Tweets....

Evening round up....

fred walton retweeted

* Ecb's Nowotny says must examine whether ECB can assist Greece in runup to referendum - newspaper wiener zeitung online

ECB TO CHECK LEGALITY OF GREECE AID W/OUT DEAL: NOWOTNY IN WZ.

fred walton retweeted

Unbelievable. I cannot really imagine the ECB signing off on this interview, what went wrong @michaelsteen?

fred walton retweeted

Important on IMF payment rules. Teeny window? @MatinaStevis @SpiegelPeter @MarcChampion1 @Schuldensuehner

Retweeted 52 times

* Greek government official says Greece will not pay IMF loan due on Tuesday - RTRS

fred walton retweeted

#Greece may default on €1.6bn tomorrow, but today it made a €50,000 fee payment to the eurozone's bailout fund, according to 2 #EU officials

fred walton retweeted

fred walton retweeted

fred walton retweeted

Leaked:@DonaldTusk has written back to @atsipras denying 11th-hr request for bailout extension. Copy of letter here: http://on.ft.com/1JsGsgv

fred walton retweeted

#Greece #capitalcontrol Withdraw limit set to 120 € a day for pensioners; 850 banks will open on Wednesday for those not having a cashcard

fred walton retweeted

Friend at Athens bank said he+colleagues went to work in casual wear for fear of being targeted by angry Greeks. Were told to wear ties tmrw

fred walton retweeted

#Greece Bank branches opening for pensioners postponed 2 Wed or Thursday. Pensioners will be allowed 2 withdraw daily 60E added up 180/240

Morning items !

