Morning Tweets....

Greece....

No comment from SYRIZA's Left Platform chief Lafazanis as he leaves Parl't. Y'day he declared intention to launch anti-bailout party #Greece

Greek PM Alexis Tsipras wins bailout vote, faces widening rebellion http://reut.rs/1KkQAmR via @Reuters

*IMF IS SIGNALING IT WILL TAKE PART IN GREEK BAILOUT, WIRTZ SAYS

Turkish fishermen claim Greek coast guards harmed a dinghy with 50 Syrians on board yesterday. http://greece.greekreporter.com/2015/08/14/turkish-fishermen-accuse-greek-coast-guard-of-sinking-syrian-refugee-boat/ …

*GREEK DEBT RESTRUCTURING OPEN TO DISCUSSION, WEISSGERBER SAYS

#EU Commission's @A_Breidthardt tweets that #Greece bailout package totals €85.5bn, not €91.7bn as reported yday.

Greek media say Tsipras will ask for vote of confidence on August 20.

Tsipras loses minimum constitutional majority for minority gov't. It's up to him if he'll resign or not now. #Greece

#Greece Parliament approves 3rd bailout with 222 Yes votes, 64 No, 11 abstentions & 3 absent but 32 SYRIZA MPs vote against & 11 abstain

Skai TV puts gov't MPs who voted for 3rd bailout at 118. Below min of 120 needed to survive confidence vote & may lead to snap polls #Greece

*SAPIN SAYS GREEK DEBT WILL BE DISCUSSED IN OCTOBER

*SAPIN SAYS GREEK DEBT WILL NEED TO BE `RE-PROFILED'

#Greece's 2y yields drop to 13.5% as Greek govt secures votes to pass bailout in parliament. http://reut.rs/1KkQAmR

Commission has agreed to prepare further bridge financing for Greece of €6.04bn in case 3rd bailout does not allow near-term payments (RTRS)

Broader Europe.....

Eurozone Finance Ministers to Discuss Backing Greek Bailout http://nyti.ms/1J81fom

Morning Note: 1. PBOC strengthens reference rate. 2. France + German GDP disappoint 3. WTI lowest since March '09

Finland stuck in a 3-year recession. Obviously needs a serious dose of "structural reform".

Germany wants #IMF onboard4 #Greece bailout .#IMF wants debt relief commitment. #Germany (#Schaeuble ) is against. Another long #Eurogroup ?

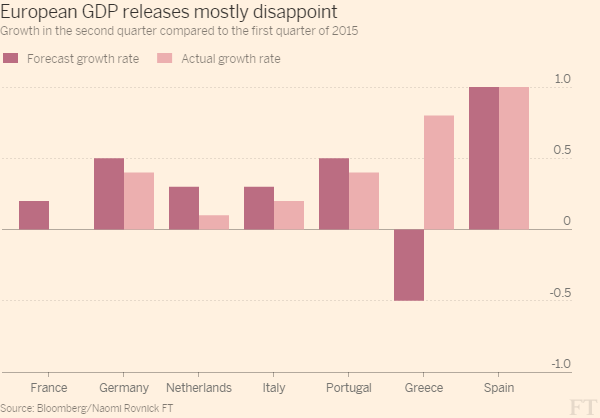

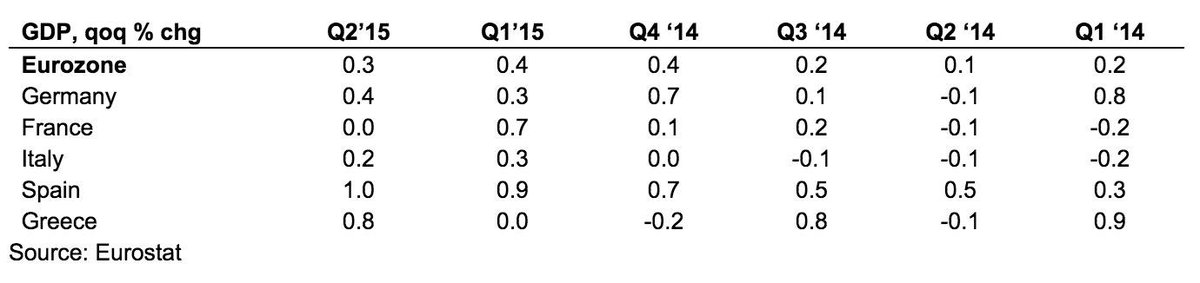

#Spain saved #Eurozone from returning to stagnation. 2Q GDP grew by 0.3%, after 0.4% in 1Q, below exp 0.4% expansion.

