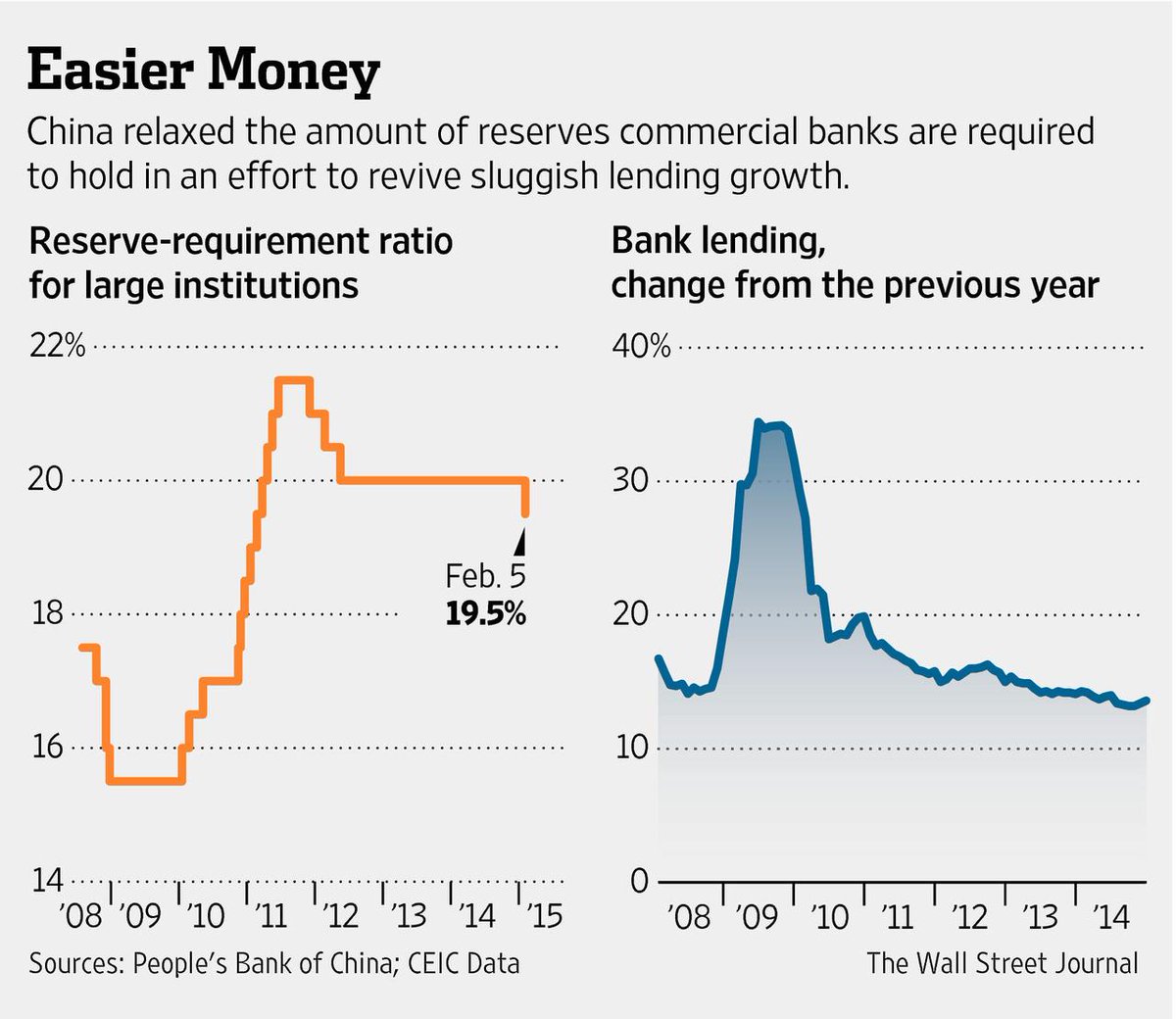

PBoC's 1st RRR cut in almost 3 yrs. 50bps cut adds up to RMB600B to China's banking system - via @HaidiLun

You mean it's not a "supply thing"? “@ReutersBiz: Oil picks up on hopes China's easing will spur demand http://reut.rs/1Auo2aR ”

PBOC TO INJECT 30B YUAN WITH 28-DAY REVERSE REPOS: TRADER. Looks like China needs ELA more than Greece

‘Lice and petloleum’: Argentina’s president mocks Chinese accent as she meets Xi Jinping http://ow.ly/Iwm7y

New worries about China's economy as leaders give banks $100 billion to lend http://on.wsj.com/1zicDJk

Robin Wigglesworth retweeted

Gulp. @FT interactive graphic shows the rise of debt in #China. http://www.ft.com/cms/s/0/893d5dc2-ac6d-11e4-9d32-00144feab7de.html#axzz3Qrle7V4l …

MNI Eurozone

MNI Eurozone  zerohedge

zerohedge

*Russian Market

*Russian Market

Frederik Ducrozet

Frederik Ducrozet  Yannis Palaiologos

Yannis Palaiologos

Wall Street Journal

Wall Street Journal

Denise Law

Denise Law

No comments:

Post a Comment