Updates at blog tweet feed during the day....

Tweets......

Greece...

@drubald @fredwalton216 All financial assistance given to GR is here:

http://ec.europa.eu/economy_finance/assistance_eu_ms/greek_loan_facility/index_en.htm …

@drubald @fredwalton216 Here's the doc that GR had to agree to in order to get the Aug 2014 tranch: http://ec.europa.eu/economy_finance/assistance_eu_ms/greek_loan_facility/pdf/reportcompliancedisbursement-082014_en.pdf …

US.....

Tweets......

Greece...

What's happening ? What about the false narrative spun about the First Greece Bailout for years ? https://www.cigionline.org/publications/laid-low-imf-euro-zone-and-first-rescue-of-greece …

@fredwalton216 What else is happening ? Let's clear up misconceptions re : the goals of Greece Debt Truth Committee. http://links.org.au/node/4347

Imogen Spedding retweeted

In today's EU briefing: Britain's goods trade deficit with EU widens & Finnish Government draws up plans for 'Grexit' http://bit.ly/1Hah7oT

April 10, 2015: "EU draws up secret plans to kick Greece out of eurozone"

http://www.thetimes.co.uk/tto/news/world/article4406467.ece …

My article on fallout of #Tsipras visit2Moscow http://buff.ly/1CoSU8Z @energyinsider @TimBoersma4 @Allison_Good1 @chrisbrako @fredwalton216

OMG @UKIP @MarkGSparrow @fredwalton216 @AmbroseEP market fears as Merkel poses $6400bn qu:

https://hat4uk.wordpress.com/2015/04/10/exposed-the-reason-why-none-of-us-can-be-sure-whats-going-on-in-the-eu-v-greece-yawn …

Not only #Greece banks but also their subsidiaries should not increase their T-Bill holdings, #ECB says (via @euro2day_gr). #economy #ELA

