Evening Wrap......

EU awards millions in emergency funds to help Slovenia and Croatia handle migrant influx http://eurone.ws/37a7hi

Total exposure -as high as 38 billion ? Wow...

#Portugal Communists say "conditions are met for the formation of a govt based on the initiative of the Socialists" http://www.pcp.pt/sobre-trabalho-em-curso-com-ps-com-vista-uma-solucao-politica …

Huge challenge for #Portugal President Cavaco Silva now. It will be very difficult for him to deny handing mandate to Socialist leader Costa

Greece Not Likely to Get Bailout Tranche on Monday’s Eurogroup http://dlvr.it/CgKTY5 #Greece

€2 bn bailout tranche at risk and why Greece’s PM Tsipras should not talk with Juncker about… http://goo.gl/fb/ZPpq5B

Black box analysis reveals causation as explosion. Now we need to figure out who did the deed ?

FAZ #Exclusive: German Int Min briefing Syrian refugees only get 'subsidiarity protection' henceforth (Though will that impact numbers?)

Merkel has been Tommy hammered by refugee crisis bunglings..

Oh er - @handelsblatt reports that German quietly redirecting abt 1,000 refugees a day to Sweden. #migrationcrisis: https://global.handelsblatt.com/edition/299/ressort/politics/article/germany-passing-the-refugee-buck?ref=MjU0NDg3 …

Sweden officially requests Commission to relocate refugees in SWE under EU relocation quotas (as we reported y-day): http://openeurope.org.uk/daily-shakeup/irish-think-tank-warns-brexit-could-reduce-uk-irish-trade-by-20/#section-2 …

'Debt for refugees,' Juncker lobbying EU states to take refugees for looser budget rules - reports FP @handelsblatt

Official figures: More than 758,000 refugees registered in Germany so far in 2015:http://www.bmi.bund.de/SharedDocs/Pressemitteilungen/DE/2015/11/asylantraege-oktober-2015.html?nn=3314802 … #migrationcrisis

Overview.......

NFP Results ......

Who Hired In October: The Full Breakdown By Industry http://www.zerohedge.com/news/2015-11-06/who-hired-october-full-breakdown-industry …

#NFP 271k Vs est 185k. Unemployment 5% Vs est 5%. Avg earnings 0.4% Vs est 0.2%

2-Yr US Yield jumps above 0.9%, highest since May2010 after solid US jobs data as probability for Dec liftoff rises.

US #NFP Guesses:

SocGen 220k

JP AM 219k

Citi 200k

Wells Fargo: 190k

GS 190k

Consensus 185k

UBS 180k

Barclays Cap 175k

HSBC 175k

MS 165k

Morning Note: 1. Some more ugly German data. 2. Carney says prepare for 2016 hike. 3. #NFPGuesses est 185k.

Good morning from Berlin. Asia stocks tread water as markets await Fed policy clues from important US jobs data.

Europe.......

Euroworking group planned for tonight to discuss #Greek implementation of milestones will no longer take place. Reschedule when more clarity

