Tweets......

Greece....

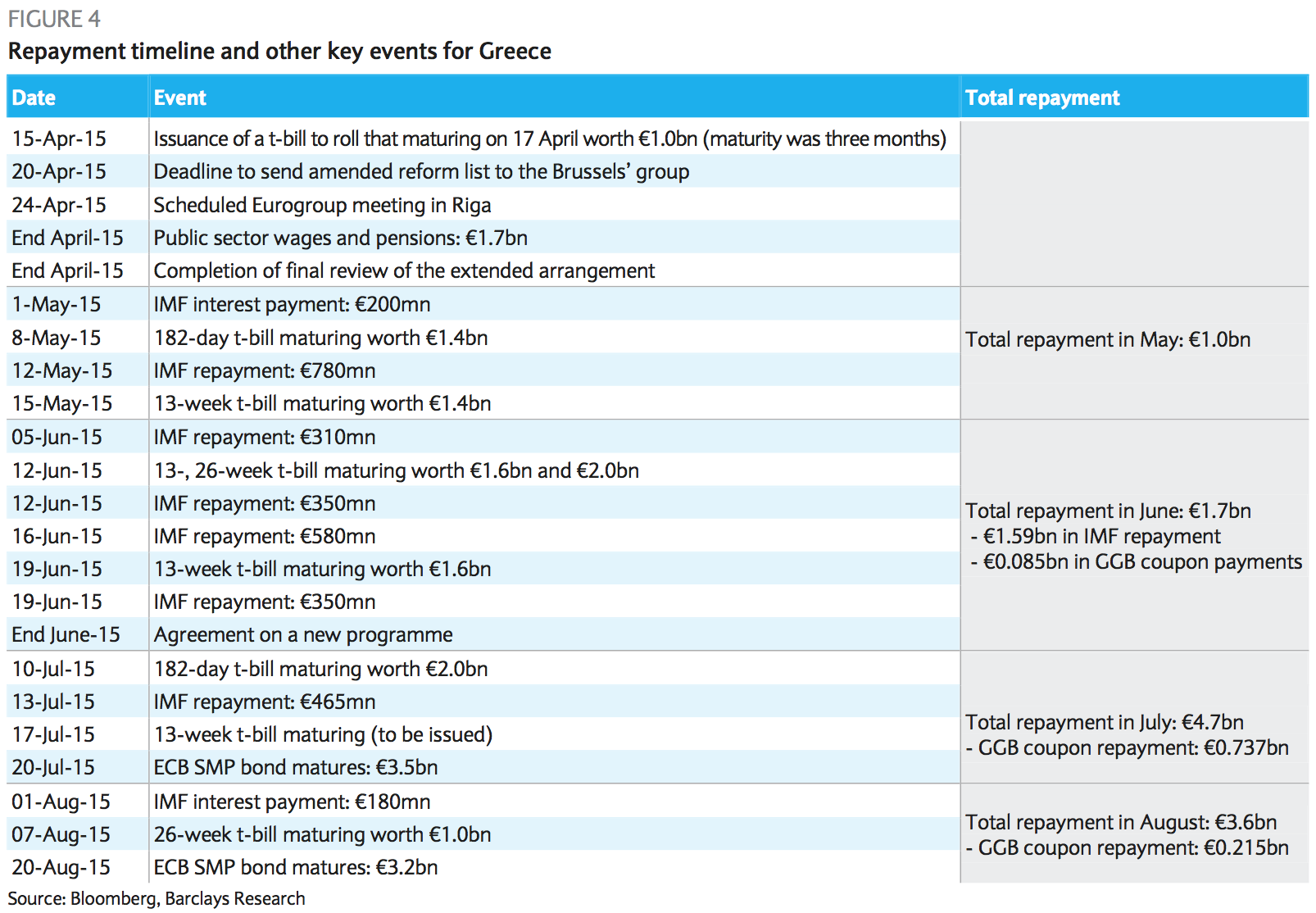

Barclays: Repayment timeline and other key events for Greece

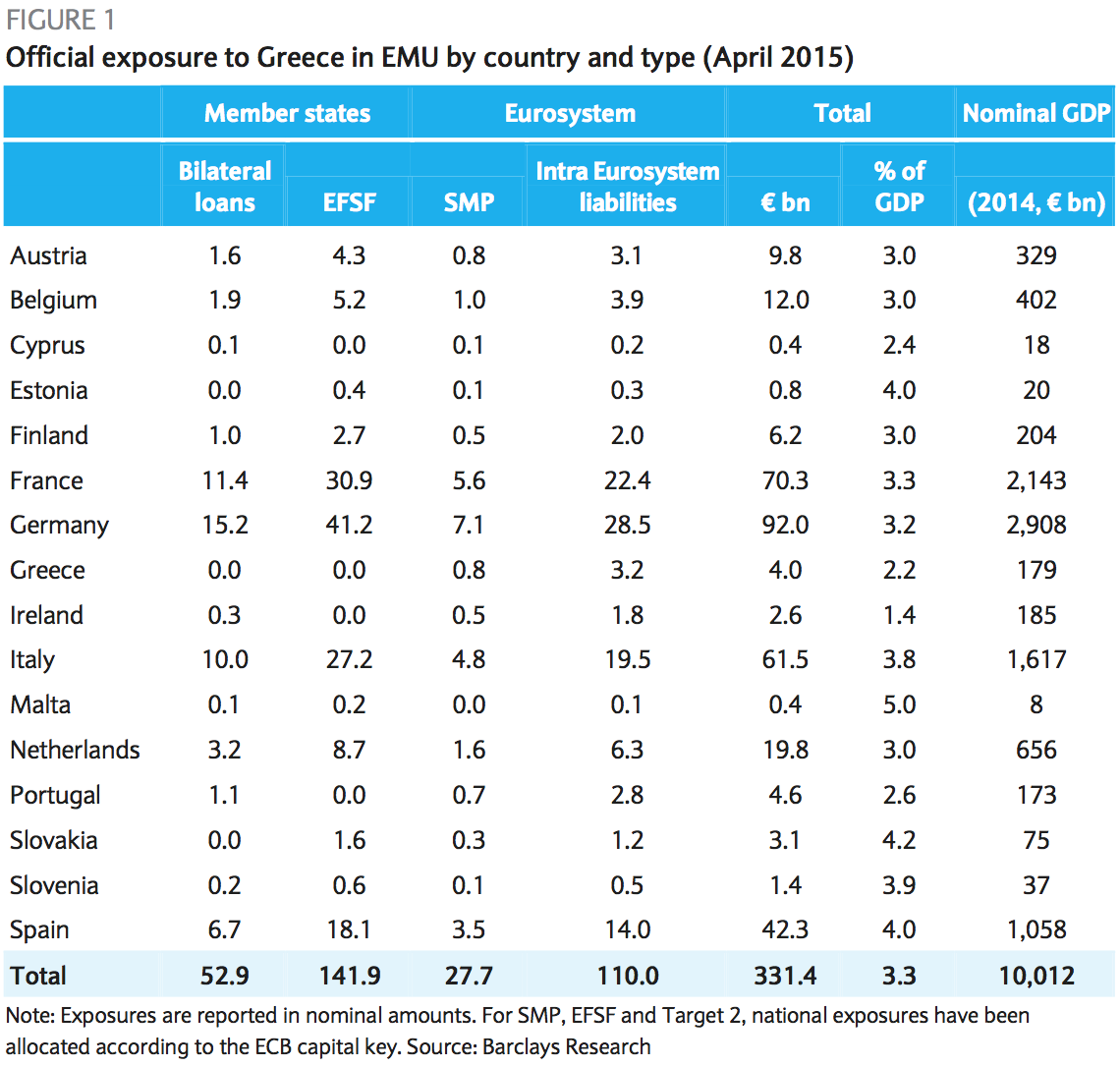

Barclays: Official exposure to Greece in EMU by country and type

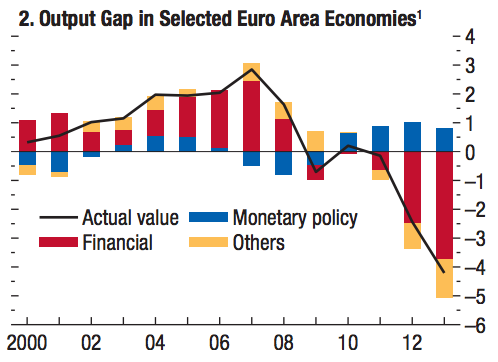

IMF: Output Gap in Selected Euro Area Economies (Greece, Ireland, Italy, Portugal, Spain)

Greece: too much talk, not enough vision - Analsyis by @er1cmau https://euobserver.com/beyond-brussels/128335 … via @euobs #Greece

The Greek Analyst retweeted

