Tweets.....

Manos Giakoumis retweeted

Marc poll for @EFSYNTAKTON

What should gov't do if negotiations not successful?

Compromise 65.9%

Rupture 30.7%

No answer 3.4%

Marc poll for @EFSYNTAKTON

Would thinks have been better/worse if ND had won elections

Worse 56.6%

Better 23.4%

About same 16.7%

#Greeece

#Greece's latest IMF payment is due in 24 hours — and Athens is desperate for positive news. http://read.bi/1FYZPLy

ONE TROIKA SCENARIO INCLUDES GREECE PAYING STAFF IN IOUS: WELT

Fabrizio Goria retweeted

BIG question: will GGB holders freak out if Greece does not pay IMF/ECB but promises to pay them and Europe loans.

Irony: Europe/Germany pushes GR over cliff re pensions/labour;Greece defaults on ECB/IMF and keeps paying Europe.

Why should Greece sacrifice countrymen to pay ECB after it dodged haircut in 2012. So thinks Syriza and co.

Tidbit: if Greece does not pay IMF/ECB, its not a credit event says S&P. Plus: no cross default on GGBs if GR does not pay ECB.

Word is that Greece has money to pay IMF on Tuesday. But what if it does not pay and then blames Europe. Divide and conquer!

Syriza pol to hedgie: if Europe does not bend tomorrow we will default on IMF

Greece's secret plan to not pay IMF/ECB

http://www.nytimes.com/2015/05/11/business/dealbook/imf-and-central-bank-loom-large-over-greeces-debt-talks.html?ref=dealbook …

Broader Europe.....

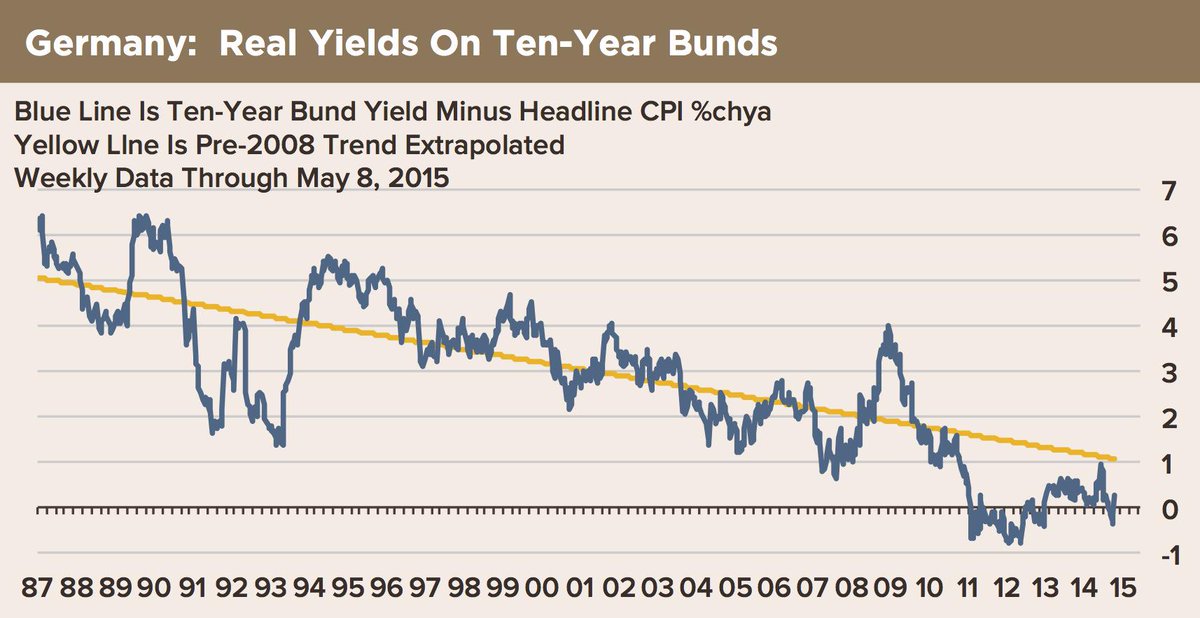

Bond markets still wobbly after last weeks crash: 10yr German Bund yields start around 0.55% to the week.

