Overview......

Goldman: "We are revising our Fed call, and now expect the FOMC to keep policy rates unchanged at the March 15-16 meeting"

Goldman: "We expect the next rate increase in June, and see a total of three rate increases this year"

Huge: Puerto Rico has not provided final 2014 financial docs to @KPMG according to federal court testimony #muniland

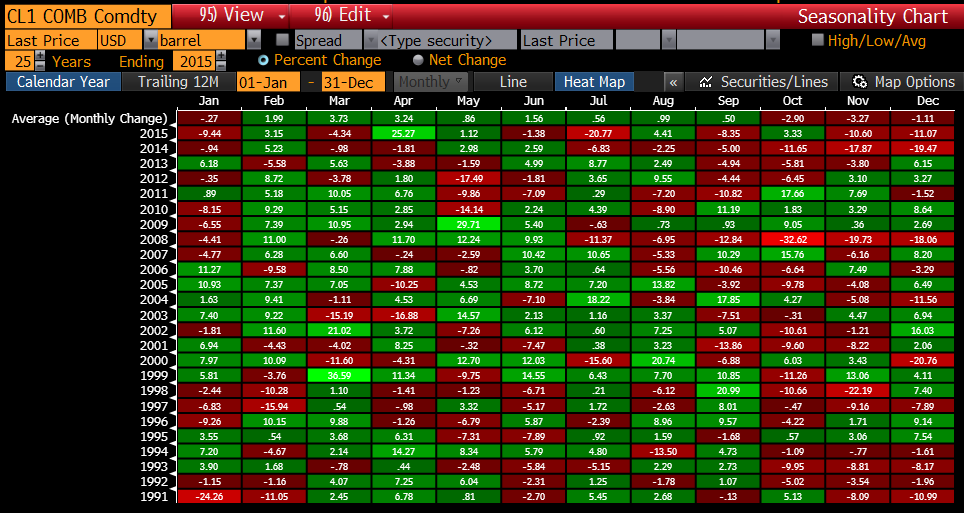

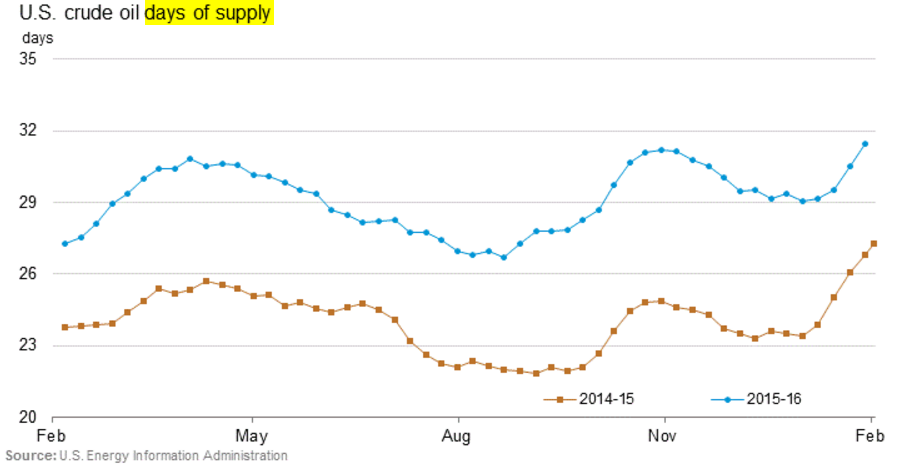

Crude Seasonality, last 25 years...

Tends to bottom in January (on avg).

