Broader Europe....

ZEW July German Economic Sentiment Index at 29.7 (31.5 in June); Current Conditions Index at 63.9 (62.9 in June)

Industrial output in #eurozone falls 0.4% m/m in May.

#Greece: -5.1%. Full table here: http://ow.ly/i/bObP3

Business confidence in #France rises to highest since February 2014

http://ow.ly/PzR2b http://ow.ly/i/bO9oP

Weaker service sector confidence in #Italy drags overall business expectations lower http://ow.ly/PzRm7 http://ow.ly/i/bO9xD

June inflation up at 0.2% says Istat: Driven by 'holiday factor' http://bit.ly/1Le2nav

Greek financial situation ‘doesn’t support’ Czech #Euro entry, Czech President Zeman says. (BBG)

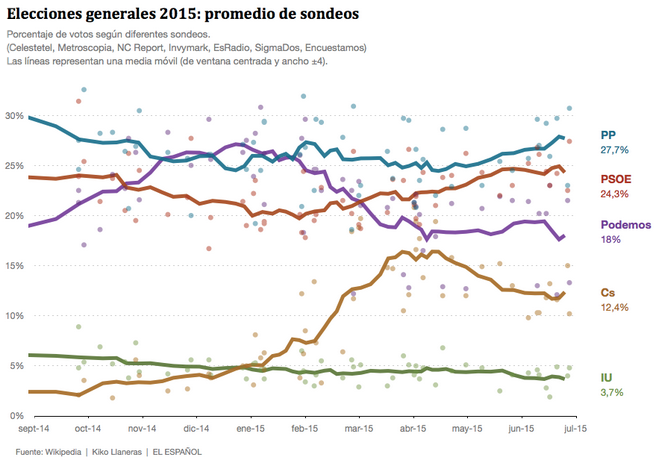

Poll of polls in @elespanolcom for the Spanish general election.

http://www.elespanol.com/actualidad/asi-seran-las-generales-segun-el-promedio-de-encuestas/ …

Greece Evening Wrap....

IMF Gre update goes much further than prev. Admit totally self defeating surplus targets. Tying themselves in knots

BBC News (World) retweeted

So why would any Athens MP tomorrow vote for deal to make Greeks poorer when IMF ridicules surplus & growth targets, & governance of banks?

BBC News (World) retweeted

So Germans ordered Greece to accept IMF in bailout, against wishes of @atsipras, & now IMF says it won't touch deal with barge pole. Nice

BBC News (World) retweeted

IMF blows up Greek bailout: "Greece’s debt can only be made sustainable through debt relief far beyond what Europe willing to consider".

IMF sustainability analysis - CONCLUSION - Greece is insolvent http://www.imf.org/external/pubs/ft/scr/2015/cr15186.pdf …

fred walton retweeted

#Syriza's Left Platform has met and it believes 40-45 MPs will vote No/abstain. Via @kevin_ovenden on FB https://www.facebook.com/kevin.ovenden/posts/10155749716520468 …

fred walton retweeted

UPDATE: Greek PM Alexis Tsipras says banks may not reopen until a bailout deal with the eurozone is finalised http://u.afp.com/ZUoG

fred walton retweeted

Video of Tsipras’ interview tonight, w/ English translation: http://www.newgreektv.com/index.php/greece/item/16414-prime-minister-alexis-tsipras-interview-in-english-translation … (1:14:24 in) #Greece /v @guftissa

fred walton retweeted

@fredwalton216 @WhelanKarl @MarthaSiska1 @POLITICOEurope @johannajaufer @Schuldensuehner his approval rating is highest it's been. 70% or so

IMF Declares War On Germany: In "Secret" Report Lagarde Says Greece Will Need Massive Debt Relief http://www.zerohedge.com/news/2015-07-14/imf-declares-war-germany-secret-report-lagarde-says-greece-will-need-massive-debt-re …

fred walton retweeted

Greek laws written by foreign powers - will be invalid unless to the letter of EU-IMF diktat

fred walton retweeted

Potential countries against EFSM bridge loans to Greece

UK

Czech

Denmark

Finland

Sweden

fred walton retweeted

Exposure of Eurozone countries to Greece up from around €150bn in 2009 to more than €300bn now. When will this end?

Greece Morning Beat ......

IMF declares war on Germany: WITHOUT HAIRCUT, GREECE WOULD NEED 30-YR GRACE PERIOD ON ENTIRE EUROPEAN DEBT STOCK, INCLUDING NEW LOANS -IMF

Schaeuble's Modest Proposal For Greek Bridge Loan: Pay Salaries In IOUs http://www.zerohedge.com/news/2015-07-14/schaeubles-modest-proposal-greek-bridge-loan-pay-salaries-ious …

EFSM Likely a dead letter - Germany backing UK position of NO...

