http://www.silverdoctors.com/barricks-200-million-ounce-silver-problem

http://www.barrick.com/News/PressReleases/PressReleaseDetails/2009/BarrickAnnouncesSilverSaleAgreement/default.aspx

Barrick’s 200 Million Ounce Silver Problem: The Impending Annihilation of the Paper Shorts

The Situation in the Paper Silver Market Is Even More Dire Than I Imagined

BIG TROUBLE FOR BARRICK AT PASCUA LAMA??

Pascua Lama is one of Barrick’s largest gold and silver mines that is slated to be in commercial production by mid 2013. Harvey Organ believes Pascua Lama should have been in commercial production several years ago, but problems associated with Glaciers have kept them from doing so.

There has been on ongoing debate about the Glacier and water issues in both Chile and Argentina as it pertains to Barrick’s mining operation of Pascua Lama.

I also believe there is bad news coming out of Pascua Lama. Again, this represents 25% of Barrick’s gold reserves and if Pascua Lama is not allowed to go commercial, it would be disastrous for Barrick’s stock price, balance sheet and contractual obligation to supply Silver Wheaton 170-200 million ounces of silver.

If Pascua Lama is unable to mine gold and silver without threatening the glaciers in both Argentina and Chile, Barrick will have to go into the futures markets and purchase silver to deliver to Silver Wheaton at its contractual price of $3.90 an ounce.

This past Friday night I had the most interesting conversation with Harvey Organ. The inspiration to contact Harvey came from a correspondence I had with The Doc. Doc was getting ready to release his interview with Harvey when he relayed this rumor of big problems at Barrick’s Pascua Lama Project… another interesting development from Harvey.

Before I get into the meat of this article, let me state a few things. I have been reading a great deal about gold and silver since the early 2000’s. I started reading Ted Butler and then it expanded to other precious metal analysts and websites. One of the authors in which I gained a great deal of insight on monetary history was from Antal Fekete. He is an extremely smart mathematician that has written a great deal about the gold standard, the Real Bills Doctrine, free market interest rates, correct hedging and on a mining company called Barrick Gold.

Fekete wrote several negative articles about Barrick and how its lousy hedging strategy was destroying shareholder value. During my conversation with Harvey, I found out that Fekete actually learned about gold mining and Barrick from none other than Harvey himself. As the conversation went on, I began to realize that Harvey knew most of the people in the industry and was one of the individuals who understood the manipulation of the gold and silver markets earlier than most.

My initial intent to contact Harvey was on the issue of Barrick’s glacier problems at its Pascua Lama Mine on the border of Argentina and Chile – a mine located at an extreme altitude of 13,000-15,000 feet. However, I began to understand that some of my assumptions of the precious metals markets where quite naïve.

It is difficult to remember every detail from our conversation, but I will try to give you an idea of just how dire the situation has become in the paper gold and silver markets.

Harvey told me that he started seeing the manipulation in the gold and silver markets back in 1988. He also told me that Barrick Gold took the heap leach method of processing gold and used it as a method to drive out the competition. Prior to Barrick coming on the scene, a large percentage of the world’s gold mines were underground mines. Barrick used the economies of scale from the technique of the open-pit mining as well as the process of heal leaching to leverage their way to the top of pack.

To be able to accomplish this feat, Barrick had to hedge a great deal of its future gold production to finance acquisitions and development of these huge open-pit mines. This is where things got very interesting.

Harvey was a Barrick stock holder in the late 1990’s and early 2000’s. He began to realize something was wrong with the company. Harvey met with Jamie Sokalsky (just recently replaced Aaron Regent as CEO of Barrick) and other top officials from Barrick back in May of 2000 to let them know that their leasing of gold was going to get them in serious trouble.

Harvey told me that when he went to Barrick’s office back in 2000 for this meeting, he mistakenly got off the wrong floor – one floor below Barricks. When he got out of the elevator he realized he was at the wrong floor because he was standing at the offices of JP Morgan. Harvey thought this was interesting to see that Barrick’s office was located right above JP Morgan.

Harvey became disenfranchised with Barrick and sold all his stock back in 2004. This is where we enter into the world of the Pascua Lama Project.

BIG TROUBLE AT PASCUA LAMA??

Pascua Lama is one of Barrick’s largest gold and silver mines that is slated to be in commercial production by mid 2013. Harvey believes Pascua Lama should have been in commercial production several years ago, but the problems associated with Glaciers have kept them from doing so.