BOOM: The Market is now pricing in NO rate hikes in '16 & only 1 hike in 2017. World War ¥€$ http://stks.co/i3sg0

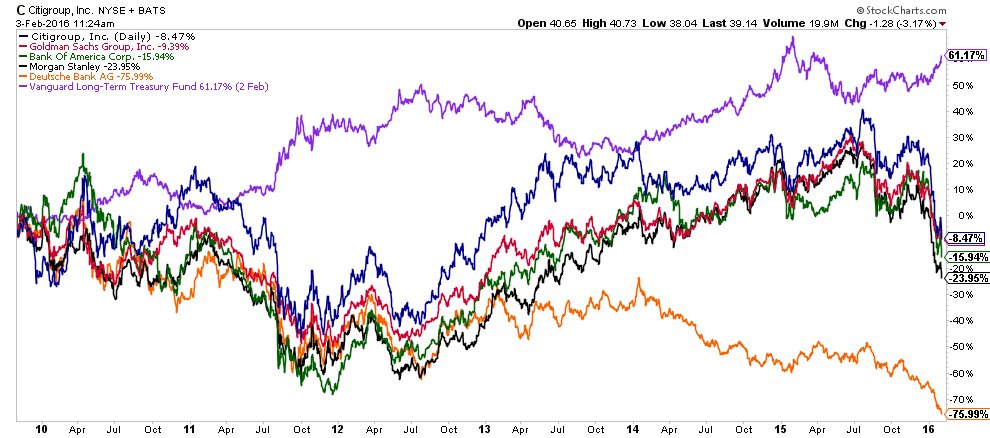

Total Returns since Nov 2009...

Oil..........

"Iran is not opposed to a meeting but there would be to a consensus about what to do," an Iranian official tells the Wall Street Journal.

Iran's position of not joining an immediate OPEC cut as reported before remains the same

. @WeatherfordCorp to Cut 6,000 Jobs as #Oil Industry Downturn Worsens http://bloom.bg/1S1dckW via @CarlosCaminada

Chart: US gasoline inventories at record high -

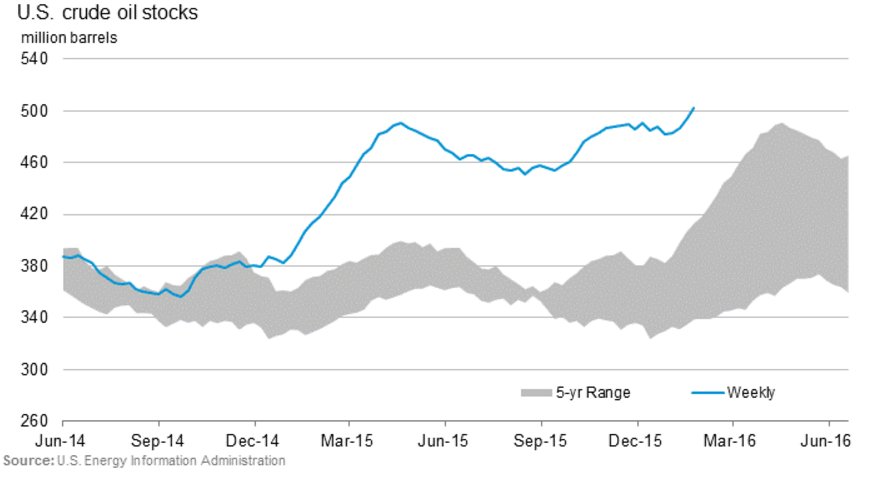

Chart: US crude oil inventories hit new highs (the only time it was higher was in the late 1920s?) -

Of course, this is all theoretical unless #SaudiArabia agrees. The 6 are likely: #Venezuela, #Russia, #Iran, #Algeria, #Ecuador plus another

Venezuela #oil minister says 6 #OPEC and non-OPEC countries agree on emergency meeting http://www.shana.ir/en/newsagency/254636/Venezuela-Says-6-OPEC-Non-OPEC-Countries-Agree-on-Emergency-Meeting …

Europe.........

