Evening wrap..... Latest from Asia/ Japan / China trading for Wednesday ( August 26th - China Section below)

"Biggest Rally Of 2015" Crashes Into Biggest Reversal Since Lehman http://www.zerohedge.com/news/2015-08-25/biggest-rally-2015-crashes-biggest-reversal-lehman …

Latest sell-off in US stocks into the close not driven by any new fundamental news rather pick up of flow & vols amid large sell-side talk

China - and Asia Broadly .....

Hong Kong yuan pool faces record liquidity crunch. Overnight rates spike at 20% - a record high http://www.scmp.com/business/global-economy/article/1852602/hong-kong-yuan-pool-faces-record-liquidity-crunch … via @SCMP_News

So, what now? Chinese markets all over the shop post-PBoC move, lurching lower now.

Yuan weakening , follow on measure from China after RRR cut and interest rate cuts.

30 years to life for aggravated selling

CHINA SHANGHAI COMPOSITE SET TO OPEN UP 0.5% TO 2,980.79

China Devalues Yuan To Fresh 4-Year Lows, Probes Securities Firms, Restricts Futures Trading As Margin Debt Dro... http://www.zerohedge.com/news/2015-08-25/china-devalues-yuan-fresh-4-year-lows-probes-securities-firms-restricts-futures-trad …

Devaluation Stunner: China Has Dumped $100 Billion In Treasurys The Past Two Weeks http://www.zerohedge.com/news/2015-08-25/devaluation-stunner-china-has-dumped-100-billion-treasurys-past-two-weeks …

RINGGIT EXTENDS LOSSES, NOW DOWN 1.9% VS DOLLAR

BREAKING: Chinese Police announced to crack down "underground banks", blamed for "hot money" inflow to grow speculations in stock market

MORE: Chinese Police has "destroyed" at least 66 "underground banks", involving 430 bln "illegal capital" incl some "hot money" in stock mkt

The Latest Currency War Entrant: India Warns May Retaliate To Chinese Devaluation http://www.zerohedge.com/news/2015-08-25/latest-currency-war-entrant-india-warns-may-retaliate-chinese-devaluation …

Dead cat bounce in U.S. stock markets. Come on PBOC, you have to think up something better than a couple of minuscule rate cuts.

Is China Quietly Targeting A 20% Devaluation? http://www.zerohedge.com/news/2015-08-25/china-quietly-targeting-20-devaluation …

Citi: Between price action & conversation Tue, there seems to be consensus: #PBoC action is not game changer & recent FX trends will persist

Europe.....

Former Greek negotiator Houliàrakis is said to become interim Finance Minister due to his experience w the bailout MoU & the Troika. #

Interview poll for Vergina TV

SYRIZA 24

ND 22

G Dawn 6

Potami 5.5

PASOK 4.5

KKE 4.5

Pop. Unity 4.5

Centre Union 4

Ind Grks 3

Other 5

#Greece

Meimarakis & Lafazanis say they insist there's a last-effort meeting of all political leaders w Pres Pavlopoulos bfore snap elections called

Public debt as % of GDP, 2015

Japan: 243%

Greece: 174%

US: 105%

France: 94%

UK: 90%

India: 66%

Turkey: 36%

China: 22%

Russia: 13%

Saudi: 2%

1 Two main impacts of China crisis on Greece: shipping (especially of dry goods) will be hurt.

2 market turbulence will make it even harder for Greek banks to raise capital from private investors. Will have to rely on bailout.

Party members are leaving Syriza so fast that I'm beginning to wonder how they'll find candidates to populate the ballot papers. #Greece

And meanwhile, Greek and int'l media are discussing Syriza's popularity & how they'll come stronger out of this mess. #OutOfTouch #Greece

11 #Greece suppl'ry funds are integrated into the Unified Auxiliary Insurance Fund (ETEA) as of Sep 1 (via @euro2day_gr) #economy #pension

Morning Tweets......

Asia Broadly , China & Japan specifically , Emerging Markets , Oil ......

China raising margins on CSI300 index futures... capitalization-weighted stock index for performance of 300 stocks in Shanghai & Shenzhen

China's financial futures exchange announces new rules including to raise margin requirement to crack down "excessive market speculations"

PBoC bombshell- cuts 1-year lending rate by 25bps to 4.6%, 1-year deposit rate by 25bps to 1.75%, RRR by 0.5ppt, further deposit rate reform

RTRS - CHINA’S CENTRAL BANK CUTS BANKS’ RESERVE REQUIREMENT RATIO BY 50 BPS

CHINA CUT RRR & INTEREST RATES!!!!!

