http://www.silverdoctors.com/srsrocco-gold-backwardation-since-2008-financial-system-died/#more-22427

By SD Contributor SRSrocco:

By SD Contributor SRSrocco:

and.......

http://www.silverdoctors.com/jim-willie-gritty-questions-on-the-historic-collapse/

SRSROCCO: GOLD BACKWARDATION SINCE 2008 = FINANCIAL SYSTEM DIED

By SD Contributor SRSrocco:

By SD Contributor SRSrocco:

Backwardation of gold and silver have been going on since 2008 — the year the financial system died.

Today, I watch as the majority of gold and silver bugs get PULLED down by the constant MOPE and misinformation by MSM. The Financial System died in 2008. The Big Banks are Zombies walking around getting increasingly weak every day. This is a huge disaster… and most in the USA have no clue.

SIGNS ARE STARTING TO SHOW

The Great Global Supply Chain System is now starting to show signs of buckling.

The manipulation of the price of Gold & Silver as well as the miners is an attempt to keep this system based on credit and debt alive a little bit longer. However, each attempt and manipulation has made the system even weaker.I believe we are now BEYOND THE POINT OF NO RETURN.

The manipulation of the price of Gold & Silver as well as the miners is an attempt to keep this system based on credit and debt alive a little bit longer. However, each attempt and manipulation has made the system even weaker.I believe we are now BEYOND THE POINT OF NO RETURN.

Backwardation of gold and silver have been going on since 2008 — the year the financial system died. I have to agree with Sandeep Jaitly and Fekete on the correct “Call for Backwardation”. Even though I have some disagreements with Fekete as it pertains to silver and etc, he and Sandeep are masters of monetary science when it comes to “Trading the Basis”.

SIGNS ARE STARTING TO SHOW

The Great Global Supply Chain System is now starting to show signs of buckling.

In this article from ZeroHedge:

The problem is not just the worst FEB SALES since 2006, but Wal-Mart’s inability to keep its shelves stocked coincides with slowing sales growth. The is very bad news going forward. According to the article:

