Tweets..

Greece.....

# Cyclades sky in mid August. # Greece

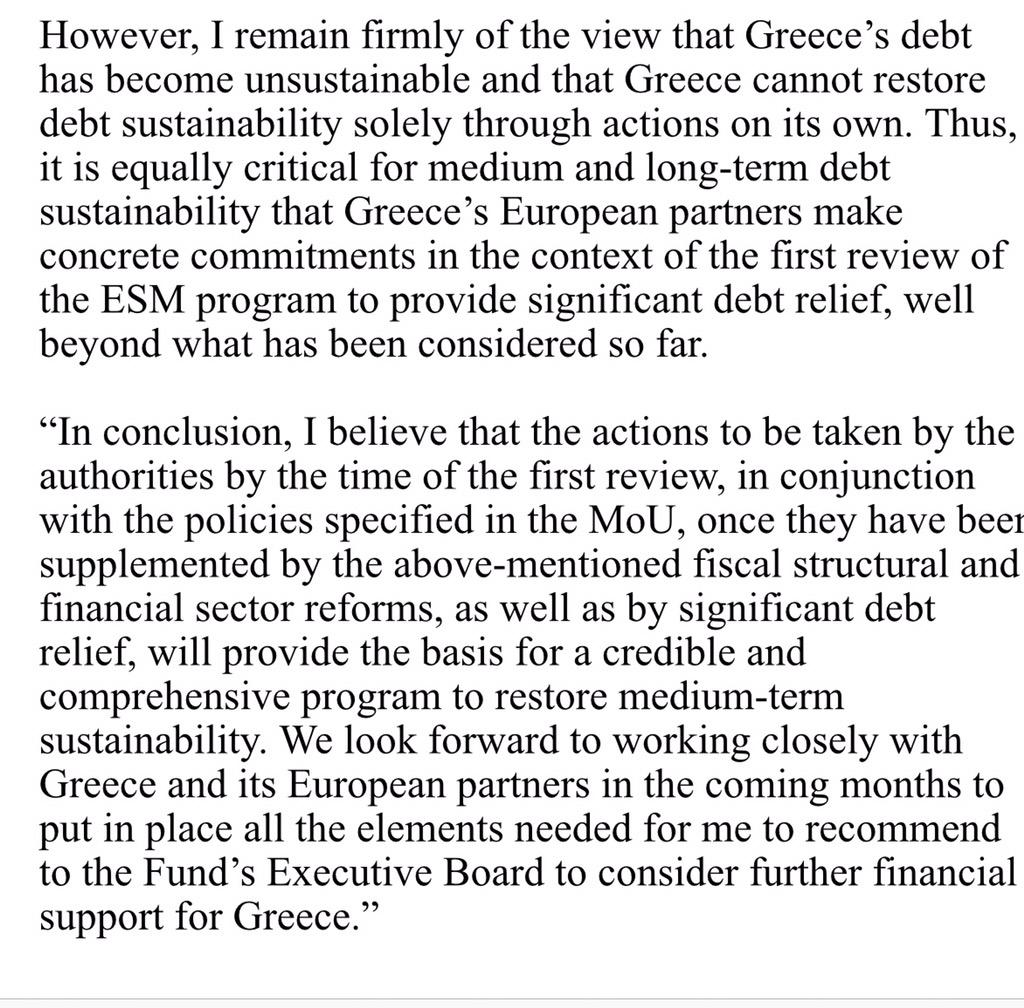

As you know I am unimpressed with the Greek bailout. Here is my latest rant about it. At @Forbes. http://www.forbes.com/sites/francescoppola/2015/08/15/the-great-eu-imf-standoff/ …

IMF vs EG Battle Royale looms ...... EG wants IMF participation in 3rd GR Bailout - but doesn't want IMF's harsh debt relief medicine ....

