http://ftalphaville.ft.com/2013/03/02/1404282/repent-argentina-said-the-ticktock-judges-part-one/

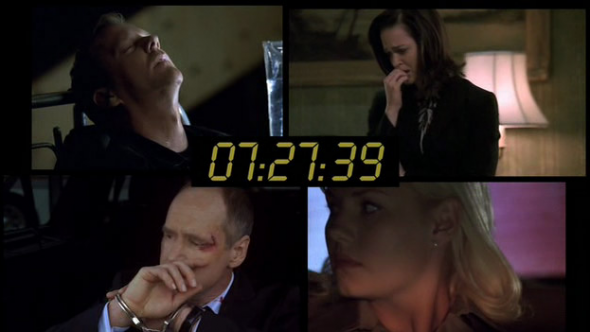

Then there were events in the courtroom itself. Look at the times given to each side on the original schedule: it’s fairly tight. There was even a 24-style timer in the bottom right of the courtroom feed, counting down as each lawyer spoke. Well, it pretty much got ignored. Rather disconcertingly, the timer would just start counting upwards after it reached zero. It was almost a strange kind of metaphor: a running satire of how Argentina has commandeered time itself with its decade of holdout litigation. Courts always tell it to end sometime, but as a sovereign, it never does.

Then there were events in the courtroom itself. Look at the times given to each side on the original schedule: it’s fairly tight. There was even a 24-style timer in the bottom right of the courtroom feed, counting down as each lawyer spoke. Well, it pretty much got ignored. Rather disconcertingly, the timer would just start counting upwards after it reached zero. It was almost a strange kind of metaphor: a running satire of how Argentina has commandeered time itself with its decade of holdout litigation. Courts always tell it to end sometime, but as a sovereign, it never does.

Headline via the Harlan Ellison short story. “Timewise, it was jangle…”

What a week for the pari passu saga, and the fight to show that an order for Argentina to pay holdouts ‘ratably’ alongside its restructured sovereign debt is both over-reaching, and an unfair threat to third-party bondholders and banks.

Yep, FT Alphaville also went along to the oral argument before three judges of the Second Circuit in NML v Argentina on Wednesday, along with about 300 other people. A pretty crazy affair in itself, the hearing has now led to a follow-up orderfrom the court, telling Argentina to give “precise terms” explaining how it would pay holdouts, and how it would obey any decision of the Second Circuit.

I was especially lucky on Wednesday, because I went with the students of Mitu Gulati, professor at Duke law school. They’ve been following the case in detail (and you might see them leaving comments on this post).

Anyway. We went in. We waited for hours before the hearing. And then we sat – famished, Blackberryless, absolutely riveted – as a scheduled 40-minute technical discussion mutated into two and a half hours of a sovereign publicly confessing that it won’t pay the debtors a US court tells it to. That, and the seeming demolition of third parties’ claims.

It was a fun afternoon.

We really recommend the eyewitness takes from Anna Gelpern and Felix for what happened, and Mark Weidemaier on this latest order from the Second Circuit. Meanwhile, you can just look up the prices for Argentina’s New York law bonds the day after the hearing. They cratered, even though we don’t even have a final ruling yet.

That’s simply how tough the questioning by Judges Reena Raggi, Rosemary Pooler and Barrington Parker was. Don’t let the hindsight of this new order affect you: they took Argentina to the woodshed. Critically, given the crux of the third parties’ arguments – they then did the same to Bank of New York.

It’s not looking good.

________________

The scene in Room 1703

With our take, we’re going to look blow-by-blow at what was said in legal argument. We’re also going to look at what wasn’t said about ratable payment of sovereign debt. They could both prove historic. They could (alternatively) provide a clue where Argentina could just about pull this one out of the fire. Still, you really have to get a whiff of what it was like to be in the court overfill room first, and we don’t just mean the olfactory consequences of almost 300 people sharing two airless rooms of the Thurgood Marshall courthouse.