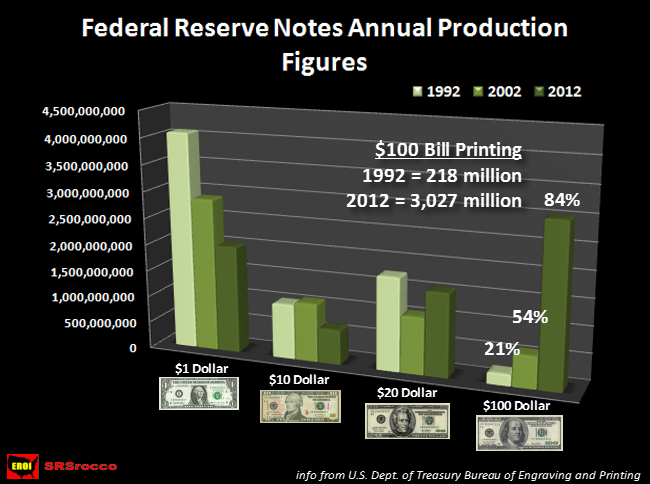

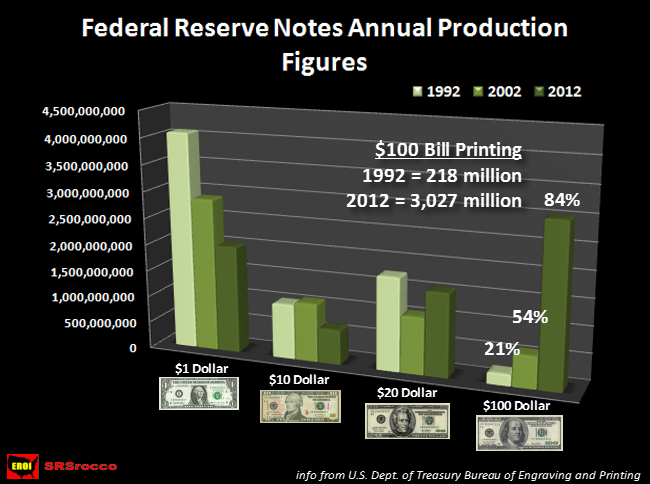

“There are gaps where merchandise is missing,” Cruz said in a telephone interview. “We are not talking about a couple of empty shelves. This is throughout the store in every store. Some places look like they’re going out of business.”Cruz, 41, who has worked at Wal-Mart for nine years and oversees the photo and wireless sections at her store, said it can take weeks or months for merchandise to be replaced after it sells out.“My camera bar hasn’t had cameras since early January,” she said. “They let the merchandise phase out but nothing new comes in to replace them. We’re supposed to have 72 cameras but we maybe have 12. What are customers supposed to buy?”You see, the problem of the Global Supply Chain System only gets weaker going forward. Basically, the world’s retail stores will not be able to keep stores STOCKED. This also gets worse when we figure in the decline of NET OIL EXPORTS.To see just how much INFLATION has hit the United States, take a look at the break-down in money printing at the U.S. Treasury:Look how much more in $100 bills are being printed just from 1992. Basically, the overall CURRENCY IN CIRCULATION is $100 bills…LOL. Now these figures represent what the U.S. Treasury prints each year to replace old and lost Federal Reserve notes.THE TALK OF DEFLATION IS LAUGHABLEI really get a good laugh at the NITWITS who talk about DEFLATION. The Western Central Banks only have one option:PRINT OR DIECharles Hugh Smith wrote a very good article that is on ZeroHedge:You see, American Wages have been falling for decades. The US Govt realizes the only way they are going to get additional revenue is from assets profits and capital gains. Thus, the reason why they are printing.Now, on the other hand, if they stopped printing, its just more than a Deflationary Collapse…. its a DISINTEGRATION OF THE GLOBAL SUPPLY CHAIN SYSTEM. Once the supply chain starts to break down… the cascading ramifications are just to horrible to think about.The upcoming closing of hundreds and hundreds of BEST BUYS, SEARS, JC PENNIES, RADIO SHACK and etc in 2013, is just the beginning. This will spread to other big box retail stores as well as the whole RESTAURANT CHAIN SYSTEM.What is taking place in Walmart is wake up call for what is to come.The manipulation of the price of Gold & Silver as well as the miners is an attempt to keep this system based on credit and debt alive a little bit longer. However, each attempt and manipulation has made the system even weaker.I believe we are now BEYOND THE POINT OF NO RETURN. Deflation is the END GAME scenario.Look what is happening in Greece. They can’t get medications now. According to another article in ZH, the Red Cross has stopped sending Blood to Greece because they haven’t received payments on past bills. Can you imagine that? RED CROSS shutting off assistance?Unfortunately, this sort of outcome awaits the USA. How long before we get there is anyone’s guess… However the signs are now showing more than ever.

and.......

http://www.silverdoctors.com/jim-willie-gritty-questions-on-the-historic-collapse/

JIM WILLIE: GRITTY QUESTIONS ON THE HISTORIC COLLAPSE

The typical articles over the last many years have featured a particular theme. In the last few months, the central theme in Jackass articles has been the isolation and demise of the USDollar, how it is happening, why it must happen, and its importance in the restoration of the global financial structure. But this week, a sudden urge has come to address an overwhelming list of critical gritty questions. They crop up with clients, colleagues, and friends.

More than a crisis, it is more accurately described as a collapse of a corrupt inequitable monetary system, and a desperate defense by the major Western bankers to preserve their power over nations and their governments, alongside a vile vicious violent attempt by the United States to maintain its privilege as owner of the vast USDollar counterfeit machinery, as controller of vast banking pillars of paper columns, and as commander of a vast military.

THE UNITED STATES IS PREPARING TO FALL INTO THE THIRD WORLD.

The current monetary system has a debt foundation, which is collapsing in lockstep with the rapid breakdown in the sovereign bond market. The last four years have seen a long drawn-out unstoppable process, where the collapse cannot be avoided and must happen. The pathogenesis is obvious to those in the Sound Money camp. The blossom of corruption and complete banker criminal immunity has only hastened the urgent need for the collapse. The cadaver in Intensive Care cannot be revived with more intravenous applications of contaminated money, the body dead since September 2008. Insolvent systems rush to the crash zone, where efforts can only delay the outcome.