Kathimerini: possible that Greek PM #Tsipras won't hold vote of confidence just yet, in order to win time (DPA)

German Company Set to Take Over Operations of 14 Greek Airports http://dlvr.it/Bs5nHd #Greece

Breakdown of the First Installment of Greece’s Third Bailout http://dlvr.it/Bs5nd7 #Greece

Greece just got €55bn debt relief. This is not a typo. Terms on €86bn loan so generous that present value only €31bn http://wp.me/p307bb-2G

just for the lolz I Calculated the implied subsidy in a 32y / 1% loan at different levels of fair rate # greece

A Pragmatic Approach to External Debt: The Write-Down of Germany's Debts in 1953: Greece's crisis, you have invited ... http: // bit.ly/1TF675O

German parliament to vote on Greek package on Wednesday morning http: // dlvr.it/BrywCy

Eurogroup on #Greece: €26bln until Oct, pension reform & asset fund this year, no depositor bail in & vague on debt https://shar.es/1tzZ3b

EU aims to lure Greek deposits back to banks with bail-in shield http://dlvr.it/Brxh7B

Greek banks senior debt at 2.6 bln in Q1, reduced in Q2 due to repurchases. #Greece #economy #banks #banking #ecb

IMF's Lagarde calls on Europe to provide 'significant' debt relief for Greece http://www.ekathimerini.com/200583 #Greece

#Schaeuble is out saying room for #Greek debt relief is limited. How will Berlin reconcile that stance with insistence #IMF stay on board?

Greece forced to privatise water as Berlin and Paris busy buying water utilities back. http://www.theguardian.com/sustainable-business/2015/aug/14/germanys-hypocrisy-over-greece-water-privatisation?CMP=share_btn_tw …

#Schäuble: We will discuss debt sustainabilitywith the Insitutions and the IMF in October. No official view on this yet. #Eurogroup #Greece

Reminder: Out of #ESM's €50bn for #Greece, more than €22bn will be used for maturing Greek bonds held by ECB & Eurozone central banks.

1/2 #Greece Finance Ministry official says first tranche of possible #ESM loan to be likely split into two sub-tranches.

2/2 First sub-tranche of €13bn for debt repayments & arrears to be released Aug 20, 2nd subtranche of €10bn for bank recap early Sep. #Greece

Broader Europe.....

Ukraine....

#Ukraine fails to secure debt write-off at US talks http://on.rt.com/6p4t

Ukraine in California debt talks end without a deal; sides say Negotiations ongoing in joint statementhttp: // bloom.bg/1LajpFr via @ business

Ukraine , creditors plan phone talks as debt deal eludes themhttp: // f24.my/1J3YjVg

Italy in focus ....