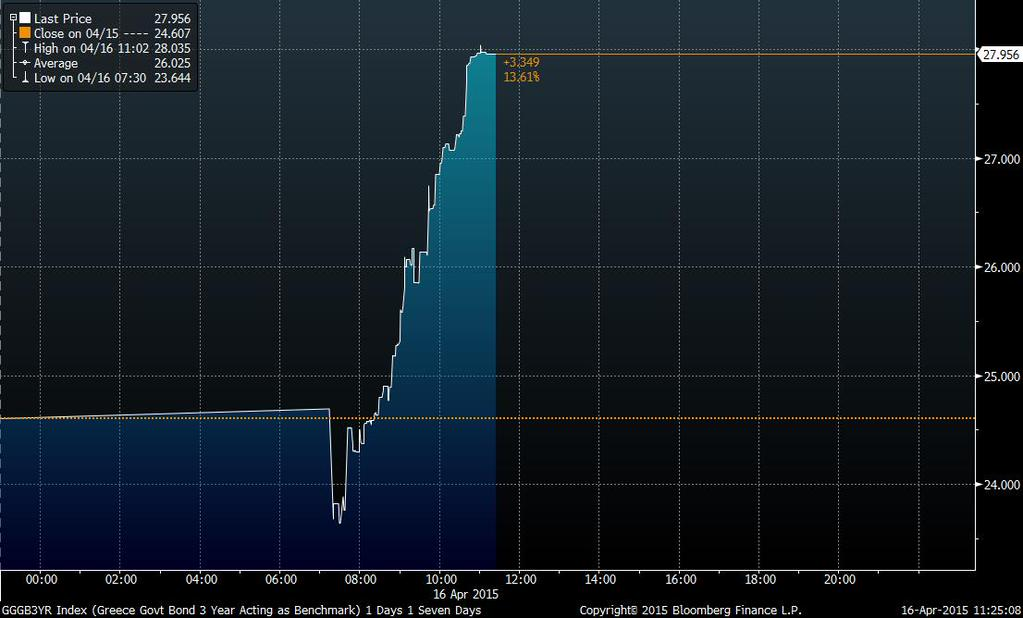

Greek bond yields are surging today. http://www.bloomberg.com/news/articles/2015-04-16/greek-bond-yields-are-surging-today …

Including today's non-competitive bids of €187.5 mln, #Greece rolled over €1 bln 3-mon T-Bills at 2.7% this week. #economy #ec #ecb #imf

Manos Giakoumis retweeted

#EC @MargSchinas on #Greece:at this stage not satisfied with the level of progress made so far, work needs to intensified before next eurogp

REGLING SAYS INTERNATIONAL AID TALKS ON GREECE ARE `DIFFICULT'

...very bearish comment

Kathimerini understands Greece may use law from 1951 to force all state bodies to transfer cash balances to the Bank of Greece #desperation

Schaeuble on Greece: No one has a clue how we can reach agreement http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_16/04/2015_549114 …

WOW RT @OpenEurope Bookmaker William Hill has suspended betting on a Greek exit from the euro this year #Grexit http://www.standard.co.uk/business/business-news/city-morning-headlines-greek-exit-fears-stoked-by-debt-downgrade-10180323.html … …

