Evening Wrap.....

A wild and crazy day for US trading - after Asia and Europe carnage ......

Asia generally , China specifically , Emerging Market news , Commodities . Currencies ....

#Japan Stocks Plunge for Second Day http://bloom.bg/1NFML0V

Europe....

#Greece tourism to hv record year despite pol turmoil.

Morning Overview !

Asia , E.M , Commodities Crush .......

Photo of Airport apt analogy to Stock markets underwater right now ....

North Korea vs South Korea Contremps haven't gone away....

Europe......

Calendar , Economic Data , US Futures ......

#Economics this week: #GDP updates in #Brazil, #Germany, #Spain + #UK; #US durable goods + flash #PMI, EZ sentiment http://ow.ly/R95OY

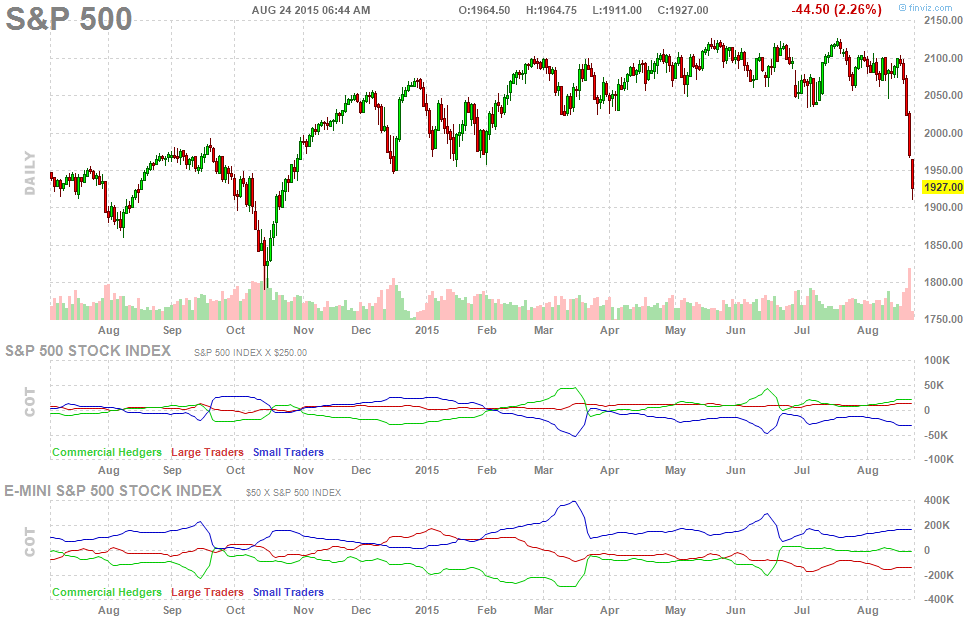

A wild and crazy day for US trading - after Asia and Europe carnage ......

History in one chart: Today Dow Jones plummeted 1,089.42 points at one point, biggest intraday point drop ever.

"Black Monday" Brings Global Market Rout, Investors Mourn The Death Of Central Bank Omnipotence http://www.zerohedge.com/news/2015-08-24/black-monday-brings-global-market-rout-investors-mourn-death-central-bank-omnipotenc …

Dow Jones total move about 6000 points (excel still calculating)

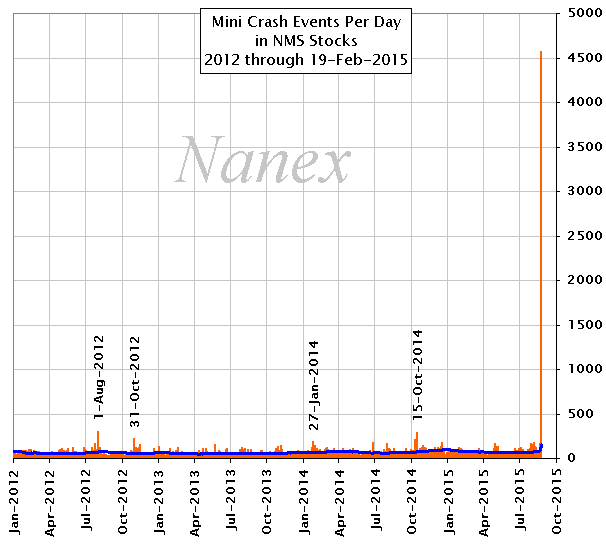

Over 4,500 mini crash events so far today. Compare to last few years:

September Rate-Hike Probability Crashes To Just 28% http://www.zerohedge.com/news/2015-08-24/september-rate-hike-probability-crashes-just-28 …

Asia generally , China specifically , Emerging Market news , Commodities . Currencies ....

