Tweets....

Greece...

Correct title would be: Compromise with lenders for the first time favoured by less than 50% of Greeks

Interpol: Over 4,000 foreign jihadists on radar @INTERPOL_HQ http://www.thelocal.es/20150604/over-4000-foreign-jihadists-on-interpol-

Prime Minister Alexis #Tsipras to brief MPs on progress of negotiations at 6 p.m. #Greece

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_04/06/2015_550709 …

Credit market is virtually dead due to the uncertainty http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_04/06/2015_550710 … #Greece

Athens promises to complete most sell-offs http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_04/06/2015_550711 … #Greece

Given a reasonable deal (ie no pension cuts) dissent at SYRIZA against Tsipras will be limited to fringe elements @paulmasonnews @hugodixon

Finance Ministry officials put Germany's WWII debt at 280 to 340 bln http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_04/06/2015_550699 … #Greece

IMF payment put off as lenders wait for new proposals http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_04/06/2015_550708 … #Greece

MineForNothing retweeted

#Greece | RTRS - GREEK DEPUTY MINISTER AND SYRIZA HARDLINER STRATOULIS SAYS GOVERNMENT MAY GO TO SNAP POLLS IF LENDERS DO NOT SOFTEN

Greece's debt restructuring plan is a non-starter. But it can probably get longer interest rate holiday and longer repayment period

Bruno Waterfield retweeted

The primary surplus discussion is misleading. On substantive points, Greece and creditors are as far apart as ever. http://www.eurointelligence.com

Alco poll for Newsit.gr

SYRIZA 31.3%

ND 20.4

Potami 5.2

G Dawn 4.8

KKE 4.5

PASOK 3.5

Ind Greeks 3.2

Undecided 13.4

#Greece

Possibly incompatible.

*STATHAKIS SAYS GREEK GOVT HAS MANDATE TO GET BETTER DEAL

*STATHAKIS: OUR GOVT HAS A MANDATE TO REMAIN IN EURO

#EU diplo says #Greece member of Euro Working Group did not know of #IMF payment delay on yesterday's conference call

#Greece's 2y yields jump as Tsipras raises stakes in Greek showdown w/ deferral of IMF payment http://bloom.bg/1cBiuAM

Broader Europe.....

German Bundesbank raises #GDP forecast for 2015 to 1.7% (vs 1.0% in Dec), 1.8% for 2016 (vs 1.6% in Dec) and forecasts 1.5% growth for 2017

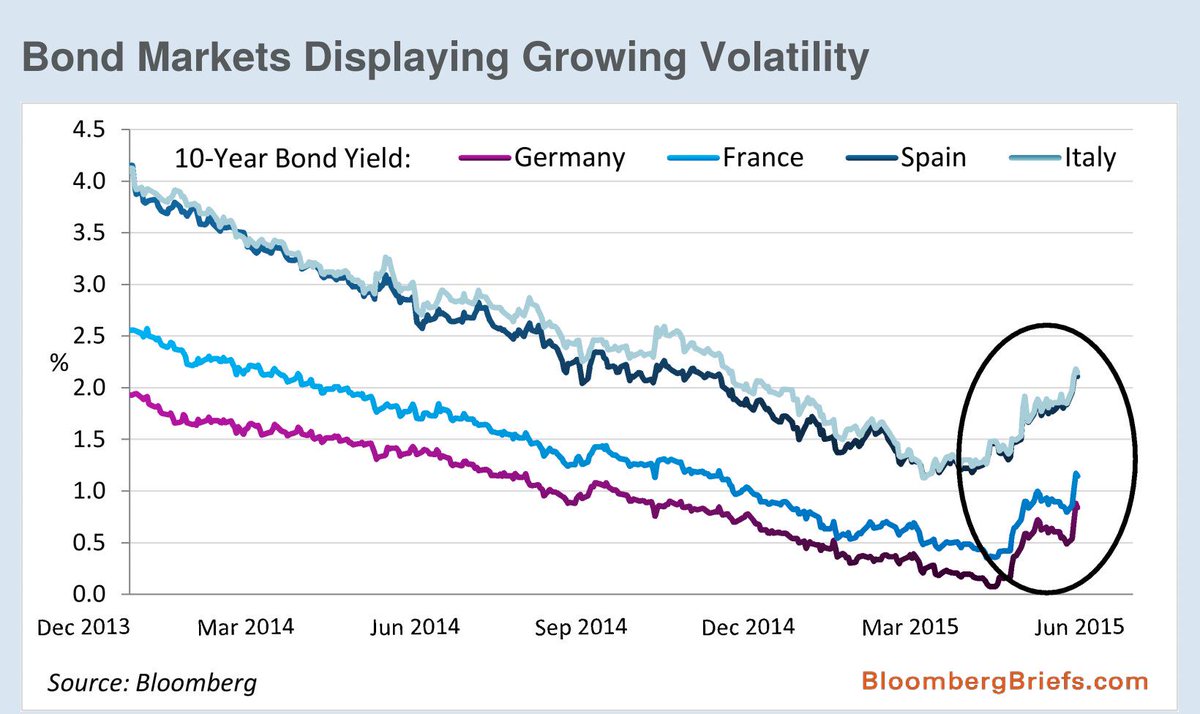

Volatility? Get used to it! The 18bps trading range on 10yr Bunds on Thu was 4times the daily median in the past year