Catalan separatists have registered a petition in the regional parliament to begin drawing up key breakaway laws.

https://www.thespainreport.com/articles/612-160203200019-daily-spain-briefing-february-3-2016 …

Eastern European officials warn EU deal may not be acceptable #Brexit http://www.theguardian.com/world/2016/feb/03/eastern-european-officials-warn-eu-deal-may-not-be-acceptable …

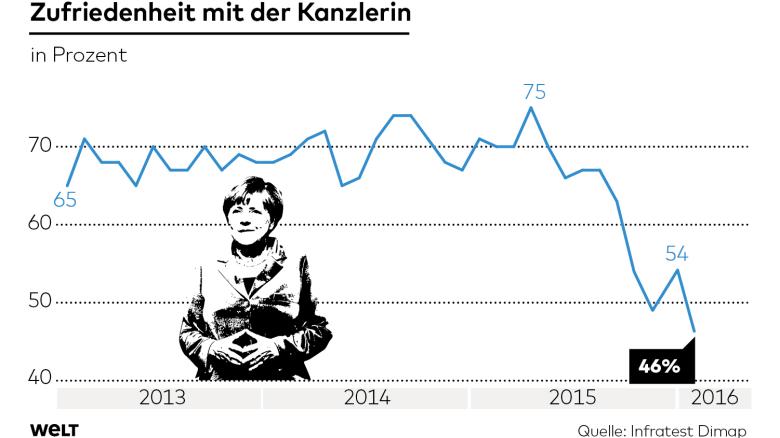

Merkel's popularity falls below 50% for the first time ever. [#Germany Infratest/Dimap poll]:

46% -8 points

The #EU agreed how to raise €3bn for the #Turkey #migration deal. Britain will contribute €324mn http://www.consilium.europa.eu/en/press/press-releases/2016/02/03-refugee-facility-for-turkey/?utm_source=dsms-auto&utm_medium=email&utm_campaign=Refugee+facility+for+Turkey%3a+Member+states+agree+on+details+of+financing …

Good summary by @plegrain of what Cameron obtained so far: http://capx.co/ignore-the-brexit-press-cameron-has-got-more-than-he-expected-from-europe/ … Question is if this will be sufficient for UK citizens

Ukraine's economy minister quits over reform obstruction http://dw.com/p/1HpFV

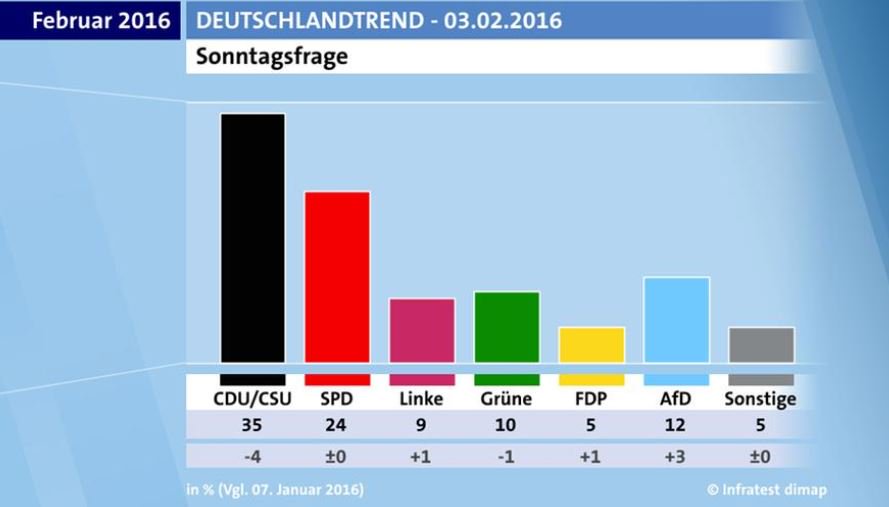

Check latest polling numbers in Germany !

Anthony Sanders: European 2Y Sovereign Yields Go MORE Negative, Deutsche Bank CDS Explodes http://ift.tt/1JYkK5y

*SCHAEUBLE: `DIFFICULT' FOR GREECE TO RECOVER W/O DEVALUATION

#Germany FinMin Schäuble says Europe needs a common army.

