Tweets .....

Greece....

Red lines update...

#Greece & creditors are close to agrmnt on:

-VAT & tax collection

-Privatizations list

-Banking sector stability & NPLs

~EU srce to @Real_gr

Civil service reforms overturned in Greece - even as Troika seeks labor reforms ?

Deputy PM Dragasakis denies split in Greek gov't following reports he was unaware of non-paper issued by Athens before his ECB talks #Greece

No wonder negotiations will drag into June then... or even later?

Reuters is reporting that #Greece has met its €200mn payment to the #IMF, due today. But plenty of payments to go.

Greek 5yr default probability continues to rise as the blame game between #Greece and it's creditors is in full swing

Frederik Ducrozet retweeted

#Greece The seasonally adjusted unemployment rate in February 2015 was 25.4% compared to 27.2% in February 2014 and 25.6% in January 2015

#Greece makes IMF payment, another looms (from @AP) http://bigstory.ap.org/urn:publicid:ap.org:7d6aeefc07f443048baf7265a10c74be …

The Greek Analyst retweeted

Thessaloniki Mayor Boutaris breaks ranks & transfers cash reserves so Greek gov't can cover short-term needs http://ekathimerini.com/4dcgi/_w_articles_wsite1_1_05/05/2015_549739 … #Greece

Dragasakis goes to ECB to convince deal near as Greek gov't claims no deal in sight. Keep 'em guessing, boys https://shar.es/1pT3HR #Greece

#Greece auctions €875 mln 6-month T-Bills. Total roll-over amount at €1.4 bln. Prev yield at 2.97% last month. #economy #markets

Broader Europe....

Frederik Ducrozet retweeted

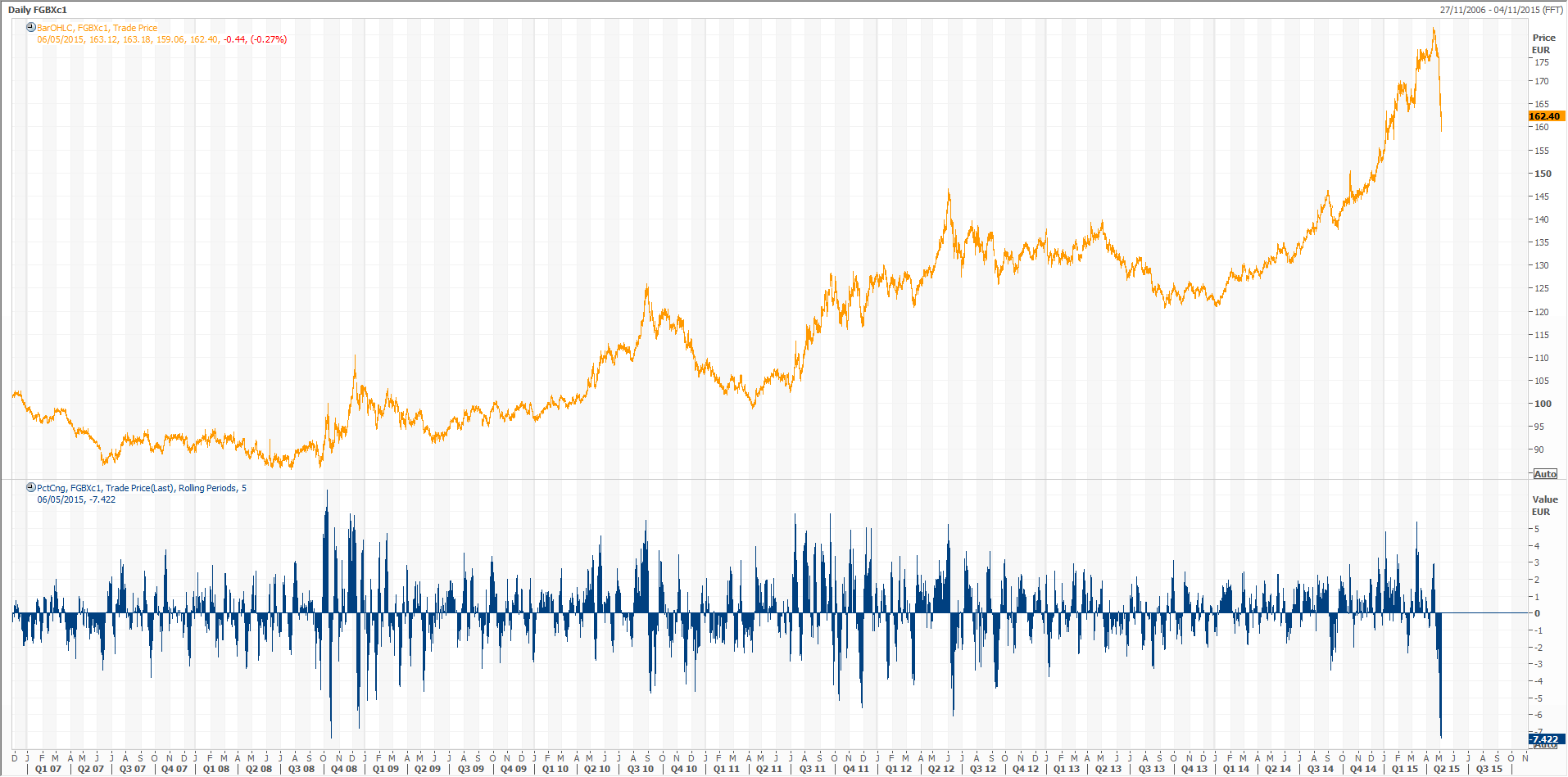

30-yr BUXL futures are set for their biggest week/week fall since the collapse of #Lehman in 2008 #MeltdownFest

*EURO-AREA MARCH RETAIL SALES DECREASE 0.8% FROM PRIOR MONTH - below consensus but with upward revision to Feb to +0.1% MoM

#Italy Markit/ADACI Services PMI Apr: 53.1 (est 52; prev 51.6)

-Markit/ADACI Italy Composite PMI Apr: 53.9 (est 52.7; prv 52.4) ~@livesquawk

Markit: Activity growth in #France's service sector slows further in April. Services Activity Indx 51.4 (52.4 in Mar) http://ow.ly/MzSzj

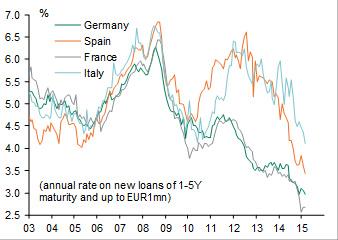

More good news? Interest rates on new SME loans down in March, to new record lows in Spain (3.4%) and Italy (4.1%).

#ECB causes flash crash in Bunds. Rational trading in irrational QE game led to brutal moves. http://www.breakingviews.com/21197311.article?h=0ae8399c9ae76dab62a72b95b4d2ca96&s=2 …

Sell-off in #Eurozone bonds continue. 10yr govt bond yields of Italy and Spain spike, make fresh 2015 highs.

Holger Zschaepitz

Holger Zschaepitz

No comments:

Post a Comment