Europe......

#Germany :Lower House of Parliament approves joining military campaign against IS in #Syria http://f24.my/YTliveEN

VIDEO - Europe migrant crisis: Thousands try to push their way on the Greek border with… http://f24.my/21B5MI2

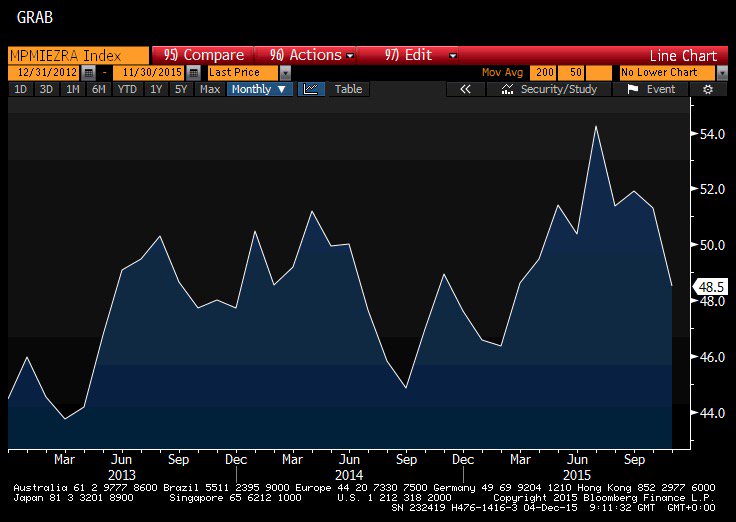

#Eurozone | Nov Retail PMI: 48.5 v 51.3

Germany: 49.6

France: 47.8

Italy: 47.7

ECB's Mario Draghi might have missed the mark this time. Here's why http://bloom.bg/1PBicfr

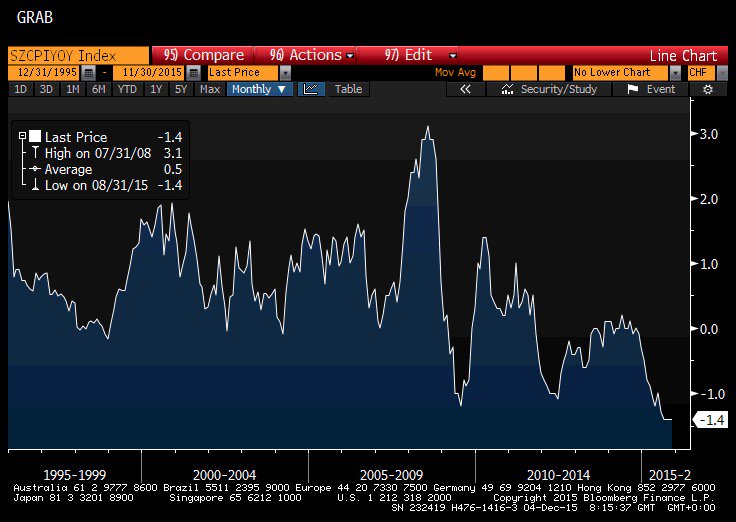

#Switzerland | NOV CPI M/M: -0.1% V 0.0%E; Y/Y: -1.2% V -1.3%E

#Spain | Oct Industrial Output SA Y/Y: 4.0% v 4.1%e...miracle

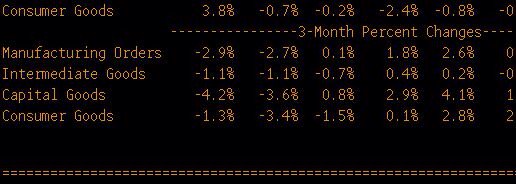

#Germany | Factory orders 3M trend -2.9%..

#Germany | OCT FACTORY ORDERS M/M: 1.8% V 1.2%E; Y/Y: -1.4% V -2.5%E

Draghi makes history: Thursday was the 3rd biggest intraday range (by percentage) for the Euro of all time. (via DB)

#ECB cancels currency war: Euro index jumps by almost 3%. http://bloom.bg/1NJsnOs

Asia , Emerging Nations & Commodities .......

#Japan #MOAR | JAPAN GOVT ARRANGING TO COMPILE EXTRA STIMULUS SPENDING WORTH 3.3 TRLN-3.4 TRLN YEN - SOURCES

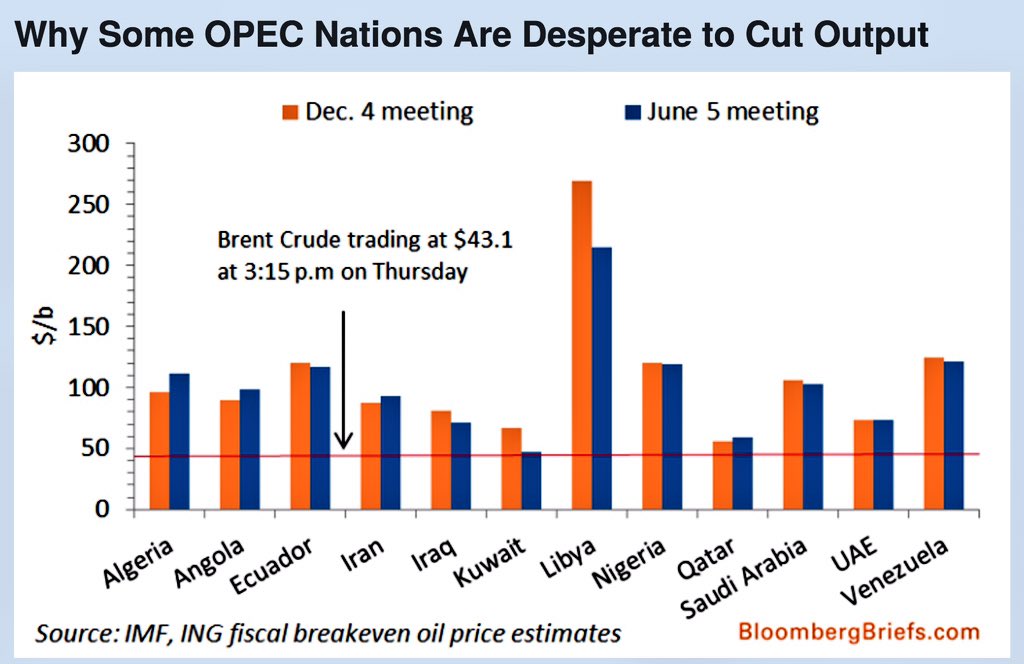

Oil prices a tad higher as OPEC set for policy rollover, no sign of Saudi cut plan. http://reut.rs/1II3wmG

Calm after the storm. Bond markets trade flat after yesterday's Draghi sell-off.

*CHINA TO CLOSE MARKET IF 5% SWING TRIGGERED AFTER 2:45PM

#China | Shah-wing ....*CHINA TO IMPOSE 15-MINUTE TRADING HALT IF 5% SWING TRIGGERED

The 40% drop in #oil over last 12 months has put crude below the breakeven rate for producing countries. (via BBG)

Ioan Smith @moved_average

#SouthKorea | Acc to Clarkson Research Services, Korean shipbuilders saw the lowest volume of orders in November since 2009

#Japan's Nikkei closes down 2.2% at 19504.48 and Yen strenghtens vs Dollar in global Draghi sell-off.

Good morning from Hanover. Asian stock markets join Draghi selloff as bonds drop; Euro holds huge gains.

Time for doom data: Fathom's #China Momentum Indicator suggests that Chinese economic growth could be as low as 2.6%

No comments:

Post a Comment