The central banks are finally in crosshairs of focus, for not producing a solution, more recently for worsening the problem. They have confused their function from providing liquidity, in the belief that they are creating wealth. They have destroyed the system as costs rise relentlessly. Perversely, their efforts to dampen demand so as to reduce price inflation has added to the economic destruction. The outcome will be shocking in its power shift to the East, shocking in its evaporation of paper wealth, and shocking in the simplicity of the new financial structure that rises from the ashes based in barter and gold payments. However, the United States will be left behind, due to its basic ownership of the global reserve currency being scrapped. The extreme corruption cannot be reformed. The US financial system must be extinguished, and with it extreme damage to the USEconomy, which has been hopelessly dependent upon asset bubbles for two decades. No single theme in this article, just an attempt to answer in a straightforward manner some extremely difficult and appropriate questions for this ongoing crisis. Some effort is made for the topics to be presented in a logical flow, with answers not lengthy. For much more detailed analysis, look to the Hat Trick Letter paid reports with a subscription, offered each month.

1) CAN WE BE CERTAIN A COLLAPSE WILL COME AND WHY ??

To be sure, a collapse is not only coming. It is happening before our eyes in what used to be ultra-slow motion. Each year the pace quickens. Two years ago, the MFGlobal client account theft episode was preceded by another red-line event a few months before, and followed by another a few months after. But nowadays, the crisis events occur every month or every week. With $1.2 trillion doled out by the USFed to European banks in January, the Germans demanding repatriation of their official gold account, the Italians electing a comedian to halt the property tax hikes that bail out banks, the British sponsoring a Chinese Yuan Swap Facility, the attack on Mali to wrest its gold for German repayment, the move to shut down the Mongolian copper & gold mine by Rio Tinto, the raids larger and bolder of the GLD inventory, the USFed preparing for QE5 (or rather QE187), the US facing a fiscal cliff, the Japanese ratcheting up the competitive currency devaluations, the Swiss managing their Euro-Franc peg, the Russians hosting a G-20 Meeting of finance ministers to coordinate the alternative to US$-based trade, the Iranian sanctions coming to a conclusion in US acquiescence, and a gathering of five aircraft carriers in the Chesapeake (against all rules, angering the Pentagon), to be sure, the pace of extreme events is quickening. All these have occurred just since the new year began less than two months ago. Extreme events have become the norm. A series of climax events is coming very soon. The changes will be rapid and breath-taking.

2) WHAT WILL THE FUSE BE THAT TRIGGERS THE FINANCIAL COLLAPSE ??

Some mid-sized seemingly minor bank will fail. It will have linkage to another big bank in a corresponding role. The obligations will not be possible to cover. The contagion will spread to numerous large banks across Europe to London and New York. The derivatives could be involved, very unmanageable. If not a mid-sized bank, then a major bank will fail from the inability to contain the profound insolvency and massive bleeding during capital flight. The Greek zone has been contained, where disaster runs its course. But larger Italy, Spain, and France are rapidly breaking down, each in its own unique important way. A great many fuses lie, each waiting to be lit.

3) WHY HAS NO SOLUTION BEEN PUT IN PLACE AFTER OVER FOUR YEARS ??

Because the big banks that hold the power are insolvent, and they choose not to shut down their helm of power. Any valid solution must begin with liquidation of the insolvent broken structures, starting with the biggest banks, which happen to be the protected sites (if not headquarters) of the corruption. The power centers are the central banks and the big attendant banks. They are responsible for the bond fraud, the bond counterfeit, the dispensation of $trillions in secret deals, the narcotics money laundering, and the financial market interventions. They are protected entities with large private police forces. They will not be reformed or prosecuted or liquidated. Thus no solution from internal forces. The solution will be imposed from the outside.

4) WHAT IS THE SIGNIFICANCE OF THE USGOVT-LED IRANIAN SANCTIONS ??