There has been on ongoing debate about the Glacier and water issues in both Chile and Argentina as it pertains to Barrick’s mining operation of Pascua Lama.

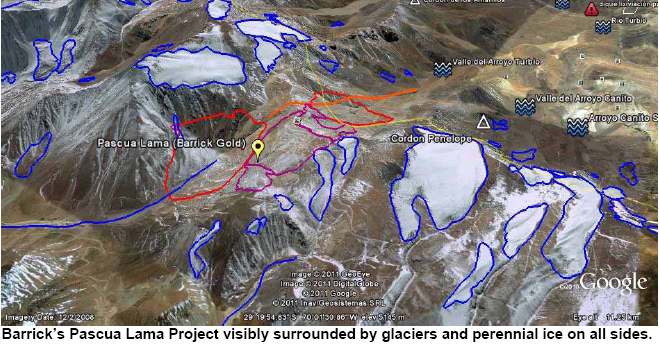

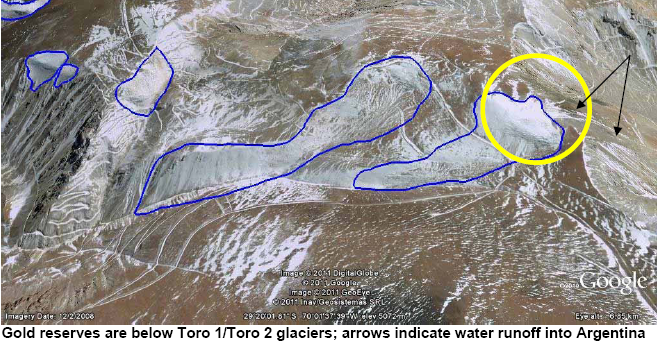

Here we can see in the photo above, Barrick’s Pascua Lama Mine is located in the middle of a Glacier field. At first glance, it looks as if the mining area does not contain any glaciers in it. However, a significant amount of the glaciers in the area are covered by a layer of rock and do not look like a glacier to the untrained observer:

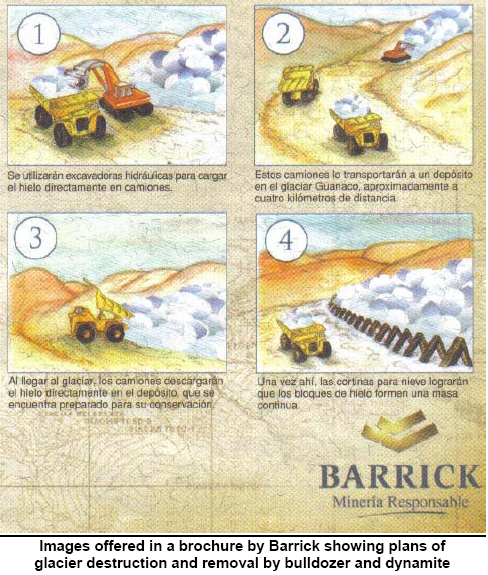

Barrick has a plan to move the glacier to a different area to get to the ore grade below. At first I thought Harvey was a bit over the top for telling me this plan…. I mean, who is stupid enough to think they can move a glacier?? Then I did some research and found out that is exactly what Barrick has planned to do to get to the gold and silver ore below:

San Juan area is located just south of Pascua Lama where Barrick has its Valadero Mine. This is what Harvey stated about Pascua Lama in his blog last week:

To me, Barrick may have a problem with their Pascua Lama project in Argentina and Chile. The gold in situ there represents 25% of Barrick’s total reserves. The mine is situated under a glacier and the plan was to move the glacier. However, the removal would cause a famine on the Chilean side. Maybe there are some problems here that we do not know about. Barrick also sold off all its silver to Silver Wheaton. What happens if somehow the mine is delayed indefinitely until a new plan is forthcoming. How will Barrick replace all of that silver that is contracted for?

To get an idea of how bad the situation is becoming for Barrick’s Pascua Lama Mine here is a brief chronology of recent news events:

NOV 25th, 2011: CEDHA Files Equator Principles Due Diligence Review to US EXIM Bank and EDC of Canada on Barrick’s Pascua Lama Project

Ottawa & Washington DC – November 25, 2011. The Center for Human Rights and Environment (CEDHA), along with several local and international groups presented today anEquator Principles Due Diligence Review to two export credit agencies considering financing Barrick Gold’s highly controversial Pascua Lama gold project, straddling the border between Chile and Argentina.

