Evening Wrap.....

Greece.....

Next Cliff - hanger deadline date for Greece.

VW.....

VW: 1.8 million commercial vehicles affected by emissions cheat http://bit.ly/1KOWKLU

Russia says @Volkswagen didn't violate its environment standards.

- Is Russia now buying Volkswagen shares together with China?

Spreading like the flu......

Five of VW Group Family of vehicles - Audi , Seat , Skoda , VW and VW Commercial implicated in Spain

Broader Europe.....

Belgium turns to Facebook to deter Iraqis, but they keep coming #refugeecrisis http://blogs.wsj.com/brussels/2015/09/29/as-belgium-turns-to-facebook-to-deter-iraqis-more-arrive-daily/ …

Glencore’s management will meet debt investors on Wed: BBG. - does being short the debt make you an "investor"?

fred walton Retweeted

Important @pietercleppe @openeurope blog Dutch ref not rly abt Ukriane, but broader EU fears, cud prompt wide debate

http://openeurope.org.uk/blog/what-to-make-of-the-dutch-referendum-on-the-eu-ukraine-association-agreement/#.Vgp80jrdeZE.twitter …

With ultra-nationalist, anti-immigrant, xenophobe, with far-right legacy candidate throwing hat in the ring #Greece

Morning Tweets....

Europe.........

Amid Europe's migrant tensions, kindness arises too http://dlvr.it/CJ77j8

Important @pietercleppe @openeurope blog Dutch ref not rly abt Ukriane, but broader EU fears, cud prompt wide debate

http://openeurope.org.uk/blog/what-to-make-of-the-dutch-referendum-on-the-eu-ukraine-association-agreement/#.Vgp80jrdeZE.twitter …

Investors continue to dump Germany Inc. Credit protection cost and so default probability rise for #Volkswagen & Co.

VW 5y default probability continue to rise to almost 25% as company signaled it would recall up to 11mln vehicles.

Turkish PM: Turkey will not host EU processing centres https://euobserver.com/tickers/130461

Euro-area Sept economic confidence rises to 105.6 Vs est 104.1... I'll have what they're having.

#FTSE now down just 0.2%, as Glencore (+11.1%) displays what may, or may not, be a dead cat bounce.

#GlencoreWatch +10%. Biggest decline on record followed by biggest pop on record.

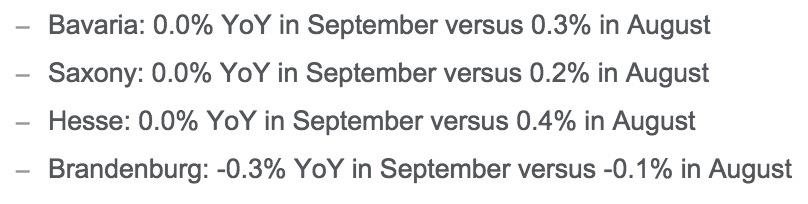

Deflationary pressure rises in Germany: German regional CPIs show weakness. (via Citi)

120 tractor is early on.

Merkel's #German conservatives dip to year low on refugee crisis: poll http://bit.ly/1JzT7IE

*NBG SAYS PREDICTIONS ON SPECIFIC RECAP OPTIONS `PREMATURE'

*NATIONAL BANK SAYS EXAMINING RANGE OF OPTIONS FOR RECAP

De-risking continues in Europe. #Germany's Dax trades 1.5% lower after open.

Spain Sept. CPI -0.9% Y/Y

#Greece 2016 draft budget to be tabled on Oct 5 may assume recession ~1.5% this year vs insitutions' estimate of 2.3% (via @kathimerini_gr)

IELKA expects the estimated drop in #Greece food retail trade by 1.9% in 2015 will lead to a decrease in VAT revenues by 14-15% (€90-100mln)

*GREEK BUDGET TO FORECAST SMALLER GDP DROP THIS YR: KATHIMERINI

#Greece govt to try to renegotiate 2015 & 2016 fiscal targets claiming lower-than-expected recession. GLWT: Public revenue worse-than-expctd

Spain Sept HICP inflation HICP -1.2% Y/Y

Morning Note: 1. India slashes interest rates. 2. Icahn warns 'danger ahead' 3. Asian stocks hammered. Nikkei -4%

Moscovici Renews Call for Eurozone Finance Minister

https://mninews.marketnews.com/content/update-eu-moscovici-need-emu-finmin-represent-eu-comm …

Who caused the #refugeecrisis? @ambchrishill explains why it's unfair to condemn Hungary and Serbia http://bit.ly/1Fuj9lz

Good Morning from Berlin. Global market rout deepens, Credit protection cost rise as investors smell some Lehman rat.

Emerging markets , Asia , Commodities ........

Holy crap #Brazil 5yr CDS 540 +45

#PBoC sets yuan midpoint at 6.3660 v 6.3729 prior setting (strongest Yuan setting since Sept 18th)

Risk off continues: Nikkei closes down 4.1% at 16930.84 and Yen strengthens as mkts seem to prepare for credit event.

1998 redux? Global sell-off accelerate as investors smell a Lehman type credit rat. Nikkei down >4%.

CPC expels Xi Xiaoming, former VP of China's Supreme People's Court under graft charges http://xhne.ws/PhiAl

New Islands, new power: airstrips and strategy in the South China Sea. http://cs.is/1LTnHlO

The Lehman of the commodity complex? Glencore shares drop 27% in Hong Kong.

China To Implement Annual Cash Withdrawal Limits Of CNY 100,000 At Overseas ATM's -- MNI

INDIA UNEXPECTEDLY CUTS KEY INTEREST RATE TO 6.75% FROM 7.25%

China's Xi Says to Prioritize Energy and Financial Cooperation With Iran http://reut.rs/1KH8vXE

Weak Reserves Spur Ringgit's Biggest Quarterly Loss Since 1997 http://bloom.bg/1YL9FbW

Zambia's Kwacha Falls Most Since 2001 After Moody's Downgrade http://bloom.bg/1MU0xyb

Russia Reconsiders Tax Proposals to Ease Oil Producer Fears http://bloom.bg/1FCOWAI

Brazil's Ibovespa Posts Longest Losing Streak Since 2012 as China Weighs http://bloom.bg/1P1q3ku

Valentina Pop

Valentina Pop

Raoul Ruparel

Raoul Ruparel

No comments:

Post a Comment