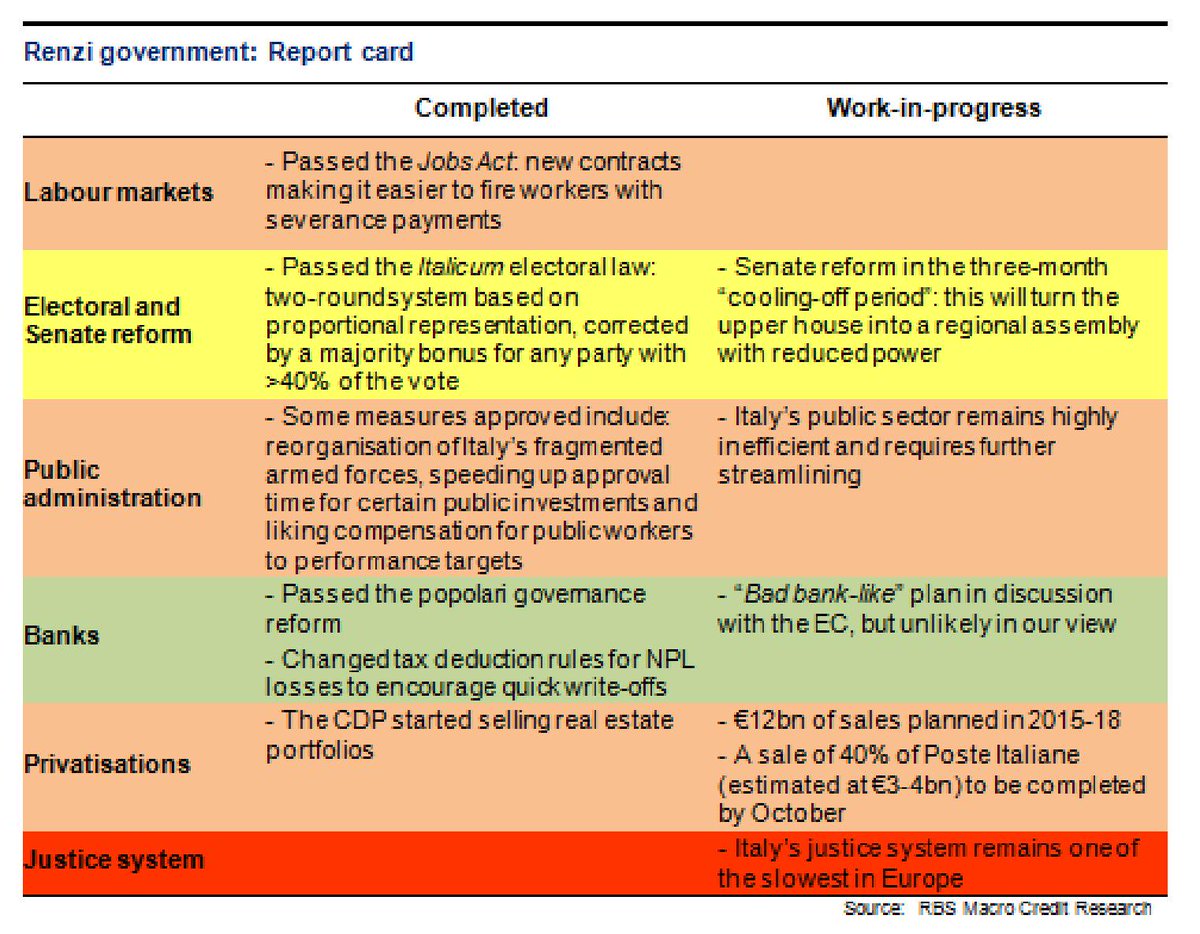

'Demolition man' Renzi has not delivered yet. Most reforms uncompleted or 1st impact not been pos. (via RBS) #Italy

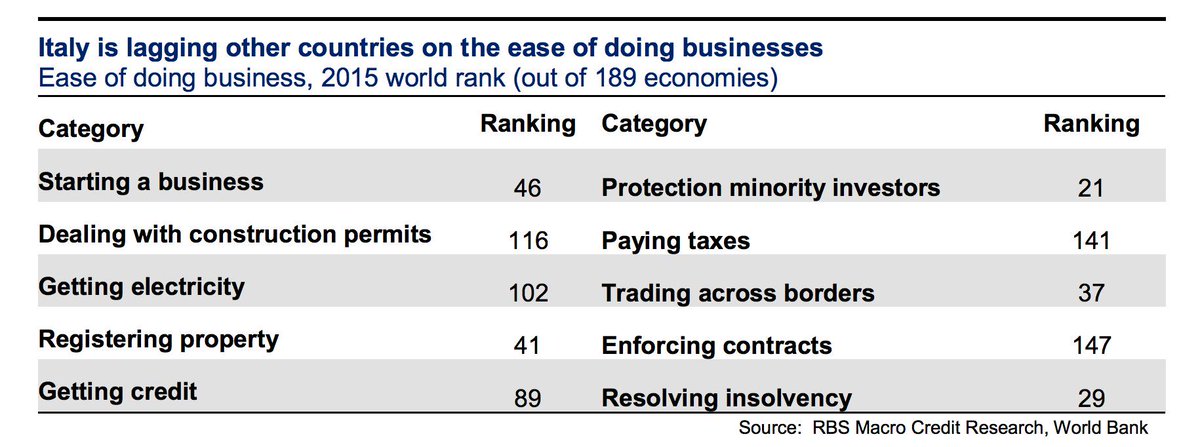

RBS: #Italy's econ outlook remains highly uncertain as country is lagging other countries on ease of doing businesses