The review argues that Pascua Lama is in direct violation of the Equator Principles, which are global norms laying out conditions for responsible investment.

MAR 15th, 2012: Barrick Gold Fails to Obtain Financing for Pascua Lama

In 2010, Barrick Gold requested financing for the Pascua Lama mine from a public financing agency in the United States (Ex-Im Bank) and months later, from Export Development Canada (EDC). Communities affected by the gold megaproject sent information to both public institutions regarding the company’s operations and requested that the financing be denied. Two years later, Barrick has withdrawn its requests.

APRIL 30th, 2012: Supreme court demands environmental reports used to approve Pascua Lama

The Argentine supreme court has ordered the national and the San Juan provincial governments to submit the environmental reports that were used to approve Canadian miner Barrick Gold’s (NYSE: ABX) bi-national Pascua Lama gold-silver project, a source from the court confirmed to BNamericas.

MAY 31st, 2012: Will glaciers be for mining in Argentina what an iceberg was for the Titanic?

An Argentine government body that is mapping glaciers in the Central Andes has released initial results of its national glacier inventory, showing that many of the country’s mining projects sit in glacier-rich areas and may, therefore, be a threat to the country’s future water supply, among other possible ill effects.

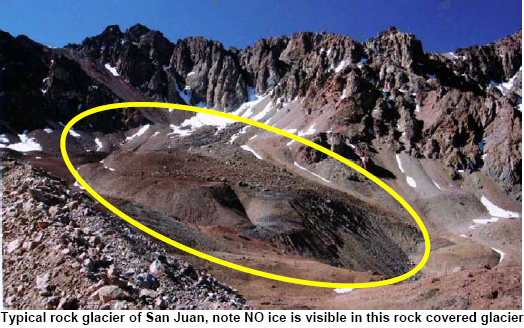

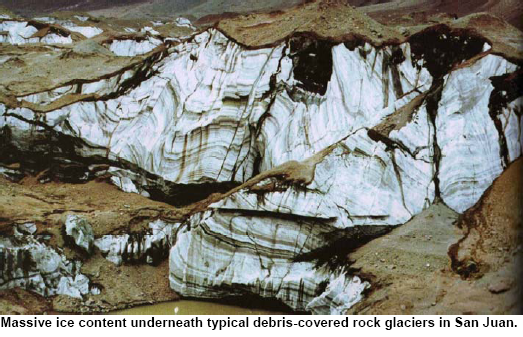

“These are ‘rock glaciers’, which are massive ice bodies covered by a thin layer of rock debris,” explains Jorge Daniel Taillant, mining, environment and human rights coordinator with Argentina’s Centre for Human Rights and Environment (CEDHA), another group which has also been tracking glaciers and supports Villalba’s findings, in a statement sent to media yesterday.

“The non-expert could be standing on a rock glacier and not even know there is ice beneath,” he notes, adding that many mining companies are just learning about underground glaciers. “Finding them is a challenge but is essential in order to protect the ice reserve, which is critical for ecosystem survival in the high and dry mountains of the Andes.”

I realize that is a lot of information and links, but that last one just drives in the point, that Barrick may not be able to mine gold or silver at Pascua Lama. I could write a book on this subject but I just wanted to add one more tidbit.

Here are some actual photos showing glaciers Toro 1 & Toro 2 where significant amount of Barrick’s gold reserves are located:

Here is a quote from the Nov 25th Report (linked above):

Note the yellow circle in this last image. This is on Toro 1, which sits on the border of Argentina and Chile. The problem for Barrick regarding these glaciers, is that significant gold reserves lie underneath (which implies that Barrick has already drilled extensively into these glaciers to take samples). In a first attempt at getting at the gold, Barrick’s answer was to get rid of the glaciers, that is, dynamite them.

If we go back to the image showing the project area, we see that Toro 1 and Toro 2 are right at the pit sites. Notice the purple and red polygons, which are pit and rock waste pile sites, respectively.

But today, new unpublished concerns have surfaced. A recently revealed reportaddressed publicly for the first time in this review, indicates that Toro 1 has been mapped incorrectly. Barrick situates the Toro 1 glacier entirely in Chile. However, this glacier actually straddles the border, with some 20% or more of the ice volume in Argentina, and subsequently Toro 1 partially discharges towards Argentina. The black arrows in the first image above of Toro 1 indicate the water discharge flowing downhill into Argentina.