Eurozone finance ministers meet ahead of Greek debt deadline - live updates http://bit.ly/1AQBlxX #Guardian

ECB SAYS 54 MLN EUROS BORROWED USING OVERNIGHT LOAN FACILITY, 108.48 BLN EUROS DEPOSITED

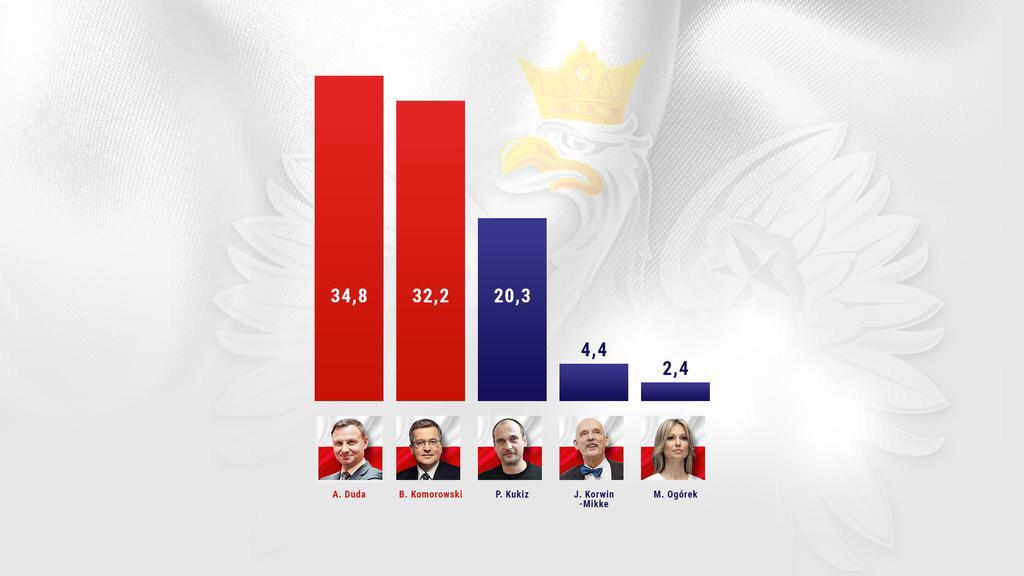

Trouble ahead for Kopacz government: Polish president suffers shock reverse in first round vote - exit poll http://uk.reuters.com/article/idUKKBN0NV0TQ20150510 …

Conservative opposition candidate wins 1st round of Poland presidential election http://on.wsj.com/1Eu70pM via @WSJ

Poland: presidential election goes to second round ►► http://i24ne.ws/MMocS

Looks as if opinion polls are losing the one election after the other these days. First UK. Now possible Poland.

Meanwhile in Poland

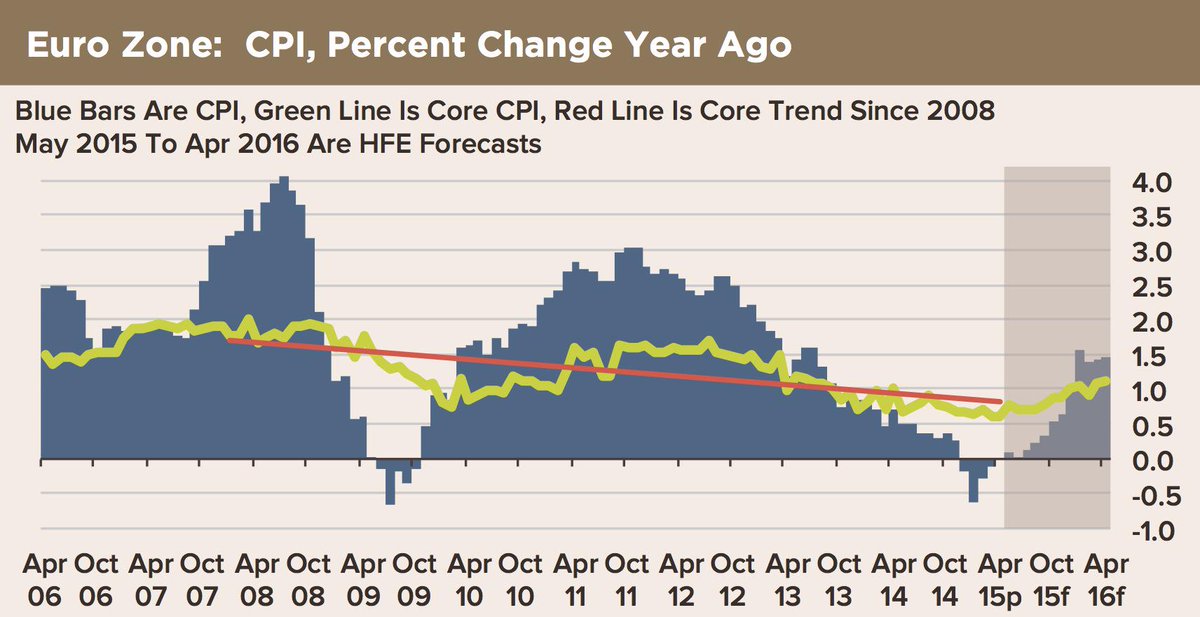

HFE expects another Bund crash as reflation trade just begun: Sees 10yr yields

to rise to 2.5% by Jan, possibly 4.5%

MacroPolis

MacroPolis

Alastair Macdonald

Alastair Macdonald

K. Hytrek-Prosiecka

K. Hytrek-Prosiecka

i24news_EN

i24news_EN

Carl Bildt

Carl Bildt

No comments:

Post a Comment