The real objection to Iran is that they sharply increased their non-US$ energy transactions over a year ago. That is regarded as financial terrorism, which entered the propaganda mill only to come out as some daft baseless story on nuclear development. Iran has thus followed the Iraq pathway to depart from the USDollar market, but Iran cannot be attacked like its neighbor since it has allies in China and Russia. They work to undermine the USDollar dominance. To brush the USDollar aside is to snuff the American Empire and to remove its full spectrum dominance by stripping the free money credit card. The significance of the Iranian sanctions by the USGovt can be described in chapters of volume, but described in simple terms. The sanctions have galvanized the efforts of Eastern nations to seek a non-US$ alternative in trade settlement that avoids the banks under Anglo-American control. By working to settle trade outside the reach of SWIFT bank rules, the Eastern nations led by China and the many Iranian trade partners have hastened their efforts to settle trade in unconventional ways that center on Gold as a means of payment, either directly or indirectly through hidden intermediaries. The United States did not shoot itself in the foot. The US shot itself in the face where the USDollar is imprinted, and in the chest where the USTBond is held in favor. The US acted to accelerate the rejection of the USDollar in global usage, and thus to quicken the pace of its lost global currency reserve status. The US has pushed itself down the path to the Third World.

5) WHAT EFFECT WILL THE NEW ITALIAN ELECTIONS HAVE ??

The creation of a three-way coalition of Berlusconi, Bersani, and Grillo will shake Europe to its core. The Italians rejected the property tax hikes imposed by appointed leader Monti in very efficient timely grandiose style. The consequent risk is for the big banks to lose their guardian in Monti, the Goldman Sachs preppie. With attention and priority taken away from serving the needs of the big banks, complete with filling the channels to bigger European banks, the risk has risen ten-fold for an accident in Southern Europe. The insolvent (broke, illiquid, desperate) big Euro banks will be vulnerable to default events which could quickly spread across Europe to London and New York. The control room managed by Monti will be at great risk of being shut down. The risk of a great accident is acute.

6) OF ITALY, SPAIN, AND FRANCE, WHICH IS IN THE WORST CONDITION ??

All of them are in dreadful atrocious condition, none worse than the others. The bigger issue is which will ignite the explosion in the financial platform. Spain has a blossom of corruption exposed during a skein of financial firm failures. The scandals involve both politics and security laced with finance. France has capital flight in response to the self-mutilation common to socialism. An absurd tax rate directed against the wealthy might as well be 100%. Socialism will soon be equated with confiscation and tyranny. Italy has a comedian to join two political leaders, where the message is a counter-attack in response to higher capital gains to finance the banker aid. Their political system is far more responsive to the people’s will than any Western government, no exception. The distinction in these three nations is their size. Their populations range from 47 to 65 million, together 17 times the size of Greece. None can be bailed out, referring to their government deficits and their banking system. Any or all of the trio of broken nations could collapse, with triple the fuses exposed. If any of the trio falls, the other two will follow quickly. Germany cannot bail out any of the three, and certainly not all three. The duty of bail out would fall on the Euro Central Bank doorstep, which would reveal the monetization schemes as a grand paper mache sham game. As the trio in Southern Europe collapses, the titan Germany will depart the common Euro club. It will then embrace Russia and China, and help the establishment of the great Eurasian trade zone.

7) WHAT THREE COMMON THREADS CONTRIBUTED MOST TO THE COLLAPSE ??

A) The dispersion of phony money throughout the economic and banking system, which in the process contaminated and undermined capital. B) The plethora of bond fraud, bond counterfeit, huge bailouts for the big banks, and hidden banker loans totaling $23 trillion (still counting), which created a banker syndicate and banker welfare system together. C) The spread of predatory war sponsored by the USMilitary and USGovt security agencies, for the advancement of banker seizures, resource grabs, and attacks on civilians. Aside from the costs to the USGovt deficit, the global impact has been horrendous concerning US prestige and good will toward the United States. With bad money, corrupt banks, and aggression through war, the world has been brought to its knees as it wishes to bring the US leadership to heel.

