Looks like we are finally seeing a reaction today from markets to the Election in Greece on Sunday.....

Along with poor earnings , poor data and currency effects , not a happy start in Europe or NY....

Tweets.....

Along with poor earnings , poor data and currency effects , not a happy start in Europe or NY....

Tweets.....

It’s Not The Greeks Who Failed, It’s The EU http://www.zerohedge.com/news/2015-01-27/it%E2%80%99s-not-greeks-who-failed-it%E2%80%99s-eu …

Greece At The Crossroads: The Oligarchs Blew It http://www.zerohedge.com/news/2015-01-27/greece-crossroads-oligarchs-blew-it …

"Sanctions require unanimity among the 28 governments. A Greek veto would shatter the fragile European consensus over dealing with Russia"

Greek Government Questions EU Bid for Russia Sanctions http://www.businessweek.com/news/2015-01-27/greek-government-questions-eu-bid-for-russia-sanctions …

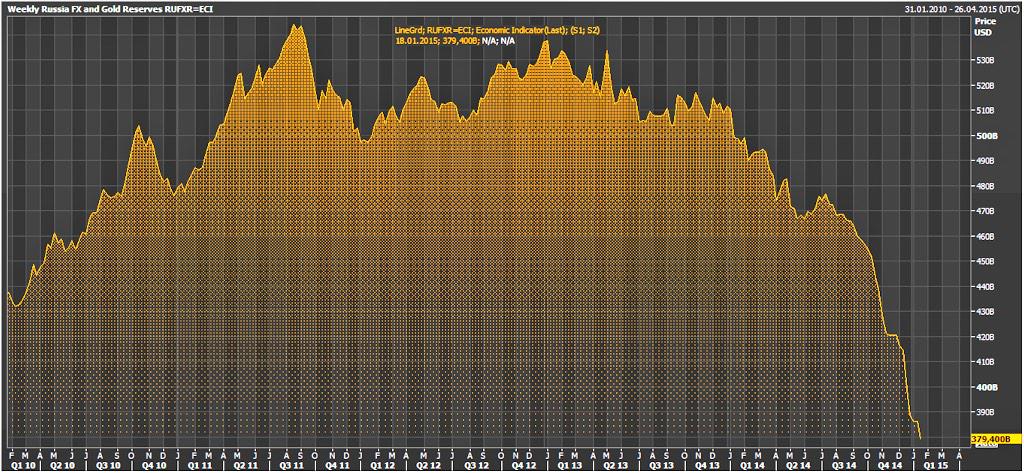

#Russia keeps bleeding due to CenBank interventions. Forex, Gold reserves drop by $6.8bn to $379.4bn in Week to Jan16

Buba's Nagel: End to #Greece's Troika aid programme would have "fatal consequences" for the country's fin system. https://mninews.marketnews.com/content/bbk-nagel-greece-aid-program-end-would-put-fin-system-risk …

