Overview........

Evening wrap.....

Gundlach: "The breadth of the equity market may be the worst ever"

Gundlach: "If the Fed hikes it will be a different world"

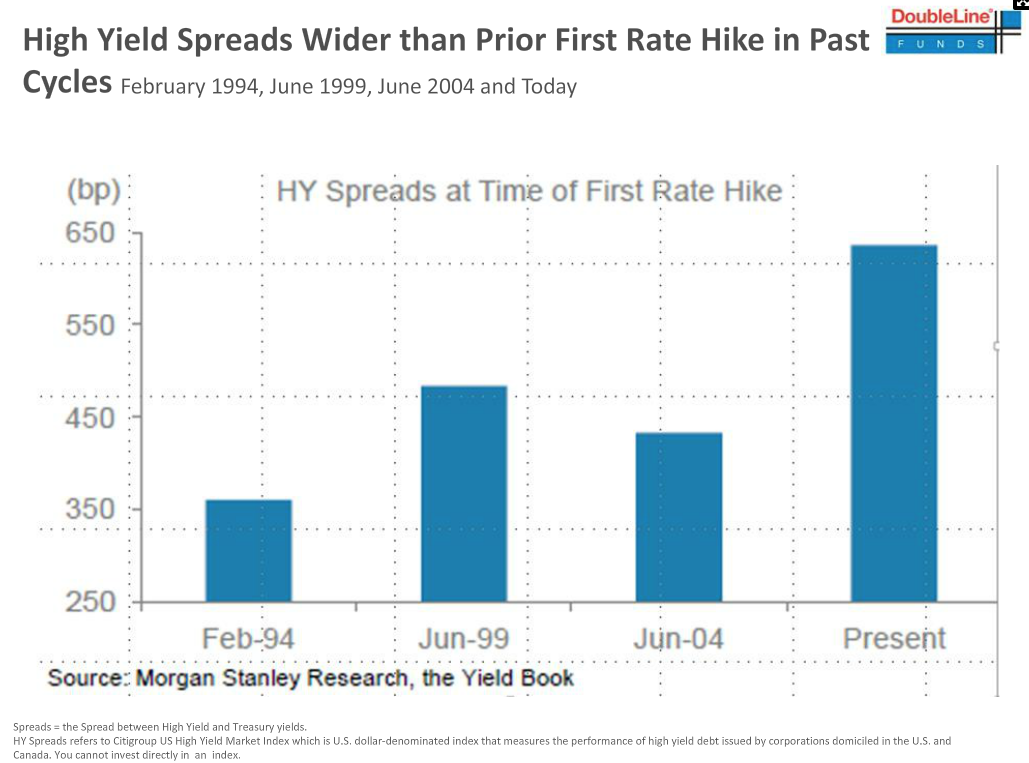

GUNDLACH: 'High-yield spreads have never been this high prior to a Fed rate hike.'

Morning look.....

Morning Note: 1. Gordon Brown to PIMCO. 2. $39 iron ore -> miners brace. 3. China's exports drop for a 5th month

Good morning from Berlin. Asia markets taking a hit from weak trade data out of #China & plunging commodity prices.

Europe......

Evening wrap.....

?

Germany's Schäuble urges Tsipras to affirm #IMF role in Greek bailout as default risk rises. http://bloom.bg/1HSNhsd

Shares of Glencore (off 73.1%) and Anglo (off 72.8%) heading for a photo-finish worst YTD performance by a mining major

UNHCR surveys Syrian refugees. Half headed for Germany, 13% Sweden. UK just 2% & France 0.4% http://data.unhcr.org/mediterranean/download.php?id=248#_ga=1.236023624.852288769.1449583646 …