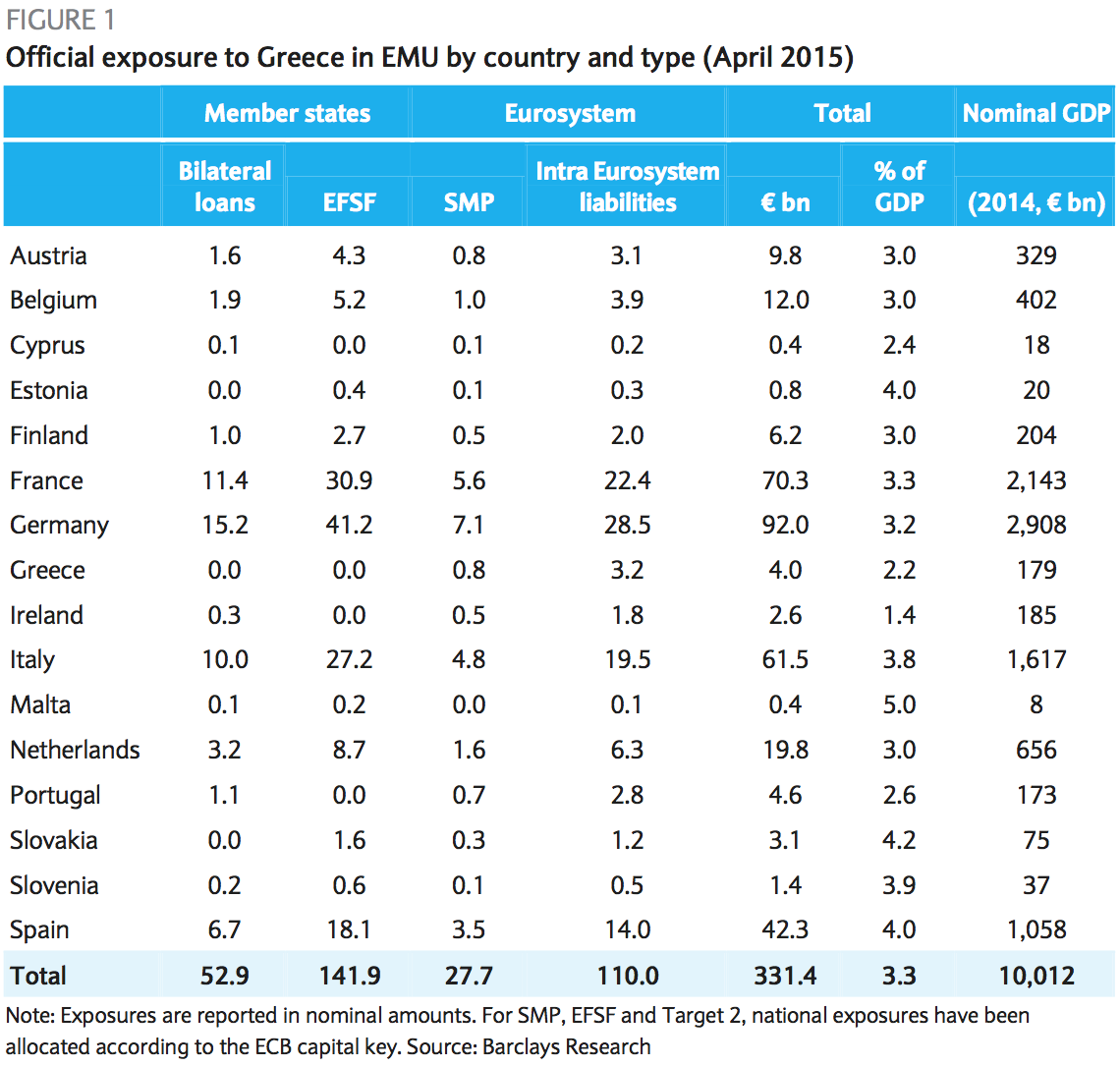

Here's my summary explanation of why €zone won't accept debt forgiveness for Greece from last wknd:

Eleni Varvitsiotis retweeted

In letter to all #eurozone PMs, @atsipras requesting they reconsider decision not to extend bailout. Leaked copy here http://on.ft.com/1JsGsgv

Banks are shut but the tax offices are open #Greece #CAPITALCONTROLS

Katerina Sokou retweeted

Peripheral yields higher but stable : Spain 10-year 2.26%, +15 bps; Italy 2.33%, 18 bps; Portugal 2.95%, +24 bps

*NOWOTNY SAYS GREEK ELA LEVEL VALID UNTIL WEDNESDAY

Wednesday happens to be day after IMF default. Would expect to trigger "cosmetic" haircut hike:

Greece in default before July 20? A 20bn Yen Samurai bond matures on July 14. Non-payment would mean first ever default on commercial paper

German Ministry of Finance: Greek Capital Controls are justified and necessary.

That Greek capital control order, now in English via @ManosGiakoumis

European Commission has No New Proposals for Greece http://dlvr.it/BMPKTh #Greece

Germany Reacts to Greece ’s Referendum http://dlvr.it/BMPDkV #Greece

Hollande: Greek Vote is For Greece to Stay or Leave the Eurozone http://dlvr.it/BMPF7S #Greece

Tourists Unaffected by Capital Controls in Greece http://dlvr.it/BMLjfC #Greece

Yanis Varoufakis’ Historic Speech at the Last Eurogroup: As It Happened http://dlvr.it/BMFdXT #Greece

Philippe Legrain retweeted

The end of "beautiful #EU ideals of peace prosperity+ democracy + the rise of brutal power politics? asks @plegrain http://foreignpolicy.com/2015/06/28/athens-is-being-blackmailed-alexis-tsipras-greece-syriza-eurozone/ …

#Greece's Pensioners queue outside banks on 1st day of capital control. http://wpo.st/IWQO0

Greek 10yr yields jump by 370bps to 14.55%, biggest increase since at least 1998. (BBG)

Chart of the day: #Greece's 2yr yields jump to 33.4% on Grexit angst.

EU's Oettinger says #Greece in Euro more than questionable. “It’s game over in the sense that Greek govt is at an end." (BBG)

Broader Europe.....

Banks among leading decliners in Europe w/ #Greece on edge. Euro Stoxx Banks drops by >5%.

SNB's Jordan: Intervened in Franc overnight as #Greece is a very critical situation and SNB is watching closely.

Preparing for a rough European stock mkt ride: Dax Futures fall 7% at market open but pare some losses. Now down 4.5%

Greek fallout: Italy's bonds fall sharply. 10yr BTP yields jump to 2.49% highest level since Oct.

Bund yields fall sharply on Greek crisis: 10yr yields down 20bps.