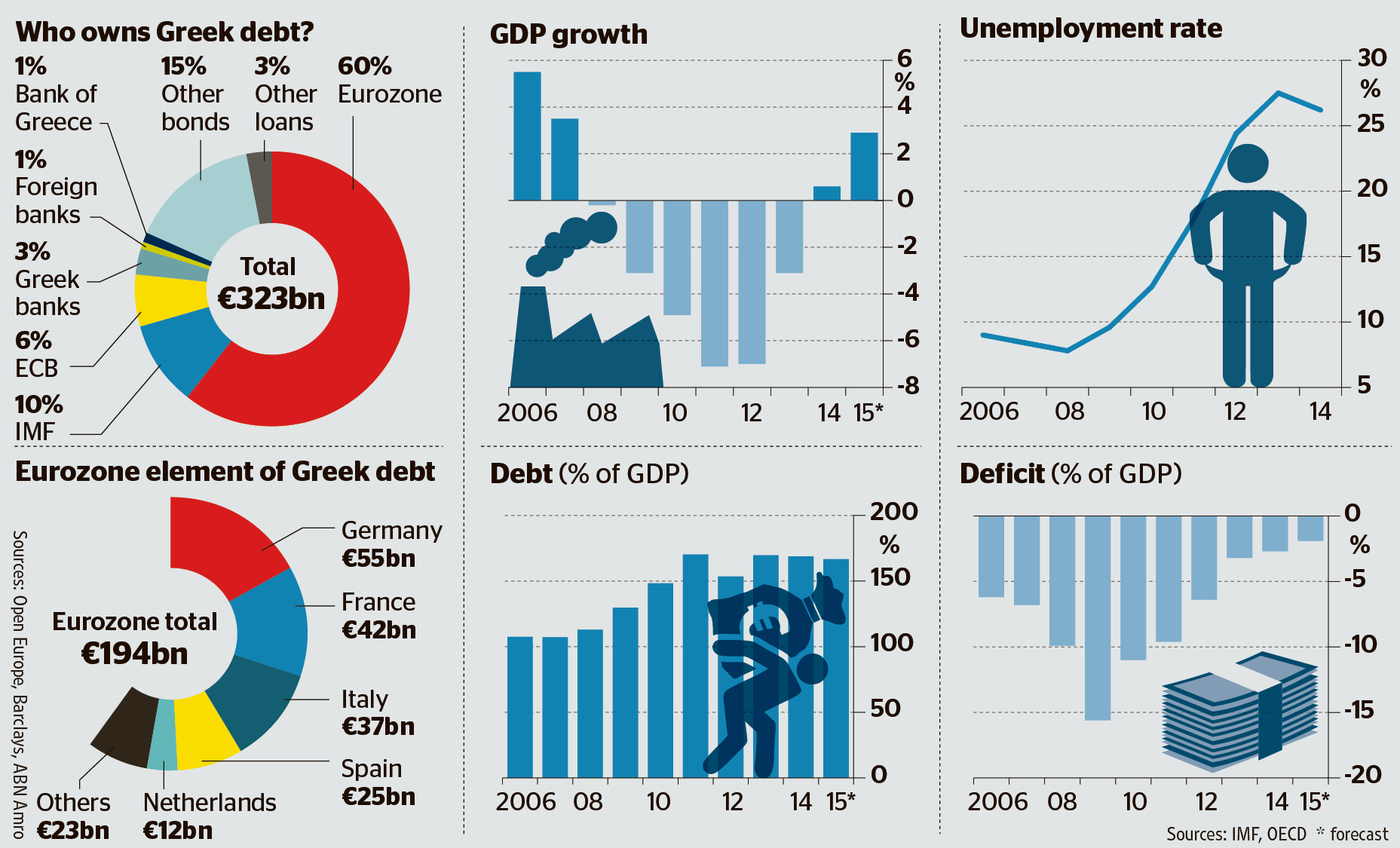

In 2012 we warned that the 2nd Greek bailout would shift Greek debt from the private to the public sector (1/2):

I

n 2012 we warned that the 2nd Greek bailout would make any future debt restructuring politically explosive (2/2): http://openeurope.org.uk/intelligence/eurozone-and-finance/second-greek-bailout-bad-greece-bad-eurozone-taxpayers/ …

UST 10Y YIELD EXTENDS DECLINE, TOUCHES 1.746%.

US Stocks extend declines after terrible US econ data. Dow Jones Industrial now down >380.

FTW: RUBLE EXTENDS GAINS VS DOLLAR, ADVANCES 2.2%

MT @YanniKouts Bombshell @repubblicait →Eurogroup's secret deal in Nov to rollover all #Greece loan payments to 2020

IMF STANDS READY TO RESUME DISCUSSIONS WITH GREECE: LAGARDE.

U.S. `FORCED' TO DISCUSS FURTHER RUSSIA SANCTIONS: NULAND

UST 30 YIELD EXTENDS DROP, TOUCHES 2.332%. Not 1-handle yet

#ECB Coeure highlights flaw of #ECB #QE - it "will work", "The money should irrigate the economy, as long as the banks play ball, of course"

Open Europe retweeted

Who owns Greek debt - mostly Germany, unsurprisingly. Credit to Open Europe and ABN Amro. From The Times today

Open Europe retweeted

Tsipras opts for academics in key cabinet posts: Varoufakis (Fin Min), Stathakis (Econ Min), Kotzias (Foreign Min). #ekloges2015 #Greece

Greek cabinet being announced now. Greek Economist Yanis Varoufakis is the new Finance Minister: http://webtv.nerit.gr/nerit1-live/ #ekloges2015

Run on the bank (stocks): #Greece's banking index has dropped 19% at one point as Syriza win spells trouble.

