Markets & Market Moving News....

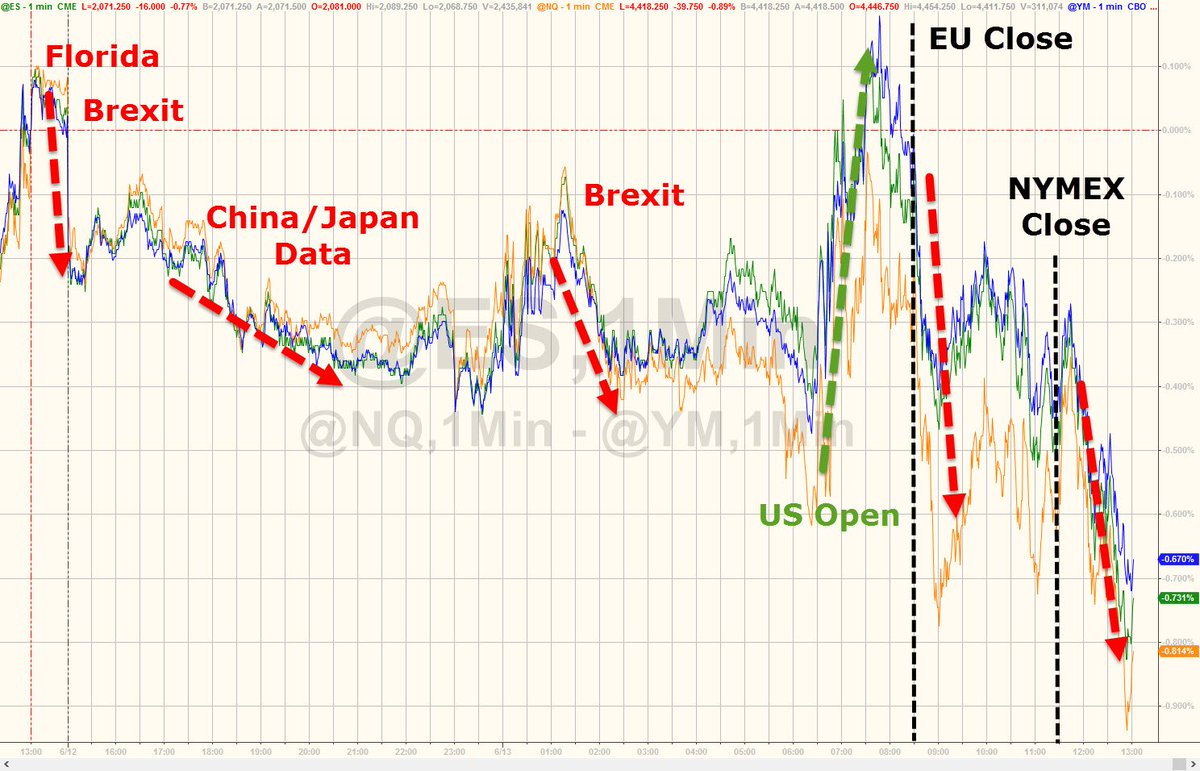

The annotated trading day http://www.zerohedge.com/news/2016-06-13/vix-soars-most-10-months-stocks-dump-gold-jumps …

VIX Soars Most In 10 Months As Stocks Dump, Gold Jumps http://www.zerohedge.com/news/2016-06-13/vix-soars-most-10-months-stocks-dump-gold-jumps …

If VIX soars the most since August 24 on a 0.8% decline, what happens in a real drop

