Evening Wrap .....

WTI Crude Breaks To $43 Handle After Another Rise In Oil Rig Count (To 3 Month Highs) http://www.zerohedge.com/news/2015-08-07/wti-crude-breaks-43-handle-after-another-rise-oil-rig-count-3-month-highs …

#Greece DepPM Dragasakis: "We are almost ready for the agreement". Says technical teams to discuss fiscal targets tomorrow ~@skaigr

[BREAKING] Greece's Gov’t Spokeswoman: Parliament Set To Vote On New Bailout Package Aug 18 - RTRS $EURUSD

#Greece Police Cybercrime unit has found no security breach linked to Varoufakis' alleged Plan B team at Tax Authority's VAT codes.

Even with banks open, Greek firms paralyzed by restrictions #thessaloniki By @AP via @seattlepi http://www.seattlepi.com/news/world/article/Even-with-banks-open-Greek-firms-paralyzed-by-6430976.php#photo-8429326 …

fred walton retweeted

#Greece govt wants to structure the bailout-linked Investment Fund as a Sovereign Wealth Fund w more assets ~@fotisk http://bit.ly/1DvcVB9

#Greece FinMin Tsakalòtos says gov't wants Greek co-operative banks to be included in the systemic-risk bank recapitalization scheme.

Wolfgang Schäuble, Debt Relief, and the Future of the Eurozone - by Ashoka Mody http://www.pieria.co.uk/articles/wolfgang_schuble_debt_relief_and_the_future_of_the_eurozone …

Poland: new legislation says banks’ share of FX-linked mortgages increases from 50% of losses to 90%. http://www.marctomarket.com/2015/08/emerging-markets-what-has-changed.html …

Liquidation of Banca Romagna Cooperativa is the 1st instance of a bail-in in #Italy http://bru.gl/1ISgsK0

ALERT .....

US Non Farm Payrolls Update..... 8:30 Am....

"Good" Jobs Data Is Bad News - Bonds, Stocks, Gold Dumped; USD Pumped http://www.zerohedge.com/news/2015-08-07/good-jobs-data-bad-news-bonds-stocks-gold-dumped-usd-pumped …

Average hourly earnings Y/Y 2.1% miss, Exp. 2.3%

Americans Not In The Labor Force Rise To Record 93.8 Million, Participation Rate At 1977 Level http://www.zerohedge.com/news/2015-08-07/americans-not-labor-force-rise-record-938-million-participation-rate-1977-level …

US July non-farm payrolls rise by 215k (June revised from 223k to 231k). #Unemployment rate at 5.3 %

US economy created 215k jobs in July vs exp 225k (revised 231k in June)

Unemployment rate 5.3% vs 5.3% in June

Average earnings +0.2%

US #NFP still above 200K and not as bad as ADP on Wed so seen as pretty solid still. Fed remain on track!

Overview ......

The Last-Minute NFP Preview: What Wall Street Expects (And Did Hilsenrath Just Warn Of A Miss) http://www.zerohedge.com/news/2015-08-07/last-minute-nfp-preview-what-wall-street-expects-and-did-hilsenrath-just-warn-miss …

Frontrunning: August 7 http://www.zerohedge.com/news/2015-08-07/frontrunning-august-7 …

