Evening Wrap.....

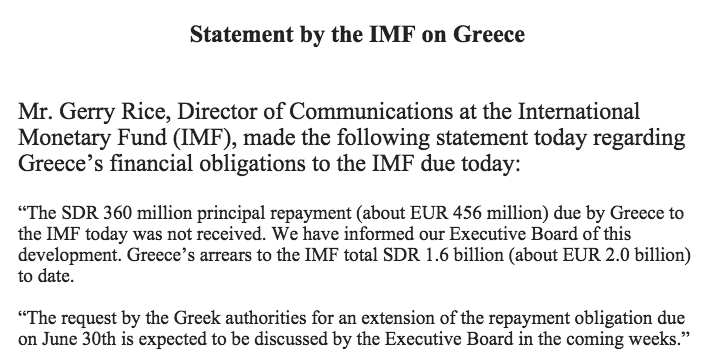

Another month of arrears due to IMF ....

If @smerler is right, then Stathikis's statement that all deposits are safe is not remotely credible: http://www.bruegel.org/nc/blog/detail/article/1679-preserving-the-greek-financial-sector-options-for-recap-and-assistance/ …

fred walton retweeted

fred walton retweeted

What #Germany thinks about the #Greece deal: 52% for new loans vs 44% against; 57% say reform measures ok (22% want more; 13% less). (1/2)

fred walton retweeted

Greek civil servants union calls strike for Wed; local authority staff & pharmacists to walk out too to protest Parlt vote on new austerity.

fred walton retweeted

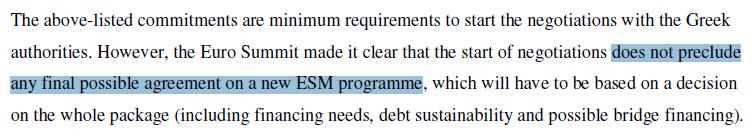

Important: Even if Greece fulfills conditions, these are only the "minimum requirements to start the negotiations" http://www.theguardian.com/business/2015/jul/13/greece-debt-agreement-eurozone-summit-statement …

fred walton retweeted

Parliament speaker Zoe Constantopoulou tells @geoterzis she has no intention of resigning ahead of apparent censure motion #Greece

fred walton retweeted

fred walton retweeted

MPs from SYRIZA's Left Platform will likely abstain/be absent from vote on prior actions but not considering resignation - Skai TV #

fred walton retweeted

#Junker confirms he talked with Greek opposition leaders to "secure measures will pass" in Parliament. Protectorate.

Brill, harrowing account of a brutal night in € history by @BrunoBrussels(Juncker fell asleep) http://www.thetimes.co.uk/tto/news/world/europe/article4496940.ece …

Morning Tweets...

GREEK FIN MIN OFFICIAL SAYS GREECE WILL EXTEND BANK HOLIDAY. Unclear for how long

GERMAN VOTE ON GREEK BAILOUT EXPECTED JULY 17: SPEAKER

Stubb of Finland:"I'm a little bit miffed that the hardlines are getting shafted here". Says IMF involvement is a sine qua non for Europeans

Tentative Deal Strips Greece of Sovereignty, Makes Debt Relief Dependent on Complainece: The tentative deal de... http://bit.ly/1Lb8YSV

Think I figured why #Greece needs €7bn by Mon: €3.5bn @ECB bond, €0.6bn interest on that bond; €1.5bn #IMF arrears, €1.6bn owed IMF in July

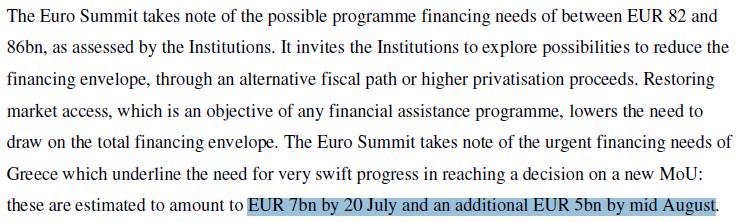

Here's amt of #Greece bridge financing still to be decided by #eurogroup: €7bn by Mon, €5bn by Aug.

Lest everyone forget, final #Greece statement makes clear there's no bailout yet. This deal just on reopening talks

Bond markets cheer that Greek bonds will become eligible for #ECB's QE programme, ones Greek bonds transferred to ESM

SYRIZA senior official tells me:"with such an important rupture within party- how can we avoid elections"

#Greece @Brusselsness @FRANCE24

Fabrizio Goria retweeted

which means that by January 2016 there will be nothing left to bail-in in Greek banks beyond ELA & insured deposits.