*STATHAKIS: GREECE WILL GET EU6B-EU7B BRIDGE LOAN TO REPAY DEBT

EC's plan to use EFSM of v. dubious legality, never mind politics. EC lawyer asked at Sun eurogroup if use possible. 'No,' was answer

Commission on Greek bridge financing: "We have to discuss calmy and go through different options...to pick up the most workable option"

*EU EXPLORING ALL POSSIBLE OPTIONS ON GREEK BRIDGE FINANCING

Dijsselbloem says bridge financing for Greece will not be easy http://dlvr.it/BWcH1D

RT @zerohedge BABIS SAYS CZECHS DON'T WANT TO SHOULDER COSTS OF GREEK AID << rare UK ally emerges

Told that inside #EU finmins meeting, @George_Osborne "furious" at suggestion EU-wide EFSM may be used for #Greece bridge financing

Got my hands on #Greece bridge financing options memo for 8:30am euro working group call. Details at @fastFT here: http://on.ft.com/1GiHd4m

Got my hands on #Greece bridge financing options memo for 8:30am euro working group call. Details at @fastFT here: http://on.ft.com/1GiHd4m

Euro Working Group considering 6 options for #Greece bridge financing this AM, including EFSM, bilateral loans, ECB-held bond profits

Other 3 bridge financing options for #Greece: transfer of "buffer" cash from natl treasuries, securitizing Greek assets, EU structural funds

Unlike coalition partner @PanosKammenos, Left Platform's Lafazanis unequivocal: asks PM to reject deal, says lenders 'callous blackmailers'

Pieter Cleppe retweeted

Tsipras faces party rebellion as Greek parliament prepares to vote on bailout measures http://openeurope.org.uk/daily-shakeup/tsipras-faces-party-rebellion-as-greek-parliament-prepares-to-vote-on-bailout-measures/ …

Finland's PM Juha Sipilä: If deal fails, a Greek time-out and Greece temporarily having two currencies is an option http://www.ksml.fi/uutiset/talous/sipila-uumoilee-kreikan-hyvaksyvan-lainaehdot/2086576 …

Check out @karat32's comments here: “I don’t think the Finns parliamentary group will vote for any loans to Greece”

http://foreignpolicy.com/2015/07/13/the-biggest-roadblock-to-a-greek-deal-could-be-tiny-finland/ …

If there is no bridge loan to Greece, it will default on the ECB on Monday, forcing the ECB to cut off Greek banks http://openeurope.org.uk/blog/bridge-financing-for-greece-what-are-the-options-and-should-the-uk-be-involved/#.VaTZd75axlE.twitter …

Pieter Cleppe retweeted

ECB could increase ELA only after 1st review of hypothetical 3rd programme concluded (late autumn?)-sourc-Meanwhile capital controls #grexit

Darkness at dawn: fragile plan to rescue Greece "We had serious doubts whether Tsipras understands" the source says http://uk.reuters.com/article/2015/07/13/uk-eurozone-greece-breakdown-insight-idUKKCN0PN23X20150713 …

This is pretty much the feeling I had yesterday. If true, it's very sad. The quote comes from FT #Greece

*SCHAEUBLE SAYS RISK DURING NEGOTIATIONS LIES WITH GREECE

Syriza ministers who broke ranks on Sat, Lafazanis & Stratoulis, may be replaced today, @tsigouriX says, with broad reshuffle after Wed vote

Kammenos: won't be a problem with passing measures this week. Not clear if he says that's 'cos he'll vote or 'cos he knows opposition will

Kammenos says his party will only vote for what was agreed at leaders' meeting last Monday. "No more than that," he says #Greece

After meeting with Ind Greeks MPs, Kammenos says "there was a coup, Tsipras was blackmailed, forces in Greece want gov't to fall" #Greece

Govt's 2 lines of argument: They wanted to kick us out of euro so we're staying in & they wanted a coup so we're not going anywhere #Greece

Italian FinMin Padoan: "Only the French, tiny Cyprus and Italy were in favour of a compromise with #Greece". (@sole24ore)

Nick Kounis retweeted

#Greece Athens drafts bill as lenders look for ways to cover short-term funding http://www.ekathimerini.com/199467

Tom Nuttall retweeted

New board meeting on Greece expected today Another missed payment, an even more pessimistic DSA & a third program should provoke some debate

Greek bonds continue to rally in anticipation of #ECB QE or OMT or what ever. 2y yields drop to 24%, 10y to 12%.

Greek drama far from over. Now Tsipras faces the toughest sales job in order to get the deal through parliament.

Robert Peston

Robert Peston

Damian Mac Con Uladh

Damian Mac Con Uladh  Agence France-Presse

Agence France-Presse  Mehran Khalili

Mehran Khalili  Karl Whelan

Karl Whelan

Bruno Waterfield

Bruno Waterfield

MineForNothing

MineForNothing  Pieter Cleppe

Pieter Cleppe

Open Europe

Open Europe  Jorge Valero

Jorge Valero  Stavros Kallinos

Stavros Kallinos  Kathimerini English

Kathimerini English  Jarno Hartikainen

Jarno Hartikainen

No comments:

Post a Comment