Oh what fresh hell is this China. #ChinaMeltdown

PBoC injects RMB150B ($23B) in 7-day reverse repos (after 120B operation just last week). Yuan fix slightly stronger today 6.3987 $CNY $CNH

AsiaPac Stocks Continue Collapse As Yuan Deposit Rates Spike To Record High, China Devalues, Japan Denies "G7 R... http://www.zerohedge.com/news/2015-08-24/asiapac-stocks-continue-collapse-yuan-deposit-rates-spike-record-high-china-devalues …

F5: *CHINA CSI 300 STOCK-INDEX FUTURES FALL 4.3%

ONE-WEEK OFFSHORE YUAN DEPOSIT RATE JUMPS 840 BPS TO 22.9%. Its probably nothing

JAPAN MOF OFFICIAL: NO PLAN TO MEET WITH BOJ OFFICIALS TODAY. Not good for global coordinated bailout rumormongers

PBOC ACADEMIC SAYS RRR CUT WON'T ADD LIQUIDITY TO STOCK MARKET

Angry investors give Chinese metals exchange head taste of market forces: Chinese investors are getting pissed... http://bit.ly/1Ia49nk

Traders in $5.3trn/d FX markets were busy Monday as currencies have had biggest day in years. http://www.bloomberg.com/news/articles/2015-08-24/biggest-day-in-years-for-currencies-as-investors-flee-risk …

Ruble Traders Snub Medvedev’s Currency Vows Amid Deepening Rout. http://bloom.bg/1JuDBCL

In case you missed it: Bloomberg commodity index has hit fresh 16yr low mainly driven by oil, copper and other metals

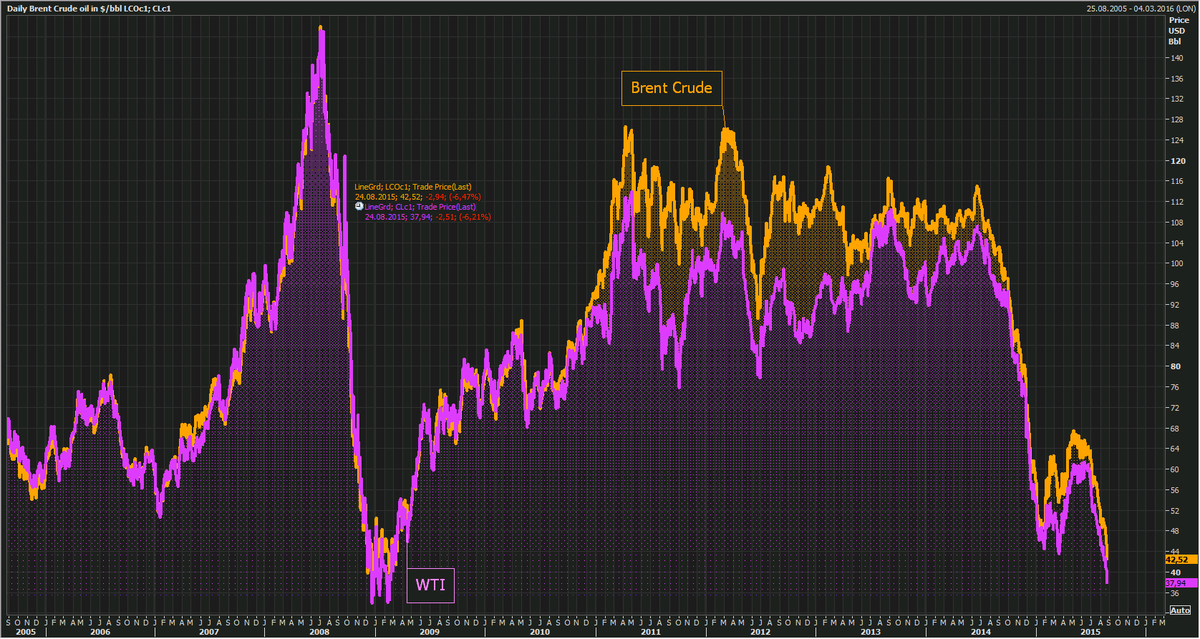

Oil in free fall. Brent & WTI hit fresh 6yr low on China angst as oil production remains robust despite drop in price

