http://prudentbear.com/index.php/creditbubblebulletinview?art_id=10721

( While yesterday more actually would represent historically " Blue Friday " with " Black Monday " to come after the weekend )

http://www.zerohedge.com/news/2012-10-21/stock-market-fragility-fast-approaching-flash-crash-levels

http://www.zerohedge.com/contributed/2012-10-20/how-i-caused-1987-crash

( While yesterday more actually would represent historically " Blue Friday " with " Black Monday " to come after the weekend )

25 Year Anniversary

- October 19, 2012

I spent a memorable October 19, 1987 in front of Quotron and Telerate screens as a Treasury analyst at Toyota’s U.S. headquarters in Torrance, California. After ending my stint as a Price Waterhouse CPA and heading south, I was introduced to the financial markets and macro analysis in 1986. It was impassioned love at first sight.

And 1987 simply could not have been a more fascinating environment for learning. Global currency and fixed income markets were in disarray. The dollar index, which had traded above 160 in March of 1985, had fallen below 100 by January of ’87. Bond yields, after beginning the year at 7%, were above 8% by May, and over 9% in September before jumping to 10.2% in mid-October. Stock markets were increasingly unstable, as speculative excess gained a foothold. At its August ’87 high, the S&P500 was sporting a frothy 39% y-t-d gain.

There were a few good articles this Friday commemorating the 25 year anniversary of “Black Monday.” I particularly appreciated Floyd Norris’ “A Computer Lesson Still Unlearned,” from the New York Times. Bloomberg (Nina Mehta, Rita Nazareth, and Whitney Kisling) did nice work with “Black Monday Echoes as Computers Fail to Restore Confidence.” I’ll take a different tack, focusing more on that period’s extraordinary macro backdrop – one that is highly relevant to today’s even more extraordinary backdrop.

Portfolio insurance played an important role in the precipitate sell orders that overwhelmed and helped crash the market. It was, however, a festering macro backdrop that had set the stage. Importantly, global stock markets had turned highly speculative, having diverged from troubling fundamentals. Global financial and economic imbalances had become a major issue. The U.S., West Germany, the UK, France and Japan had agreed in the September 1985 “Plaza Accord” to take measures to devalue the over-extended dollar. By early 1987, the dollar was seemingly trapped in a downward spiral. “G6” (including Canada) countries reconvened in February 1987 (“Louvre Accord”) to try to stabilize global markets and halt the dollar’s fall. The West Germans and others were worried that the U.S. was pointing fingers at its trading partners instead of addressing its own economic maladies.

The “twin deficits” were a major concern. The U.S. fiscal situation had deteriorated significantly during the 1981/82 recession. Our nation’s fiscal position then did not improve as expected by 1986, with the federal deficit still running at close to 5% of GDP. The U.S. trade balance had deteriorated in tandem. After running an almost balanced position for the period 1979-1982, the U.S. Current Account began to spiral out of control. Our Current Account deficit jumped to $39bn in 1983, $94bn in 1984, $118bn in 1985, and $147bn in 1986. By 1987, the U.S. was running quarterly Current Account shortfalls the size of its annual deficit from only four years earlier.

Credit excesses were certainly not limited to government finance. Total Non-Financial Debt expanded 14.8% in 1984, 15.6% in 1985 and 15.6% in 1986. The Credit boom was broad-based, with Federal, State & Local, Household, and Corporate debt all expanding at double-digit rates throughout the period. Financial Sector Credit Market Debt was exploding, with growth of 17.5% in ’84, 19.3% in ’85, and 26.2% in ’86. Importantly, this growth reflected the commencement of a historic expansion of non-bank Credit, led by (Agency/GSE) MBS and ABS, along with finance company and (“captive finance”) corporate borrowings.