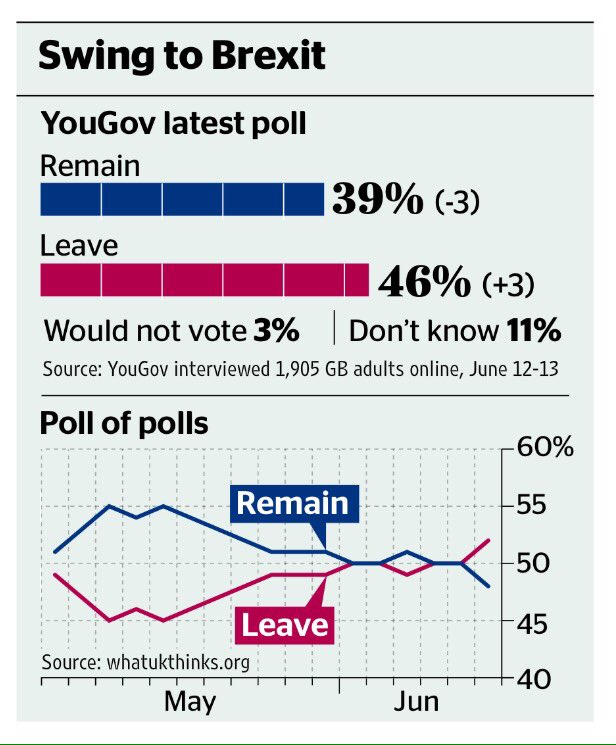

GBP vol jumps as latest poll shows #Brexit lead increase & Don't Know to swing towards Leave http://www.icmunlimited.com/polls/

Handy schedule for the week -key events for various markets..

Daily review of Asia overnight , Europe this morning and US day to come...

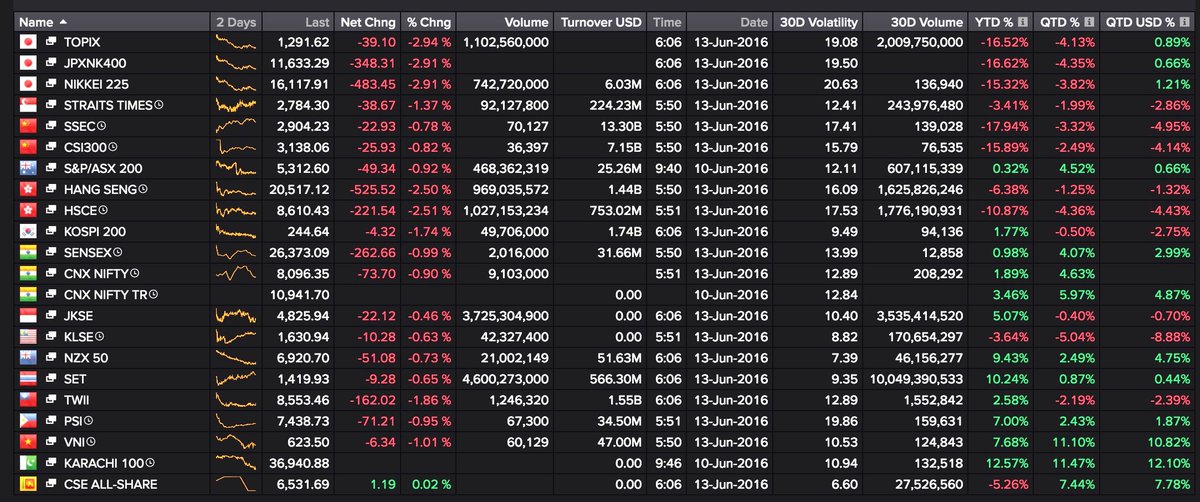

Good morning from Berlin. Asia markets start the week in risk-off mode w/ stronger Yen and JGB yields at fresh lows.

Another week, another low in JGB yields. #Japan's 10y ylds just hit fresh historic low at -0.17% on flight to safety

Nikkei starts week off poorly...

Spain....... Debate snippets .....

( Much more at Spain Report )

Debate starting…

Asked if he would go to Brussels with a €60 billion public spending plan, Iglesias says Spain needs to cut deficit more slowly.

Pablo Iglesias: "Spain has a [tax] revenue problem. Five points behind the European average".

So far, three out of four candidates have said they are not going to bow to Brussels and do any more spending cuts. Will PSOE stand out

This second round was supposed to be about social policies but it has just ended up as economic policies again. Pensions, healthcare, etc.

Candidates are being asked what they would cut to comply with EU deficit rules. Rajoy: "Me? Nothing".

Pablo Iglesias tries to bait Pedro Sánchez: "You must choose between us and the Popular Party, there is no other option".

Rivera trying to scoop up some PP voters by attacking Rajoy on corruption and decency.

Rajoy to Rivera: "A bit of modesty and humility wouldn't do you bad".

Rivera, to Iglesias: "It's not right for foreign regimes to finance parties. You should shut up about this issue".