Refugee relocation in Athens hits snags http://bit.ly/1XYIM0Z

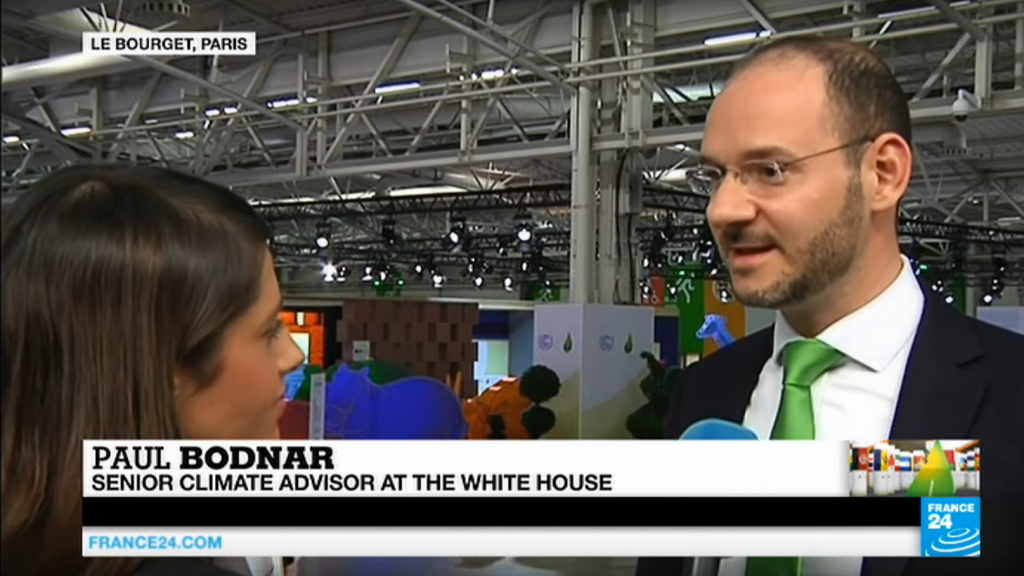

#ParisClimateConference: "#US cannot accept liability & compensations as part of the deal" http://youtu.be/8iloXGj0LnM

Morning Look....

#BREAKING Paris, Berlin 'convinced' of need to reduce migrant flow: letter to EU

Eurogroup expects Tsipras & Co. to have legislated the relevant prior actions for the 1bn sub-tranche by 18 Dec. GLWT! :-) #Greece

Tusk on Monday: I'll be 'honest broker' in UK negotiations. Commission on Tuesday: we'll be 'honest broker' in UK negotiations. Honest, guv!

*SCHAEUBLE SAYS FTT TALKS CAN'T LEAD TO RESULT OF NO ACTION

GREEK PRIVATISATION FUND HEAD SAYS ATHENS WILL SIGN DEAL WITH GERMANY'S FRAPORT ON MANAGING REGIONAL AIRPORTS WITHIN TEN DAYS

Grexit is in the past, says German ambassador in Athens http://dlvr.it/CxystT

Spanish opposition candidates rail against deputy PM over corruption in TV election debate http://cort.as/a_QX

Dijsselbloem: Greek privatisation income may turn out to be smaller than expected €50bn (due to improved banks) http://fd.nl/economie-politiek/1130440/grieks-privatiseringsfonds-kan-kleiner-uitvallen …

#France - PM Valls urges to join forces to stop FN winning regions. This can backfire. Reinforces Le Pen's 'they are all the same' rhetoric.

Credit Agricole Returns to Greece as Major Shareholder in Alpha Bank http://dlvr.it/CxzkWd #Greece

Turkish leader's son denies Russian allegations of Islamic State trade http://reut.rs/1NI7cGp

746,714 migrant arrivals in #Greece but just 10,718 asylum applications. Our latest on the migrant-crisis frontline

http://country.eiu.com/article.aspx?articleid=1623750146&Country=Greece&topic=Politics …

DB's Reid: 'At this rate it'll be cheap enough to decorate the tree with all sorts of commodity based products'

Next casualty of commodity rout: Anglo American suspends 2H 2015 & 2016 dividends as BBG Commodity index at 17y low.

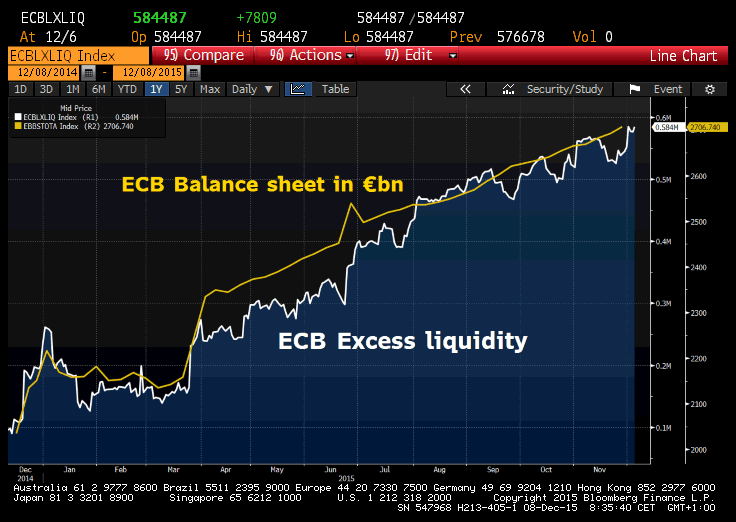

#ECB has failed to bring money into the real econ. Balance sheet expansion generating huge flood of excess liquidity