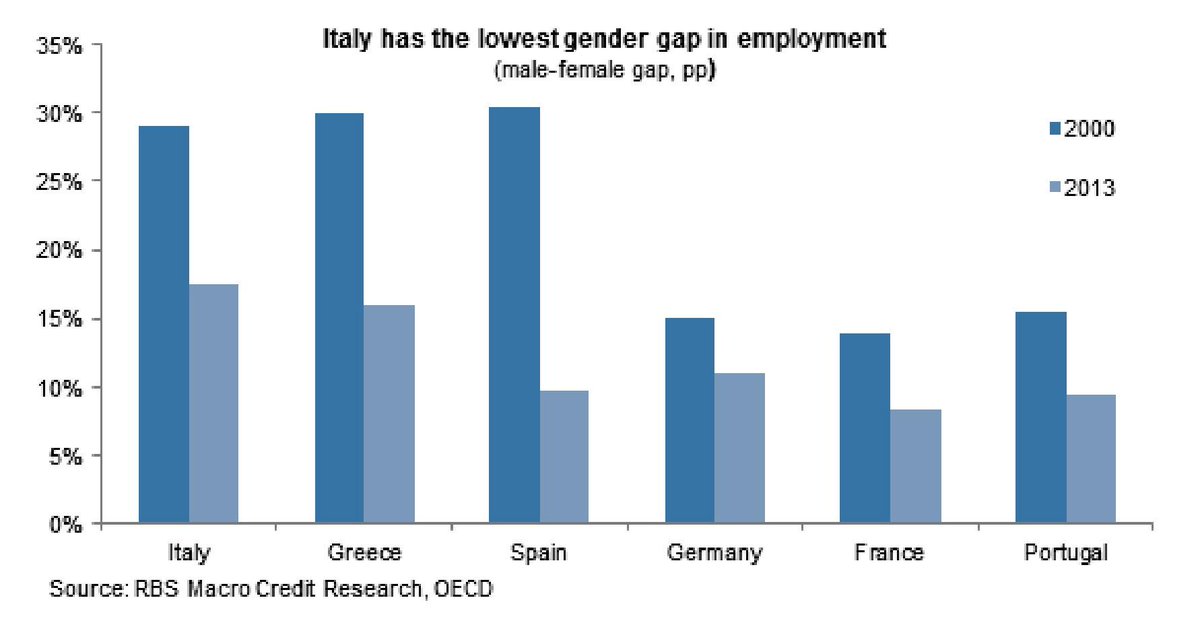

RBS: #Italy’s labour markets remain in need of modernisation, to bridge large gap between young & old, male & female.