JUN 7th, 2012: Was Regent the heavy or the fall-guy for Barrick’s missteps?

Topping suggested Regent may be a “‘fall guy’ for the disastrous Equinox Minerals (copper in Africa) acquisition in April 2011, for which we believe Barrick overpaid by 50% in a $7.5bn deal that even beat out a Chinese parastatal.”

“The acquisition was supported by the chairman and the board at the same time,” Topping observed. “It may also suggest that the Equinox assets are worse than expected, or that the $5bln Pascua Lama development has issues and, therefore, a head must roll.”

————————————————

As the last article states, Aaron Regent may have been made the fall guy for Barricks big mistakes. Here we can see that the big acquisition of Equinox Minerals may turn out to be much worse than expected. I also believe there is bad news coming out of Pascua Lama. Again, this represents 25% of Barrick’s gold reserves and if Pascua Lama is not allowed to go commercial, it would be disastrous for Barrick’s stock price, balance sheet and contractual obligation to supply Silver Wheaton 170-200 million ounces of silver.

If Pascua Lama is unable to mine gold and silver without threatening the glaciers in both Argentina and Chile, Barrick will have to go into the futures markets and purchase silver to deliver to Silver Wheaton at its contractual price of $3.90 an ounce. This would be another nail in the coffin for the paper silver manipulated market.

HOW NAÏVE I HAVE BEEN

I have written several articles about the precious metals markets and industry. I had focused some of this attention on the retail investment part of the gold and silver market. In 2012, we have had a significant decline in Gold and Silver Eagle purchases. From last count, Silver Eagles were down 23% in the first five months of 2012 compared to the same time last year, and Gold Eagles were down a whopping 45%.

From my perspective looking at the information in front of me, it looked like investment demand in silver was falling due to the takedown in May 2011, Sept 2011, and Feb 2012. After speaking with Harvey, I now realize current retail investment demand is not the force that is putting pressure on the silver price… it is wholesale demand coming mainly out of the East with the majority coming from China.

As the London trader has stated on KWN (which Harvey concurs), the Eastern buyers bought a huge amount of silver several weeks ago when silver hit $27 an ounce. Not only is there a backlog for this silver, Harvey states that Eric Sprott still has to wait to get silver for his organization.

Harvey understands the working of the Comex more than anyone else I know in the industry. He asked me… how can the Comex receive so much silver in a day, when everyone else has to wait weeks or a month to get their silver? Furthermore, he believes the ability for the Comex to receive so much silver may be due to the fact that there is this CAT & MOUSE game going on between the LBMA (the dominant market for silver trading) and the Comex. Silver is moved from one vault to another to keep the ponzi paper leverage scheme alive.

Things are even tighter in the Gold market. Harvey told me that Iran is trying to buy any gold coin it can get their hands on. Again, as the London Trader stated… during the takedown last week there was no physical gold available to purchase. We are not talking about a few gold coins from Apmex or Tulving, instead this is the type of demand that runs in the 100’s of tones.

That is why I have now realized that my concern for retail investment demand in the USA or Canada is really a RED HERRING. The foundation for exponential move in the price of gold and silver is now taking place in the trading pits and in the LBMA market. I am starting to believe, it will be too late for the investing public to get in the precious metal markets before gold is revalued in the process of saving paper currencies.

Even though I have read about the real demand going on in the precious metals’ markets, I still focused on the information I was getting from typical sources that we all read from. Harvey helped open my eyes by reinstating the REAL DEMAND going on which is not being reported by the media or by most of the alternative media.

Ironically, both Turd Ferguson and I had an EPIPHANY on the precious metals about the same time last week. Turd mentioned in one of his posts that he was no longer going to produce charts every day in his blog entries due to the fact that the markets are so manipulated that it really doesn’t call for it much anymore. I also reached the same conclusion but in a different way when it came to INVESTMENT DEMAND in the price discovery mechanism.

Of course I still believe investment demand is the real force driving up the price of silver, but now I think it is more due to the huge volume of physical buying by the Eastern buyers that is determining the price and not individual investors buying Silver Eagles or Canadian Maples.

There are so many details of the conversation that I had with Harvey that would help reinforce to the reader why gold and silver are the best stores of value going forward. However, I can’t quote it all accurately and it would also make this post 2-3 times longer.

