Tweets.....

Japan....

BOJ MEMBERS: EXPECT JAPAN GOVT TO PROMOTE SUSTAINABLE FINANCES. Such as 100% debt monetization

Here is the story on this - Japan 10-Year Yield Falls to Record on Outlook for BOJ Purchases http://bloom.bg/1wI2DZ0

Chart: JGB yield collapse continues, with the 10yr now below 32 basis points -

Russia ....

Ruble Rallies 34% After Biggest Russian Intervention In 5 Years http://www.zerohedge.com/news/2014-12-25/ruble-rallies-34-after-biggest-russian-intervention-5-years …

Russia’s international reserves fall below $400 billion to 5-year low http://tass.ru/en/economy/769196 …

MOSCOW, December 25. /TASS/. Russia’s international reserves fell by $15.7 billion in the week of December 13-19 to $398.9 billion, the Central Bank of Russia reported on Thursday.

During the previous week (December 5-12) the reserves fell by $1.6 billion.

Russia’s international reserves have fallen below the $400 billion mark for the first time since August 2009.

Russia’s VTB Bank, Gazprombank may get aid from Welfare Fund by yearend — official http://tass.ru/en/economy/769147 … Official support

MOSCOW, December 25. /TASS/. Russian lenders Gazprombank and VTB may receive aid from the National Wealth Fund until the end of 2014, Deputy Finance Minister Alexey Moiseyev told reporters on Thursday.

***

VTB earlier asked the government for 250 billion rubles ($4.8 billion) subordinated loans and Gazprombank for 100 billion rubles ($1.9 billion) financial aid.

Russian Ruble Strengthens In Thin Trade http://www.businessinsider.com/r-russian-ruble-strengthens-in-thin-trade-2014-12 … via @bi_contributors

Ruble reversal !

Full scale bailout of Russian private sector - http://www.foxnews.com/world/2014/12/24/russia-central-bank-offers-banks-and-companies-to-refinance-their-debts-to/ …

Beijing says Russia is able to overcome economic crisis itself, China ready to help http://tass.ru/en/economy/769104 …

Russian government to issue 9-bln-rouble guarantee to Transaero airlines http://tass.ru/en/economy/769084 …

Kremlin orders exporters to sell foreign reserves http://on.ft.com/16MBf21 Gambling on sanctions being eased?

China ....

China's Christmas Present To The World: Beijing Eases Again, Sets Non-Bank Deposit Reserve To Zero http://www.zerohedge.com/news/2014-12-25/chinas-christmas-present-world-beijing-eases-again-sets-non-bank-deposit-reserve-zer …

Chinese Gold Diggers Drop Their Shovels As Gold Miner Bankruptcies Begin http://www.zerohedge.com/news/2014-12-24/chinese-gold-diggers-drop-their-shovels-gold-miner-bankruptcies-begin …

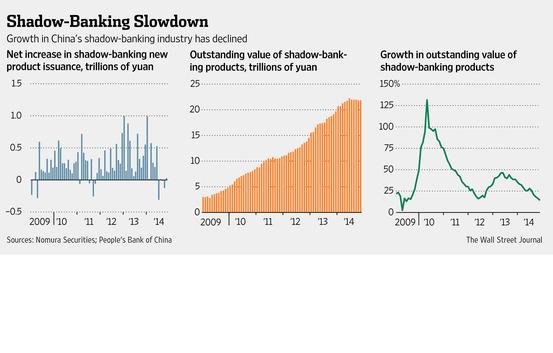

Tighter Government Rules, Jump in Stock Market Curb Informal-Lending Sector in China http://www.wsj.com/articles/chinas-shadow-banking-growth-slows-1419370402 …