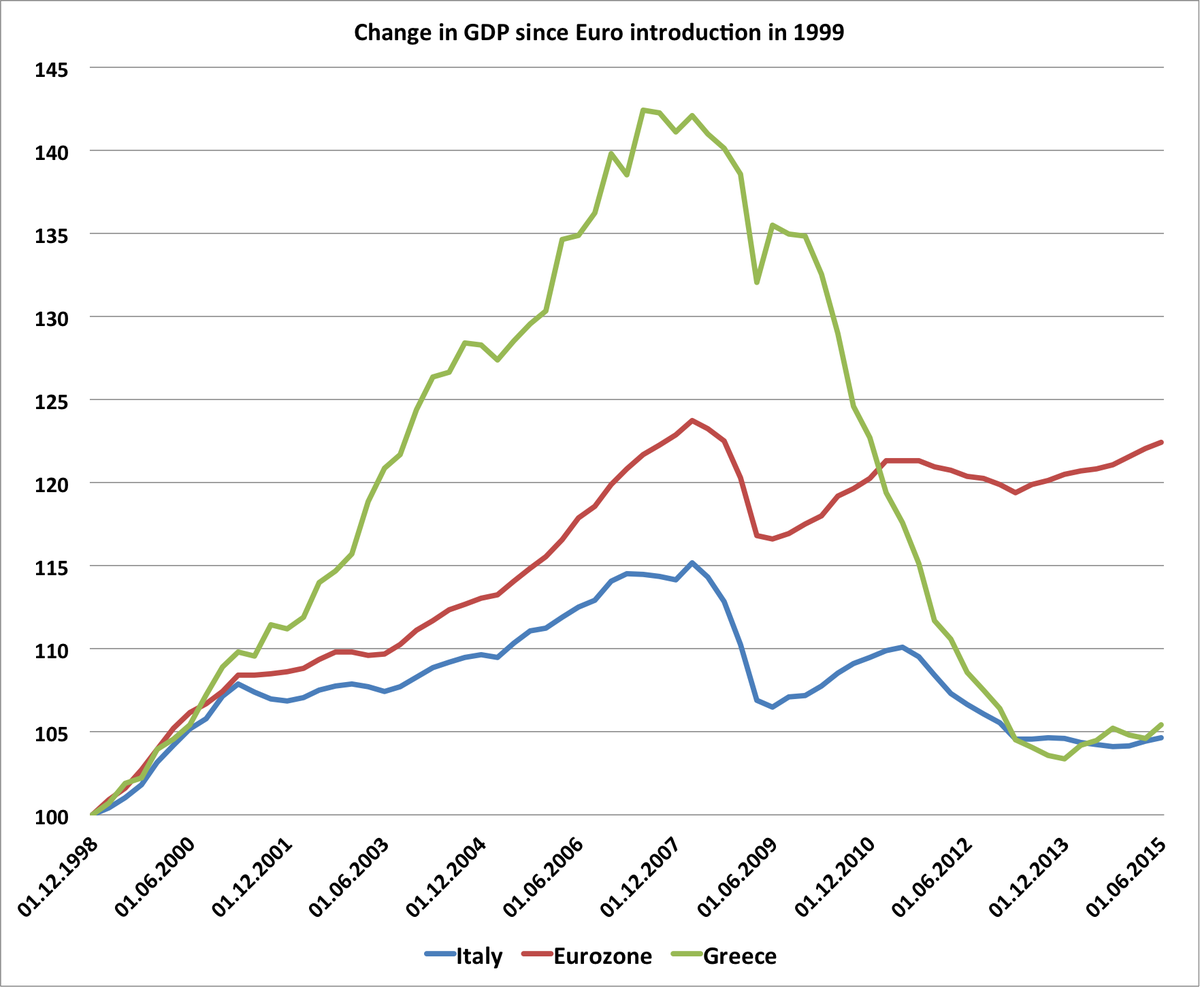

What do you call country that has grown in total 4.66% since it joined euro 16ys ago? Country in depression or #Italy

China.....

IMF's article IV on China. Says credit flow contracted 19pc Jan-May due to shadows. Hence it crunch. Now picking up

https: // www. imf.org/external/pubs/ ft / scr / 2015 / cr15234.pdf ...

China's external $ debt now $1.014 trillion (8.9% of GDP). $882bn is short-term. NIIP share of GDP deteriorating fast

China losing global share of low-end goods, esp apparel, shoes, furniture. From IMF's latest

How # China 's # Singapore -like plan will 'boost growth' by shaking up state-run behemoths.http: // ow.ly/QTAO1

Air pollution killing 4,000 people a day in China, says US report http: // ow.ly/QT93v

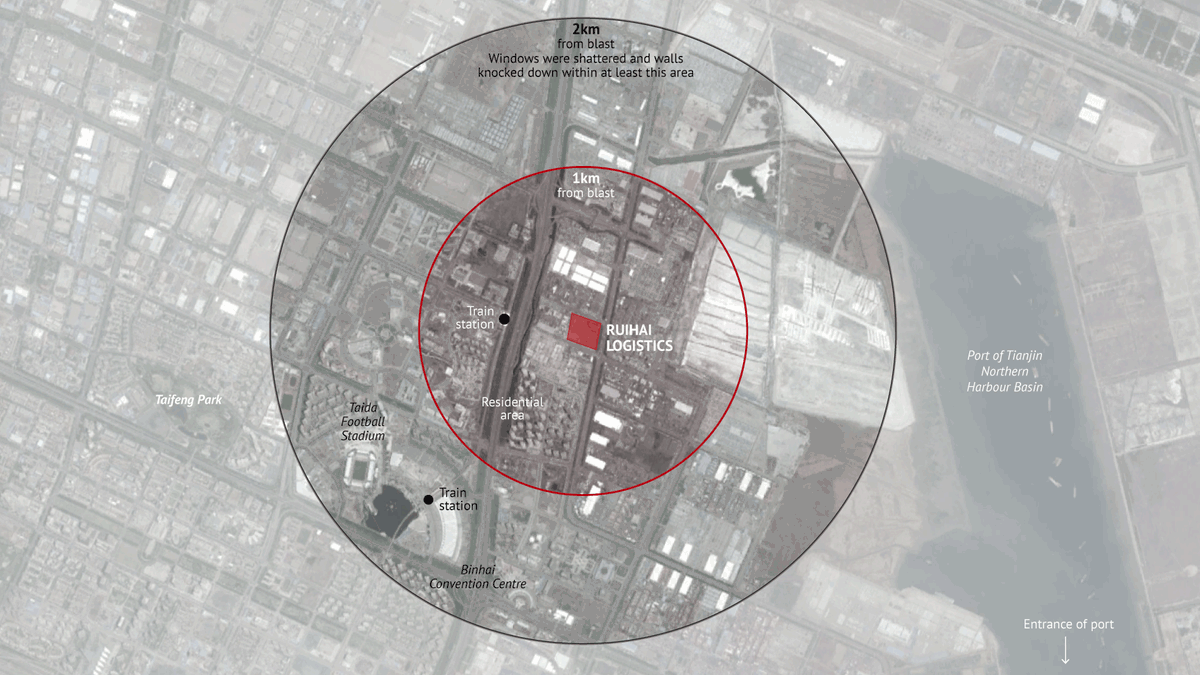

Wind change at # China blast site raises fears of toxic spreadhttp: // www. reuters.com/article/idUSKC N0QH2B220150815 ...