The market and U.S. economic environments troubled Toyota executives back in 1987. They were also plenty worried about Japan. Japanese policymakers were under intense American pressure to stimulate their economy in order to remedy their widening trade surplus with the U.S. After beginning 1986 at about 13,000, Japan’s Nikkei equities index surpassed 26,000 in the autumn of 1987. The Japanese real estate balloon was also rapidly inflating, even as consumer prices remained well contained. Toyota officials were increasingly worried that loose monetary policy and other stimulus measures had fostered a dangerous Bubble in Japan. The 1987 crash proved but a minor setback for the Japanese Bubble, as “terminal phase” excesses in 1988 and 1989 sealed Japan’s fate. The Nikkei ended 1989 at 38,916. The Nikkei closed Friday, some 23 years later, at 9,003.

I’ve often contemplated where I might “officially” pinpoint a starting point for the prolonged U.S. and global Credit Bubble. There is strong justification for choosing the early eighties, on the back of that period’s explosions in U.S. federal debt, non-bank Credit creation, and destabilizing Current Account Deficits. I’ll instead propose October 20, 2012 as the 25 Year Anniversary of the Great Credit Bubble. It was, after all, 25 years ago, on the Tuesday following “Black Monday,” that a statement changed history: “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.”

There were myriad critical issues that needed immediate attention by 1987 - and certainly in the Crash’s aftermath: the root cause of problematic market distortions, including excessive speculation and new derivatives strategies (i.e. “portfolio insurance”); excessive system Credit expansion, especially the rapid growth of non-traditional Credit creation; federal deficits and attendant Current Account Deficits that had begun to fuel dangerous global imbalances, including the Bubble engulfing our important ally and trading/financing partner in Japan.

Yet, the fixation at the Federal Reserve and Washington was with the markets and the imperative of ensuring no repeat of the Great Depression. The Greenspan Fed was willing to overlook serious fundamentals issues and instead ensure that market participants were emboldened by the Fed’s liquidity backstop. Besides flooding the system with liquidity (concurrent with other measures), the Fed cut rates in the months following the Crash (from 7.25% before the crash to 6.5% in February ’88). After surging above 10% in October of ’87, 10-year Treasury yields dropped to almost 8% in early ’88. Financial conditions remained loose and the markets (and speculation) bounced right back. Total Non-Financial Debt growth remained strong (9.1% in both ’87 and ’88). Importantly, Federal Reserve largess ensured that areas of fledgling excess throughout the system actually gained critical momentum. These included the Drexel Burnham junk bond scheme, the Wall Street “Gordon Gekko” M&A boom, and real estate lending excesses, especially on both coasts.

When this Bubble phase eventually burst in the early-nineties, eighties period excesses were referred to as “the decade of greed.” In the name of fighting the scourge of deflation and depression, the Greenspan Fed responded even more aggressively. The Fed went from guaranteeing marketplace liquidity to ensuring a steep yield curve (short-term rates pegged significantly below market bond yields). This (manufactured borrow short/lend long "carry trade" profits) worked like magic to recapitalize a banking system deeply impaired from the late-80’s Credit boom. It also provided spectacular returns for financial speculators and essentially unleashed the modern era of hedge funds and leveraged speculation, of which there has been no turning back.

Furthermore, the Fed’s activist market interventions/manipulations spurred rampant growth in non-bank Credit, including MBS, ABS, GSE balance sheets, “repos” and securities finance, and Wall Street finance more generally. Indeed, the Fed’s statement the day following the ’87 Crash proved a seminal inflection point for finance and the global economy. Amazingly, the Greenspan Federal Reserve even became outspoken proponents of New Age finance, including derivatives, hedge funds and Wall Street risk intermediation. And the leverage speculating community, global derivatives and securities trading, and the proliferation of unconstrained marketable debt instruments changed the world.

