Morning Tweets......

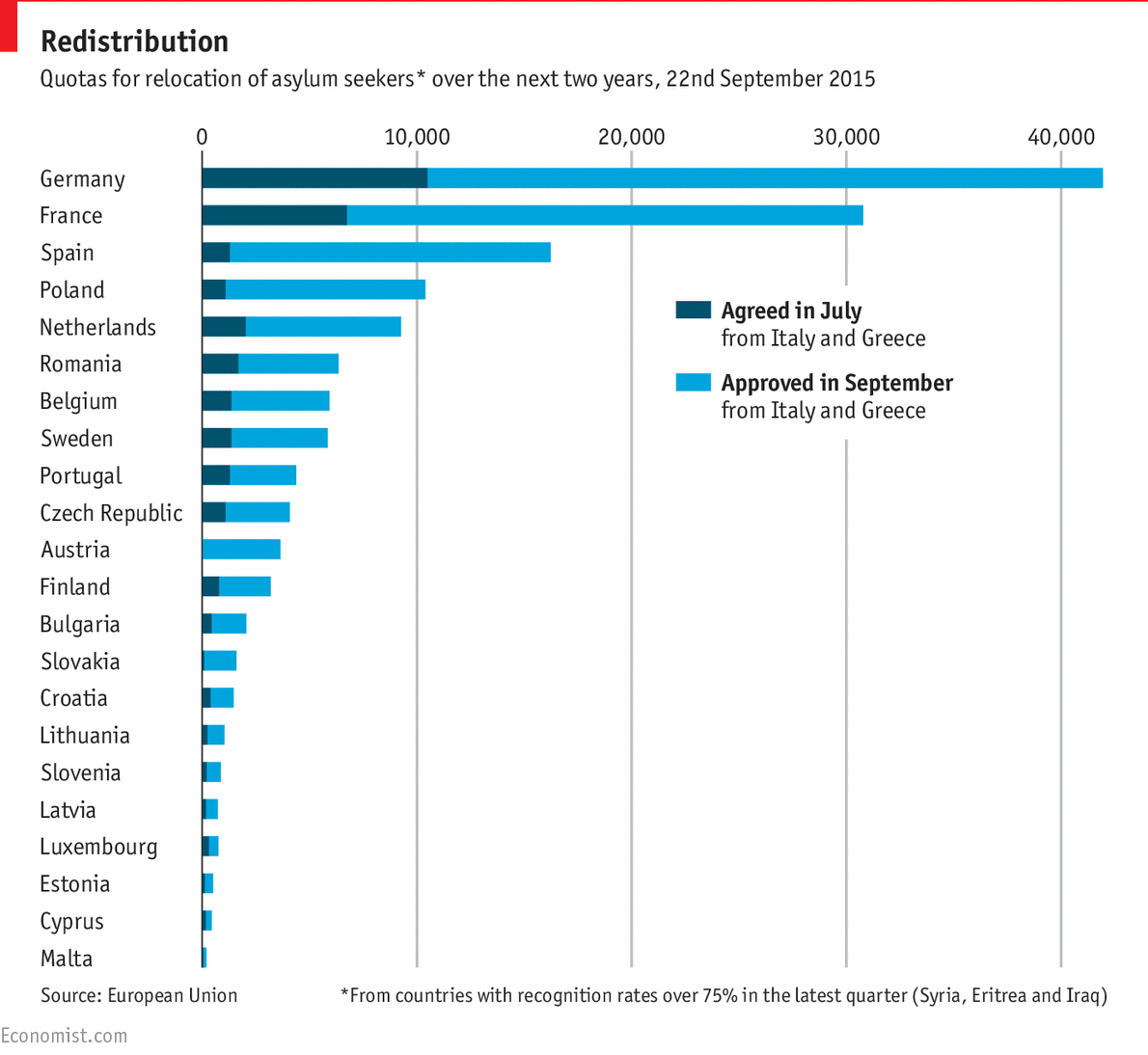

The first migrants are being relocated to Sweden from Greece. Europe's relocation quotas http://econ.st/1hu628o

#migration wow! german govt threatening to take german govt to supreme court over reffos. seehofer v merkel. csu v cdu

7,000 refugees flow to Greece on a daily basis - Europe fighting a literal tide of people seeking refuge.