Brexit......

Looks like we have the real thing -today's ICM poll..

Leave campaign has 6 point lead in both Online and Phone polls

#Brexit

Leave campaign has a majority

ICM poll: The proportion of people who indentify as "Don't Know" falls to 6% and 7% respectively in the Phone and Online survey #Brexit

ICM poll - % of voters "certain to vote"

Leave voters: 83%

Remain voters: 76%

- ORB POLL FOR THE TELEGRAPH SHOW 48 PCT OF BRITONS WOULD VOTE TO REMAIN IN EU, 49 PCT VOTE TO LEAVE much closer than Fridays orb poll

woe big swing to stay here covering all risk shorts

Swing to #Brexit

Another brilliant post from economist @Rex_N

The stay campaign in a nutshell, the strategy and it's transparency

http://www.rexn.uk/2016/06/13/a-challenge-to-call-me-dave/ …

*PRESIDENT OF GERMAN BANK ASSOC. EXPECTS BREXIT TO GO THROUGH:BZ

William Hill offers shortest ever odds on Brexit http://www.cityam.com/243160/william-hill-offers-shortest-ever-odds-on-brexit …

Officials decry selective use of quotes...

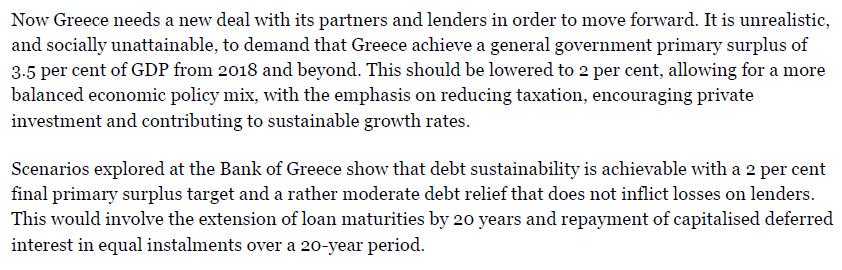

Greece......

Greek-French State Ministers Discuss Bilateral Issues in Paris http://dlvr.it/LYL01P #Greece

#Greece stock market -3.89% to 594.58, lowest level since May 4. Bank index -7.81% to 44.01, new low since Apr 14. #economy #markets #stocks

#Greece banks’ #Eurosystem funding down €3.86bln MoM to €95.71bln (end-May) from €99.57bln (end-Apr). ELA at €64.81bln (BoG) #economy #ECB

Greek police clears migrant camps near border, volunteers detained http://dlvr.it/LYDLKN

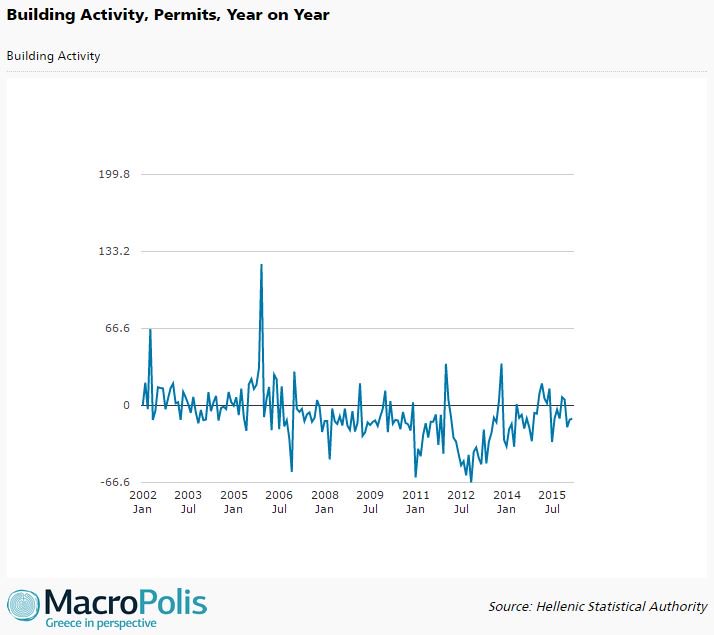

#Greece building activity falls by 11.5 pct in Mar for 3rd straight decline https://shar.es/1J4Loq #economy

Odds & Ends....