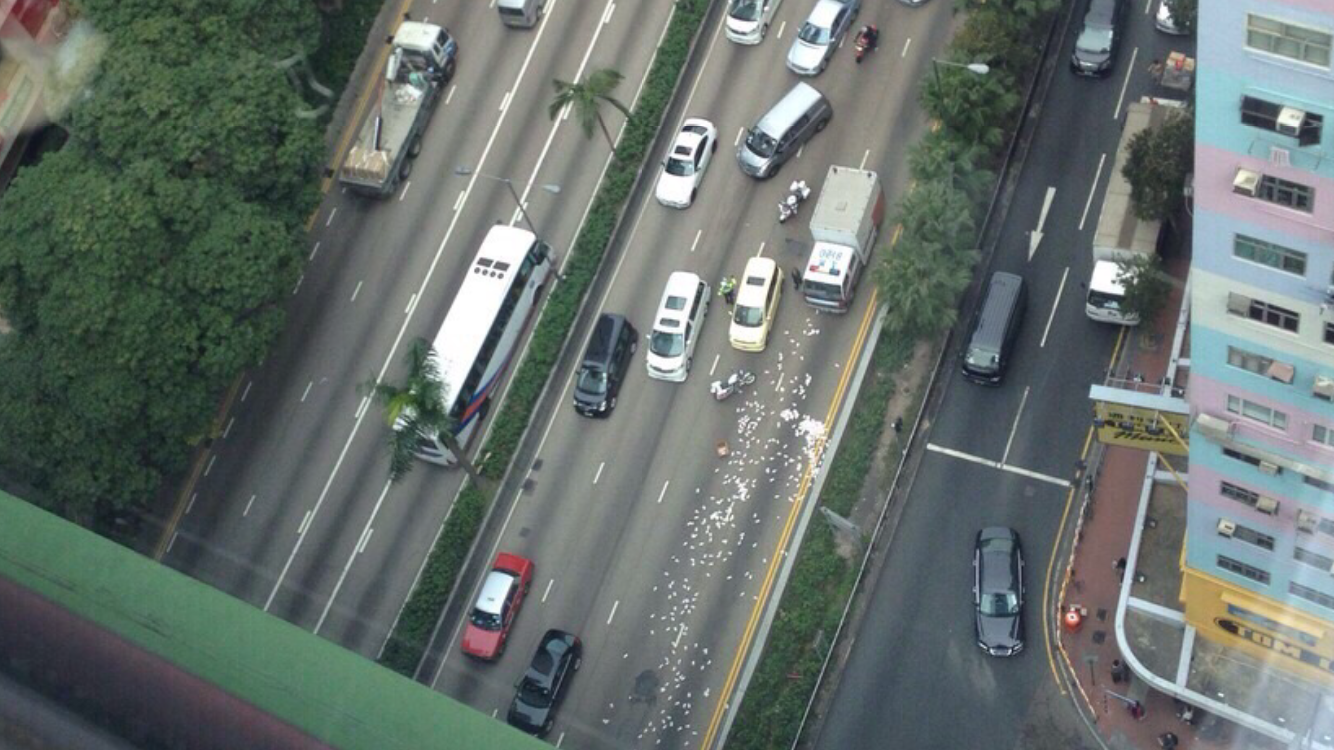

So much for Helicopters dropping cash....

UPDATE: HK$4.8m recovered of missing HK$15m cash spilled from security van on Christmas Eve http://www.scmp.com/news/hong-kong/article/1668594/christmas-comes-early-scramble-cash-after-security-van-spills …

Shale Oil....

Background: Have read that total volume of derivatives based on shale oil companies is 5x that on subprime mortgages in 2007.

Economically literate people - What do you make of claims shale oil bubble is the new subprime bubble? With $60 oil can it cause new crisis ?

The Dangerous Economics of Shale Oil http://www.zerohedge.com/news/2014-12-24/dangerous-economics-shale-oil …

Make No Mistake, The Oil Slump Is Going To Hurt The US Too http://www.zerohedge.com/news/2014-12-24/make-no-mistake-oil-slump-going-hurt-us-too …

Saudi debate-->short-term revenue impact oil price decline vs medium-term potential reducing competition from shale: http://www.wsj.com/articles/why-saudis-decided-not-to-prop-up-oil-1419219182 …

"John Kerry allegedly struck a deal with King Abdullah under which Saudis would sell crude below market price" http://www.theguardian.com/business/economics-blog/2014/nov/09/us-iran-russia-oil-prices-shale …

zerohedge

zerohedge

TASS

TASS  fred walton

fred walton

Anatoly Karlin

Anatoly Karlin

Gregory Djerejian

Gregory Djerejian

Club des Cordeliers

Club des Cordeliers

No comments:

Post a Comment