The reason why I enjoyed the conversation so much with Harvey is due to the fact that we both share the same interest in gold and silver… and that is the PHYSICAL SIDE. Harvey got interested in gold and silver because his father was in the industry. He told me he started to buy silver when he was seven years old.

Harvey got involved with GATA early on and was the one who knew more about actual gold mining and the physical aspect of the industry. Bill Murphy and Chris Powell focus more on the paper and financial aspect of the industry.

I still believe energy will play an import role in limiting the amount of gold and silver that will be mined in the future. On the other hand, the situation in the paper precious metals markets is already becoming untenable.

The thing that Harvey and I agree on is that the event that will change the financial and precious metal markets will occur overnight. One day the price of gold may be $1700 or so and the next day when a banking holiday is announced gold will be trading at a bid of two to three times its value with no offers whatsoever… basically no gold available anywhere anyhow.

It’s time to be acquiring precious metals and not time to be trading paper.

and.......

Barrick Announces Silver Sale Agreement | 09/08/2009 |

| Download this Press Release (PDF 74 KB) | |

"The transaction enhances Pascua-Lama's economics. The upfront cash consideration increases returns and represents an attractive source of financing for the project while still maintaining Barrick's upside on 100% of the gold and 75% of silver production at Pascua-Lama," said Aaron Regent, President and Chief Executive Officer.

The Pascua-Lama project, on the border of

Annual production is anticipated to be 750,000-800,000 ounces of gold and 35 million ounces of silver in the first full five years and 600,000-700,000 ounces of gold and 20-25 million ounces of silver on a life-of-mine basis. Pascua-Lama's expected total cash costs of

In certain circumstances, including failure to achieve project completion and customary events of default, the agreement may be terminated. In such an event, Barrick may be required to return to

Barrick's financial advisor for this transaction is

1 Proven reserves contain 42.68 million tons of ore at 0.050 oz/ton for 2.13 million ounces. Probable reserves contain 397.55 million tons of ore at 0.039 oz/ton for 15.67 million ounces. Measured resources contain 12.51 million tons of ore at 0.039 oz/ton for 487 thousand ounces and indicated resources contain 118.99 million tons of ore at 0.035 oz/ton for 4.2 million ounces. Contained silver within reported proven gold reserves are 75.54 million ounces at a grade of 1.77 oz/ton and contained silver within reported probable gold reserves are 642.08 million ounces at a grade of 1.62 oz/ton. Mineral reserves and resources have been calculated in accordance with National Instrument 43-101 as required by Canadian securities regulatory authorities. For a breakdown of reserves and resources by category and additional information relating to reserves and resources, see pages 21 - 31 of Barrick's 2008 Form 40-F/Annual Information Form on file with the

and the problem with the GLD ETF - do they really have the gold they claim .......

The Doc spoke with Cheviot Asset Management’s Ned Naylor-Leyland Sunday regarding the Euro-zone crisis and the €100 billion Spanish banking system bailout announced this weekend, extreme supply constraints in the physical bullion markets, the new allocated silver exchange launching in China this summer, and gold rehypothecation concerns.Ned provided some explosive details regarding the infamous GLD gold bar presented by CNBC’s Bob Pisani which was quickly discovered NOT to be on the GLD’s bar list.Ned reveals the ACTUAL OWNER of the gold bar shown on CNBC, who HAD NOT GIVEN PERMISSION to CNBC or to Bob Pisani to handle their bullion, and was shocked to see Pisani claim their bar as part of the holdings of the GLD!In Ned Naylor-Leyland’s words, ‘this tells you EVERYTHING YOU NEED TO KNOW ABOUT ETF’S!!‘As our readers are well aware, it was quickly discovered that the gold bar held up by Pisani in the interview stamped ZJ6752 was not included in SPDR’s gold bar list.The story almost immediately went viral, but CNBC went silent on the issue over the actual ownership of the gold bar held by Pisani.This is what Ned Naylor-Leyland had to say today, regarding the recent concerns that the GLD’s gold holdings are actually swaps from the LBMA, and whether investors will one day soon wake up to discover that the bullion they thought they owned is really rehypothecated paper:

I’ve been saying that to clients, to potential clients, and to my colleagues in London and in the investment world since 2003-4! Effectively, you MUST BE CAREFUL WHICH VEHICLE YOU USE!!

| |

No comments:

Post a Comment