8) WHAT HAVE BEEN THE OBJECTIVES FOR THE ARAB SPRING ??

Multiple motives appear at work. The goal has been to loosen the grip of power by Moslem autocrats, which would permit the replacement of more suitable pro-West leaders (puppets). The goal has been to loosen the lines to official government accounts, like the 144 tons of Libyan gold that still sits in London banks, which is much more integrated into their bank management schemes. The goal has been to destabilize the national fabrics, an old favorite game of the USGovt security agencies, since it tends to permit a climate conducive to their ploys. Imagine pitting your neighboring husband and wife against each other with false sexual dalliances, while setting fire to other neighboring houses, then robbing the neighborhood homes. But a backfire is in progress on three fronts. Egypt is on the verge of a banking breakdown which might expose the USTreasury Bond is unwanted in the global financial market, outside the big US bank control. Syria is leaning more heavily toward a Russian alliance. Their naval port will not be yielded. The presence of HezBollah is clear, with the Saudi assassination of Prince Bandar in September, in response to other Assad family hit squad actions. The big impact crater is likely to be the House of Saud itself, which is in great danger of falling. King Abdullah is teetering in health, if not comatose. With the fall of the Saudi regime will come the fall of the Petro-Dollar, thus the USDollar itself as global reserve.

9) ARE THE OFFICIAL GOVERNMENT GOLD RESERVES DATA ACCURATE ??

Not a single nation reports accurate gold reserves data. Doing so would reveal the absence of their gold from domestic raids and the consequent bankruptcy. Doing so would reveal the accumulation of gold toward new plans for the next financial chapter. Either weakness or strength would be publicized in a true accurate statement of the gold accounts. Not even foreign official accounts are accurate. In fact, no gold accounting is accurate the world over. The national treasure and jewels are well concealed, as the global monetary war runs white hot.

10) HOW MUCH GOLD DO CHINA AND RUSSIA REALLY HAVE ??

At least five times as much, and possibly ten times as much gold as reported, which would mean more than Fort Knox before it was pillaged in the 1990 decade. Both superpower nations purchase all their domestic gold mining output, with nothing exported. The Russians have gold accumulated over the centuries dating back to Peter the Great, Catherine the Great, and the Czars. (Tidbit: Russian word Czar is for Caesar, and German word Kaiser is for Caesar.) The Kremlin contains a vast system of tunnels under its main buildings, stretching for kilometers, filled with gold bars and gold artifacts (think chalices, necklaces, inlaid gemstones). The Kremlin is a veritable Eastern Orthodox version of the Vatican itself, in wealth under control, but surely not religious political power. Over the last decade or more, Russia has been converting its vast oil wealth into gold bars. Since the Soviet debt default, a new strategy has been put to work in the conversion. On the other hand, China has two gold accounts. Their official sovereign wealth accounts and central bank reserves have been accumulating gold at a much more rapid pace than revealed. They see no need to reveal any strategic plans. The fast accumulation of reserves from trade surplus has served as easy flow to gather gold, mostly through the Hong Kong window. The public statement of their Gold reserves data brought laughter to my best gold source of information, since he personally has brokered great volumes of Chinese gold purchases.

11) WHY DOES GERMANY DEMAND A RETURN OF ITS GOLD ACCOUNT ??