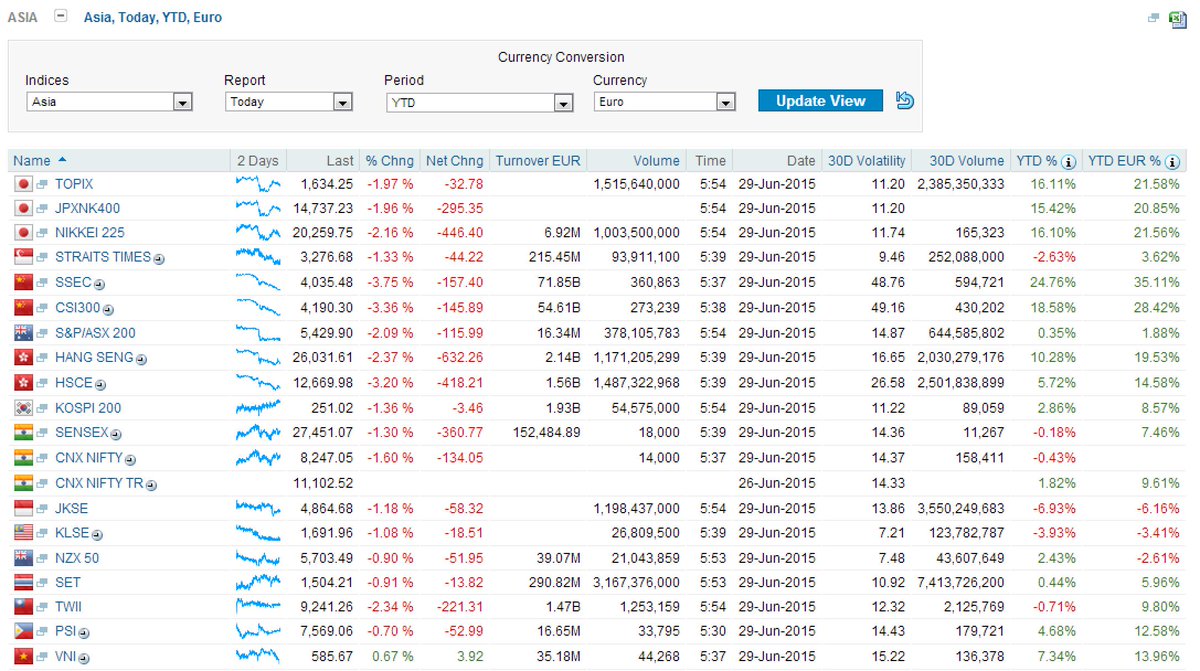

From Asia.....

#Grescalation roils global markets: #Japan's Nikkei plunges 2.9% to 20,109.95.

Asian stocks slide with #Euro as collapse of Greek rescue talks roiled global markets. http://bloom.bg/1LwAQRW

Greek crisis prompts #euro to slide in early Asian trading. Drops below the $1.10 mark http://on.ft.com/1GUqZSA

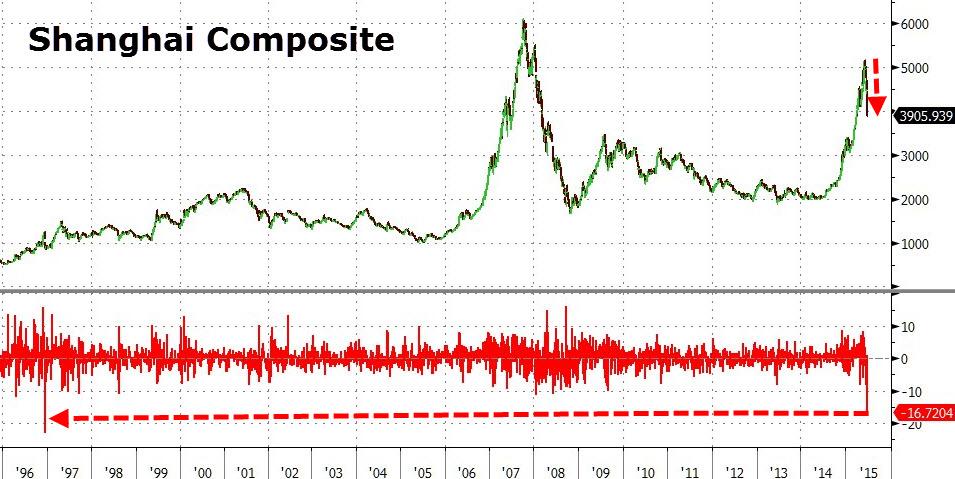

ICYMI: SHANGHAI COMPOSITE HEADS FOR BIGGEST 3-DAY DROP SINCE 1996. before dropp only 3.3%

Fabrizio Goria

Fabrizio Goria  Christian Odendahl

Christian Odendahl

Peter Spiegel

Peter Spiegel  Pablo Rodríguez

Pablo Rodríguez  spyros gkelis

spyros gkelis

NikiKitsantonis

NikiKitsantonis  Keep Talking Greece

Keep Talking Greece

Stelios Bouras

Stelios Bouras  MNI Eurozone

MNI Eurozone

Vangelis Vitalis

Vangelis Vitalis

No comments:

Post a Comment