Tweets....

Greece....

Derek Gatopoulos retweeted

"My answer is simple: No, no, no" #Varoufakis on some creditor-demanded reforms; talks head into weekend http://apne.ws/1DGus2m @dgatopoulos

FYI: The Parliament's Budget Office has NO influence over the cabinet's policymaking - unfortunately. #Greece

The Greek Analyst retweeted

#Greece talks at 'Brussels Group' continue today. Greek side expected to present fiscal consolidation measures targeted at 1.5% prim surplus

The Greek Analyst retweeted

The #ECB could raise #Greece’s current T-bill issuance ceiling (at €15bn) if there

was an “agreement in sight” http://on.wsj.com/1GyX4wk

#Eurogroup President @J_Dijsselbloem travels to Paris, Berlin and Rome on 6-8 May mainly re situation in #Greece. http://www.consilium.europa.eu/en/council-eu/eurogroup/president/news/may-visits/ …

Broader Europe....

U.K. APRIL MANUFACTURING PMI 51.9 VS 54 IN MARCH; EST. 54.6

UK MARCH CONSUMER CREDIT +1.242 BLN STG, BIGGEST INCREASE SINCE FEB 2008

#Euro hits 2m high this morning at $1.1284 a tad below 100d MA of $1.1294 (not broken since May2014).

#ECB declares victory in curbing decline in long-term #inflation expectations. http://www.globalpost.com/article/6533559/2015/04/30/eurozone-inflation-outlook-brightening-ecb …

No Mayday for #Euro bears as split in policy seen capping strongest monthly rally in 3.5yrs. http://bloom.bg/1Jd0Zlw

‘Sell in May’ resonates for bond investors after april rout in US treasuries and Bunds. http://bloom.bg/1OKEzii

Fabrizio Goria retweeted

What Would Happen if Greece Defaulted? UBS explains http://blogs.wsj.com/moneybeat/2015/05/01/what-would-happen-if-greece-defaulted/ … via @WSJMoneyBeat

Fabrizio Goria retweeted

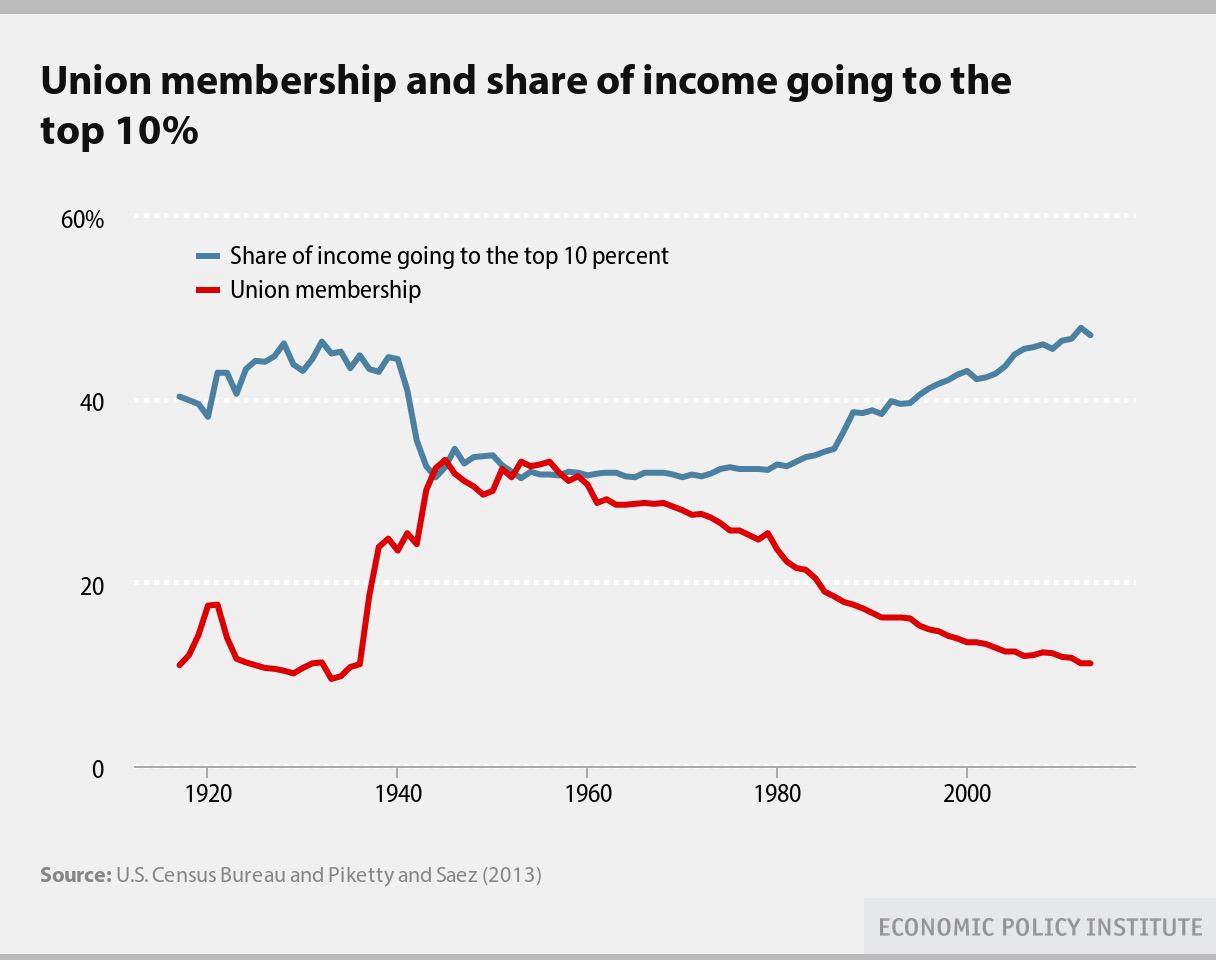

Graph for #MayDay: on labour unions and income inequality http://oxfamblogs.org/mindthegap/2015/04/17/graphs-of-the-day-on-labour-unions-and-income-inequality/ …

Asia......

zerohedge retweeted

zerohedge retweeted

Apple only has 19 stores in China in 10 cities which together account for a urban population of ~100m or 13% China urban population

With China away from market, overnight trade was relatively subdued, although the Nikkei 225 was weighed upon by yesterday’s BoJ decision

#BoJ offers to lend $JPY 400bln in #JGBs as a secondary source of supply of some issues for settlement today!

Shanghai, Hong Kong, Taiwan, South Korea, India & Singapore markets all closed today due to public holidays...GREAT!!

No comments:

Post a Comment