SAPIN: REASONABLE TO SAY NO ACCORD ON GREECE NEXT WEEK

...Sapin is French Finance Minister

#Greece made informal approach to the #IMF to delay repayments but was 'persuaded' not to file request ~@fastFT:… http://twishort.com/l1cic

#Greece| Varoufakis to meet reportedly 2day w Lee Buchheit, an expert on debt restructuring. His view on Greek debt► https://www.youtube.com/watch?v=TdrN1zxEl9U …

Schäuble says #Greece must ditch false hopes. S&P warns Greece could run out of money mid-May. http://bloom.bg/1FLw4cw

Broader Europe....

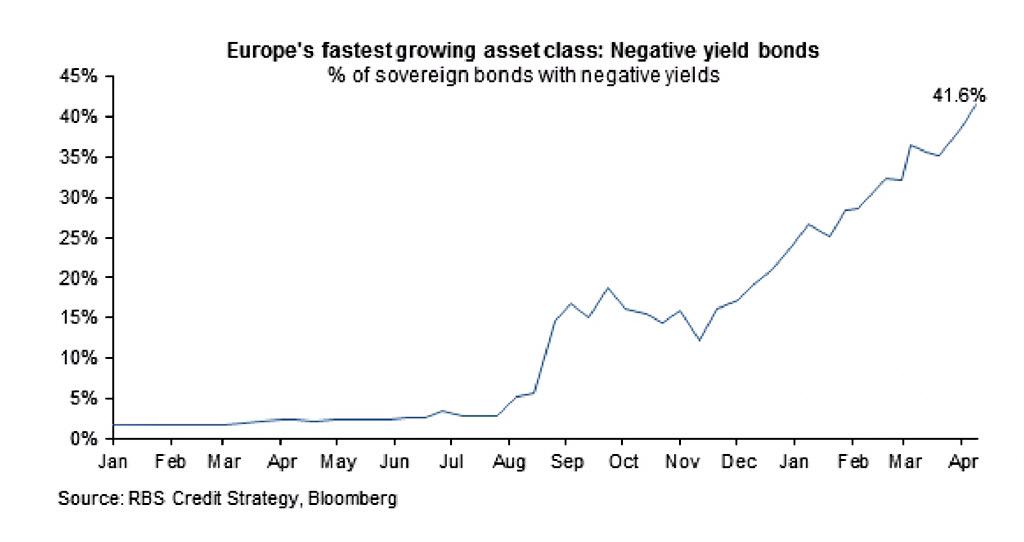

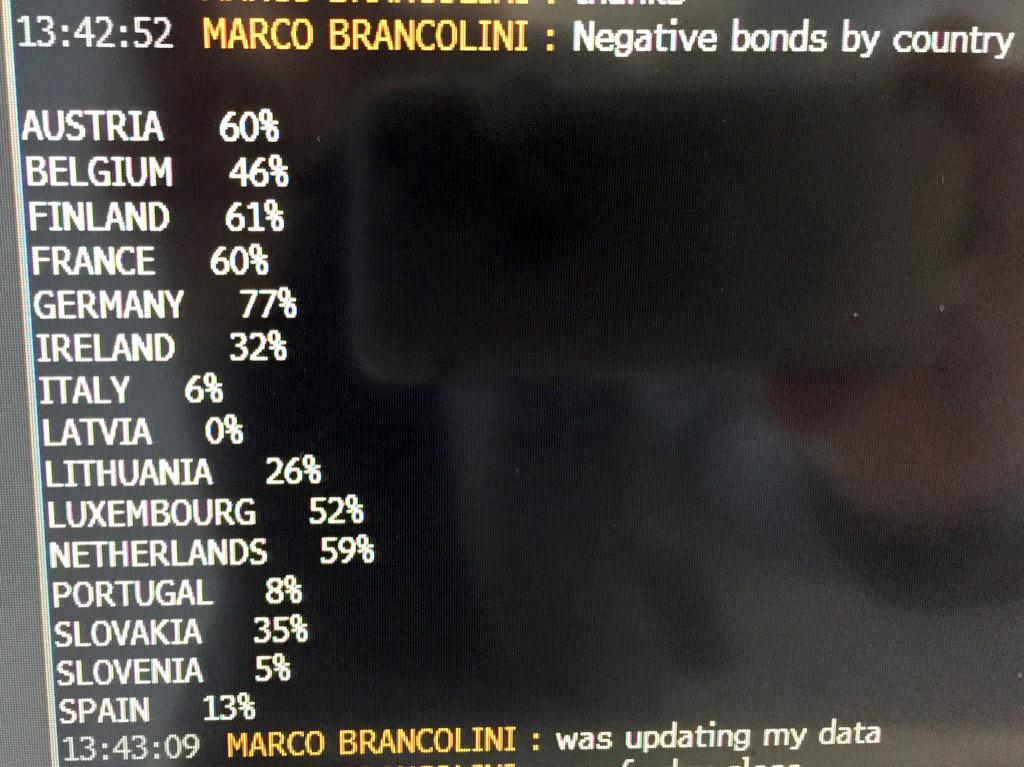

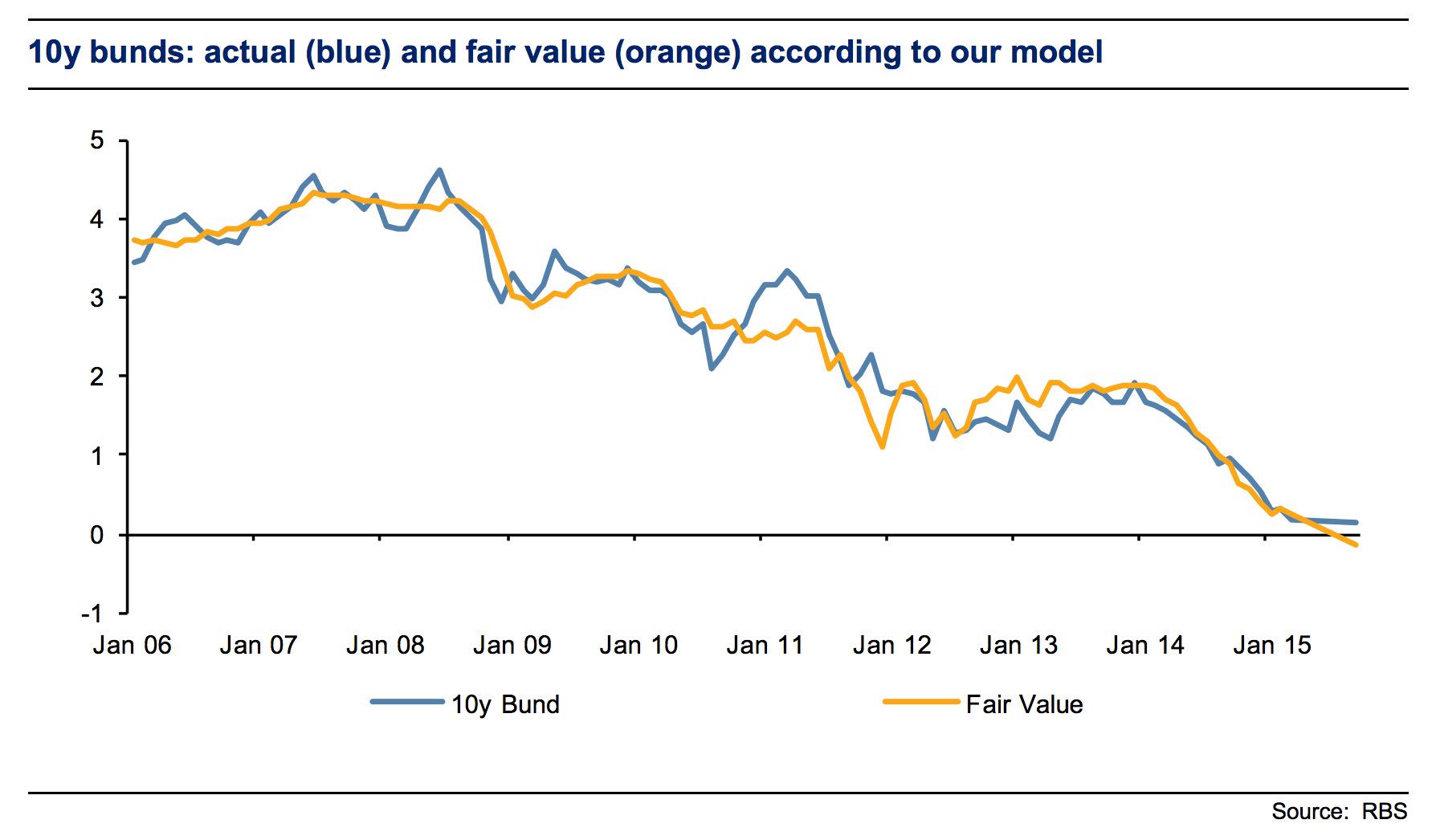

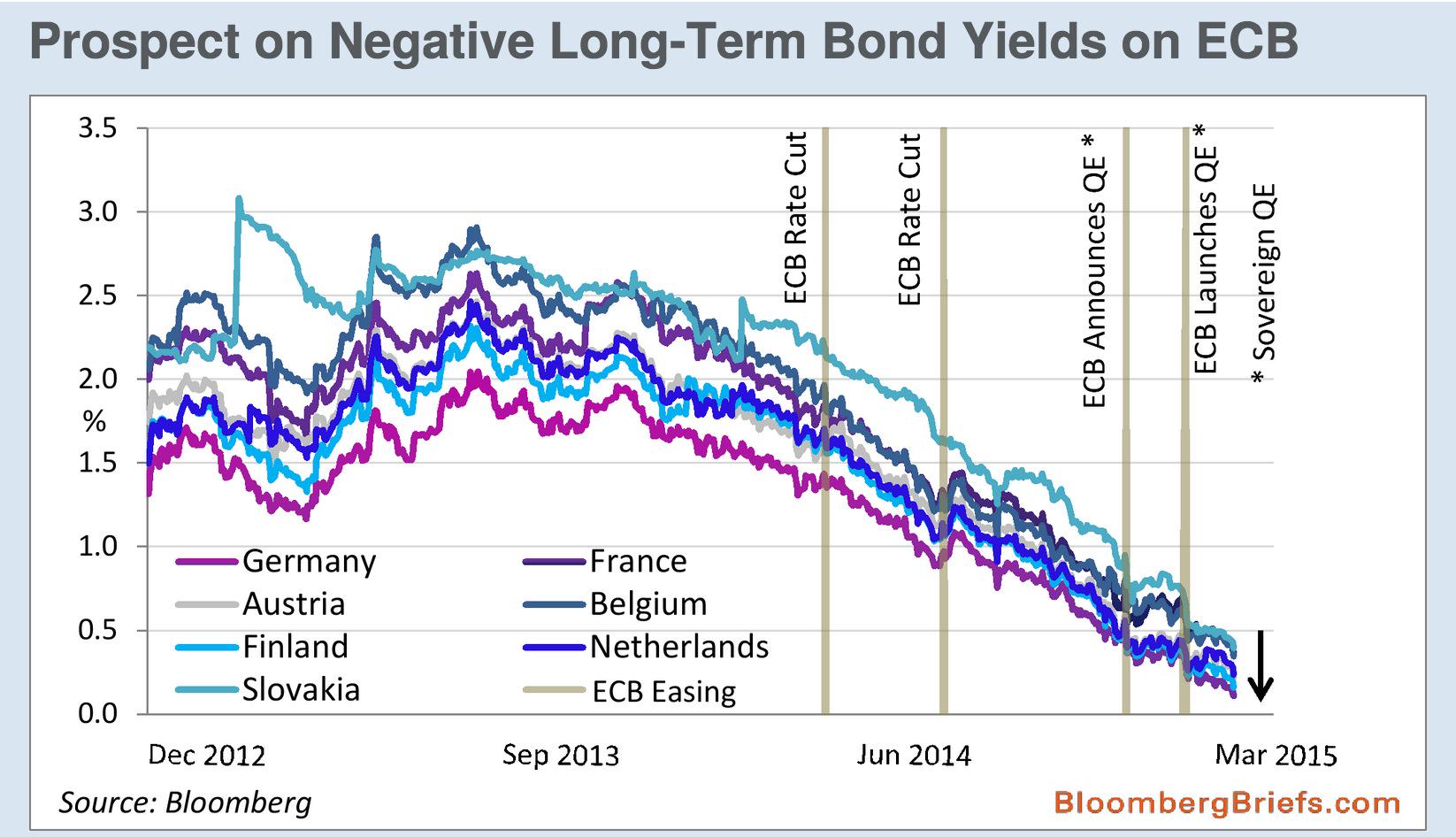

#Europe's fastest growing asset class: Bonds with negative yields. Now 77% of German govt bonds yield neg. (via RBS)

Schauble: "I agree with @JosephEStiglitz on one thing: the current construction of the eurozone is unsustainable."