Copper, Aluminum Close at Lowest Levels Since 2009 http://tinyurl.com/ncc3kcv

Daimler Cutting 1,500 Brazil Truck Jobs as Demand Plunges http://bloom.bg/1PM0UJ9

Beijing capitulates after spending $200bn to prop up equities http://ow.ly/RhN3p currency intervention to prop up peg tightens credit

South and North Korea reach agreement to end military conflict http://sabahdai.ly/2MbzC1

BREAKING: Chinese authorities issued notice to state media to censor negative market reports following #BlackMonday

Europe....

Head of hotel owners forecast:

26ml arrivals vs 24ml 2014.

Revenue €14.5bn vs €13.5

SUPER SUNDAY: Greek and Catalan elections (potentially) on the same day.

What #Greece's Memorandum really Means or why #Tsipras wants a quick election http://www.dissentmagazine.org/online_articles/europe-greece-memorandum-understanding-mou-galbraith-munevar … v @zoemavroudi

#SYRIZA announces it will not participate in 'pretence' parliament sessions announced by the Speaker for next week - ouch

NEGATIVE 1yr interest rates: Austria, Belgium, Denmark, Finland, France, Germany, Japan, Switzerland, Sweden. Staggering expression of fear

Greece: How can an avalanche of tax hikes for an economy suffering from capital controls ever boost growth? https://euroinsight.mni-news.com/posts/why-the-third-greek-bailout-is-also-likely-to-fail-9620 …

Morning Overview !

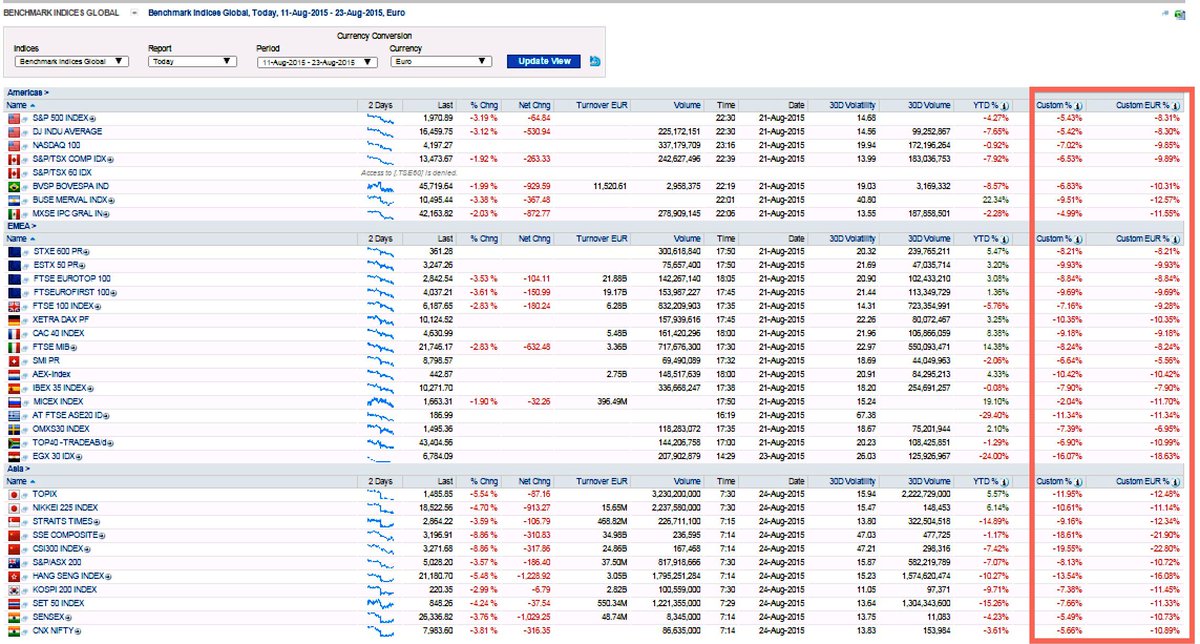

Deutsche Bank Says Rout ‘Very Serious’ as Growth Outlook Dims: http://www.bloomberg.com/news/articles/2015-08-24/deutsche-bank-says-rout-very-serious-as-growth-outlook-dims … Global stocks have lost $5 trillion since August 11th.