The Greenspan Fed’s 1987 promise of market liquidity was the precursor for today’s zero rates, the Fed’s almost $3 TN balance sheet, and recent promises of “open-ended” quantitative easing (QE). Over the years – and through every crisis – the Fed became only more zealous activists supporting the uninterrupted expansion of marketable debt. The bigger the securities markets – and the more dominant the leveraged speculators – the more Fed policy revolved around ensuring a favorable liquidity and rate backdrop for unending leveraging and speculating.

Especially after the ’87 Crash, the Federal Reserve and other regulators should have moved decisively to nip the derivatives boom in the bud, especially in the area of the dynamic hedging (i.e. selling S&P500 futures into a rapidly falling market to hedge market insurance derivatives written) of myriad market risks. “Black Monday” provided unequivocal evidence of the serious flaws and dangers associated with the premise of “liquid and continuous” markets – an assumption that is really the foundation for contemporary derivative hedging strategies. Instead of the Crash destroying this market fallacy, the Fed’s day-after statement validated the view that derivative contracts could be written and risk-strategies pursued on the belief that policymakers would be there to counterbalance market illiquidity and neutralize “tail risks” and system shocks. This fundamentally changed finance, the pricing and trading of risk instruments, and risk-taking more generally. The unprecedented proliferation of market risk insurance took the world by storm and played a pivotal role in runaway Credit excesses and associated global imbalances and economic distortions.

The Fed’s statement on October 20, 1987 commenced 25 years of serial (and escalating) booms and busts around the world. We’re nowadays in the midst of “melt-up” Credit debasement, a “blow-off” top in global speculative excess, and complete policy capitulation in hope of holding the downside of the global Credit cycle at bay. For a few years now, I’ve referred to the “global government finance Bubble” as the granddaddy of them all. What started as excesses at the fringes of U.S. bank and junk bond finance back in the late-eighties eventually made its way to terminally infect Treasury and related debt at the core of our entire monetary system. Global excesses, having fueled precarious Bubbles in Japan, SE Asia, Europe and the emerging economies over the years, afflicted China with its estimated population of 1.3 billion. Today’s historic Bubble phase risks the loss of market trust in sovereign debt. The current global “inflationist” policy regime risks being completely discredited. And the historic Chinese Bubble risks a precarious post-Bubble day of reckoning.

Unlike the 80’s and 90’s, there’s no longer any attempt to fashion a coordinated strategy to deal with global excesses and imbalances. Policymakers have thrown in the towel - and these days have no strategy beyond reflation and Bubble perpetuation. U.S. policymakers pay little more than lip service to incredible federal deficits. This, however, is actually more than is paid to the massive Current Account Deficits that have been the root cause of now deep structural global imbalances and economic impairment. More than 25 years later, our nation’s policy prescription for unmatched global imbalances is even looser monetary policy and added stimulus for all nations, everywhere, all-the-time.

And the way I see it, the Fed, ECB and global central bankers today fight a losing battle. The mountain of global debt, securities, and derivatives, along with this destabilizing global pool of speculative finance, just inflate larger by the year – and after each policy response. And the more outrageous the policies implemented to try to resolve each crisis, the more these desperate measures further inflate the global Bubble. Ironically, the ongoing assurances of central bank liquidity seem to ensure an eventual crisis beyond the liquidity capacity of central banks. Happy 25th Anniversary, you aged and ornery Credit Bubble. They’ll be reading, writing about and studying you for at least the next century.

***

Global Credit Watch:

October 18 – Bloomberg (Charles Penty): “Spain’s banks face more loan losses as the pace of an economic slump risks turning a worst-case scenario dismissed in stress tests into reality. Bad loans as a proportion of total lending jumped to a record 10.5% in August from a restated 10.1% in July as 9.3 billion euros ($12.2bn) of loans were newly classified as being in default… The ratio has climbed for 17 straight months from 0.72% in December 2006… Spanish bank stress tests by management consultants Oliver Wyman have factored in an economic contraction totaling 6.5% from 2012 to 2014 in an adverse scenario that the government and Bank of Spain said has a probability of about 1%. Analysts at Nomura and Citigroup Inc. disagree, saying spending cuts and economic conditions mean the worst-case outcome already looks feasible… Lending in Spain’s banking system fell 1.1% in August from July and 5 percent from the same month a year earlier, the Bank of Spain said. Deposits dropped 1.1% in the month and 8.7% from a year ago.”