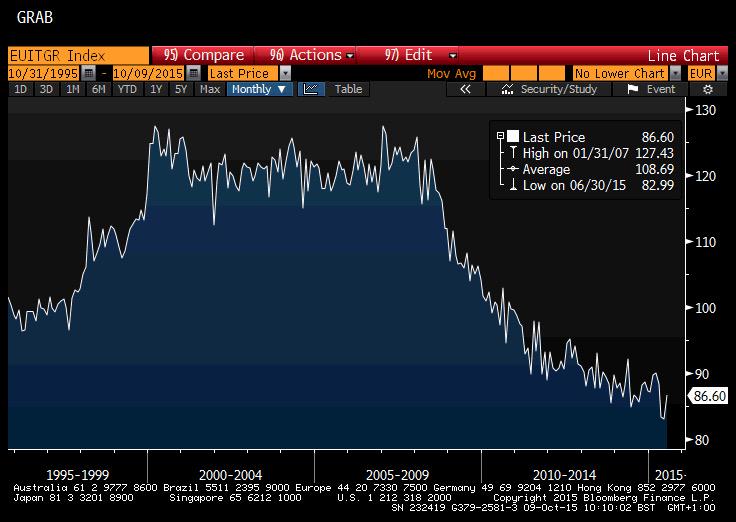

#ECB Draghi now needs to walk the talk - dovish commentary no longer cutting it - EUR/USD now higher at 1.137 - Bund yields continue to rise

Clear sailing for Ukraine's debt deal as 2015 group says will vote in favour; so Russia looks like the only holdout http://bloom.bg/1htWRoL

#EC examines consolidation of #Greece bank subsidiaries in SEE by end-2015 and disposal by end-2016 (via @kathimerini_gr) #economy #banking

#Greece’s lenders have time: Dijsselbloem “sees” Debt serving problems after 15 years http://www.keeptalkinggreece.com/2015/10/09/greeces-lenders-have-time-dijsselbloem-sees-debt-serving-problems-after-15-years/#.VheV-FXsGgc.twitter …

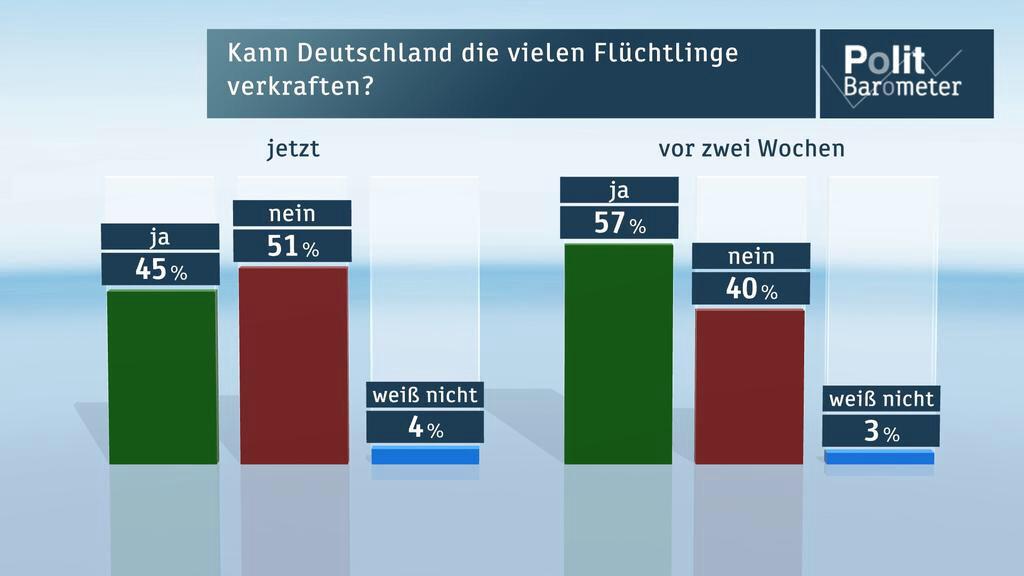

New @ZDF poll confirms shift in German public sentiment on refugees. 51% now say Germany can't cope with influx.

Vice Chancellor & Foreign Minister (both SPD) oppose Merkel by calling for cap on number of asylum seekers in DE: http://www.spiegel.de/politik/deutschland/sigmar-gabriel-und-frank-walter-steinmeier-fordern-begrenzung-der-zuwanderung-a-1057006.html …

Glencore plans to cut output and zinc is flying. Poised for biggest gain since '89.