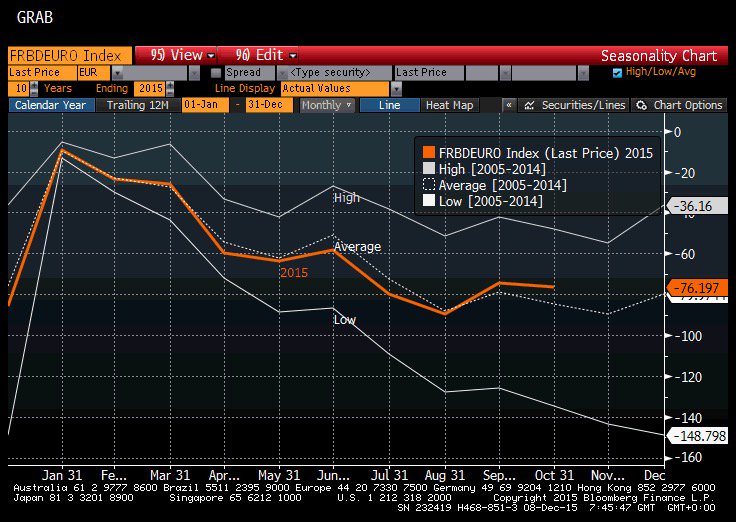

#France | Oct YTD Budget Balance: -€76.2B v -€74.5B

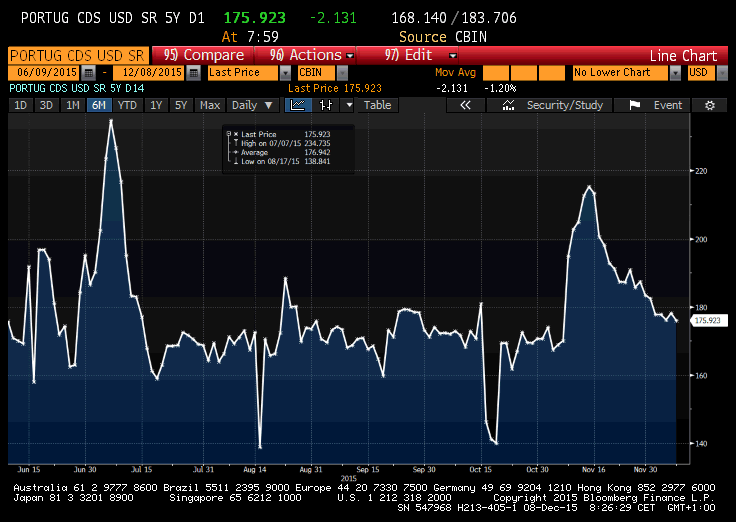

Eurogroup's Dijsselbloem says #Portugal reassured him would respect rules. Mkts fine w/ new govt as CDS prices show.

*FRANCE WANTS TO TAX INCOME FROM SHARED ECONOMY WEBSITES: ECHOS ..what doesn't France want to tax ?

Ioan Smith @moved_average

#Ukraine | Nov CPI M/M: 2.0% v 1.7%e; Y/Y: 46.6% v 46.2%e ...Carney, Draghi & Yellen must be so envious

Asia & Emerging Nations...

Evening wrap......

zerohedge @zerohedge

Oil Producer's Currencies Are Collapsing As Brent Breaks Below $40 http://www.zerohedge.com/news/2015-12-08/oil-producers-currencies-are-collapsing-brent-breaks-below-40 …

Venezuela's oil basket fell below $35/bbl today

Brazil Supreme Court to Rule on Impeachment Case Dec. 16: Folha

DAILY SABAH @DailySabah

BREAKING - US Consular services canceled in Istanbul on Dec. 9 due to possible security threat

Morning Look....

Japan cut its target for women in leadership positions from 30% to 7% http://qz.com/567026/japan-cut-its-target-for-women-in-leadership-positions-from-30-to-7/ … via @qz

China calls for global cooperation against Daesh after being targeted by terrorists in Mandarin song

http://sabahdai.ly/MJcq9z

Beijing issues 'red alert' pollution warning http://dw.com/p/1HJ1R

#Japan | GOVT TO CUT EFFECTIVE CORPORATE TAX RATE FURTHER TO 29.74 PCT FROM APRIL 2018 - DRAFT ..not sure what it is to 4 decimal places

#Saudi | *SAUDI BENCHMARK STOCK INDEX FALLS BELOW 7,000

#Crude | OPEC SHOULD HOLD EMERGENCY MEETING IF OIL FALLS TO $30/BARREL -INDONESIA'S OPEC GOV

#Japan #France | Japanese Bought Most French Government Debt Since May in October ...saving the world