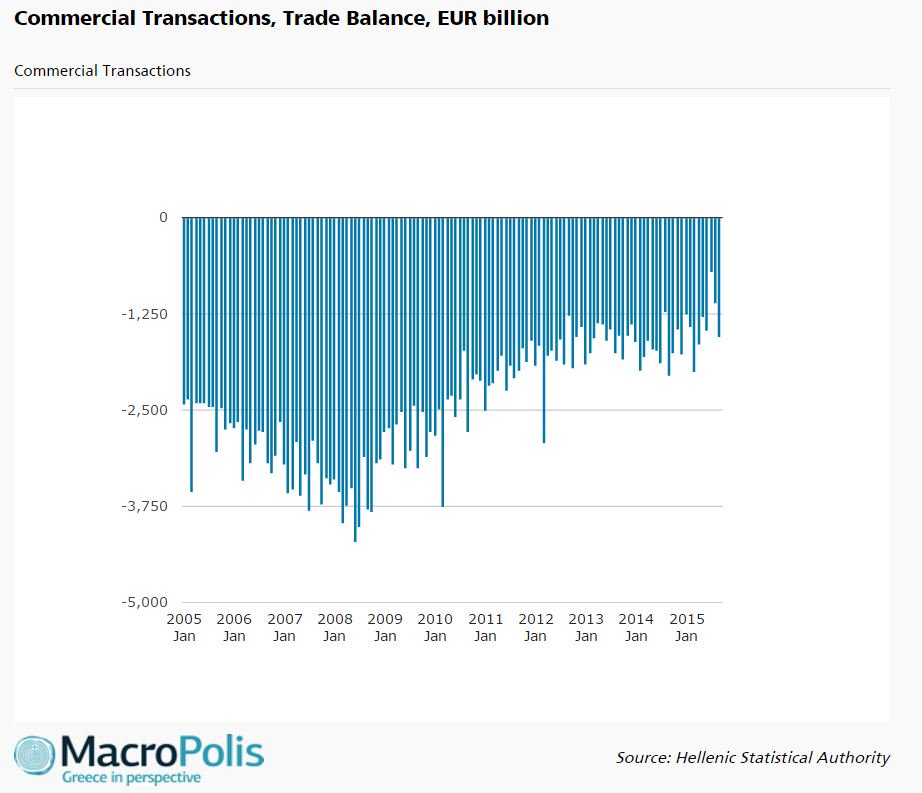

Greek trade deficit falls by markedly accelerating pace of 24.2 pct in Sept https://shar.es/15hWUE #Greece #economy

Finnish PM says government “very likely” to fall over health reforms http://openeurope.org.uk/daily-shakeup/european-commission-sees-slowdown-in-eurozone-growth-next-year/#section-6 …

#Greece Alpha amends voluntary bond tender offer terms (LME) cancelling the cash consideration option. #economy #banking #markets

QE infinity? #ECB's Praet: Asset purchases to run until sustained adjustment in inflation path.

New report warns UK would lose access preferential market access to 51 states if it were to leave the EU http://openeurope.org.uk/daily-shakeup/european-commission-sees-slowdown-in-eurozone-growth-next-year/#section-3 …

#BREAKING Sept UK Industrial Production -0.2% Vs est -0.1%. Manufacturing Production +0.8% Vs est +0.6%

Lidington promises more details on EU reform in letter but accepts treaty change won’t be ratified before referendum http://openeurope.org.uk/daily-shakeup/european-commission-sees-slowdown-in-eurozone-growth-next-year/#section-2 …

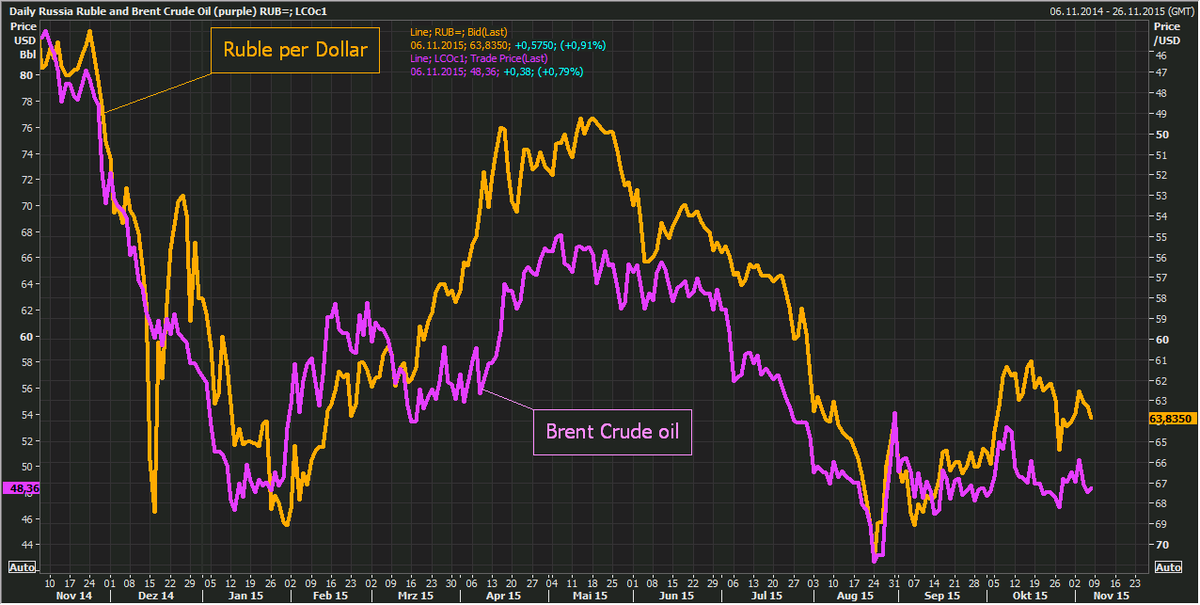

#Russia Ruble keeps falling despite small rebound of oil price.