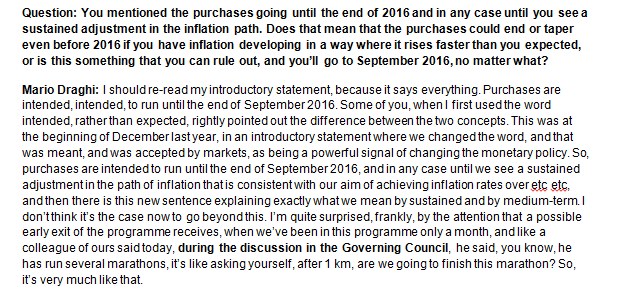

#ecbtaper news. More from Q&A text. Mario Draghi did suggest that taper issues "discussed" at meeting, to be rejected

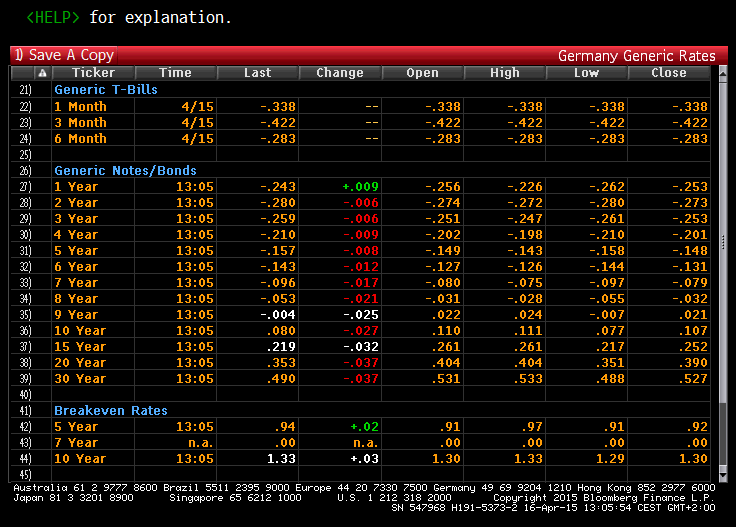

#Germany's 9yr yields turned negative. German yield curve now negative out to 9yrs. (via @hnektarios)

Headfake or turnaround? #Russia's stock index RTS$ has rallied by a whopping 68% since Dec, driven by oil & Ruble.

RBS cuts 10yr Bund yield target from 0.13 to -0.13% as QE is less than 10% complete & 8yr already trades at neg yield

German 10yr yields keep falling. Now 0.089%.

Dangers of "liquidity shock", quasi-bubble signs in US again, EM at big risk. My take on IMF Global Stability Report

http://www.telegraph.co.uk/finance/economics/11538509/IMF-tells-regulators-to-brace-for-global-liquidity-shock.html …

Bloomberg Markets

Bloomberg Markets

Holger Zschaepitz

Holger Zschaepitz

No comments:

Post a Comment