NYSE Invokes Rule 48 To Pre-Empt Selling Panic http://www.zerohedge.com/news/2015-01-27/nyse-invokes-rule-48-pre-empt-selling-panic …

EURUSD 1.1360. Time to start pricing in Q€3

The Mystery Deepens: Dutch Central Bank Denies Reports It Bought Gold For The First Time In 17 Years http://www.zerohedge.com/news/2015-01-27/mystery-deepens-dutch-central-bank-denies-reports-it-bought-gold-first-time-17-yea-0 …

PASOK's Venizelos resigns, Proto Thema reports. #Greece

"@TheStalwart: The Greek market is getting crushed. https://twitter.com/EfiEfthimiou/status/560070531278721024 …"

#Greece Athens stock exchange -6.43%, Banks -18.35% (Alpha Bank -20%, Pireaus -19%, NBG -15.75%)

Ouch! US Durable goods orders hurts USD and Stocks: Euro jumps > $1.13, Dow Future drops by >300points.

Durable Goods -3.4%. Goodbye rate hike

Who voted for QE timing that we should remember? France, Latvia, Lithuania, Lux, Finland, Slovakia, ECB Board’s Couere, Mersch, Praet

SCHAEUBLE: GREECE NEEDS PROGRAM FOR ECB TO TAKE BONDS IN REPOS. Yes, thanks, we know how Europe's shadow monetization works

YANIS VAROUFAKIS APPOINTED GREEK FINANCE MINISTER

Dow Futures Plunge 425 Points From Friday Highs; Greek Stocks/Bonds Plunging, Crude $44 Handle http://www.zerohedge.com/news/2015-01-27/dow-futures-down-250-overnight-highs-greek-stocksbonds-plunging-crude-44-handle

GREECE NEEDS EUROPEAN RESCUE FUNDS, SPAIN'S DE GUINDOS SAYS. But... 2 months ago you said...

CAT stock has tumbled by over $20 in the past three months despite management buying back $4.2 billion of CAT stock

Swiss Franc Tumbles Then Soars, On Suspected Failed SNB Intervention http://www.zerohedge.com/news/2015-01-27/swiss-franc-tumbles-then-soars-suspected-failed-snb-intervention …

zerohedge retweeted

EU FINANCE MINISTERS AGREE 1.8 BLN EUROS IN LOANS FOR UKRAINE

More taxpayer money going straight to Gazprom

"

Greece can not manage without further bailout programs" - Austria fin min. You mean the "Grecovery" was one big lie?

Western countries’ threats to restrict Russia’s operations through the SWIFT international bank transaction system will prompt Russia’s counter-response without limits, Prime Minister Dmitry Medvedev said on Tuesday.

#Russia to offer 5bn Rubles of 2017 OFZ bonds at auction tomorrow. 2yr yields jump 16bps after S&P downgrade to junk.

