Tweets......

If Greek govt holds firm with 'dirty exit' from the bailout agreements, I very much doubt the ECB will approve ELA beyond Feb 20. Game on.

Greek Finance Ministry cleaners show dichotomy of Tsipras as markets tumble. http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_30/01/2015_546694 …

TREASURIES EXTEND GAINS; 10Y YIELD TOUCHES 1.707%

Monte Paschi Falls on Report Bank Plans Larger Capital Increase http://www.bloomberg.com/news/articles/2015-01-30/monte-paschi-falls-on-report-bank-plans-larger-capital-increase …

#Greece Athens market immediately turns red following German FinMin spox statement. Now -1.34%

German govt spox says no extension without completion of Troika review. MNI reports that #Greece won't seek #EU bailout extension.

Greece turns away from EU bailout cash before visit by Eurogroup President Dijsselbloem to Athens. http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_30/01/2015_546691 …

Eurozone Deflation Ties Post-Lehman Record, Worse Than Expected http://www.zerohedge.com/news/2015-01-30/eurozone-deflation-ties-post-lehman-record-worse-expected …

Why quantitative easing and negative interest rates will fail http://ow.ly/IcRkx

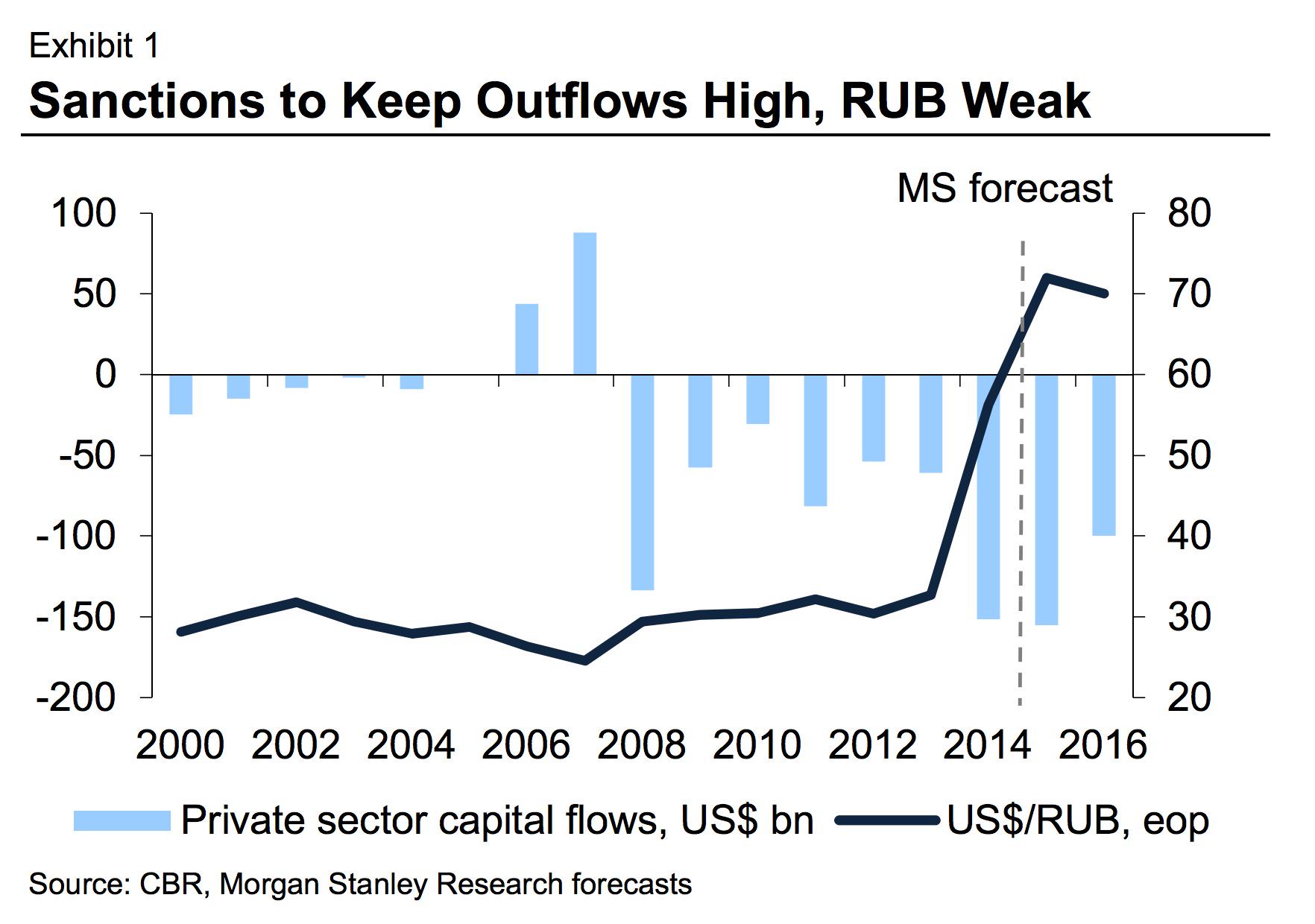

Morgan Stanley sees #Russia in a downward spiral. Expects cap outflows to be in $150-160bn range this yr, fresh high.

Russian QE coming: Russia Pledges 2008-Style Bond Buying If More Junk Grades Follow.

Eurogroup chief Dijsselbloem in Athens for talks with PM Tsipras, FinMin Varoufakis. http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_30/01/2015_546690 …

Eurostat: Flash estimate - January 2015, Euro area annual inflation down to -0.6% http://ec.europa.eu/eurostat/documents/2995521/6581740/2-30012015-BP-EN.pdf/d776fbcc-89b2-4bae-beb0-ad30fa709244 …

Open Europe retweeted

New poll: Only 16% of Germans in favour of Greek debt write-down http://openeurope.org.uk/daily-shakeup/new-poll-16-germans-favour-greek-debt-write/ …

Bank Of Russia Surprises With Unexpected Rate Cut, Brings YTD Total Of Nations Easing To 14 http://www.zerohedge.com/news/2015-01-30/bank-russia-surprises-unexpected-rate-cut-brings-ytd-total-nations-easing-14 …

ITALIAN ELECTORS FAIL TO ELECT PRESIDENT IN 2ND ROUND: TALLY

BOJ Taps Fed’s FX Swap Line for Second Straight Week: BBG

RUSSIAN CENTRAL BANK CUTS THE RATE TO 15%

USDRUB 70.31

EURRUB 79.62

- WHY NOW!!!???

zerohedge

zerohedge  Kathimerini English

Kathimerini English

No comments:

Post a Comment