October 17 – Bloomberg (Mark Deen): “French President Francois Hollande backed Spain’s demand for clarity on the conditions it would face in return for financial support, underscoring a divide with Germany as European leaders prepare to gather in Brussels. ‘Spain needs to know the precise conditions under which it would receive financial help,’ Hollande said… Chancellor Angela Merkel’s government believes that terms should be negotiated once a request is made… By throwing his support behind Spanish Prime Minister Mariano Rajoy and calling for budgetary easing from countries that can afford it, Hollande is setting out a challenge for Merkel similar to the one he made at the last summit in June.”

October 18 – Bloomberg (Rebecca Christie): “The French-backed effort to fast- track a European bank supervisor is running into German-led concern over potential costs as the region’s leaders tussle over putting their crisis-fighting blueprint into action. The 27-nation European Union has struggled to maintain momentum on a June plan to spur investor confidence by putting the European Central Bank in charge of banks across the euro area. Skeptics have questioned the scope of the ECB’s supervisory powers and how losses would be shared. As leaders gather in Brussels for a two-day summit, French President Francois Hollande says efforts to stem the turmoil that began in 2009 could unravel if the EU fails to deliver on its promises. He called on the EU to press ahead on banking union, provide economic help to countries that rein in budget deficits, and show investors that Greece will be able to stay in the euro zone if it keeps its commitments.”

October 17 – Bloomberg (Ben Sills): “Germany is pressuring Italy to request European aid alongside Spain so that the government of Prime Minister Mario Monti doesn’t reap the benefit of lower borrowing costs without being tied to tougher economic reforms, La Vanguardia reported.”

Germany Watch:

October 19 – Wall Street Journal (Gabriele Steinhauser): “German Chancellor Angela Merkel took a hard line on Spain Friday, saying that Madrid will have to keep on its own balance sheet the tens of billions of dollars it is about to inject into its banks and won't be able to transfer them to the euro-zone bailout fund. That position, laid out after a two-day summit of European Union leaders in Brussels, would mean that Spanish borrowing from the euro zone to bolster the capital of shaky banks—estimated to be as much as €60 billion ($78.72bn)—will swell the country's already-heavy debt load. Germany's stance appeared to dash hopes, fostered by the leaders at a summit in June, that the government's capital injections into the banks could later be transferred to the bailout fund once an effective euro-wide bank supervisor is in place…”

October 19 – Bloomberg (Rebecca Christie and Tony Czuczka): “German Chancellor Angela Merkel said it’s an open question whether European policy makers can meet the deadline they’d set hours earlier to establish a euro-area bank supervisor by year-end. ‘There are complicated questions to clarify and we’ll see in December if we complete it or not,’ Merkel told reporters… ‘For now, the political will is there.’ The comments underscore Germany’s go-slow approach that may stymie plans laid down in June to break the link between banks and governments that has worsened the region’s debt crisis.”

October 18 – Financial Times (Quentin Peel): “Angela Merkel, the German chancellor, refused to be rushed on Thursday into rapid creation of a fully-fledged banking union in Europe, despite strong pressure from President Francois Hollande of France and other European leaders. While insisting that while Germany would engage ‘urgently’ in negotiations for a single European bank supervisor, she said the new system must be proved ‘effective’ before taking the next step: giving a green light for eurozone rescue funds to be used to recapitalise banks directly. ‘I want to say very clearly: merely agreeing on the legal procedure for banking supervision is not enough,’ Ms Merkel told the German parliament… The new system must be ‘effective and independent of national banking supervision’ before the €500bn European Stability Mechanism could be used for recapitalisation.”