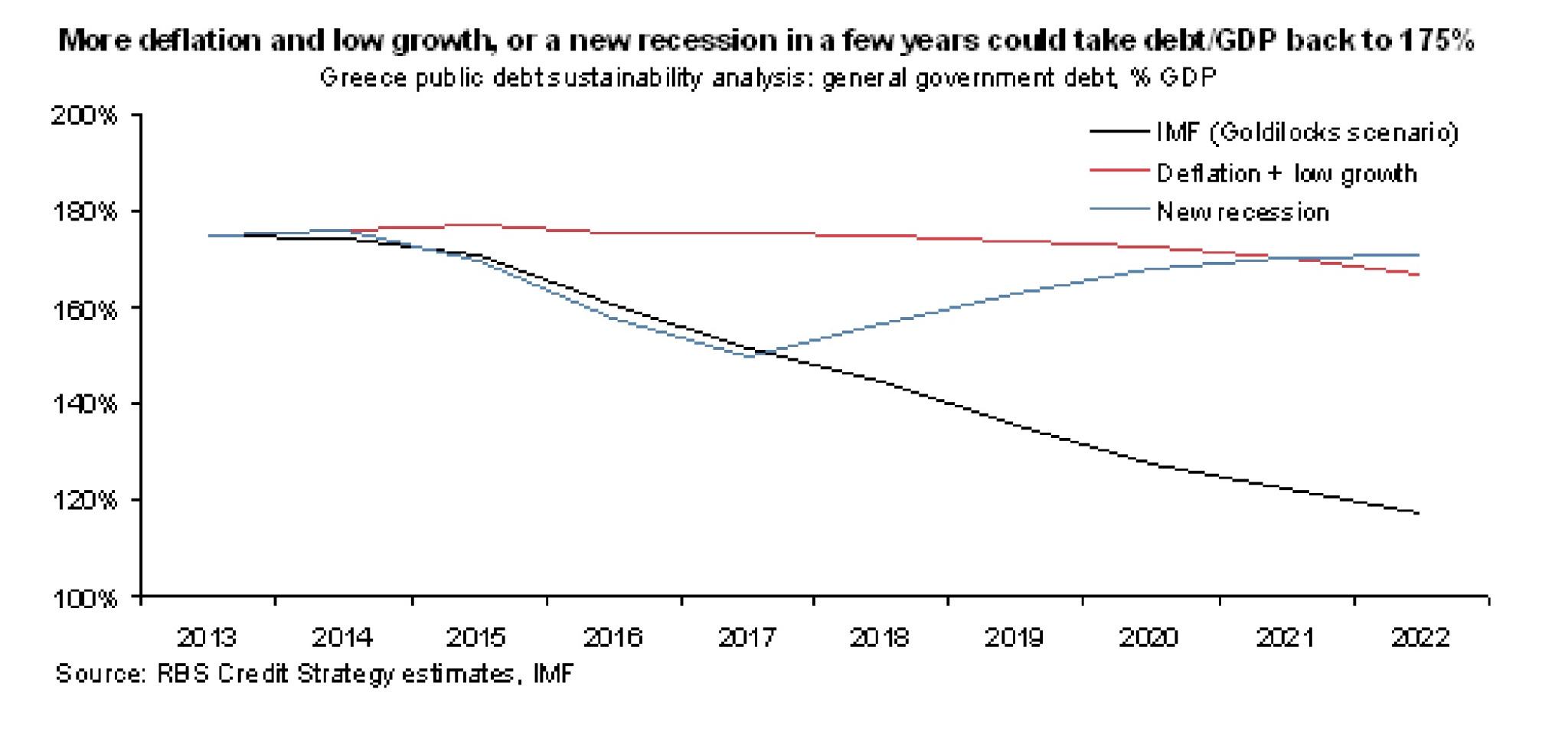

RBS: Even w/ maturity ext, #Greece debt/GDP might go back >170%. Troika forecast of decade of 3.5% growth unrealistic

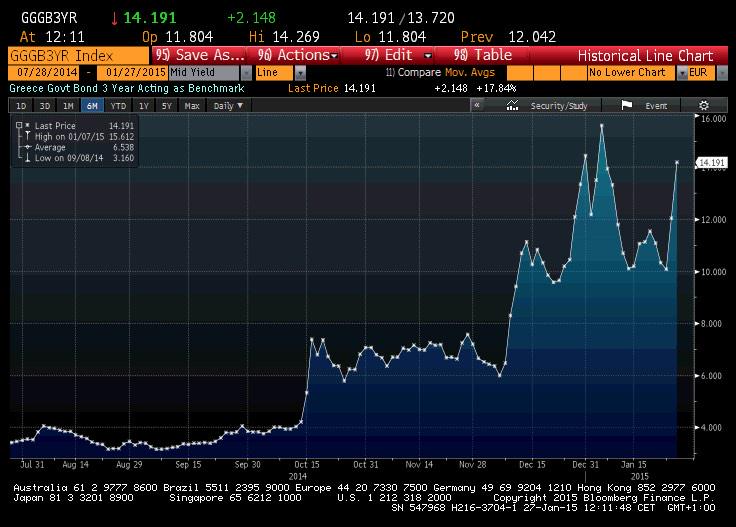

#Greece's 3yr yields jump by 214bps to 14.19% as #Grexit Index has risen to highest level since 2012.

Whoa! The IMF's former European head Moghadam says eurozone shld halve Greece’s debt & required fiscal balance. http://www.ft.com/cms/s/0/4cdc1898-9c1c-11e4-a6b6-00144feabdc0.html …

EU member states at odds over sanctions as Poland accuses France of prioritising relations with Moscow http://openeurope.org.uk/daily-shakeup/eurozone-leaders-warn-greece-stick-commitments-new-cabinet-set-unveiled/#section-1 …

Eurozone leaders warn Greece to stick to its commitments as new cabinet set to be unveiled http://openeurope.org.uk/daily-shakeup/eurozone-leaders-warn-greece-stick-commitments-new-cabinet-set-unveiled/ …

Five members -- German, Dutch, Austrian and Estonian NCB governors and German member of ECB's executive board — opposed QE timing - RTRS

Edward Harrison retweeted

Greece 5-year CDS up 271 bps since the election, from 1265 bps to 1536 bps.

zerohedge

zerohedge

Yannis Koutsomitis

Yannis Koutsomitis

Edward Harrison

Edward Harrison

No comments:

Post a Comment