Gunman Omar Mateen visited gay nightclub a dozen times before shooting, witness says http://www.orlandosentinel.com/news/pulse-orlando-nightclub-shooting/os-orlando-nightclub-omar-mateen-profile-20160613-story.html … #PulseShooting

****

Seemed like he frequented the club a lot , got drunk & had conversations with some of the patrons....

Not surprised to read this , all things consideted...

No HoR session today due to the lack of quorum. Around 70 members & Agilah Saleh were present. Saleh's two deputies were not there. #Libya

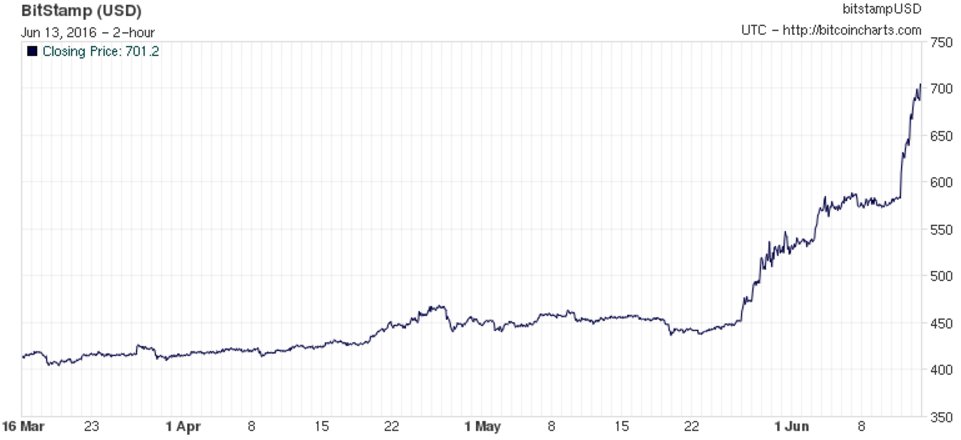

Chart: Bitcoin above $700 -

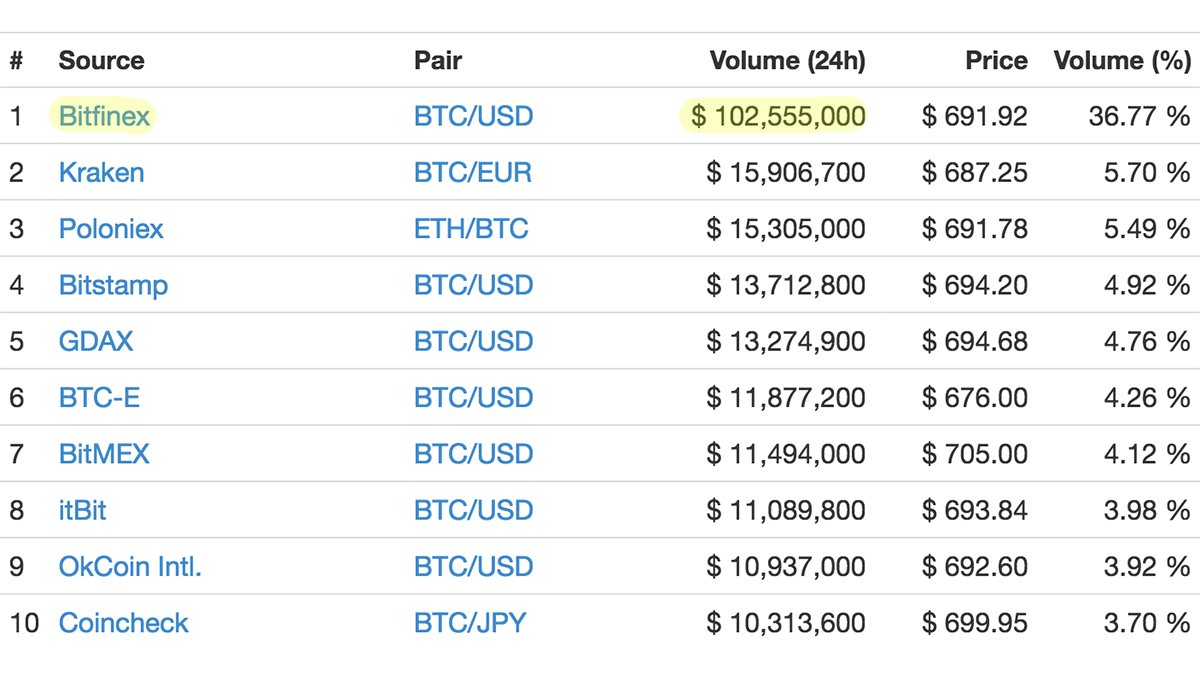

Yowza! @Bitfinex' BTC/USD pair did over $100 million in volume today.

