Morning Tweets......

Refugee Crisis......

SLOVAK GOVERNMENT AGREES TO TAKE LEGAL ACTION AGAINST EU QUOTAS FOR DISTRIBUTING ASYLUM SEEKERS-RTRS

#migration interesting vienna election coming up. good piece by @asmalenyt

http://www.nytimes.com/2015/09/30/world/europe/rise-of-austrian-right-lengthens-shadow-of-nazi-era.html?smid=tw-share&_r=0 …

Germany Struggling To Ward Off Panic Over Migrant Crisis.

Read more: http://bit.ly/1L3hCU5

Japan pledges $1.5bn to migrant crisis http://bbc.in/1YNN4f6

Don’t waste money on reaching #Europe unless you need refuge http://fb.me/7PrLkNvd3

Shinzo Abe said Japan would triple its aid to address the refugee crisis in the Middle East.

http://nyti.ms/1VqAIFg

Migrant crisis threatens Europe’s stability, Hungary leader warns http://on.wsj.com/1KQvoFf

A Failed European Response to Migrant Crisis Will Hurt Transatlantic Ties #RefugeeCrisis http://buff.ly/1L2He3w

EU must choose to help #refugees instead of tightening border controls - PACE http://sptnkne.ws/PGX #RefugeeCrisis

Berlin tries to reassure German voters that it can handle the migrant crisis http://on.ft.com/1FB6T33

Many countries represented here do not allow migrants & refugees to enter at all. The #refugeecrisis demands global solidarity. #UNGA

On @TalktoAlJazeera Federica Mogherini discusses the refugee crisis, ISIL and the war in Syria http://aje.io/5w7s

This graphic shows the astonishing scale of Syria’s refugee crisis http://ti.me/1MDFX25

Why migration hardliners may force Europe to resolve the refugee crisis http://econ.st/1Mshug6

Financial Markets - Asia & Europe - Data and News Moving the Markets ....

An internal European assessment obtained by POLITICO shows #TTIP talks stalled on key issues http://www.politico.eu/article/ttip-negotiations-not-even-half-done/ … DC too focused on #TPP

"There are almost 500,000 people who have left [Portugal] since 2011" (Population: 10.5m): http://www.bloomberg.com/news/articles/2015-09-29/not-even-voters-care-as-portugal-s-election-offers-little-choice …

In case you missed it: #Japan's Nikkei closes up 2.7% at 17388.15, erases 3Q loss to 14%.

French public debt rose to 97.6% of GDP in Q2, up from 95.4% in Q2 2014

French Household Consumption +0% in August. QE is working.

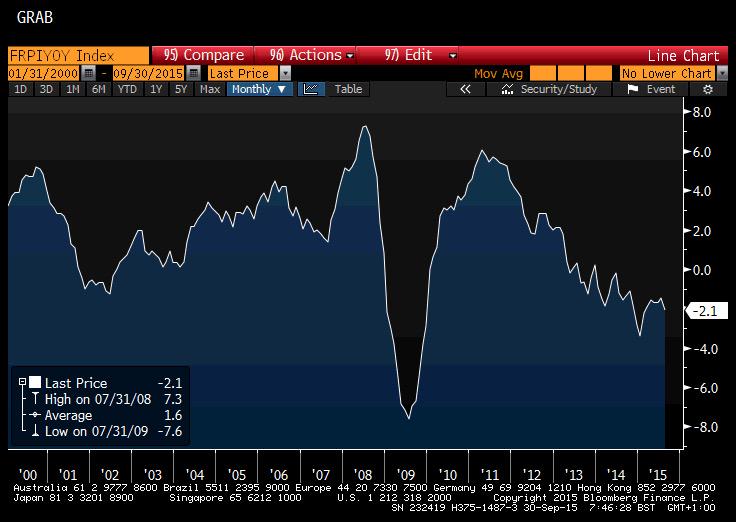

Eurozone faces slipping back into #deflation: Sep CPI likely to have fallen back into neg territory. (via BBG)

#Austria | AUG PPI M/M: -0.5% V -0.2% PRIOR; Y/Y: -1.5% V -1.1%

#France | AUG PPI M/M: -0.9% V -0.1% PRIOR; Y/Y: -2.1% V -1.6%

German inflation is once again negative. After six months of QE, we are back to where we started - http://www.eurointelligence.com

Commodity Exporters Facing Difficult Aftermath Of The Boom, IMF Says http://emergingequity.org/2015/09/29/commodity-exporters-facing-difficult-aftermath-of-the-boom-imf-says/ …

#BRICS FMs discuss cooperation, exchange opinions on global issues

http://sptnkne.ws/PMg

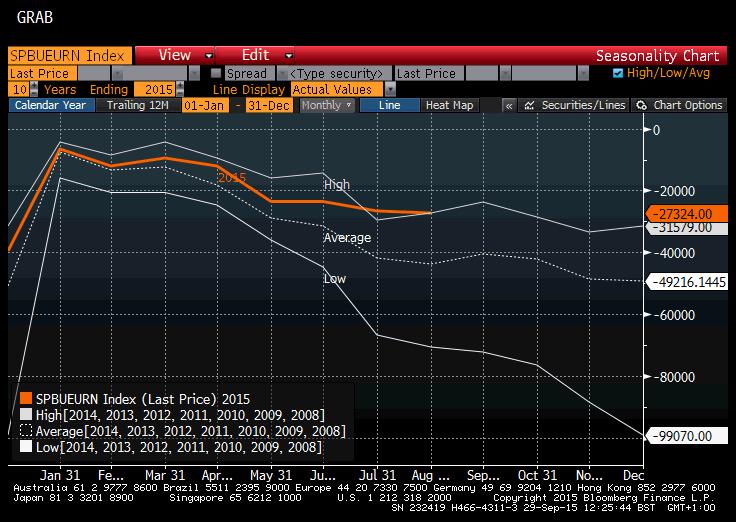

Global stock markets eye worst quarter since 2011 over fears for global economy. #Germany's Dax down almost 14% QTD.