European Commission sees slowdown in Eurozone growth next year http://openeurope.org.uk/daily-shakeup/european-commission-sees-slowdown-in-eurozone-growth-next-year/ …

Over 758,000 refugees registered in Germany in 2015 http://openeurope.org.uk/daily-shakeup/european-commission-sees-slowdown-in-eurozone-growth-next-year/#section-1 …

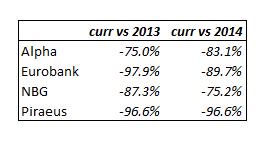

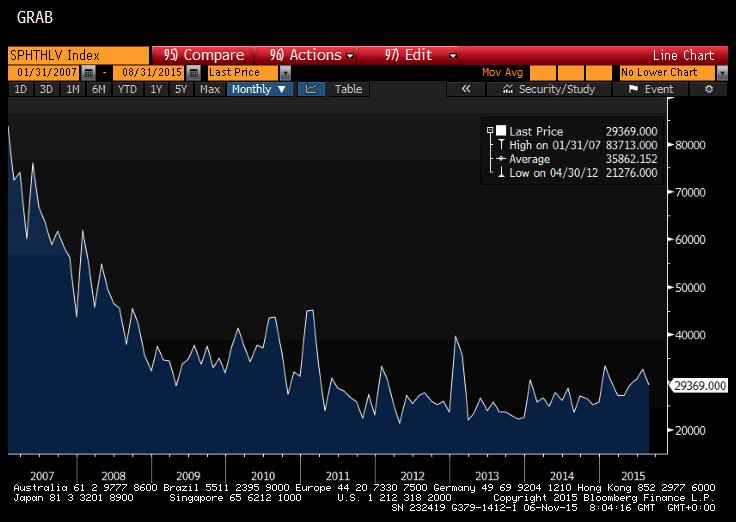

#Greece bank shares plummeted 75-98% since 1st recap (Q2 2013) & 75-97% since 2st (Q2 2014). #banking #markets