The Greek Analyst retweeted

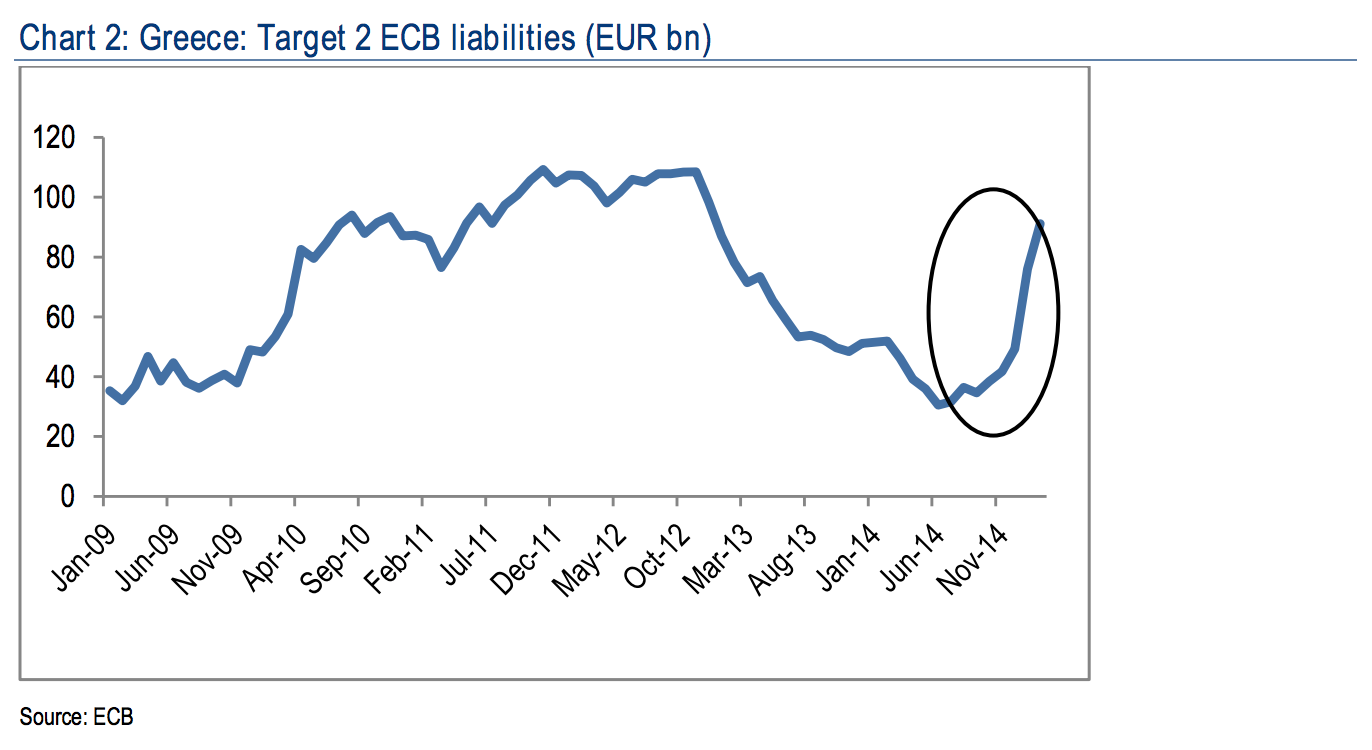

BofA-ML - Greece: Target 2 ECB liabilities (EUR bn)

The Greek Analyst retweeted

Buffet's comment that Grexit "may not be a bad thing" for eurozone has opened Pandora's Box, argues @nkonstan http://ekathimerini.com/4dcgi/_w_articles_wsite3_1_09/04/2015_548995 … #Greece

The Greek Analyst retweeted

"Syriza doesn’t seem to have thought through how to achieve its objectives," argues @plegrain http://foreignpolicy.com/2015/04/10/greece-needs-to-start-playing-hardball-with-germany/ … #Greece

#Greece Brussels sources tell @capitalgr abt a Plan B for an extra Eurogroup meeting on April 29 if no deal in April 24 meeting

#Greece 5yr default probability on the rise again after Athens has made IMF payment on Thursday. Now at almost 83%.

MineForNothing retweeted

ITALY SELLS ONE-YEAR DEBT AT RECORD LOW YIELD OF 0.013%

As I forecast in the middle of March.

https://twitter.com/RichardBarley1/status/586477803509567488 …

When Will The ECB Start To Taper? http://edwardhughtoo.blogspot.com.es/2015/03/when-will-ecb-start-to-taper.html …

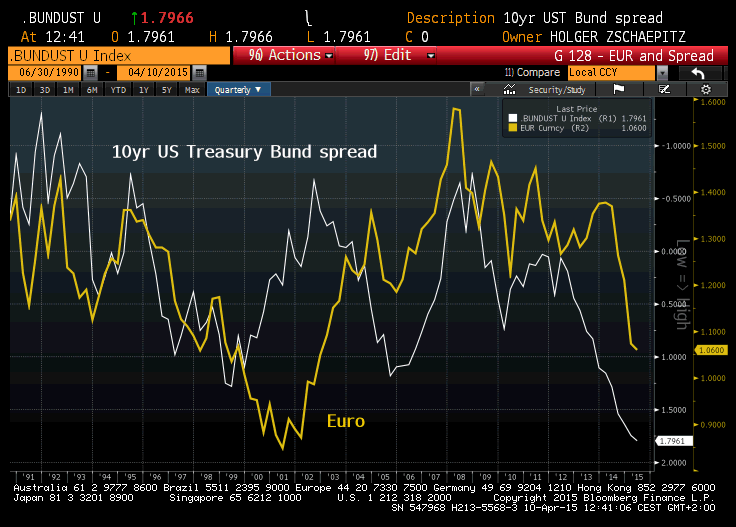

Monetary policy divergence continues to drive Euro expectations down.

#Euro drops below $1.06 as markets decided to give the single currency another clump w/o any obvious reason.

Mysterious Ruble rally continues. Strengthens another 1% vs Dollar. #Russia's currency has decoupled from #oil price.

#China bears on wrong end of $4trn rally. Shanghai Composite crosses 4k for 1st time since '08 http://bloom.bg/1DpDh53

Nikkei tops 20k for the first time in 15yrs and it looks as if foreign investments in the Nikkei no longer FX hedged.

Asia Superbubble Unstoppable: Hong Kong Up 10% In Past Week; Soaring Dollar Pushes Euro Back Under 1.06 http://www.zerohedge.com/news/2015-04-10/asia-superbubble-unstoppable-hong-kong-10-past-week-soaring-dollar-pushes-euro-back- …

US.....

GE Announces One Of Largest Buybacks In History, Will Repuchase $50 Bn In Shares After Selling Most Of GE Capital http://www.zerohedge.com/news/2015-04-10/ge-announces-one-largest-buybacks-history-will-repuchase-50-bn-shares-after-selling- …

No comments:

Post a Comment