Breaking: # Tianjin blasted warehouse on fire again! Blasts Heard by Xinhua reporters at site, dense smoke spotted

New explosions rock #Tianjin, residents within 3km of blast site evacuated http://on.rt.com/6p51

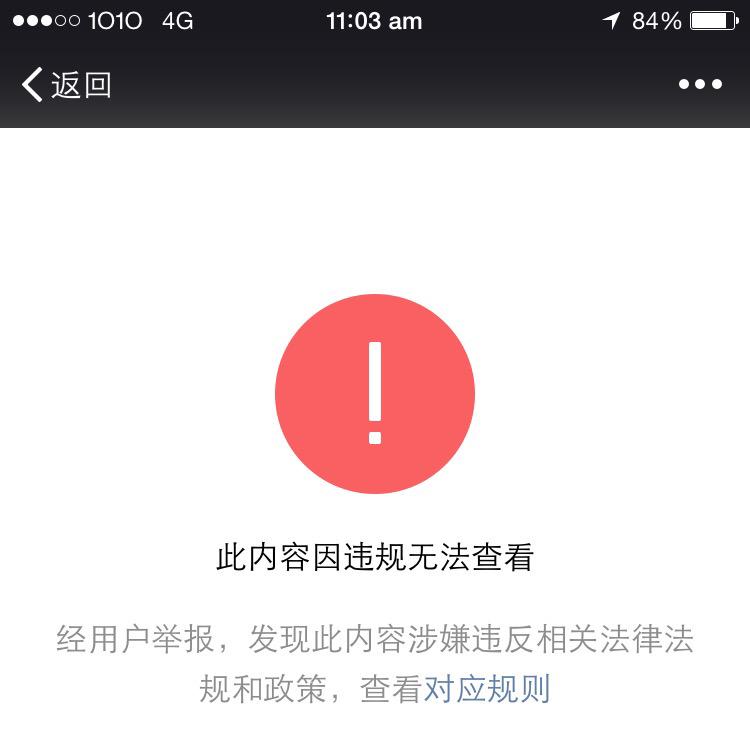

BREAKING: Chinese authorities started to heavily censor, delete #TianjinBlast related news, info esp about death toll

Confirmed: An exclusive investigative report by @caixin mag about #TianjinBlast death toll has been deleted by gov on social media WeChat

More than 300 social media accounts incl on Weibo and WeChat have been suspended due to spreading #TianjinBlast "rumors", state media report

After pushing down the yuan three times in three days, China just pumped it up a bit http://qz.com/479772/after-pushing-down-the-yuan-three-times-in-three-days-china-just-pumped-it-up-a-bit/ … via @qz

My view: China's latest statement seems like the end for this round of "stock market rescue"; just let investors help yourself from now on!

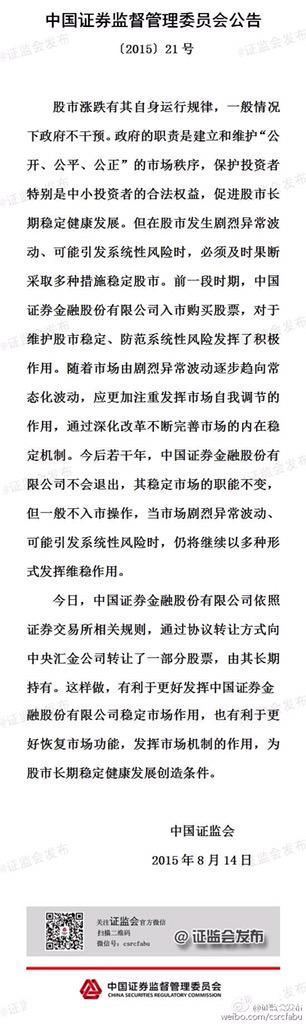

MORE: Chinese Gov will only intervene stock market when it sees potential systemic risk (see attached full statement)

BREAKING: China's state agency for margin finance has "transferred some stocks" to national sovereign wealth fund for its long-term holding

BREAKING: China's securities regulator promises the state agency for margin finance won't "exit from market" for "next few years" -statement

No comments:

Post a Comment