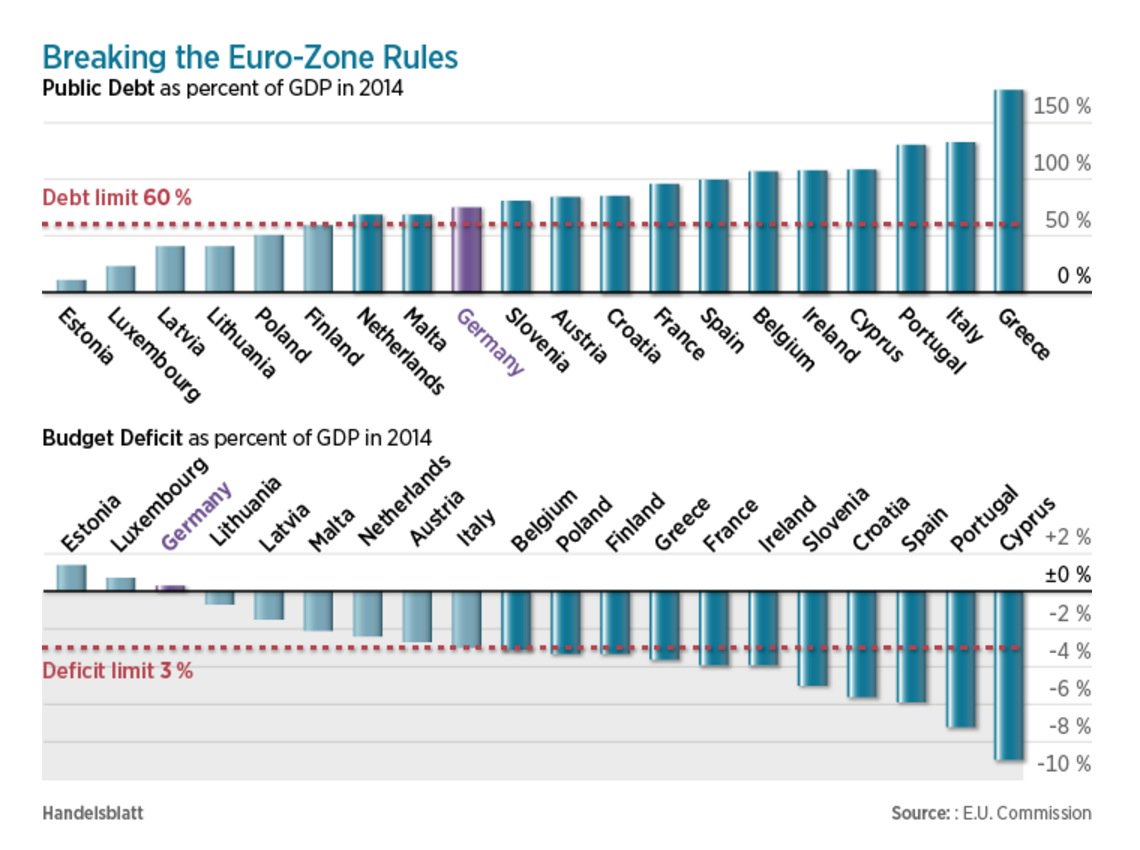

Farewell to Maastricht criteria: Costs for refugees a welcomed excuse to loosen debt limits. https://global.handelsblatt.com/edition/301/ressort/politics/article/berlin-coalition-agrees-to-fast-track-deportations?ref=MTI5ODU1 …

#Portugal | Left Bloc's Political Committee approves agreemnt w Socialists, w focus 'on employment, wages, pensions'

Ukrainian parliament coalition risks collapsing as another party may join opposition http://tass.ru/en/world/834404

Germany has taken in 760,000 asylum seekers in 2105; 1/3 of all arrivals coming from Syria http://bit.ly/20yUFit

#Austria | Oct Wholesale Price Index M/M: -0.8% v -0.4% prior; Y/Y: -4.1% v -4.3%

#Spain | Sept House transactions Y/Y: 13.8% v 24.2% ...context..

#Spain | Industrial Production WDA ...

#France | Sept YTD Budget Balance: -€74.5B v -€89.7B

#Finland | *STUBB: HOPE CENTER PARTY WON'T FORCE HIS PARTY TO QUIT GOVT

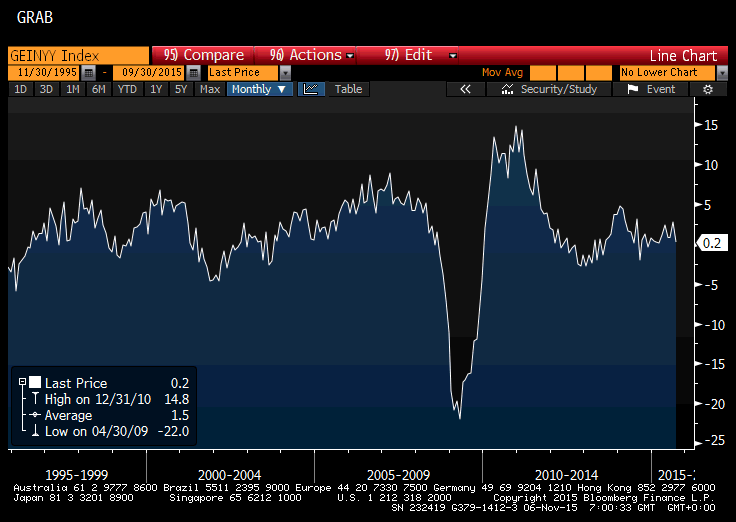

German Sep industrial output falls unexpectedly. Doesn't bode well for #Germany's Q3 GDP. http://www.bloomberg.com/news/articles/2015-11-06/german-industrial-output-unexpectedly-declines-amid-china-risks …

#Germany | GERMANY SEPT INDUSTRIAL PRODUCTION M/M: -1.1% V 0.5%E; Y/Y: 0.2% V 1.3%E

#VW | *VW'S PORSCHE UNIT REJECTS MEDIA REPORT ON MANIPULATION SOFTWARE

*MAERSK CEO: CONTAINER FREIGHT RATES FELL TO HISTORIC LOW IN 3Q

Asia.....

Russian crude exports to Japan increase despite weaker trade – Rosneft CEO http://on.rt.com/6vpc

Clash of cultures as democratic Taiwan meets autocratic China http://reut.rs/1SuUC1J

*BNP PARIBAS SAID TO SHUT DOWN HONG KONG DARK POOL BUSINESS:RTRS

#China | *SHIMAO PROPERTY JAN.-OCT. CONTRACT SALES DROP 6% ON YR

CHINA SECURITIES REGULATOR SAYS TO RESUME IPOS

$SHCOMP ends the week a very respectable 6.1% higher...have we gone back in time to when everything was rosy in China?