Asia , E.M , Commodities Crush .......

This is what Shanghai Hongqiao Airport looks like right now - completely flooded. Not a good day to fly to Shanghai !

ICYMI: The Shanghai Composite was up 60% on June 12, it is now red for the year

BREAKING: Hong Kong Financial Secretary John Tsang will meet the press and speak at 5:15pm (after stock crash in Greater China region today)

Free fallin’: #Japan Nikkei closes down 4.6% at 18540.68 in correction territory. Logs biggest ppt-fall since Jun2013

A Chinese newspaper editor just told me he got "order" that he shouldn't use words like "crisis" or "disaster" 股災 for today's market story!

Since #China’s FX regime change on 11Aug, markets in sell-off mode. Shanghai Comp has plunged by 22% in Euro terms.

CHART: China's Shanghai Composite just recorded one of its largest-ever losses

http://www.businessinsider.com.au/chart-chinas-shanghai-composite-is-staring-at-one-of-its-largest-losses-on-record-2015-8 …

DUBAI'S STOCK INDEX OPENS DOWN 5.6 PCT

INDIA CENTRAL BANK CHIEF RAJAN SAYS WON'T HAVE ANY HESITATION IN USING FOREX RESERVES AS APT TO REDUCE VOLATILITY

After arresting short-sellers, ban margin finance, hedge & program trading, now Beijing simply blames "global economy" for China crash today

ALL CHINESE STOCK INDEX FUTURES CONTRACTS FOR CSI300, CSI500, SSE50 DOWN MAXIMUM 10 PCT DAILY LIMIT DOWN

FACTS: By midday break, nearly 2000 stocks down 10% daily limit in Chinese market -- only 13 stocks up; Shanghai benchmark index down 8.45%

Shanghai Comp has closed down 8.5% way below the sacrosanct 3500 level.

Global de-risking accelerating: Commodities plunge to lowest in 16 years. http://bloom.bg/1KFzTCC

You were warned! Dr. Copper, the metal with the PhD, saw #China market sell-off coming.

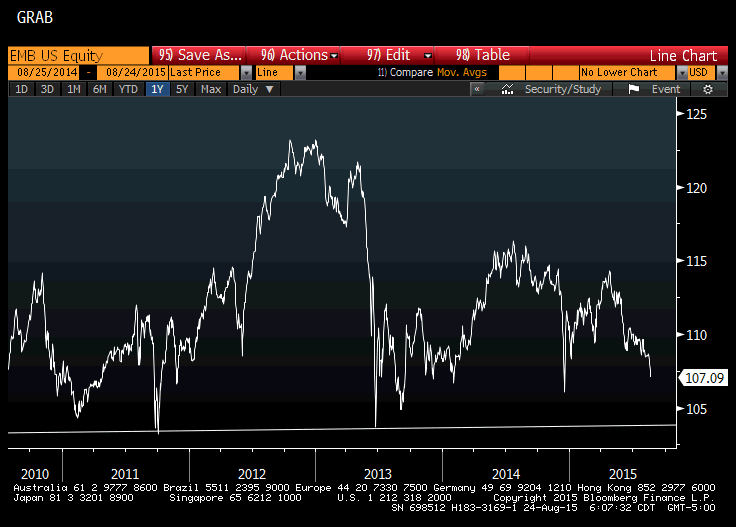

As The EM Rout Intensifies: Saudi Arabia, Taiwan, Brazil, Indonesia Join China In Bear Market

Who Will Be Next? http://emergingequity.org/2015/08/24/emerging-market-rout-deepens-with-no-end-in-sight/ …

TAIWAN VICE FIN MINISTER SAYS "HIGHLY CONCERNED" ABOUT TAIWAN STOCK LOSSES, DOES NOT RULE OUT GOVERNMENT FUND PROPPING UP STOCKS IN DUE TIME

North Korea vs South Korea Contremps haven't gone away....