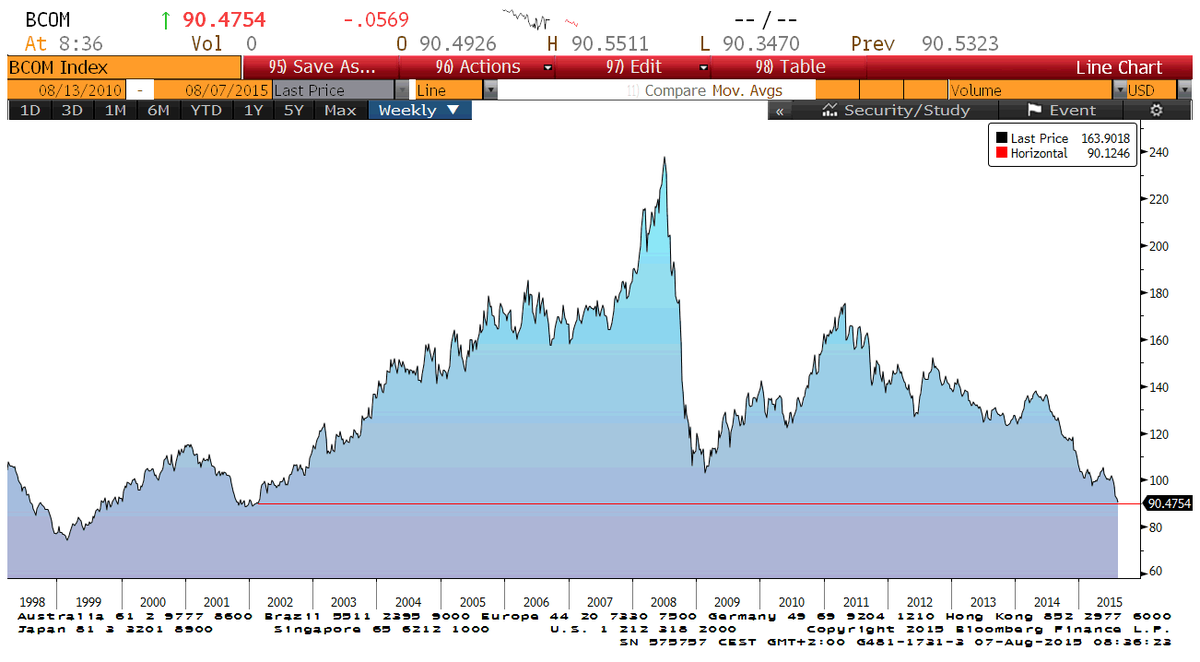

With All Eyes On Payrolls US Futures Tread Water; China Rises As Copper Crashes To New 6 Year Low http://www.zerohedge.com/news/2015-08-07/all-eyes-payrolls-us-futures-tread-water-china-rises-copper-crashes-new-6-year-low

Tweets.....

Greece.....

Varoufakis advisor explains what went wrong http://www.capx.co/yGypU via @CapX

Prosecutor investigates “violations of capital controls” by citizens & politicians http://goo.gl/fb/jnwLBW

Greece's Tax Revenues Plummet Amid Crisis / Sputnik International http://sputniknews.com/business/20150807/1025491758.html … via @SputnikInt #greece

Athens market +1.3%, FTSE banks +3.4%, NBG +4.8%, Alpha +3.2%, Piraeus +2.1%, Eurobank -1.6%. #ASE #Greece

*EU SEES NO PARTICULAR DECISIONS ON TONIGHT'S GREEK CALL

*EU SAYS AIDES FROM ALL EU STATES TO HOLD CALL ON GREECE - ALL 28 STATES TO GET UPDATE ON GREEK SITUATION TONIGHT

*GERMANY SAID TO PREFER FURTHER BRIDGE LOAN FOR GREECE: SZ

Nick Malkoutzis retweeted

#Greece Jul CPI -2.2% YoY (unch from Jun) and -1.3% MoM. 12-month trailing CPI -1.9% (ELSTAT). #economy #euro

Tsipras chairing emergency meeting on refugee crisis today. Greek gov't overwhelmed http://www.ekathimerini.com/200333 #Greece #refugees #migration

Around 124,000 out of the +225,000 migrants & refugees that have reached Europe this year via the Mediterranean arrived to #Greece (3)

Greece has made a loan interest payment - €186.3 million - due to the International Monetary Fund, avoiding another default

Broader Europe.....

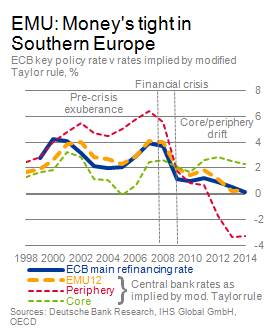

#Eurozone's diversity of monetary conditions between core & periphery in one chart [via @DeutscheBank]. #euro #ECB

IMF sees Portugese recovery on track - but warns over debt & reforms: http://openeurope.org.uk/daily-shakeup/

UK TRADE DATA - exports - Y/Y change in Q2

Non EU +14.4%

EU -9.8%

Major divergence now apparent with UK's EU and non EU trade

#France | JUN INDUSTRIAL PRODUCTION M/M: -0.1% V 0.2%E; Y/Y: 0.6% V 1.4%E

#Germany | JUN CURRENT ACCOUNT: €24.0B V €16.0BE; TRADE BALANCE: €22.0B V €21.0BE

#Germany | JUN INDUSTRIAL PRODUCTION M/M: -1.4% V +0.3%E; Y/Y: 0.6% V 2.2%E

#Ukraine | *UKRAINIAN JULY PRODUCER PRICES RISE 37.0% IN YEAR

# Russia keeps bleeding: FX and # Gold reserves drops to $ 357.6bn after Central Bank has stopped FX purchases.

The rise of the precariat in the Eurozone. http://www. ft.com/intl/cms/s/3/d 42ddef4-3c1b-11e5-8613-07d16aad2152.html?siteedition=intl#axzz3i2Be8cL6 …

China , Other Emerging Market News & Commodities

BREAKING: China's securities regulator has launched investigation on "high-frequency, computer program-oriented trading" cases - state media

MORE: Most high-frequency program trading activities are already "temporarily suspended", pending on new rules - official Securities Times