October 17 – Bloomberg (Brian Parkin and Patrick Donahue): “The German government cut its economic outlook for next year, citing stalling effects from the debt crisis in the euro area and slower growth in Asia hurting exports. Europe’s largest economy will expand 1% in 2013, compared with a forecast… of 1.6% projected in May…”

October 19 – Bloomberg (Annette Weisbach): “The outlook for German banks remains negative as ‘intense competition’ and low interest rates weigh on earnings, according to Moody’s… ‘Intense competition and low interest rates are causing margin pressure that will likely further erode the banks’ already-weak revenues and profits over the 12-18 month outlook period,’ Moody’s wrote… While the German economy remains stable, Moody’s said banks face ‘challenging conditions’ because of the nation’s dependence on other European Union countries for export markets… ‘Rising risk charges in individual bank results in 2012 to date indicate that domestic asset quality is gradually deteriorating,’ Moody’s said. Exposure to stressed euro-area countries, plus commercial real estate and shipping, make the nation’s lenders ‘vulnerable to a worsening of the sovereign debt crisis in Europe,’ the ratings company said.”

Global Bubble Watch:

October 18 – Bloomberg (Sarika Gangar): “Xstrata Plc and Oracle Corp. led borrowers raising at least $20 billion in the second-busiest day this year for U.S. corporate bond sales.”

October 19 – Bloomberg (Sarika Gangar): “Sales of corporate bonds in the U.S. doubled this week as relative yields narrowed to the tightest level in more than 17 months. Xstrata Plc, the world’s largest exporter of coal burned by power stations… led at least $39.4 billion of new issues… Sales compare with a 2012 weekly average of $27.8 billion.”

October 19 – Bloomberg (Sarika Gangar): “Sales of corporate bonds in the U.S. doubled this week as relative yields narrowed to the tightest level in more than 17 months. Xstrata Plc, the world’s largest exporter of coal burned by power stations… led at least $39.4 billion of new issues… Sales compare with a 2012 weekly average of $27.8 billion.”

October 17 – Bloomberg (Boris Korby and Drew Benson): “Corporate bonds in Brazil are becoming more vulnerable to losses than any major developing nation as companies exploit record-low borrowing costs to sell the longest-dated overseas debt in three years. The so-called duration of Brazilian company bonds, a measure of how much prices change as yields rise or fall, which increases with longer maturities, climbed to a 13-month high of 6.12 years… That exceeds the average of 5.18 years for company debt in China and is about 40% higher than in Russia and India.”

October 19 – Bloomberg (Charles Mead): “Relative yields on U.S. investment-grade bonds are poised to tighten to the least since 2007 as the Federal Reserve’s program to buy up mortgage debt boosts demand for company obligations, according to JPMorgan Chase & Co… While a ‘frenzy’ for high-grade debt that has pushed borrowing costs to record lows will probably slow considerably, the Fed’s open-ended mortgage purchases announced last month to support housing and boost employment ‘is a powerful force for lower spreads,’ the strategists wrote.”

October 19 – Bloomberg (Charles Mead): “Relative yields on U.S. investment-grade bonds are poised to tighten to the least since 2007 as the Federal Reserve’s program to buy up mortgage debt boosts demand for company obligations, according to JPMorgan Chase & Co… While a ‘frenzy’ for high-grade debt that has pushed borrowing costs to record lows will probably slow considerably, the Fed’s open-ended mortgage purchases announced last month to support housing and boost employment ‘is a powerful force for lower spreads,’ the strategists wrote.”