Very weak GDP data from Austria and Finland. Economies have both stagnated.

Eurozone economy grows just 1.3% Y/Y in the year ending Q2 2015

EURO-AREA JULY CONSUMER PRICES DECREASE 0.6% VS PREV MONTH

EURO-AREA ECONOMY GREW 0.3% IN SECOND QUARTER VS 0.4% ESTIMATE

Italy's economy grew just 0.4% Y/Y in the year ending Q2 2015

ITALIAN ECONOMY GREW 0.2% IN SECOND QUARTER VS 0.3% ESTIMATE

#Italy 2Q GDP a touch soft: Grew +0.2% on Qtr undershooting forecast of +0.3%.

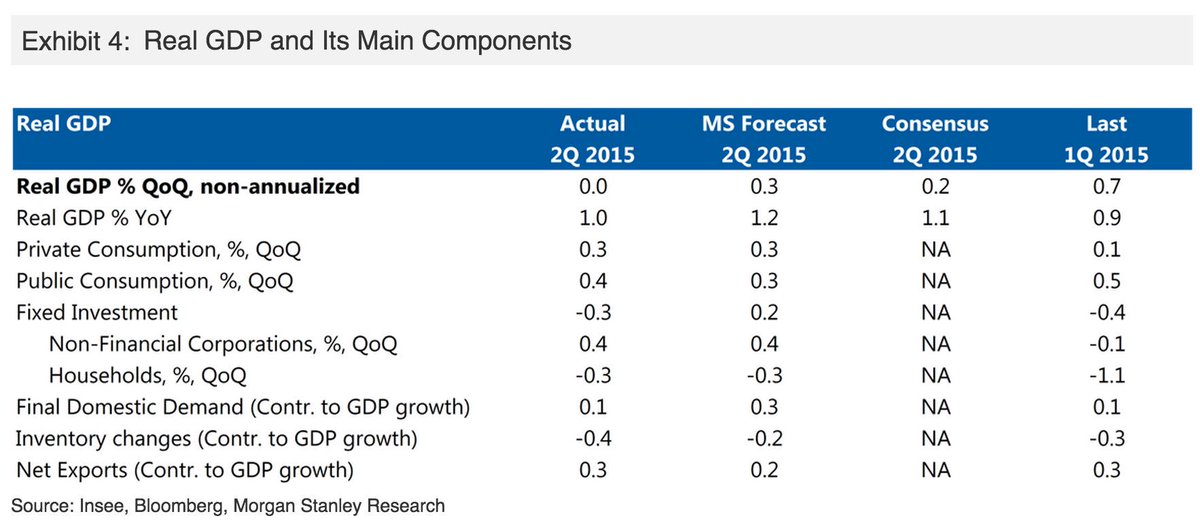

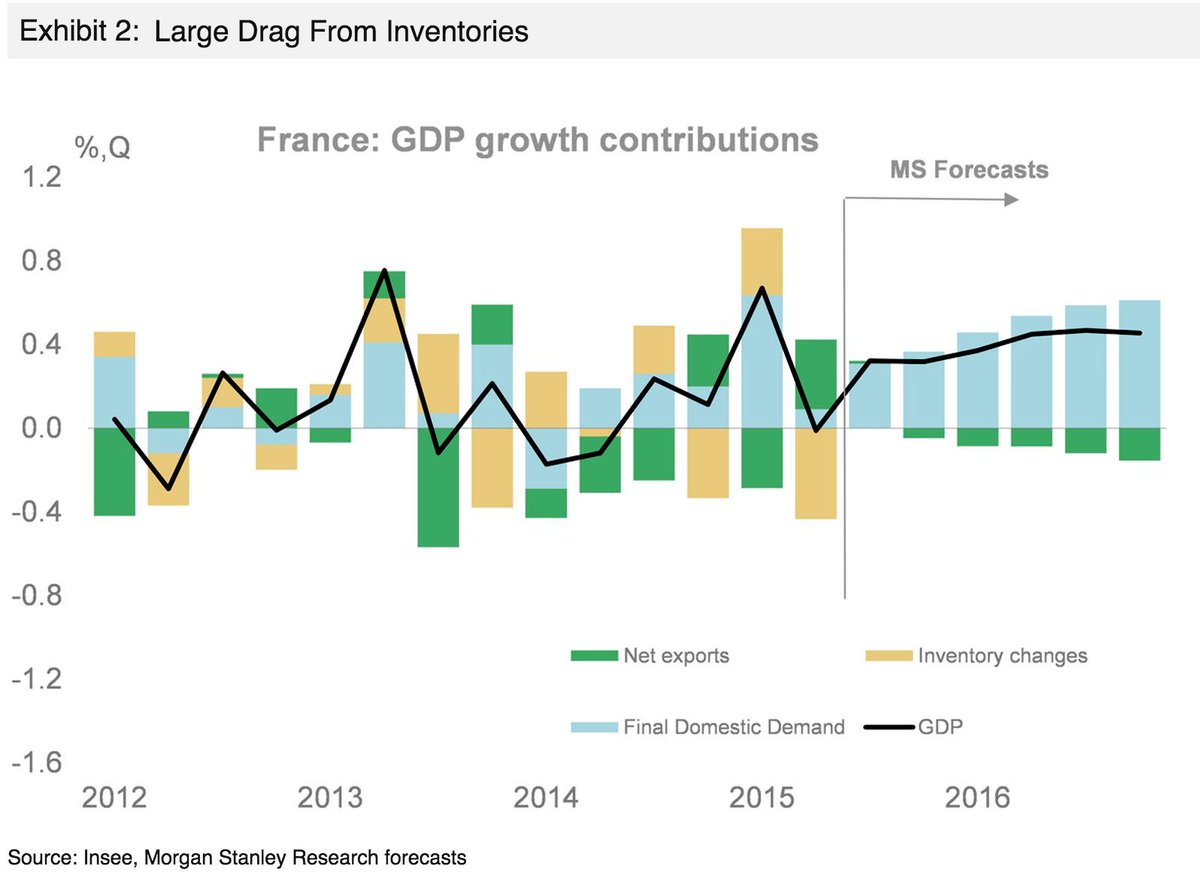

Inventories and Fixed investments have ruined #France Q2 GDP numbers. (via Morgan Stanley)

French Economy posted 0% growth in Q2:

Private Consumption +0.1%

Investment -0.3%

Govt Spending +0.3%

Exports +1.7%

Imports +0.6%

Despite ZIRP, $50 oil, and weak exchange rate, Germany & France are still tracking a GDP growth rate less than 1.5%

Net exports save the day for German Q2 GDP data. But Morgan Stanley expects #Germany to shrink by 0.1% in Q3.

GERMAN ECONOMY GREW 0.4% IN SECOND QUARTER VS 0.5% ESTIMATE ... very weak

German economy grows just 1.3% Y/Y in H1

German economy tracking just 1.4% growth for 2015

German Exporters See Long-Term Fallout From Yuan Decline http://bloom.bg/1JetljE

FRANCE 24 @FRANCE24

Oil prices head for seventh weekly fall http://f24.my/1TzRO7X

Glencore sells stakes in copper, nickel mines for $290 mln http://goo.gl/EhoK7s

From a year ago, price of WTI crude is down 56%, gold by 15%, copper by 27%, and sugar by 35%. http://ow.ly/QSwK9

MacroPolis

MacroPolis

fastFT

fastFT

No comments:

Post a Comment