Russia +3.95%

Saudi Arabia +4.6%

Brent $44.08

Crude $39.50

Half of the 30 biggest emerging markets are bear #markets, down 20% including #China #Brazil #Poland via @BloombergEM

"You will be deciding who will govern Singapore for the next 5 years," says @leehsienloong http://str.sg/Z7Pd

#Singapore goes to the polls on Sept 11

http://www.news.gov.sg/public/sgpc/en/media_releases/agencies/pmo-eld/press_release/P-20150825-2/AttachmentPar/0/file/Press%20Release%20on%20General%20Election%202015.pdf … #sgelections #SG50 #GE2015

It's about to get harder to move money out of China- new crackdown on "grey" fund outflows as yuan flight intensifies http://www.reuters.com/article/2015/08/25/us-china-economy-capitalflight-idUSKCN0QU0JQ20150825 …

#China margin debt now probably higher as % of free float than ever before. This doesn't even include non-margin stock linked debt.

FACTS: After #BlackMonday there were just another 2000 stocks down 10% daily limit on Tuesday in Chinese stock market. How many up? Only 28!

China's stock market crash impact: stock crash -> SME bankruptcy -> hard landing -> fail to redistribute wealth -> forget Xi's "China Dream"

BREAKING: China's stock market down over 8% again -- two large caps Sinopec and PetroChina both down 10%, w/ all listed brokerages down 10%

FT sources suggest that #China has spent $200bn since it devalued its currency 2 weeks ago. /via @RANsquawk

Earlier today well-respected @caixin quoting official sources reports China won't intervene market any more after pouring big money recently

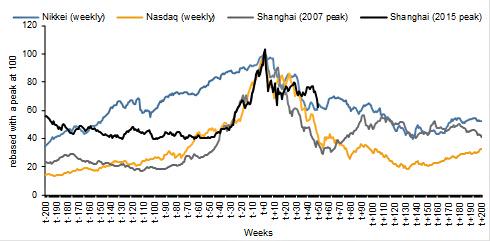

How low can it go? A lot lower as the comparison of Shanghai Comp w/ other bursted bubbles shows. (Chart via RBS)

This is scary - 3000 points for Shanghai benchmark index means A LOT to Chinese investors. Many began to buy when index rose to 3000 points!

Chinese Gov has so far not yet shown any support to stock market today, letting market fall like Isaac Newton's apple. So, just let it be?

BREAKING: Bye-bye! Shanghai benchmark index sinking nearly 7%, breaking psychologically important 3,000 points level

Shipping sources in Singapore say a slowdown in oil demand is now becoming visible

ICYMI, my Forbes post on #China. #BlackMonday signals the end of its growth cycle: http://www.forbes.com/sites/francescoppola/2015/08/24/chinas-black-monday-signals-the-end-of-its-growth-cycle/ …

As much as $12.5 billion in oil money has been “diverted” away from the Nigerian government http://econ.trib.al/ZhfUzOJ

Europe......

Euro drops below $1.15 as markets in Risk-on-Mode after China has cut benchmark interest rates.

* French economy minister says German economy will be affected more by China than France because of higher export exposure - RTRS

* French econ min says expects that FED chairman Yellen will not raise U.S. interest rates in September, at the earliest in December - RTRS

The Euro is currently more of a RoRo-trade (Risk-on/Risk-off trade). Drops after German Ifo beats expectations.

Not all gloom & doom. German Ifo defies market woes. Rises to 108.3 in Aug, points to GDP YoY growth of around 2%.

France PM Valls: Govt To Cut Taxes and Still Reduce Deficits

https://mninews.marketnews.com/content/france-pm-valls-govt-cut-taxes-and-still-reduce-deficits …

#Ifo rise surprised me, no trace of #China effect. Postponed to September? #capex outlook not too promising

Germany's Dax stabilizes after yday's rout. Trades 1.4% higher after open in a very volatile session.

#ECB | *ECB SAYS BANKS DEPOSITED EU162.3 BLN WITH IT OVERNIGHT

#Spain | July PPI M/M: 0.1% v 0.9% prior; Y/Y: -1.3% v -1.3%

Lafazanis, leader of Popular Unity, asks for a meeting with Greek PM Alexis Tsipras: http://openeurope.org.uk/daily-shakeup/merkel-and-hollande-call-for-unified-asylum-system-and-fair-sharing-of-refugees/#section-3 …

Leader of #Syriza's breakaway Popular Unity asks for new Greek elections to be held later than Sept 20th: http://openeurope.org.uk/daily-shakeup/merkel-and-hollande-call-for-unified-asylum-system-and-fair-sharing-of-refugees/#section-3 …

#Greece stock market rebounds 5.3% today after a nosedive by 10.5% on Mon. #economy #markets #stocks

#Greece President unlikely to call party leaders' meeting on Thurs. Straight to caretaker gov't, making Sept 20 elex possible via @geoterzis

Ex-Greek FinMin Varoufakis calls #Germany's Schäuble a "puppet master" who minted the #eurozone. http://www.welt.de/politik/ausland/article145595148/Mit-Dr-Schaeuble-habe-ich-mich-nie-gelangweilt.html … via @welt

The quintessential *must read* about the Greek crisis: #Greece & Its Misguided Champions https://hbr.org/2015/08/greece-and-its-misguided-champions …

No comments:

Post a Comment