An important camp within Germany is no longer part of the Anglo-American financial team of syndicate bankers. When Deutsche Bank CEO Ackerman was pushed out, fell out, or was dropped into the hot seat of interrogation, the German role changed more visibly. The nation is of two camps, one still beholden to the Anglo-American bankers and the satellite offices at the Intl Monetary Fund and the World Bank. Their past cooperation and allegiance had been firm and loyal. The other camp has been building ties with Russia and China, even the Persian Gulf. It has been working diligently and vigorously for over four years in establishing the framework for a new trade system founded in barter, to be transacted in gold. Germany offers the engineering, project management, and coordination, like from the Finns on connecting the electronics from commodity to monetary markets. The other camp has been busy in heavy railroad construction directly with Russia for resource and mineral delivery. It has been busy in trade with China, centered on construction equipment. Germany no longer trusts the bankers to the West, having suffered a fraud from both London and New York. The fraud involved runs far deeper than reported, since it includes a substantial amount of fake gold bars made of tungsten. The British Brown Bottom in 2001 involved Deutsche Bank in gold delivery to cover massive short positions. The Mali excursion in yet more USMilitary (NATO cover) adventure involves an attempt to secure more gold in order to repay the German gold account. Germany has changed teams in the true playbook, the new adversary to the Anglo-American bankers who will find themselves increasingly isolated. Germany has been defrauded, and they are angry. The Germans make for a strident determined potent adversary. In the Jackass view, Germany is the swing nation, the brain trust, the key member of the newly formed Eastern Alliance. It has aligned with Russia, China, and the Persian Gulf.

12) HOW WILL THE COMEX SUFFER A FINAL SHUTDOWN ??

The COMEX will be drained eventually of its Gold & Silver inventory. They had to resort to stealing 140 thousand accounts at MFGlobal in November 2011 in order to preserve its inventory. Do not be surprised if the Libyan 144 tons of liberated gold found its way to the LBMA and then COMEX. The two crime events should indicate the final stages of desperation. The COMEX has resorted to regular raids of the GLD & SLV exchange traded funds over the last two to three years, in greater recent volumes. They short the ETF shares, a privilege granted only to the big banks, then arrive to cart off bullion bars in overnight shipments. Also, vast supply routes have been established between the LBMA and COMEX, with help from the Swiss castles situated at the Bank For Intl Settlements, and from the Roman Catacombs, where decades of cooperation have been afforded. The armored shuttles have been at a frenetic pace to avoid defaults, especially in Silver. The most recent element has been the solicited aid of Scotia Mocatta, the Canadian pillar which appears to have joined the big US banks in naked shorting. The COMEX will shut down from a vicious combination of absent inventory and thin ranks of brokerage accounts. The players have left the COMEX, after the MFGlobal thefts which were endorsed by the corrupted US court system beholden to Wall Street objectives. All across the United States, compliance departments have banned usage of the COMEX by futures risk management teams. Empty shelves and no traffic.

13) CAN THE INELASTIC SUPPLY IN THE GOLD MARKET BE EXPLAINED ??

The inelastic demand for Gold is well known. Demand rises with a rising Gold price, called Gold Fever. But inelastic supply is less understood and mentioned. As forward sales schemes unravel, they drain large mining firms of scarce cash. Operations suffer and big projects are not funded like in the past when a lower Gold price was the case. Two new ravaging effects have taken root. As the major central banks debase the currencies worldwide, they lift the cost structure for businesses and the cost of living for workers. So mining firm profit margins are reduced and worker household stress increases for feeding families. The pinch from reduced profitability combines with the nasty pinch of labor strikes to hinder mining output. Also, the new wave of resource nationalism has struck in several nations. The poorer nations that host mining projects have turned hostile. They are suffering from slower economies and wider deficits. The response has been for their governments to renegotiate royalty agreements, to confiscate properties, and to manage a much tougher line against the foreign mining firms. They have imposed harsher strictures on environmental contamination, often as a ploy to gain more revenue from royalty or penalties. The end result is lower mining output in association with a higher price for Gold & Silver, which defines inelasticity. It is the opposite of what clownish conventional economists predicted, and exactly what the Jackass predicted over the last seven years.

14) WHAT CRITICAL DAMAGE HAS THE CHINESE YUAN SWAP FACILITY DONE ??

The Yuan Swap practice has created a broad platform and precedent for non-US$ trade. The list of nations with such swap deals include Brazil, Australia, Russia, Japan, South Korea, Belarus, Malaysia, and Indonesia. Add England to the long and growing list of nations making bilateral currency agreements with China, which should instill fear in New York. The swaps have established a virtual barter system that is divorced from the banking settlement for trade. Instead, a bilateral account is set up with credits and debits, depending upon delivery and receipt. Regard the swap system as a foundation for global trade settlement in Gold, as the Chinese Yuan makes the rough transition to a gold-backed currency. In the Jackass view, the shift to a gold trade settlement system will coincide with the gradual Yuan currency backed by gold. They will become interchangeable when procuring Gold Trade Notes, my theory, all in time. The Chinese Yuan Swap Facility has undermined the USDollar dominant role in trade. Following trade practices will come bank reserve management practices, which means the removal of the USTreasury Bond from global banking. The numerous Yuan Swap Facilities have essentially worked to dethrone the USDollar as global reserve currency.

