Tweets...

Varoufakis apparently attacked Tuesday in Greece...

Greek Finance Minister Attacked By Anarchists, Shielded By Wife

#Greece government sees reform multi-bill as path to funding but resistance abounds. http://www.macropolis.gr/?i=portal.en.politics.2471 … #politics #economy #ec #ecb #imf

#ELA (cash) liquidity buffer almost unchanged at around €3bln. #Greece #economy #ecb #banking #markets

Edward Hugh retweeted

Greek banks get more funds -- but #ECB signals future access to funds will be harder http://bloom.bg/1FwJ0Y9 via @business

Greek deposits in the banking system hit new 10 year low ... bullish!

***Greece expected to present draft reform legislation to international lenders on Wednesday - gvt officials - RTRS

Greek Banks Count on More #ECB Cash as Bailout Talks Drag On http://bloom.bg/1FwFwoA via @business #Greece

Europe’s deflation specter moving on as #Greece clouds recovery http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_29/04/2015_549553 … via @ekathimerini

The Greek Analyst retweeted

Νοte to Greek govt: Any interim agreement w the creditors, i.e. partial disbursement, would require Bundestag approval. Good luck with that

The Greek Analyst retweeted

Possible refusal of the creditors to strike an interim agrmnt w the Greek govt could serve quite well in a blame game & referendum/elections

GERMANY FAILS TO GET BIDS TO MEET SALES GOAL AT DEBT AUCTION

GERMANY GETS BIDS FOR EU3.649B 5-YEAR NOTES VS EU4B SALES GOAL

German yields +6bps today... That was the yield on the 10-year just two weeks ago!

MineForNothing retweeted

RIKSBANK EXPANDS QE PROGRAM, WILL BUY BONDS FOR SK40-50 BLN

RIKSBANK SAYS REPO RATE 'MAY BE CUT FURTHER'

#Euro jumps above $1.10 on whopping #Eurozone data. #M3 money supply rose further to 4.6% YoY in Mar, a 6yr high.

End of the credit crunch? #Eurozone bank lending increases for 1st time Since Mar2012. http://bloom.bg/1PWdype

#ECB's Draghi might need Janet Yellen to bail him out in bond mkt as EZ investors hoard debt. http://bloom.bg/1JzOWlo

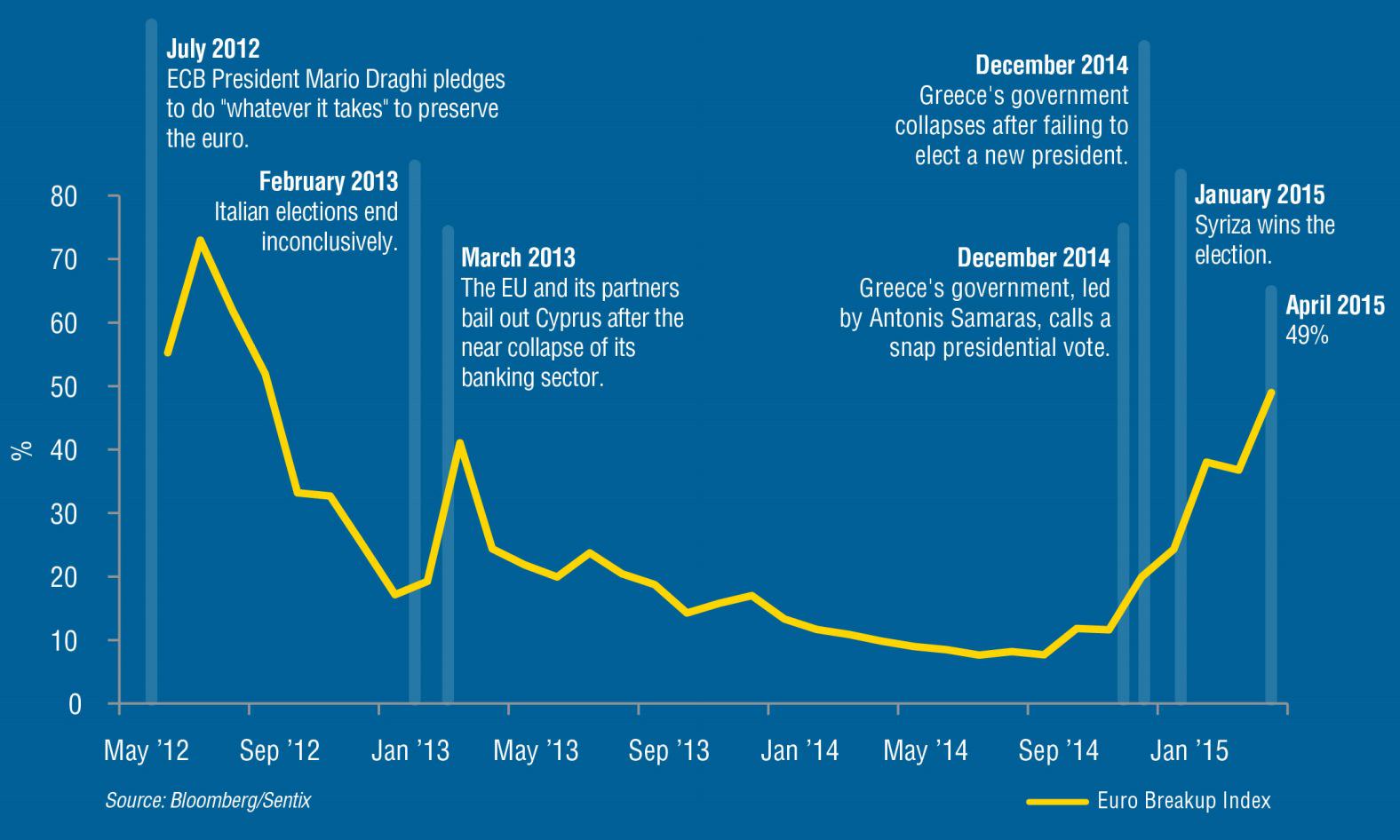

Rising #Grexit fear don't make it more likely: Investors underestimate political will to keep bloc intact. (via BBG)

Edward Evans

Edward Evans

No comments:

Post a Comment