October 17 – Bloomberg (John Glover): “Junk bonds are proving cheap even with yields at record lows, helping to explain the record sums flowing into the securities as firms from Morgan Stanley to BlackRock Inc. say it may be time to pull back. While non-financial, speculative-grade corporate debt yields about 7.15% on average, some 87% of that consist of spread, or the amount above benchmark rates... Investors put $64.8 billion into high-yield bond funds globally this year through Oct. 10, more than double the previous record of $31.7 billion in 2009…”

October 17 – Bloomberg (Sarika Gangar): “Sales of convertible securities are accelerating from the slowest pace on record as the Federal Reserve’s efforts to steer investors toward riskier assets stokes demand for debt tied to stocks. WellPoint… and… Stillwater Mining Co. are leading sales of $2.9 billion worldwide this month that are up four-fold from the same period last year… That follows $10.3 billion of convertible bond offerings in September that were the most for a month since March 2011.”

and interesting coincidences between then and now - two articles both from Zero Hedge , the second from Bruce Krasting.........big difference today is HFT though , a flash crash could occur at any time , on any day now......

Stock Market Fragility Fast Approaching "Flash Crash" Levels

Submitted by Tyler Durden on 10/21/2012 19:17 -0400

This past Friday, on the 25th anniversary of Black Monday, Bill Gross warned that in the current centrally-planned market "central bank puts" are the modern day equivalent of "portfolio insurance", and he is right. By sending complacency to record levels, and essentially forcing investors to no longer worry, hedge and generally ignore tail risk, the central planners, in their futile attempts to reflate stocks at all costs, are guaranteeing that the market will experience just the type of fat tail event they promise will never occur. As for the catalyst that will make sure of it is none other than our old friend: high frequency trading. Because while central planning is the mechanism by which investing is dragged away from mean reversion, price clearing and fair value discovery, it is HFT that is Bernanke's analogue in the millisecond trading world (as all those who had stop limit orders (that did not get DKed) on May 6, 2010 very well remember). Because when the next Black ___day does happen, it will be due to central planning, but it will be enacted courtesy of HFT (which will never go away until the next and probably final market crash: too much exchange revenue depends on the perpetuation of this parasitic liquidity drain).