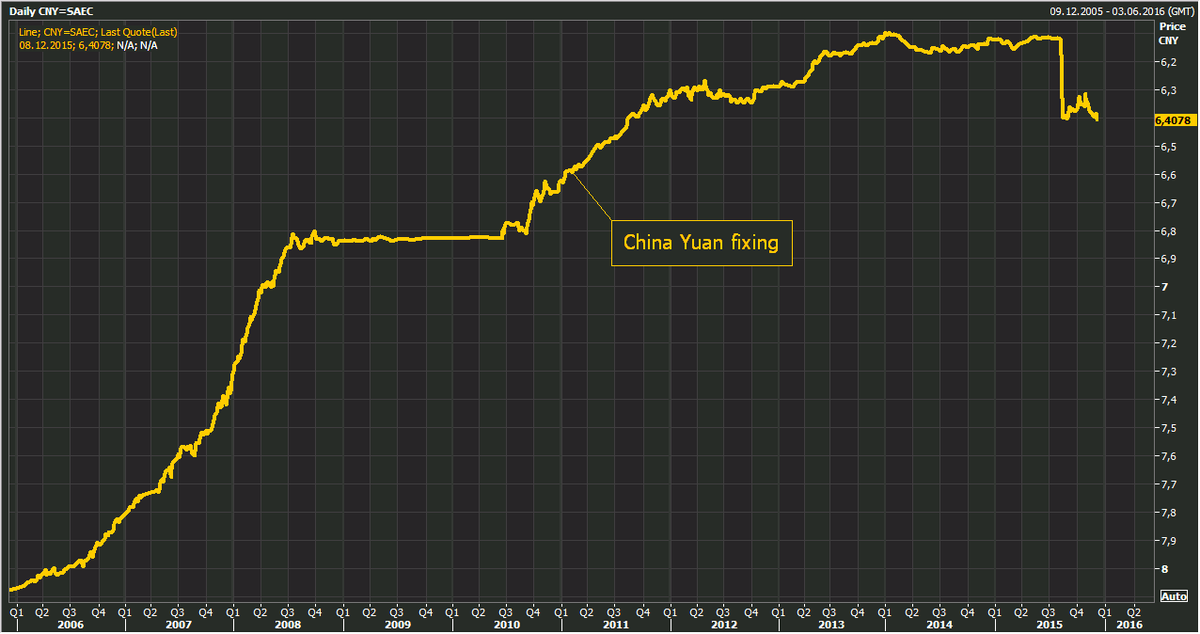

#China Yuan set for weakest close since 2011 as exports, reserves drop. http://bloom.bg/1HRFjzz

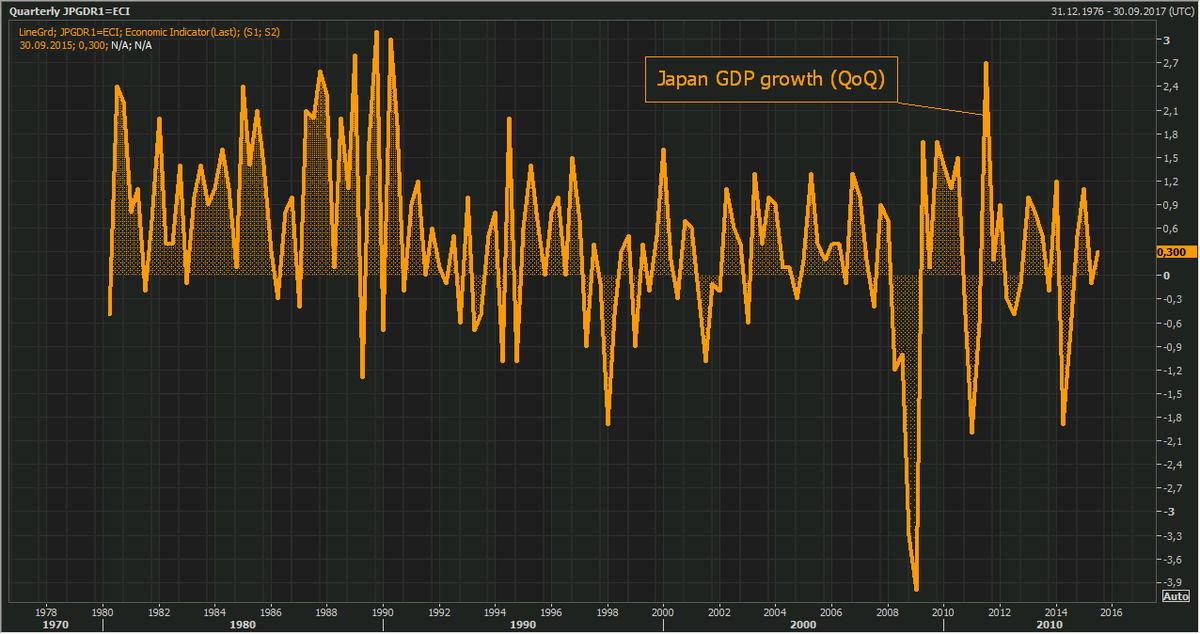

#Japan's economy wasn't in technical recession in 3rd Quarter, revised data show. http://bloom.bg/1XQCqGs

