Evening wrap......

Europe.....

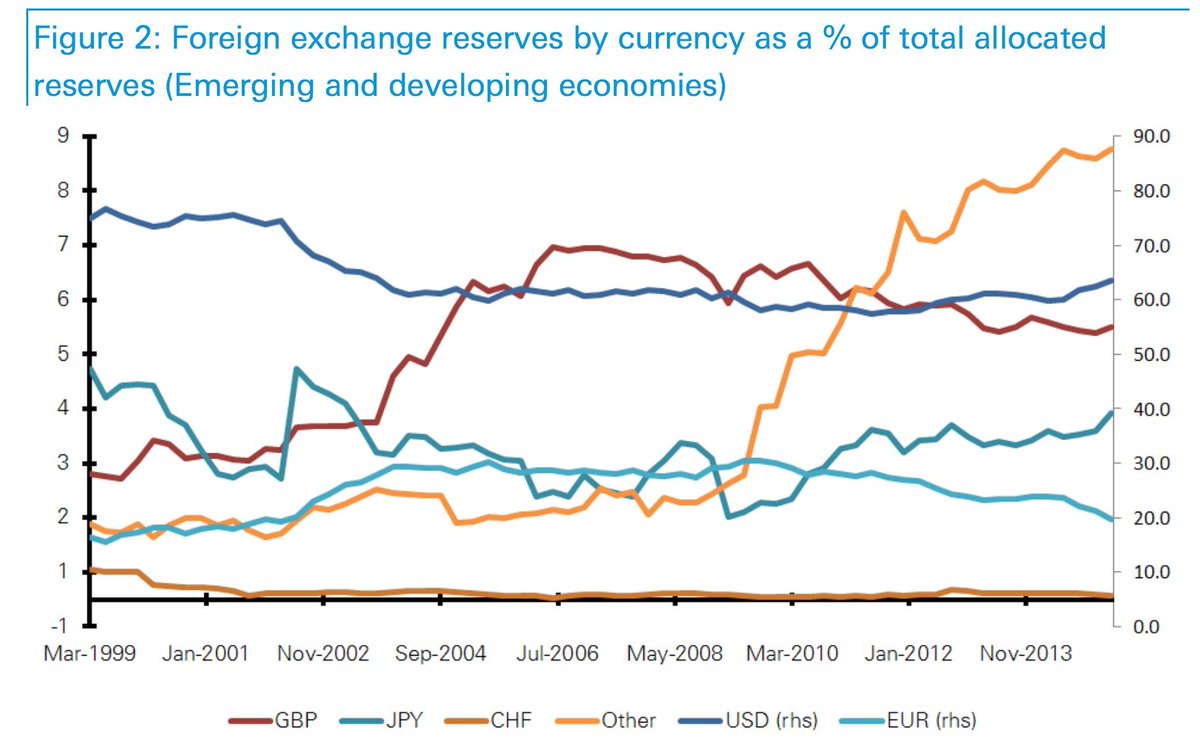

Bye bye status of world currency: Euro constitutes 20.5% of glob reserves from 28% in 09. In 2Q € holdings fell $65b

fred walton Retweeted

Portugal Elections: PP Coehlo cites #Greece’s far-left government as an example of how not to resolve a debt crisis http://www.politico.eu/article/portugal-elections-we-dont-want-to-be-greece/ …

UN expects 700,000 migrants in Europe in 2015, same in 2016; Germany took in 200,000 in Sept http://str.sg/Z2vX

BREAKING: Rajoy Says Spanish General Election Will Be Held On December 20

https://www.thespainreport.com/articles/205-151001211001-rajoy-says-spanish-general-election-will-be-held-on-december-20 …

Germany To Expel European Migrants To Make Room For Syrian Refugees http://www.zerohedge.com/news/2015-10-01/germany-expel-european-migrants-make-room-syrian-refugees …

German MOF Official: Fed's Interest Rate Policy to Be Discussed At Lima Meeting. G-20 to Discuss Whether Timing Is Right to Raise Rates (DJ)

Greek shipowners looking to leave #Greece in the face of higher taxes http://www.wsj.com/articles/greek-shipowners-prepare-to-weigh-anchor-on-prospect-of-higher-taxes-1443520314 …

#Greece FRAPORT is confident on sealing ’14 Greek regional airports’ deal in 3-6 months http://www.keeptalkinggreece.com/2015/10/01/fraport-is-confident-on-sealing-14-greek-regional-airports-deal-in-3-6-months/#.Vg0kmtwTAtE.twitter …

As Russia enters war in Syria, conflict in Ukraine begins to wind down http://trib.al/eXOY5Yj

Tensions in Austrian government as migrant crisis bites http://bit.ly/1Lm820A

Potami leader Theodorakis tells his MPs that party won't vote for any new taxes. New Democracy has suggested similar approach #Greece

Victor Orban of Hungary calls for a global refugee quota at the UN General Assembly: http://openeurope.org.uk/daily-shakeup/200000-asylum-seekers-arrive-in-germany-in-september-as-interior-minister-pushes-for-eu-wide-refugee-cap/ … #migrationcrisis

Morning Tweets.....