N. Korea forward deploys amphibious landing crafts carrying special forces http://english.yonhapnews.co.kr/national/2015/08/24/69/0301000000AEN20150824001300315F.html?input=www.twitter.com …

(URGENT) Deployment of U.S. B-52 strategic bomber, nuke-armed submarine in S. Korea under discussion http://english.yonhapnews.co.kr/national/2015/08/24/7/0301000000AEN20150824003900315F.html?input=www.twitter.com …

(2nd LD) Park urges N. Korea to apologize for provocations http://english.yonhapnews.co.kr/national/2015/08/24/8/0301000000AEN20150824001652315F.html?input=www.twitter.com …

Europe......

Brent $43.31

Oil market collapsing further today, WTI hits 38 handle

COMMODITIES SLIDE TO LOWEST IN 16 YEARS AS OIL EXTENDS COLLAPSE

RTS -6%

Gazprom -7.4%

Lukoil -6.4%

Novatek -5%

Sberbank -7.4%

VTB -6.11%

$Ruble 71.28

Main opposition leader fails to form govt; next up 4 exploratory mandate is #Lafazanis' newly-formed Popular Unity. He's also likely to fail

Over $1 trillion wiped off top Europe shares in August. http://reut.rs/1fAT1cl

#Inflation expectations collapse in tandem w/ commodity prices. #Eurozone 5y5y swap drops to 1.6210, lowest in 6mths.

#Euro rally continues. Since #China's FX move on 11 Aug, common currency has gained 5 big figures vs. Dollar.

Germany's Dax breaks below 10k

Free fallin': #Russia Ruble breaks beyond 70 per Dollar as sell-off in Oil continues.

Calendar , Economic Data , US Futures ......

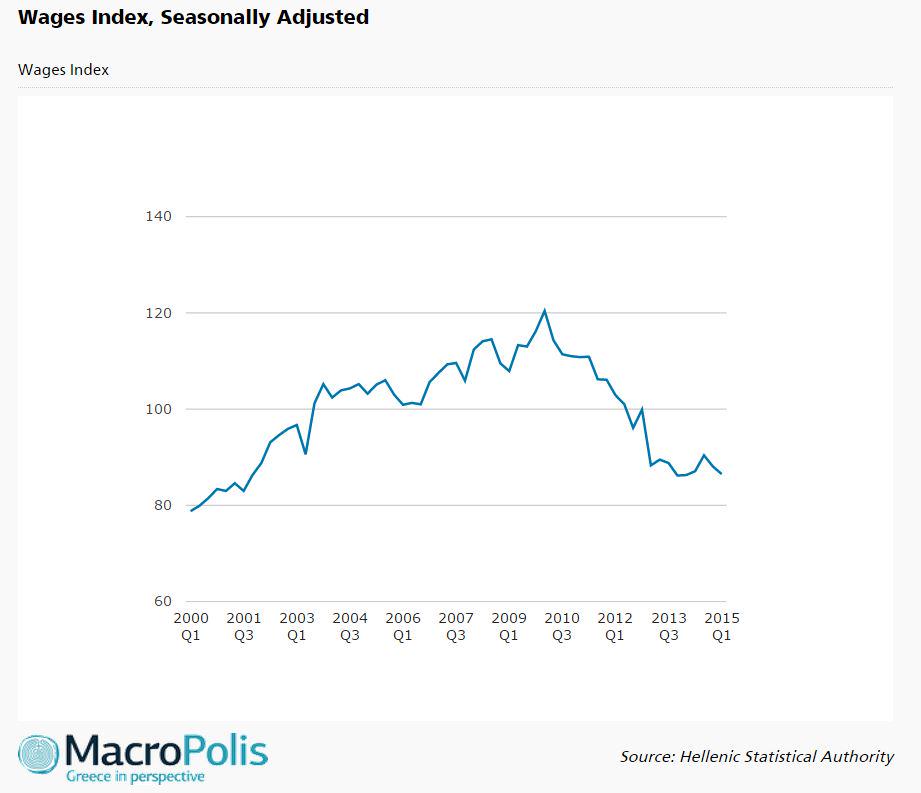

#Greece wages index falls 1.8% QoQ in Q1 for the 2nd successive Q to level similar to Q4 2001. http://www.macropolis.gr/?i=portal.en.economy.2858 …

BREAKING: Dow Futures plunging 400+ points; S&P and Nasdaq Futures also steeply lower. http://cnb.cx/1JMMnxG

Stock futures tumble as Wall Street preps for meltdown: http://finance.yahoo.com/news/dow-futures-down-330-points-090059627.html?l=1 …

No comments:

Post a Comment