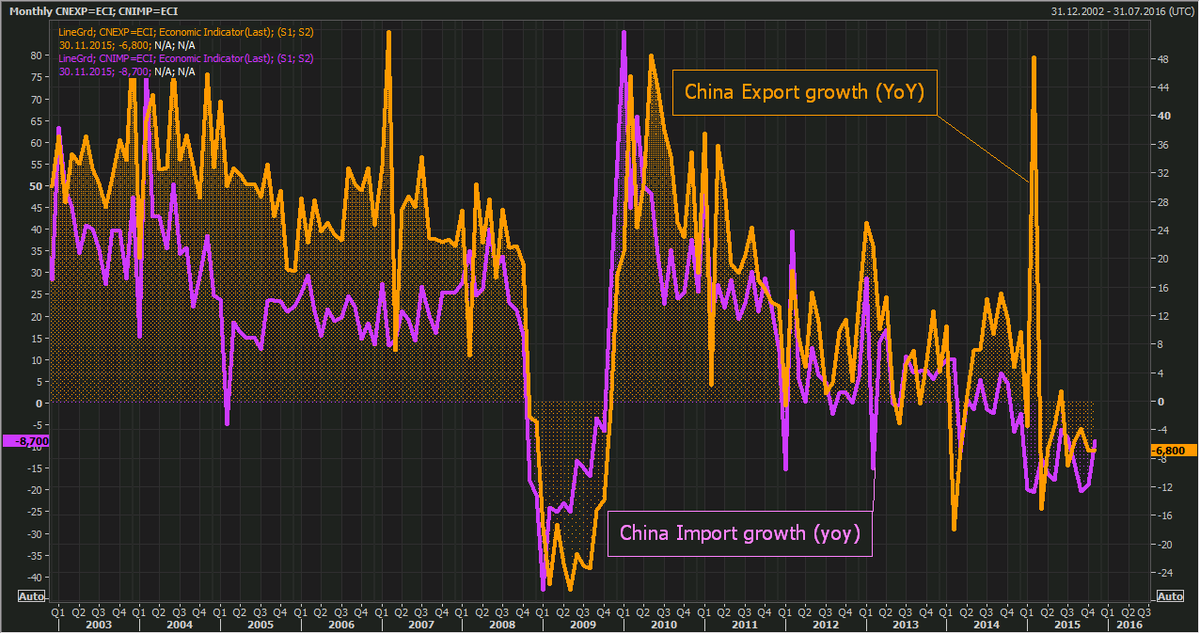

More doom data from #China: Exports fall for 5th month, Import slump continues. http://bloom.bg/1HRFwTl

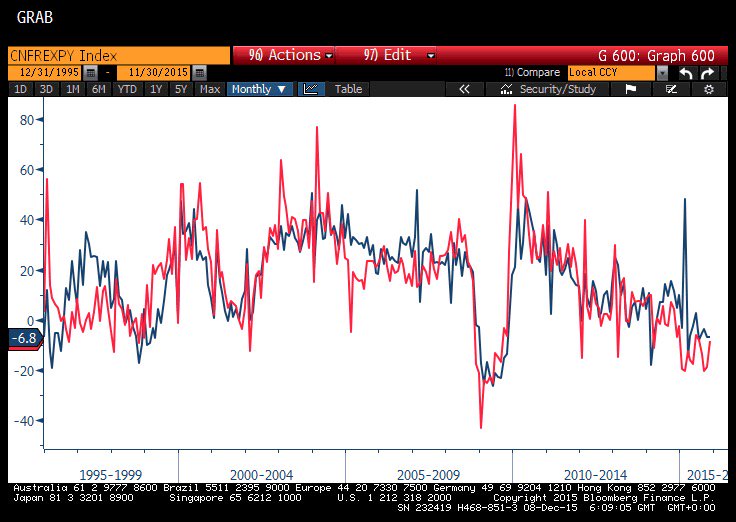

#China | Exports Y/Y: -6.8% v -5.0%e; Imports Y/Y: -8.7% v -11.9%e

No comments:

Post a Comment