German Chancellor Merkel has sidelined FinMin Schäuble in Greek negotiations. That could coming back to haunt her. http://www.bild.de/bild-plus/politik/inland/wolfgang-schaeuble/verliert-kanzlerin-merkel-ihren-wichtigsten-minister-41229068,var=a,view=conversionToLogin.bild.html …

"Our neighbours in the North, in Spain, […] should be worried—very worried."

Two top PP officials resign to help party reach regional investiture deal in Madrid http://elpais.com/elpais/2015/06/04/inenglish/1433429846_896003.html …

Anti-mob unit nabs 44 in Rome mafia case: Italian church blasts plundering of migrant funds http://bit.ly/1FX9H72

Merkel 'totally supports' Renzi reforms: 'Germany wants Greece in euro' http://bit.ly/1AQmngR

Frederik Ducrozet retweeted

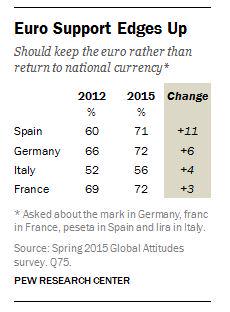

CHART: Euroskeptic parties are rising but ever less electors want to exit the single currency. http://www.pewglobal.org/2015/06/02/chapter-2-support-for-the-european-project-rebounding/ …

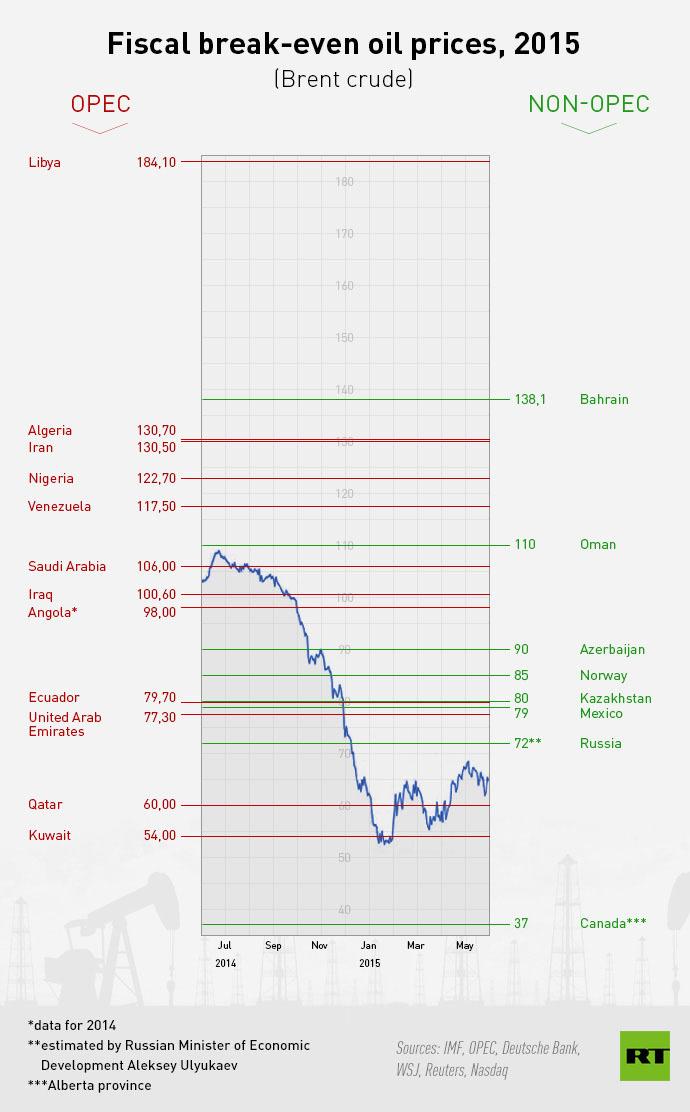

INFOGRAPHIC: Fiscal break-even oil prices, 2015. #OPEC meeting LIVE UPDATES http://on.rt.com/v4129u

Ioan Smith

Ioan Smith  Wolfgang Munchau

Wolfgang Munchau

Maxime Sbaihi

Maxime Sbaihi

No comments:

Post a Comment