Securities Times: Regulator has "invited" some high-frequency traders for meetings but some of them already "travel abroad for holiday" now

#China | JULY FX RESERVES: $3.65T V $3.69T

Top news story

Desperate times: # China funds hold $ 161 billion in 'ammunition' to re-enter stock market, state media 'reports'http: // reut.rs/1K69y0e

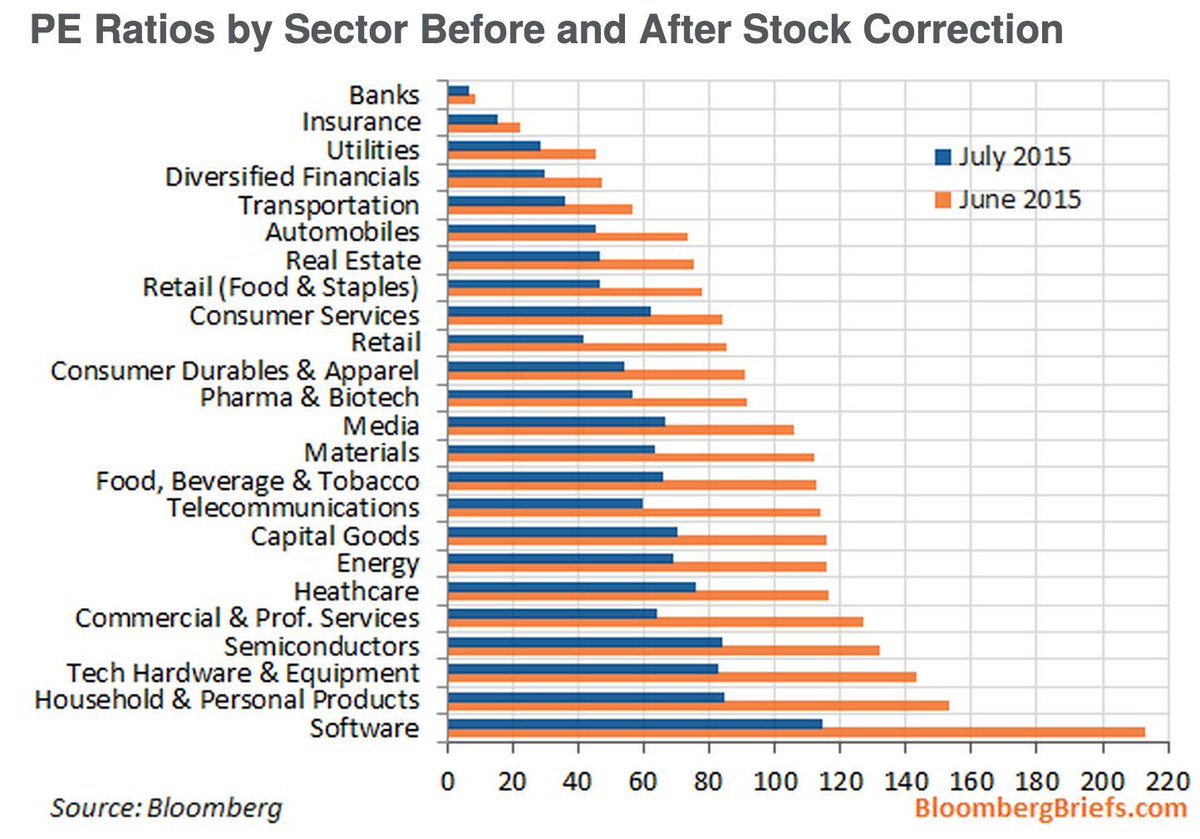

# China PE crash have reduced levels of stocks in Shanghai and Shenzhen Valuations but still demanding. (Chart via BBG)

# Russia Ruble extends losses on lower oil. Brent crude trades near $ 49 / bbl.

Emerging-Market rout Polish worsens as Banks Slide, Ruble Drops. http: // bloom.bg/1gLEpbH

# Brazil Real weakens to lowest since 2003 as Rousseff Suffers setback. Approval rating at 8%.http: // bloom.bg/1E9zypC

One Third Of All Chinese 'Gamblers' Have Shut Their Equity Trading Accounts http://www.zerohedge.com/news/2015-08-06/one-third-all-chinese-gamblers-have-shut-their-equity-trading-accounts …

Emerging Market Mayhem: Gross Warns Of "Debacle" As Currencies, Bonds Collapse http://www.zerohedge.com/news/2015-08-06/emerging-market-mayhem-gross-warns-debacle-currencies-bonds-collapse …

Oil Trading "God" Loses $500 Million In July On Commodity Rout http://www.zerohedge.com/news/2015-08-06/oil-trading-god-loses-500-million-july-commodity-rout …

Pedro da Costa @

Pedro da Costa @

No comments:

Post a Comment