Greece......

IMF WILL ONLY PARTCIPATE IN GREEK AID IF EU LOWERS DEBT - IMF SAYS GREEK DEBT CUT OF ABOUT EU100B NEEDED: RHEINISCHE POST CITES

Greek-flagged ships are setting sail for other registers http://www.ekathimerini.com/202075 #greece

EWG to decide on prior action list http://www.ekathimerini.com/202076 #greece

HFSF hopes for a speedy recap process http://www.ekathimerini.com/202077 #greece

PM finds 'open ears' in US to Greek appeal for debt relief http://www.ekathimerini.com/202070 #greece

Meimarakis set to announce candidacy for ND leadership http://www.ekathimerini.com/202071 #greece

Athens mayor calls for action as tensions rise at makeshift camp http://www.ekathimerini.com/202072 #greece

Greece limits short-selling ban to top banks http://dlvr.it/CK3dQ6

Clash of generations in ND’s succession battle http://dlvr.it/CK2mY2

European Manufacturing and PMI Data.....

UK manufacturing PMI - new orders index falls to lowest level in 2015

U.K. SEPT. MANUFACTURING PMI FALLS TO 51.5; FORECAST 51.3

Eurozone final Sep MFG PMI 52.0; Flash 52.0; Aug 52.3

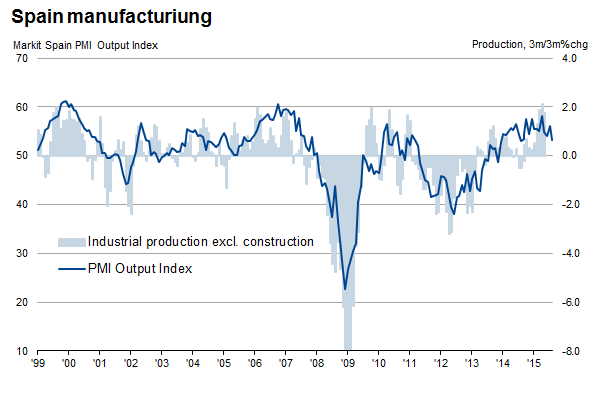

#Spain's recovery loses some momentum as manufacturing PMI sinks to 21-month low of 51.7 in Sept via @WilliamsonChris

Nevi #Netherlands manufacturing #PMI at 6-month low of 53.0 in Sep (53.9 in Aug) http://ow.ly/SSnk8 http://ow.ly/i/doGMj

At 50.9 (51.1 in Aug), the Markit #Poland Manufacturing #PMI signals weakest business conditions for a year in Sep http://ow.ly/SSn7M

Markit #Russia manufacturing #PMI moves closer to stabilisation during September. Index at 49.1 (47.9 in Aug) http://ow.ly/SSmYh

Growth of Irish manufacturing output slows to 19-month low, despite headline #PMI ticking up to 53.8 (53.6 in Aug) http://ow.ly/SSmUo

GERMANY SEPT. MANUFACTURING PMI FALLS TO 52.3; PRELIM. 52.5

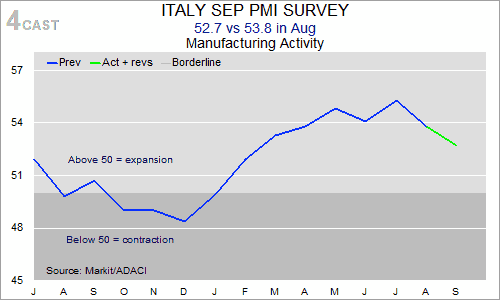

#Italy disappoints. MFG PMI has lost further ground in Sep. Fallen to 52.7 from 53.8, below cons of 53.4. (via 4cast)

Good news frm #France: Manufacturing sector returns to expansion territory in Sept. Headline PMI @ 50.6 (48.3 in Aug) http://ow.ly/SSrRx

Asia Manufacturing and PMI Data

#India's manufacturing sector loses growth momentum in Sep: Nikkei #PMI at 51.2 (52.3 in Aug) http://ow.ly/SSmKt

