Tweets and blurbs..........

12/29/14 ....

Commodity Prices Are Cliff-Diving Due To The Fracturing Monetary Supernova - The Case Of Iron Ore

Submitted by Tyler Durden on 12/30/2014 - 17:05

The worldwide economic and industrial boom since the early 1990s was not indicative of sublime human progress or the break-out of a newly energetic market capitalism on a global basis. Instead, the approximate $50 trillion gain in the reported global GDP over the past two decades was an unhealthy and unsustainable economic deformation financed by a vast outpouring of fiat credit and false prices in the capital markets. In short, when the classical Austrians talked about “malinvestment” the pending disasters in the global steel and iron ore industries (and also mining equipment and other supplier industries) are what they had in mind.

Saudi Facing Largest Deficit In Its History

Submitted by Tyler Durden on 12/30/2014 - 11:49

The nearly 50 percent plunge in the price of oil during the past six months is expected to leave oil-rich Saudi Arabia with its first budget deficit since 2011 and the largest in its history. Oil is the principal, if not the only, resource in Saudi Arabia, so it’s clear that the price of oil has a strong influence on how the country’s annual budget is drawn up. Different analyses, however, provide different answers to how Riyadh has forecast the commodity’s value. Four of these reports say the Saudi budget is predicated on oil averaging $55 to $63 per barrel in 2015.

Alaska Governor Warns State's Fiscal Situation "Critical" As Oil Price Drops

Submitted by Tyler Durden on 12/30/2014 - 09:44

Narrative, we have a problem. What is billed day after day as 'unequivocally good' is entirely not good for Alaska (oh and Texas and Pennsylvania and...) as with oil prices dropping, AP reportsAlaska Gov. Bill Walker has halted new spending on six high-profile projects, pending further review. With oil taxes and royalties expected to represent nearly 90% of Alaska's unrestricted general fund revenue this year, officials warned, "the state's fiscal situation demands a critical look."

12/29/14 ....

The consequence of local fighting, but a spectacular sight none the less - an oil tank fire in Ras Lanuf in #Libya

Al-#Sidra Oil terminal: 7 crude oil tanks have been destroyed.

An 8th tank exploded on Monday the 29th

#Libya

Al-#Sidra oil terminal has 19 storage tanks with capacity of 6.2 million barrels. 5 tanks ablaze. 2 contained #Libya

Nearby tanks to those on fire being emptied. Estimated loss so far range from 1 to 1.5 million bbl. Al-#Sidra #Libya pic.twitter.com/Abqv5zLEpM

12/19 tanks have storage capacity of 350,000 bbl. 4/19 tanks have capacity of 500,000 bbl. Total 6.2 million bbl.

Half of Libya's daily crude oil exports are from Al-#Sidra port..making it #Libya's largest #oil terminal.. pic.twitter.com/SJHptdk0qs

#Russia Ruble now down 9.6% vs Dollar as Russian GDP contracts for 1st time since 2009. http://news.xinhuanet.com/english/europe/europe/2014-12/30/c_127345119.htm …

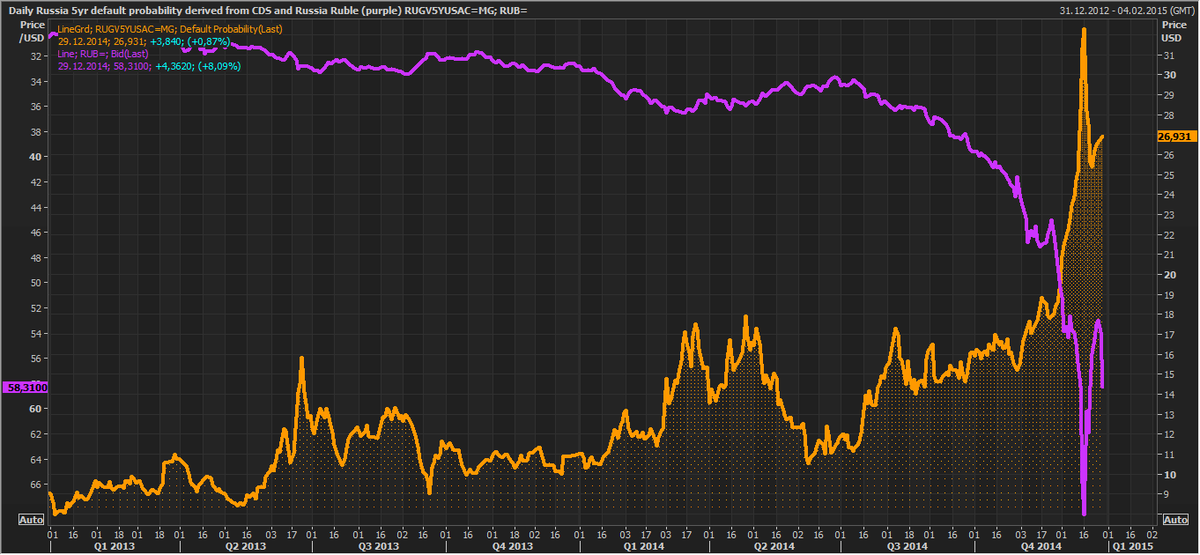

RT @Schuldensuehner: Ruble tumbles 8% on lower oil prices while 5yr Russian implied default probability rises to 27%-