*IBEX FALLS 4 PCT, HITS LOWEST LEVEL SINCE MID-2013

Everything just going swimmingly , I see.

Yes, that's the yield on the German 2-year... -0.5%

France reiterates its long-standing position. Now , back to Cameron discussing his wonderful deal.

DETAILS: German mayor says schoolgirls shouldn't walk nr refugee center to avoid harassment http://on.rt.com/73hx

The police chiefs of Austria, Slovenia, Croatia, Serbia and Macedonia agreed not to let though #migrants travelling without documents

€10bn a year: The cost of restoring France's borders http://www.thelocal.fr/20160203/eu-borders-could-cost-france-an-annual-10-billion … via @TheLocalFrance

#Greece “Hot Spots? No, thanks” say #Kos residents & hinder Greek Defense Minister from landing on the island http://www.keeptalkinggreece.com/2016/02/03/hot-spots-no-thanks-say-kos-residents-hinder-greek-defense-minister-from-landing-on-the-island/#.VrHzrCPvhjs.twitter …

Keep your eyes on the ever-growing chorus to ban cash.

Cameron confirms EU referendum won't be held within 6 weeks of Scottish, Welsh and Northern Irish elections though date not fixed yet #PMQs

SNP's @AngusRobertson calls on Cameron not to call EU referendum in June due to clash with Scottish, Welsh & Northern Irish campaigns

German Interior Minister hopes to extend border controls "indefinetely" when they expire in Feb: http://openeurope.org.uk/daily-shakeup/tusk-tabled-draft-deal-for-the-uk-as-may-hints-she-will-back-remaining-in-the-eu/#section-4 … #migrantcrisis

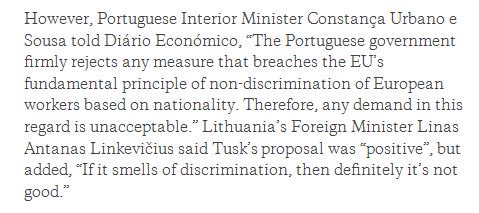

Portugal goes in hard on proposed #UKinEU #EUReform deal: http://openeurope.org.uk/daily-shakeup/tusk-tabled-draft-deal-for-the-uk-as-may-hints-she-will-back-remaining-in-the-eu/#section-1 … #EURef

Spanish socialist leader faces uphill struggle as he is asked to try and form govt: http://openeurope.org.uk/daily-shakeup/tusk-tabled-draft-deal-for-the-uk-as-may-hints-she-will-back-remaining-in-the-eu/#section-5 …

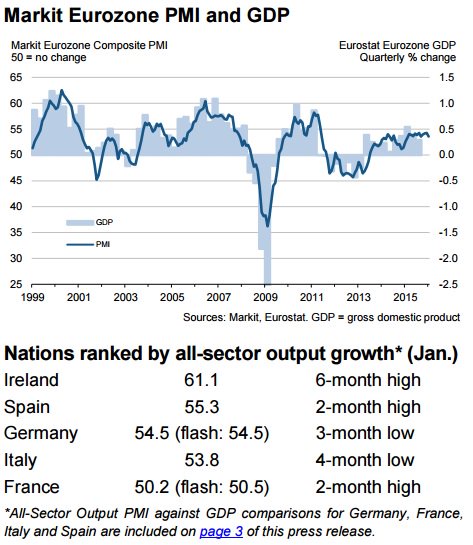

Data Splash..... Key Europe Items - much more at Timeline (Twitter)

#BalticFriedIndex | Almost a 2 handle! Baltic Dry Bulk Index -2.3% at 303 points ...record low obviously