Nikkei #Indonesia Mfg #PMI falls to 47.4 in Sep (48.4 in Aug). Rate of job cuts 2nd strongest in survey history http://ow.ly/SSmC2

Operating conditions in #Malaysia continue to worsen at end of Q3. Nikkei #PMI at 48.3 (47.2 in Aug) http://ow.ly/SSmrA

Nikkei #Vietnam Manufacturing #PMI at 49.5, signals declining business conditions for first time in 25 months http://ow.ly/SSmm4

Nikkei #Taiwan #PMI continues to signal marked deterioration in operating conditions. PMI at 46.9 (46.1 in Aug) http://ow.ly/SSmju

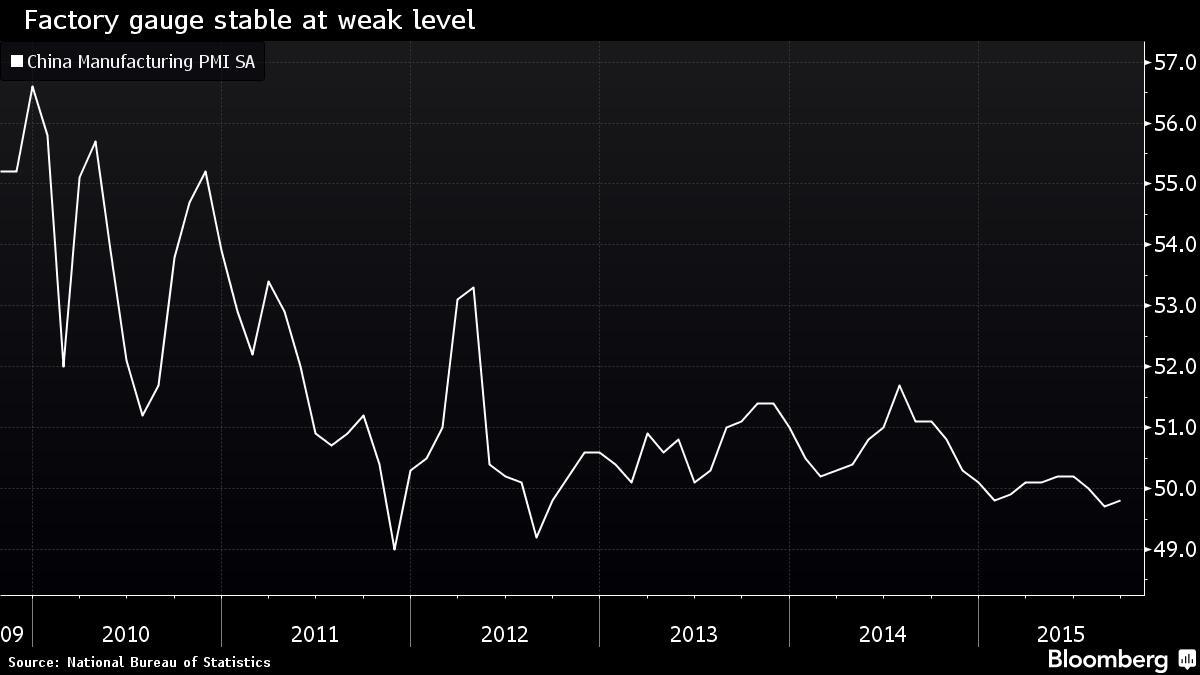

Caixin #China Composite Output Index at 80-month low of 48.0 in Sep (48.8 in Aug); Services at 50.5 (51.5 in Aug) http://ow.ly/SSm0Z

Caixin #China General Manufacturing #PMI posts 47.2 in Sep (47.3 in Aug), lowest since Mar'09 http://ow.ly/SSlRM http://ow.ly/i/doG5A

South Korean manufacturing sector remains in contraction: Nikkei #PMI at 49.2 in Sep (47.9 in Aug) http://ow.ly/SSlJp

Nikkei #Japan Manufacturing #PMI falls from August's 51.7 to 51.0 in Sep. #Exports decline for 1st time in 15 months http://ow.ly/SSlDN

#Japan's Nikkei rallies 1.9% to 17722.42 brushes off weak econ data.

#China’s Official Factory Gauge Stabilizes Near 3-Year Low. http://bloom.bg/1VrwahS

Good morning. Markets start Q4 in the green but for most people the strength elicited reaction of incredulousness.

Proper Greek Analyst

Proper Greek Analyst

No comments:

Post a Comment