Dave Walton

Dave Walton

Ahmed Sanalla

Ahmed Sanalla

Holger Zschaepitz

Holger Zschaepitz

Nick Timiraos

Nick Timiraos

CFR

CFR

Bloomberg Business

Bloomberg Business

Kazi Australia™

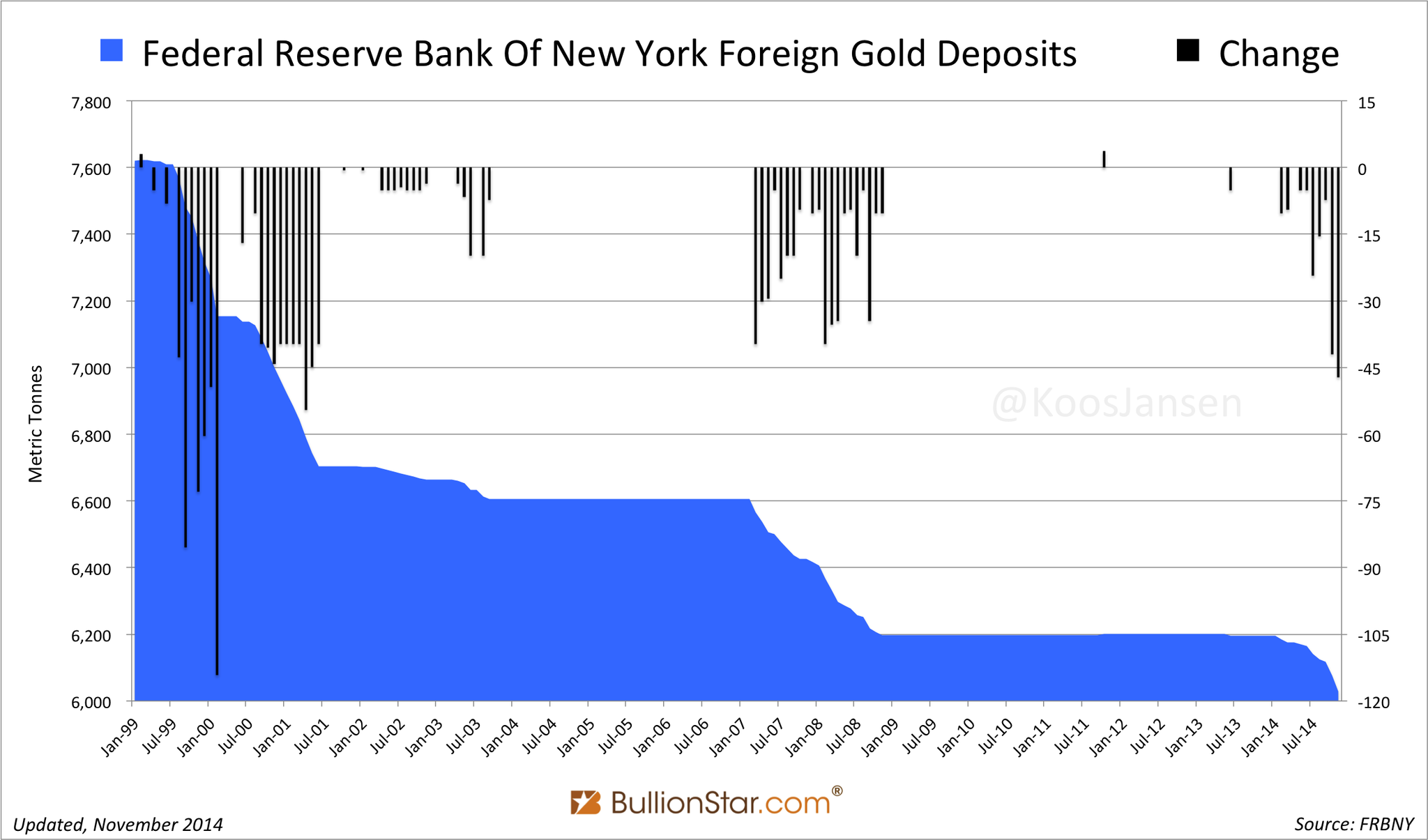

Kazi Australia™  Gold slips as US dollar rebounds: GOLD prices have fallen, but investors are watching Greece, ...

Gold slips as US dollar rebounds: GOLD prices have fallen, but investors are watching Greece, ...  Ian Fleming

Ian Fleming  Alasdair Thompson

Alasdair Thompson

No comments:

Post a Comment