#China | Someone going to tell CSI300 futures that China is in a bull market?! "Volume"

*JAPAN MULLS EARLY CORP TAX CUT FOR RAISING WAGES, CAPEX:REUTERS

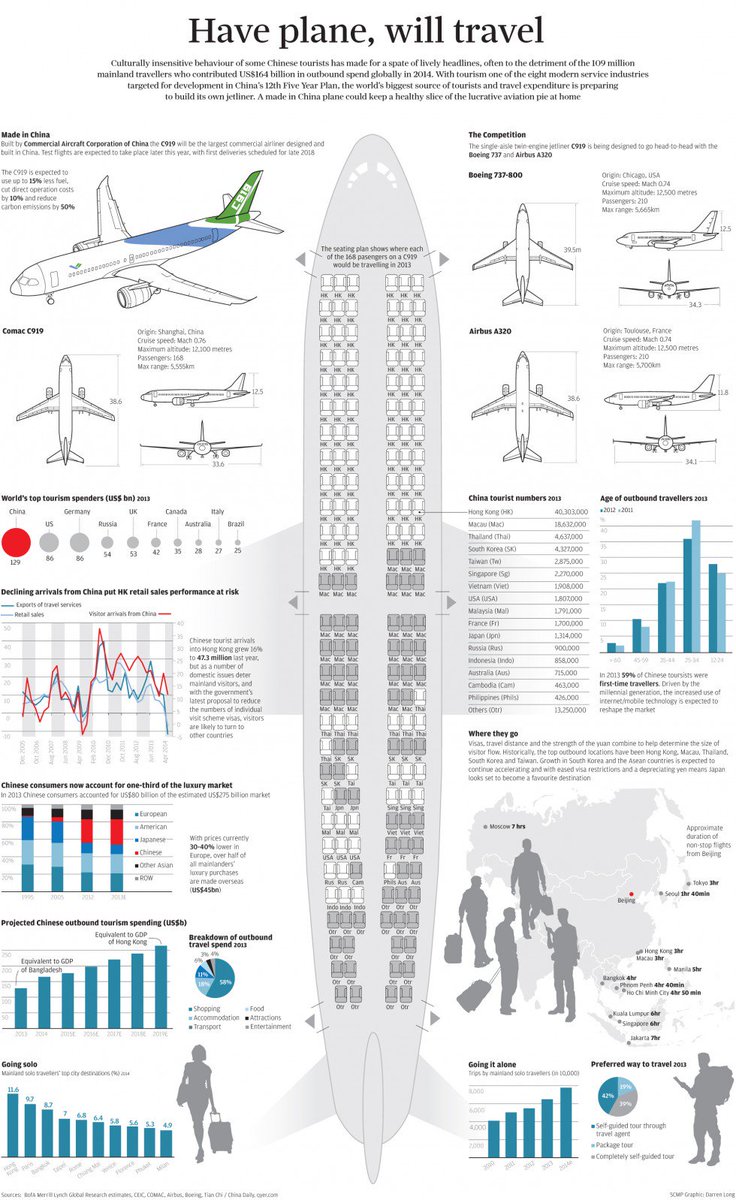

The #C919 was unveiled this week. Here was our April 2015 #infographic on Chinese tourism http://sc.mp/yw9o3

China house prices via Nomura today. Has the mini-surge peaked?

De-Dollarization: Global Yuanization Is One Step Closer, Thanks To London http://emergingequity.org/2015/11/06/de-dollarization-global-yuanization-is-one-step-closer-thanks-to-london/ …

#China | China banks' NPL topped 2% in some provinces - bad loans from Zhejiang, Guangdong and Shandong provinces totaled CNY440B

Nikkei closes up 0.8% at 19265.60 and Yen weakens vs Dollar ahead of all important US NFP data.

#BOJ #JPY | Risk of #Japan Recession Seen by Economists in Data Torrent - Bloomberg - http://bloom.bg/1PrjpUv

#China End-Sept. Bad Loans Top 100b Yuan in Some Provinces - China Business News - http://bit.ly/1PrlnnP

EM Equity @EM_Equity

Four Charts Are Sounding Alarms for India's Biggest Steelmakers http://bloom.bg/1MfyFj0

No comments:

Post a Comment