#Greece | Aug Industrial Production Y/Y: +4.5% v -2.8%e

UK export growth - Y/Y (3 months ending August)

EU -5.2%

Non EU +5.4%

#Brexit

Preparation of omnibus bill with Oct prior actions at final stage, deadline for ballot may be extended until Oct 17 (via @amna_news) #Greece

Clearly not representative poll but margin of victory for Seehofer's refugee stance over Merkel's still surprising

#Italy | AUG INDUSTRIAL PRODUCTION M/M: -0.5% V -0.3%E; Y/Y: 4.1% V 2.8% PRIOR; WDA Y/Y: 1.0% V 1.4%E

#France | Aug YTD Budget Balance: -€89.7B v -€79.8B

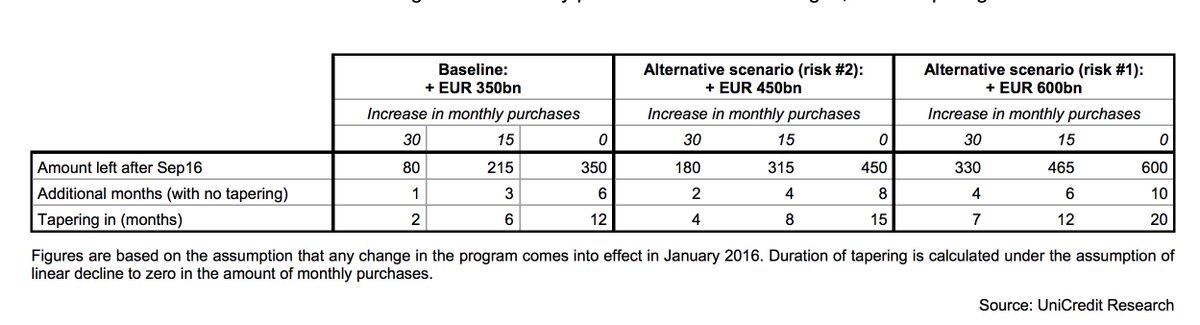

UniCredit cuts Euro forecast on new ECB call w/ QE2. Cuts end-2015 forecast to $1.11 from 1.17 still above cons $1.09

UniCredit expects #ECB to boost QE by another €300-400bn after Sep 2016. https://www.research.unicredit.eu/DocsKey/economics_docs_2015_150382.ashx?M=D&R=24092300 …

#Finland | Aug Industrial Production M/M: % v -0.3% prior; Y/Y: -2.3% v -1.3%

Morning Note: 1. Gross Vs PIMCO. 2. Global risk gets a seat on the FOMC. 3. FTSE 100 on a 7-day winning streak

Asia & Emerging Markets ......

Standard Chartered Plans to Cut ~1,000 Senior Staff: Reuters

Fed minutes and China calm give risk a lift. Japan's fear index Nikkei Volatility drops almost 5% to lowest since Aug

Year-end risk rally in full swing w/ US oil above $50/bbl. Nikkei ends up 1.6% at 18438.67 while Yen weakens.

Dovish Fed minutes give EM assets another lift. Rupiah and Ringgit jump most since #Asia crisis in 1998 on inflows.

Asia stocks extend $2.5 Trillion global rebound w/ EM assets especially soar. http://bloom.bg/1Ooip4B

Good Morning. The ‘bad-news-is-good-news’ dynamics continue after dovish Fed minutes. Asian risk markets rally.

BREAKING: China GDP may lose 2.2% if Beijing doesn't join US-led #TPP, China's central bank chief economist Ma warns

Dollar Demolition Extends To 6th Day As EM/Asian FX Soars Most In Over 6 Years http://www.zerohedge.com/news/2015-10-08/dollar-demolition-extends-6th-day-emasian-fx-soars-most-over-6-years …

Fukushima Kids Suffer Thyroid Cancer Up To 50x Normal Rate, New Study Finds http://www.zerohedge.com/news/2015-10-08/fukushima-kids-suffer-thyroid-cancer-50x-normal-rate-new-study-finds …

Mainland outcry over Li Ka-shing reducing China assets shows outflow fears & Beijing's frayed patience with HK elite http://www.bloomberg.com/news/articles/2015-10-08/china-s-attack-on-li-ka-shing-spooks-hong-kong-s-elite …

Liquidity Strains Reappear As China's "Golden Week" Stock & Housing Market Disappoints http://www.zerohedge.com/news/2015-10-08/liquidity-strains-reappear-chinas-golden-week-stock-housing-market-disappoints …

The Economist

The Economist

No comments:

Post a Comment