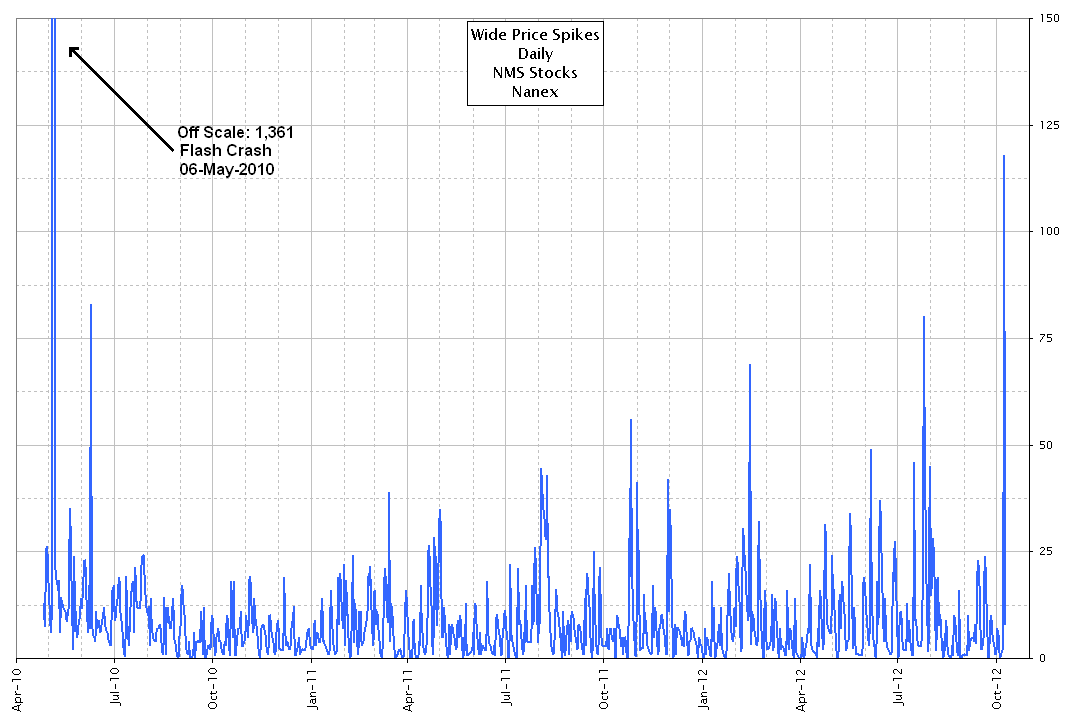

Which is why it is only appropriate to warn readers that when it comes to system market fragility, at least according to Nanex, whose work ZH first presented nearly two years ago and has since gone mainstream now that HFT is the universal scapegoat of even such legacy media venues as CNBC (it is always better to bash the vacuum tubes than the people who profit, or those who have made a mockery of the stock market - it is not like anything will change anyway), the frequency and magnitude of "wild price spike" events (to put it simply) are now both rising at an exponential rate, and fast approaching Flash Crash levels.

From Nanex:

Below is a chart showing the daily counts for all NMS stocks of prices that exceeding NxCore filter level 6. Filter levels range from 2 (lowest) to 7 (highest). Stock prices flagged at these levels are almost always canceled or corrected by the exchange later in the trading session. The chart below indicates that wild price spikes are happening with greater frequency and magnitude. The highest peak on the right side of the chart is from the October 9, 2012 "Mini-Knight" event.1. Daily Count of NMS Stocks with Prices Exceeding NxCore Filter Level 6 Since the Flash Crash.

The Flash Crash had 1,361 of these events, which would skew the scale.Remember: with just two months left until the Fiscal Cliff deadline, and Congress not one picometer closer to a compromise resolution, there are just two catalysts which can get the House to cross the aisle and do what is in this nation's interest: i) a "rally behind the flag" war (which is certainly an option), or ii) a massive market crash that wakes everyone from their "the Chairman will get to work and fix everything" stupor and forces the cliff to be resolved or else everyone's political career will be cut short.So keep a close eye on the Nanex core feedand abnormal market activity. At this rate, the next wholesale stock market flash crash can not be too far away...P.S. for those curious about macroeconomic implications of systemic instability and macro stress tresholds, we urge re-reading ""Trade-Off": A Study In Global Systemic Collapse" - because in today's 'just in time' world, an "equilibrium phase shift" is always just at most minutes away, and no, you cant hedge 'after' the event.

and....

How I Caused the 1987 Crash

Submitted by Bruce Krasting on 10/20/2012 12:37 -0400

I got a chuckle from the biz blogs and TV yesterday with the rehash of the 1987 stock crash. Twenty-five years is a very long time. I’d forgotten most of the events of that day.

I was at Drexel, and at that time, Drexel was a powerhouse. The firm had plenty of capital and huge capacity to borrow money to fund positions. Money was rolling in; risk taking was encouraged. I was working with a small group of people on one of the screwier sub-sets of the high yield bond market. It was referred to as LDC debt (Less Developed Country debt). These were the busted bank loans of all of the countries in South America.

You might wonder why anyone would spend time mucking around with the debts of Brazil, Mexico, Argentina and Chile. Actually, it was a great business. We were coining money. The key to our (and others) success was the ability to make a price on illiquid assets. If some regional bank needed to sell $25Mn of Brazilian debt, we would make a bid on the phone. If a company were in need of some Mexican debt that would be used in a debt for equity transaction, we would offer the paper to the buyer, even though we did not own it.

My old days of currency trading came in handy as some of the paper we traded was denominated in currencies other than the dollar . The fact that I had a “license” to trade currencies gave me the opportunity to speculate pretty freely, and I/we did. The shop that I worked in was no different than any other on Wall Street. We had a “book” of positions. Some were outright specs, others were hedges against commitments we had made. To hold this book together, we required equity (cash).