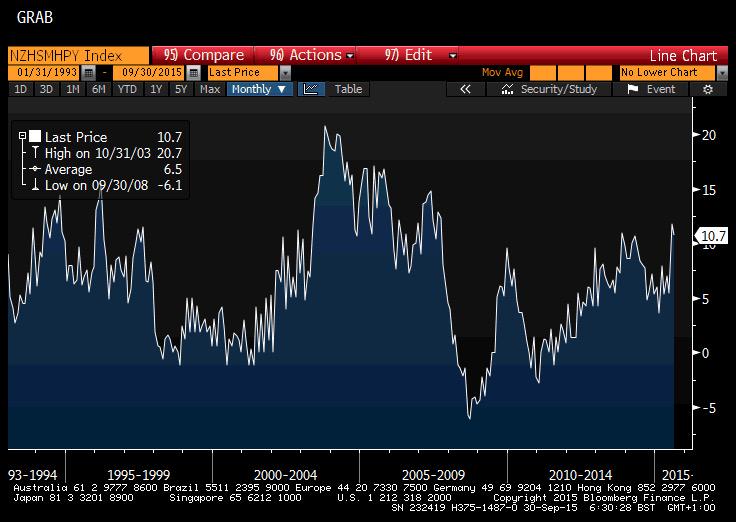

#NZ | Finance Minister English: Very concerned about the housing market and the possibility of a crash

#China | As of Sept 29th, total margin debt CNY921B v CNY929B d/d (lowest since Dec 8th 2014)

#Australia | AUG PRIVATE SECTOR CREDIT M/M: 0.6% V 0.5%E; Y/Y: 6.3% (6Y high) V 6.2%E

#China | China shipbuilders Jan-Aug new orders -68% y/y - China Daily

#Japan | AUG PRELIMINARY INDUSTRIAL PRODUCTION M/M: -0.5% (3rd straight decline) V 1.0%E; Y/Y: 0.2% v 0.8%E

Risk on is name of the game in Asia as FX risk barometer AUDJPY highlights.

Good morning from Berlin. Markets calm down particularly visible in credit mkts. Risk barometer iTraxx #Japan lowers.

Global 'Wealth' Destruction - World Market Cap Plunges $13 Trillion To 2 Year Lows http://www.zerohedge.com/news/2015-09-29/global-wealth-destruction-world-market-cap-plunges-13-trillion-2-year-lows …

China Regulator Imposes Record Fines in Market Rout Clampdown http://bloom.bg/1KQyZEc

#China | UnionPay: China to cap annual withdrawals for its users to CNY50K from Oct to Dec; 2016 will have a cap of CNY100K - Shanghai Daily

Peak Japaganda: Advisers Call For More QE (But Admit Failure Of QE); China's Yuan Hits 3-Week High http://www.zerohedge.com/news/2015-09-29

Volkswagen sold 393,648 vehicles with 'cheat' software in Belgium: importer http://www.reuters.com/article/idUSKCN0RT2KS20150929 …

Two Very Disturbing Forecasts By A Former Chinese Central Banker http://www.zerohedge.com/news/2015-09-29/two-very-disturbing-forecasts-former-chinese-central-banker …

China:Fmr PBoC member says to stop intervention. Rise in corp debt-to-GDP most serious threat http://piie.com/publications/papers/yu20150929ppt.pdf …

#Germany | ECO MIN GABRIEL SAYS NO GREAT THREAT TO NATIONAL ECONOMY IF VOLKSWAGEN CLEARS UP EMISSIONS SCANDAL PROMPTLY.."clears up emssns"

Ioan Smith Retweeted

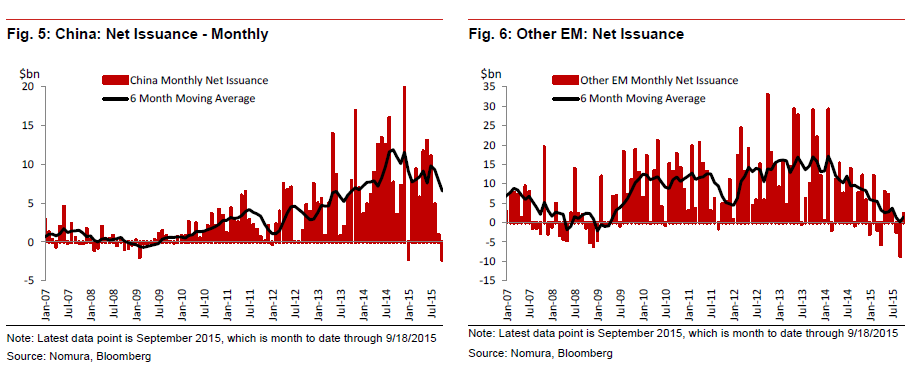

Emerging market net bond issuance now at its lowest since the financial crisis, ex-China. From Nomura:

#Glencore | Trafigura feeling the pain too...

#Spain | *SPAIN'S BUDGET DEFICIT AT 27.3 BILLION EUROS JAN-AUG. ...things that make you go hmmmm

Tracy Alloway

Tracy Alloway

No comments:

Post a Comment