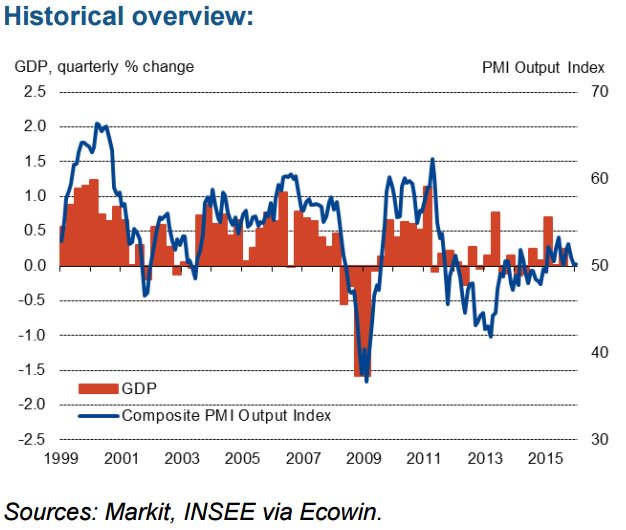

Final Markit #France Composite Output Index at 50.2 in Jan'16 (50.1 in Dec'15). http://ow.ly/XSQJo

Final #Germany Services Business Activity Index at 55.0 in Jan'16, down from 56.0 in Dec'15 (3-month low). http://ow.ly/XSQXG

#Germany Composite Output Index at 54.5 in Jan'16, down from 55.5 in Dec'15 (3-month low). http://ow.ly/XSRKx

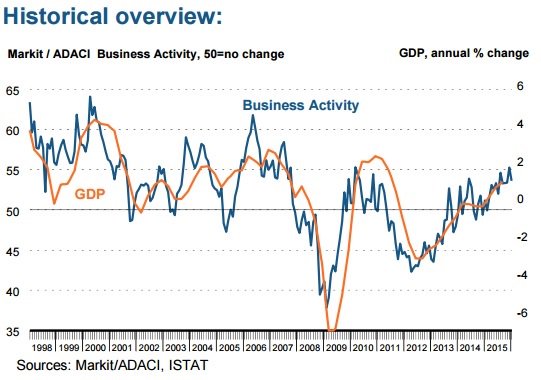

Markit/ADACI #Italy Services #PMI at 53.6 in Jan'16, down from Dec'15 69-

month high of 55.3 http://ow.ly/XSPVt

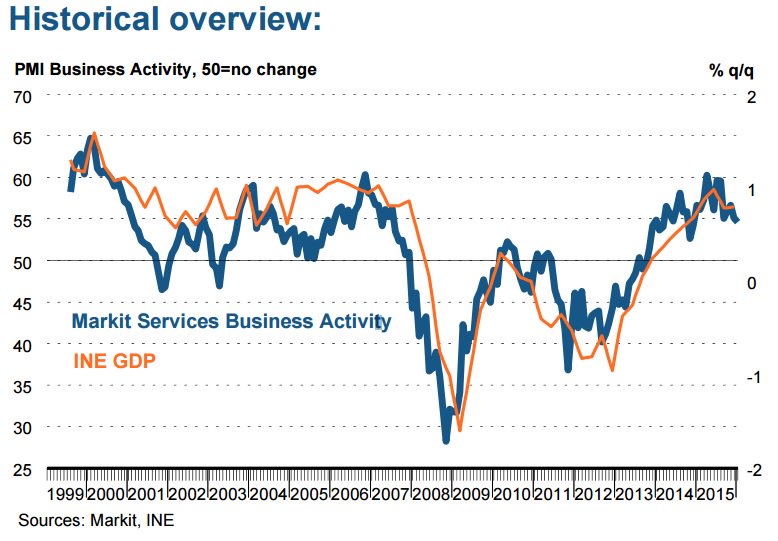

Markit #Spain Services #PMI at 54.6 in Jan'16, the weakest increase since Dec'14. http://ow.ly/XSPhc

Markit/CIPS #UK Services #PMI at 55.6 in Jan'16, little-changed from 55.5 in Dec'15 http://ow.ly/XSSUk

No comments:

Post a Comment