The Crash of 1987 happened on a Monday. But the crash really started the week before. The S&P tanked 9% on the week, Friday was a particularly bad day. The big move in stocks set things in motion over a very nervous weekend. I got the call from the controller’s office on Saturday. It went like this:

Controller:

Hi, Sorry to bother you, but we have some issues with our bank lenders (It was Bankers Trust that first pulled the plug on street liquidity). They are nervous, and want to cut back our funding lines. You are using a fair bit of capital in your trading book. Can you tell me what all this money is being used for?

BK:

Sure. We have a matched book of longs and shorts on the prop trading side. We also have some open currency positions. We have an inventory of hedges against open client positions. We also have some naked longs.

Controller:

Ah, can you be more specific?

BK:

Sure. We are long Brazil, Mexico and Chile; we are short Ecuador, Peru and Venezuela. We are naked short the USDHK$ and have $60Mn of Cuban bonds in inventory.

Controller:

You’re shitting me! What is that junk? Is any of this liquid? Can you sell this book of crap?

BK:

I might be able to run things down a bit. How much time do I have?

Controller:

Cut it by half by Monday night.

And that is how the crash of 87 happened.

Sunday night October 19, at the opening in Tokyo the HK$ position was closed off (at a loss of course). I got up at 2am and started the calls to London where there was a market for LDC paper. I was hitting bids on anything I could. The prices for the long assets were getting clobbered. There was no liquidity in the markets I was short. It was about minimizing losses and cutting a book. There was no finesse about it.

Of course I was not alone in those early morning hours. Hundreds of players from NYC were on the phone hitting bids on all sorts of squirrely assets. The folks who make markets in London were never dopes. When their phones lit up with Americans looking to lighten up, they voted with their feet. Bids for everything dropped like a stone. By eight o’clock in NY everyone knew that wholesale liquidations were going on, and that stocks were going to get beat to a pulp when the market opened up.

I think I stood all of that day. The phones rang and rang. Both buy and sell side clients were panicked. Most were sellers; the buyers went on strike. Prices were dropping without any trading taking place. The brokers were all, “offered without the bid”. It was next to impossible to get trades off.

Some where’s around 2pm NY time, the Cuban paper got sold (more losses). There was not much more that could be done. So I sat down and watched the Reuters screen and the Dow tape for the rest of the day. I’d had next to no sleep, drank a ton of coffee and smoked too many cigarettes. I'd sweated all day, and stank. I left before the 4pm close.

To me, there are today many similarities to the market conditions that triggered the 87 crash. These two ring a bell:

In 87 I bet on Cuban paper. The rumor at the time was that Castro was sick. The thinking was that when he died, the bonds would increase in value. I’d bought the bonds at around 5 cents on the dollar. Exactly the same bet, for the same reason, is being made today:

The Hong Kong dollar was pegged to the USD in 1983. Four years later guys like me were betting that the central bank could not hold the peg. Money was flowing into Hong Kong; the central bank was forced to intervene in the market to keep the lid on the HK$. This same trade is popular today:

The most important comparison has not yet shown up yet in 2012. In 1987, over the course of a weekend (and many panicky phone calls), market liquidity and the ability to finance off-the-run assets dried up. It started at the bottom of the rung of asset quality, by the end of the day it had spread to the most liquid stocks.

On Thursday, October 15, 1987, the farthest thing from my mind was a squeeze on the equity capital I was using to support a book of business. If anything, I was (everyone was) being encouraged to put more money to work. That vaporized in hours. It was one giant “risk off” event.

There were no external factors of significance that led to the 87 crash. The market did itself in on that day. All it took was a few calls that said, “I want you to cut back at open”.

The repo markets that fund the zillions of assets (good and bad) in 2012 are exponentially larger and more complex than in 1987. If anything, that market is more vulnerable today to the call that says, “Cut it back”.

***

No comments:

Post a Comment