It was who was there — some of the best sovereign debt lawyers, litigators and law professors in the world. Many of them had been involved in various past bits of litigation between Argentina and its holdouts down the years. Some had even played a part in Elliott v Peru, the original ratable payments victory. Then there were representatives from the official sector – there to take notes on resurrecting the SDRM? Watch this space – and lots and lots of sharp-edged ladies and gents from what appeared to be distressed-debt funds. And on the screen, of course, were Ted Olson (arguing for NML) and David Boies (arguing for the Exchange Bondholders Group). This wasn’t quite Bush v Gore redux, where the two famously faced each other; but even so, it was something to see.

Then there were events in the courtroom itself. Look at the times given to each side on the original schedule: it’s fairly tight. There was even a 24-style timer in the bottom right of the courtroom feed, counting down as each lawyer spoke. Well, it pretty much got ignored. Rather disconcertingly, the timer would just start counting upwards after it reached zero. It was almost a strange kind of metaphor: a running satire of how Argentina has commandeered time itself with its decade of holdout litigation. Courts always tell it to end sometime, but as a sovereign, it never does.

Then there were events in the courtroom itself. Look at the times given to each side on the original schedule: it’s fairly tight. There was even a 24-style timer in the bottom right of the courtroom feed, counting down as each lawyer spoke. Well, it pretty much got ignored. Rather disconcertingly, the timer would just start counting upwards after it reached zero. It was almost a strange kind of metaphor: a running satire of how Argentina has commandeered time itself with its decade of holdout litigation. Courts always tell it to end sometime, but as a sovereign, it never does.

Anyway, over to the arguments.

This post is going to focus on Argentina’s argument by itself, since it helps illuminate the court’s call on Friday for “precise terms”. (Part two will cover BNY, the exchange bondholders, NML). Italicised quotes at the start are from the judges.

________________

What Argentina said

“How can we be sure, if we agreed with you on a percentage, that it would get paid?”

Oh boy, was this a taking to the cleaners.

Argentina actually started pretty well, mostly because of what they chose not to open with. This was any real attempt to refight the pari passu clause, as opposed to ratable payment: “A ratable payment obligation is different from a payment obligation.”

Indeed the court said right at the start that it had refused Argentina’s separate bid to have the whole case reheard by the three judges. This is where pari passu exegesis could have had another chance. Here’s the official denial of the panel rehearing. Argentina also made a en banc (full court) rehearing petition, with US government support, but Shearman has noted that the Second Circuit reheard “less than 3/100 of 1%” of cases en banc in 11 years.

What Argentina did want to do was talk about a formula for ratable payment. Its formula. Undeterred as the panel’s first queries hit home — why hadn’t Argentina proposed its alternative earlier in the case?: “I didn’t see that,” Judge Raggi said — the Republic’s attorney, Jonathan Blackman, made his offer.

It was kind of vague, but the gist was that holdouts would get paid the same percentage of their bonds as the percentage the exchange bondholders got. One key thing here: by doing this, Argentina seemed to be accepting a basic premise within the court’s original October 26 decision (and repeated in Judge Griesa’s November 21 confirmation of his order). This was that ratable payment for the holdouts is just a remedy: there was nothing inherent in the pari passu clause which ‘means’ ratable payment, so the court can’t be misreading the clause itself. Is this logical? We’ll come back to that. In any case, Argentina was coming back with what it saw as the only “equitable” remedy.

Interestingly, the judges appeared willing to at least hear this one out, including asking about making the holdouts “current”. This “being made current” didn’t quite suggest “being made whole.” Again, it was all a bit vague in the courtroom, but one idea seemed to be giving NML et al whatever the backlog of 11 years of payments was, and then paying them at the EBG rate thereafter. Then again, that (oops) reminded everyone that the original bondholders had been waiting 11 years, with anacceleration clause promising complete upfront payment on default.

That’s when it got messy.

Blackman had to concede that the holdouts “have every legal right to accelerate”. So, he had to convince the court of two things to make up for it, really. First, what the holdouts wanted was no ordinary injunction: they effectively had a judgement. NML had called pari passu an “enhanced judgement enforcement mechanism”, right? And, well, sometimes life and the 1976 Foreign Sovereign Immunities Act mean that judgements against sovereigns have to go unenforced. Second: “the problem with injunctions is that no one gets paid”.

