Zero Hedge ......

The Line Every Gold Trader Is Watching

Submitted by Tyler Durden on 08/22/2013 17:01 -0400

From Indian leases to negative GOFOs, from Chinese physical demand to Western bank paper gold deleveraging, and from practical mining cost floors to the ongoing playing out of the grandest experiment of monetary policy in history; there are a plethora of drivers for the price of the precious metal. But, for now, the only thing that counts is the 100-day moving average as gold prints its first positive closing breakout of 2013.

This close above $1367 is the first since 12/12/12 and a positive technical indicator likely to bring the momo crowd in.

Chart: Bloomberg

The Primary Dealers Have Spoken: Taper Begins September With $15 Billion Trim; QE Ends June 2014

Submitted by Tyler Durden on 08/22/2013 - 14:52

Back on July 17, the New York Fed, which as always operates based on the decisions and inputs of its Primary Dealer superiors, asked the Dealer community for their thoughts on the Taper, specifically when and how much. The survey has come back and the PD community has spoken. The answer: Taper is announced, and begins, September with the first reduction in monthly purchases of $15 billion ($10Bn cut in TSY purchases, $5BN cut in MBS), eventually tapering to nothing in June 2014 when the Dealers believe QE formally ends.

Silver Doctors.....

GATA....

Market seems indifferent to any gold leasing by India, Grant Williams says

Submitted by cpowell on Thu, 2013-08-22 17:51. Section: Daily Dispatches

1:45p ET Thursday, August 22, 2013

Dear Friend of GATA and Gold:

Singapore fund manager Grant Williams, editor of the "Things That Make You Go Hmmm. ..." letter, today tells King World News that the gold market seems indifferent to speculation that India might lease the 200 tons of gold it purportedly bought from the International Monetary Fund four years ago. Supply of real metal, Williams says, seems much too tight. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Barron talks to KWN about India's gold, dollar devaluation, protests of free trade

Submitted by cpowell on Thu, 2013-08-22 16:17. Section: Daily Dispatches

12:14p ET Thursday, August 22, 2013

Dear Friend of GATA and Gold:

Famed geologist and mining entrepreneur Keith Barron tells King World News today that India's attempt to squelch gold demand has failed completely, that the devaluation of the U.S. dollar is sparking protests against free trade, that official U.S. inflation figures are ridiculously understated, and that the Western financial system is at risk. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

http://jessescrossroadscafe.blogspot.com/2013/08/gold-daily-and-silver-weekly-charts_22.html

22 AUGUST 2013

Gold Daily and Silver Weekly Charts - When Exchanges Crash Do They Dream of Electronic Sheep

When the Exchanges crash and burn, do they dream of electronic sheep?

Well, I cannot say if they dream or not, but you may as well be dreaming of electronic money, if that is where you keep your wealth, and it is lost somewhere in an electronic storm. You are reliant on the integrity of the exchanges and their owners for restitution. Often it works out well, and things go on as normal. But as the dominoes of counterparty risk start falling, it is 'might makes right' as we saw in the mysterious case of MF Global.

I hear that Obama was 'informed' of the problems on the NASDAQ today. I assume that is a symbolic gesture designed to inspire confidence. And it is as practically futile as giving the Princes of Wall Street a big pile of the public's money to keep their doors open in a collapse of their own causing, and expecting them to 'do the right thing' for the sake of the country.

Gold and silver held their ground today, and are very obviously coiling. You can see it more clearly on the gold daily chart. The odds are it will break to the upside, but there seems to be a determined effort not to allow the metals to break and run, but to keep them well leashed.

I have included two charts of gold in grams priced in Indian Rupees to show the remarkable recovery gold has made from the lows despite the extraordinary efforts being made by the Reserve Bank of India and that government to stop the flow of gold into the hands of ordinary Indian people who are seeking their traditional safe haven for their wealth.

At some point the leash that is holding gold back is likely to break, and then the price will find its own level, though the heavens may fall. Or at least a few of those demigods that think they are doing God's work.

As a reminder, next Tuesday 27 August is option expiration for gold and silver on the COMEX. And Friday 30 August is the last delivery day for August.

There could be some interesting cross currents next week.

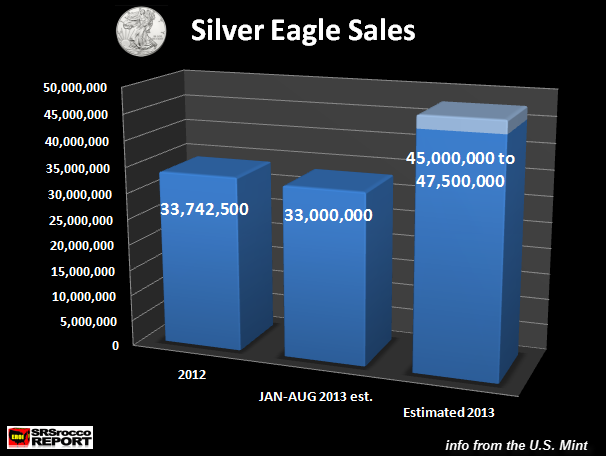

Ever since the big take-down in the price of the precious metals in April of this year, an interesting trend has taken place in the Gold & Silver Eagle market.

Ever since the big take-down in the price of the precious metals in April of this year, an interesting trend has taken place in the Gold & Silver Eagle market.  In his latest interview, David Morgan discusses the big rally in the metals and his view on the sudden deterioration in the bond market.

In his latest interview, David Morgan discusses the big rally in the metals and his view on the sudden deterioration in the bond market.  This past Monday, the POTUS Obama met with ALL top US banking regulators and the chairman of the Rothschild Private Bank (aka the US Federal Reserve).

This past Monday, the POTUS Obama met with ALL top US banking regulators and the chairman of the Rothschild Private Bank (aka the US Federal Reserve).

No comments:

Post a Comment