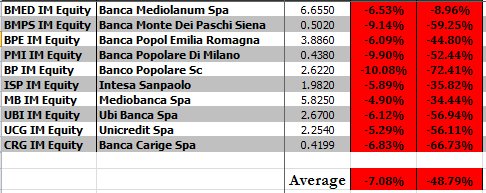

Major Italian banks sank 7.08% (-48.79% ytd) at close

5 to 2 SCOTUS decision ......

Yardbarker: Drug-resistant “super bacteria” found in Rio beaches, waterways set to host Olympics http://www.yardbarker.com/olympics/articles/report_drug_resistant_super_bacteria_found_in_rio_beaches_and_waterways_set_to_host_olympic_events/s1_13156_21090751 … via @yardbarker

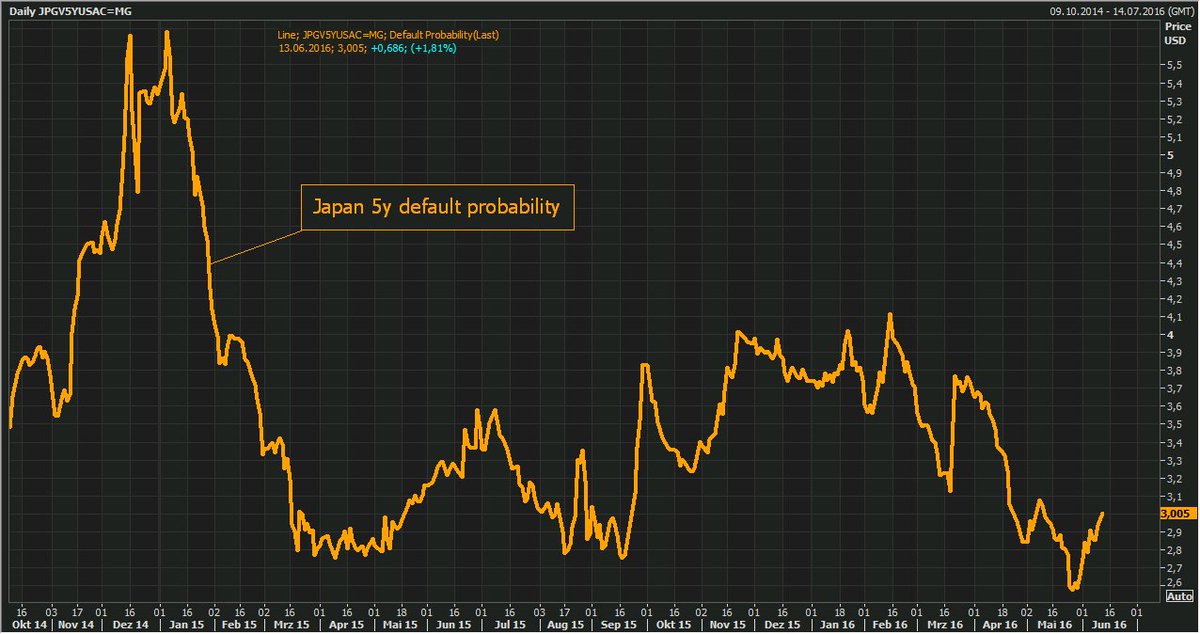

Fitch cuts #Japan credit outlook to negative, citing delay of consumption tax increase. https://www.fitchratings.com/site/pressrelease?id=1005944 …

Donald Trump revokes Washington Post's press credentials http://nbcnews.to/1WM0AR7 @aseitzwald @AndrewNBCNews report

Deleted official report says Saudi is key funder of Hillary Clinton's presidential campaign http://ow.ly/xMhD301bQXC

David Jack

David Jack

No comments:

Post a Comment