That just about tore it.

“You would not obey any order other than what you have just proposed?” Judge Raggi now asked Blackman. (You will have to imagine the rising incredulity in her voice.) “We would not voluntarily obey such an order,” came the answer. The judge pounced. So what (dial the incredulity up to 11) did “voluntarily obey” mean?

And it got worse. Having said it was public policy “not at all unique” to his client that governments just will not pay some creditors in full while they’re asking others to take a haircut, Blackman then argued that “Argentina has a public policy: it does not and cannot prefer Mr Olson’s clients”.

Pretty soon, the C-word — contumacious! — was being thrown around the courtroom like a live hand-grenade. This, in short, is why Argentina CDS shot to the moon in the market. As soon as the analysts had gotten their phones back from court security, that is.

“Voluntarily”

But let’s just freeze-frame it right there.

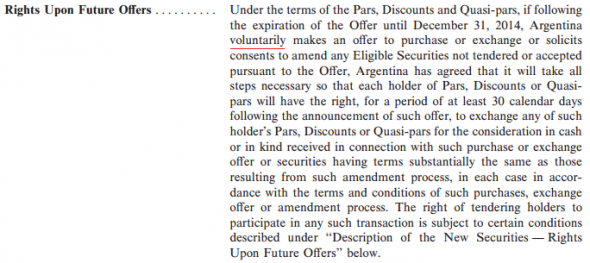

Rewind back to what the lawyer said about “would not voluntarily obey”. Technically, this is not the same as “would not obey”. This reminds us of something we wrote right at the beginning of the pari passu saga. “Voluntarily” is a word the exchange bondholders might recognise:

That’s the ‘most favoured nation’ clause in the 2004 prospectus for bonds received under Argentina’s 2005 debt restructuring. If Argentina ever did make a deal with holdouts, and it was better than what the restructured holders got, the clause lets the latter swap their bonds to receive the same upside.

Famously this clause had some loopholes. One story for why the Argentine government passed the padlock law subordinating holdouts for eternity – handing NML a smoking gun for its previously no-hoper pari passu claim – was to close the loopholes. (Another story is just that the government was politically stupid. We like this story.)

But the government can suspend the lock law, and going by the clause, it appears Argentina can also “involuntarily” make an offer to holdouts. President Cristina Fernandez de Kirchner could wake up in the Casa Rosada one day and consider a US court order “involuntary” after all. Couldn’t she?

Why else keep intoning “voluntarily” on Wednesday? And now we have this order for precise terms.

As Mark Weidemaier says, the other interesting part of Friday’s order for clarification is that the implications come out “an awful lot like a sovereign bankruptcy regime”. Interestingly, there were shades of bankruptcy-talk in the rest of the judges’ questioning, once we got through the toe-curling sovereign defiance bits.

All this stuff about how court approval of the order “would be forcing a nonpayment” made Argentina’s advocacy of “intercreditor equity” trickier. This is close to the language of bankruptcy. But challenged by Raggi that it was “more than curious” that his client hadn’t offered to put funds into escrow as a sign of good faith – if Argentina wants to help build an equitable remedy, why not do that? – Blackman said this wasn’t a bankruptcy setting.

After that, there wasn’t much left to argue about. Except to argue that the arguments would go on and on if the court left third parties in the frame. Failing to change this part of the order would lead to more legal process, not less, and this time not for Argentina but for affected parts of the US payment system. “You are judges of equity: do no harm,” Blackman said.

And then, finally and tantalisingly – we’ll come back to it in what wasn’t said – he suggested the next pari passu litigation would ensue from other holdouts wanting their piece of the pie.

But well, as Blackman made his rebuttal, Argentina already seemed to be looking ahead to its next options. Blackman’s “this is not the end” plea indicated as much, as did an earlier line – which gained much laughter in the overfill – that “we have limited recourse, except to another court.”

Until, of course, the Second Circuit came back on that payment formula point…

In the next post: “reckless” BNY, an awkward trustee fees moment – and who’s got Argentina CDS?

No comments:

Post a Comment