Citi: Tsipras returns to Athens w/ a deal significantly more restrictive than that rejected by Greeks 8 days ago. http://www.consilium.europa.eu/en/press/press-releases/2015/07/pdf/20150712-eurosummit-statement-greece/ …

Tsipras & Kammmenos meeting this afternoon & Independent Greeks MPs to hold talks at 8.30 a.m. tomorrow, reports @geoterzis #Greece

SYRIZA senior official tells me dissent w/in SYRIZA likely to lead to elex; opposition parties to vote in new bailout @France24_en

#Greece

Read it and weep - full Council statement on Greek humiliation http://dsms.consilium.europa.eu/952/system/newsletter

"Grexit might have been avoided for a couple of weeks or – in a best-case scenario – for a couple of months" - @carstenbrzeski

The biggest risk now is implementation in the coming days, weeks, months against the background of a deepening recession #Greece #EuroSummit

#ECB said to hold Emergency Funding ELA for Greek banks steady at €89bn. (RTRS)

Dijsselbloem 'The banks have to be refinanced from aid program, but after that I take it that they’re worth money and then we can sell them'

Slovak PM not sounding very optimistic “It would be a small miracle if Greece meets the commitments that Prime Minister Tsipras has pledged”

1. Worst deal offered to Greece in last 6 months 2. Germany lost monpol argument, still owns fiscal policy 3. Huge slap for Podemos #Greece

Marcus Walker retweeted

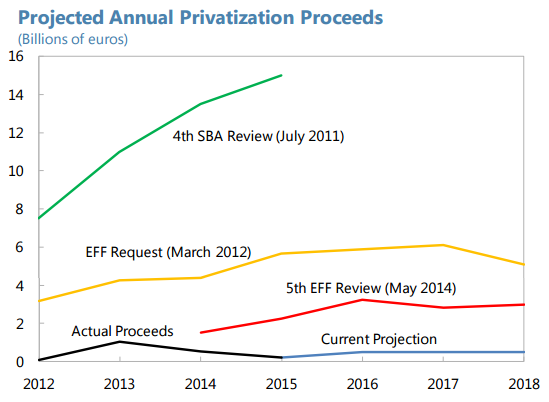

How past (IMF) predictions for Greek privatisation proceeds turned out. (From the latest DSA)

Copies of what EU officials said were 'final conclusions' from 14-hour summit via on Greece. Via @jameskanter http://www.nytimes.com/interactive/2015/07/13/world/europe/document-text-of-the-euro-summit-statement-on-greece.html?_r=0 …

A small victory re €50-bln assets fund. To be set up in Greece + managed by Greek authorities (under supervision of European institutions).

Clarification:Merkel called for laws passed in Greek Parl since Feb to be annulled, saying Greece will be given help for humanitarian crisis

. @tsipras_eu concedes deal will be difficult to implement and 'may be recessionary' but says Greeks will back as gives hope of recovery.

Nina Schick retweeted

Deal agreed in princple but no complaceny, plenty of hurdles to fall over - approval of Greek & other parliaments as well as final details

And again - no haircut. #Greece

Summary of #Greece talks: #Tsipras agrees to everything & more that he told ppl to reject in #Grefenderum. #Grexit (temporarily) off table.

Some More Key Provisions of Sunday Agreement.....

The new Greek fund. Read carefully, please.

The Greek authorities must legislate without delay a first set of measures. These measures

Greek banks: The ECB/SSM will conduct a comprehensive assessment after the summer. Try to imagine the shortfalls

The part of Euro Summit statement about debt sustainability. Conditionality everywhere. #Greece

Grexit has been delayed but not avoided. Our latest: http://country.eiu.com/article.aspx?articleid=1973338781&Country=Greece&topic=Politics …

Albert Broomhead

Albert Broomhead

Olaf Cramme

Olaf Cramme  NikiKitsantonis

NikiKitsantonis  Pieter Cleppe

Pieter Cleppe  Kathimerini English

Kathimerini English  zerohedge

zerohedge  Nick Malkoutzis

Nick Malkoutzis  Dim Rapidis

Dim Rapidis

Silvia Merler

Silvia Merler

Joseph Cotterill

Joseph Cotterill

Raoul Ruparel

Raoul Ruparel

The EIU Europe

The EIU Europe

Edward Harrison

Edward Harrison

No comments:

Post a Comment