15) WHAT IS THE CRITICAL PIECE IN THE GOLD TRADE FINANCE CONCEPT ??

Actually three pieces. The absent usage of the USDollar itself, and the bypass of the Western banking system with its community of SWIFT members, and the sidestepping of the FOREX currency market. If trade is to be settled in Gold, or using vehicles such as the Gold Trade Note, then the USDollar, the big Western banks, the SWIFT codes, and the FOREX are all rendered suddenly obsolete. The banks must adapt to become utility firms. A few gold-backed currencies might spring up with unique distinctions. The gold trade finance concept ushers in a new alternative system long sought in order to create a more viable equitable sustainable financial structure. The banking system should serve trade, not the reverse. Hence the USTBond will slowly vanish from the global banking system, and the USDollar will lose its global reserve status. The end result is a unavoidable slide by the United States into the Third World.

16) WHAT WILL BE THE NEXT FINANCIAL CENTERS ??

Whatever nations begin to dominate as intermediary functions for gold trade as it serves trade settlement between nations, they will grow into the next financial centers. The current attention is on Turkey and India. The Ankara banks are under scrutiny. New attempted controls by the USGovt have been announced by the pretender lords, under the guise of consequence for aiding trade with Iran. The US efforts will not succeed in stopping the progress in gold intermediary development. The Near East has a long history, much longer than the American history. Iran has numerous trade partners, and an extensive system of intermediaries that include the United Arab Emirates, which is undergoing a transformation. Iran’s partners include Turkey, India, China, Japan, and South Korea. These are major nations which will refuse to comply with pressured US tactics. The emergence of alternative trade payment methods in order to keep Iran moving will create the next financial centers. They will be centered upon Gold flows, Gold management, Gold purchases as intermediary, Gold in payments, as well as Gold in smuggling. The recent decision to relax Gold rules within India, to permit corporations to form banks, to ease the pathways for integrating the vast household gold wealth in India, will work to thrust India as a potential gold finance center. Both Turkey and India will realize a benefit in economic growth, which has been nonexistent in the last five years under the fiat paper currency regimes that fast approaches the dust bin. The Near East is a logical center for gold finance, since it links the East with the West in a natural intermediary role. They have been developing the non-standard currencies that have served for five thousand years, namely Gold, Silver, and Platinum. By pushing Gold into the periphery, the financial centers of the West have pushed themselves into an awkward position where they will fall off the stage. In doing so, they have promoted new centers to crop up and mushroom in growth.

17) WHERE ARE THE SAFEST PLACES TO STORE GOLD BARS & COINS ??

Hong Kong for a number of reasons will remain the safest place for Gold storage. It has a long history of professionalism, independence, and integrity. Following the independence in 1997, the city state nation has pursued a unique role and direction. It is under the Chinese wing, but has its own regional charter toward continuity and some measure of autonomy. The Mainland China rulers prefer to use Hong Kong as a port to the West, but also to copy it internally. The British roots helped to establish HK bankers as top notch, but they are no longer subservient to London whims. The HK banking hub is the foremost in all of Asia, with a new rival Shanghai having emerged. The HK airport has greatly expanded its vaulted services. My source indicates that the HK vault service capacity is three to five times greater than reported. It has associations with all the major vault firms in an impressive list. Their integrity is as great as their disdain for the US bankers, with whom they show zero cooperation, as confirmed by an Interpol source. The claimed advantages of Singapore are spurious and illusory. Don’t bother, since it does not even have a Depository Bond agreement for the bullion vault firms.

18) WHAT HAS GONE SO HORRIBLY WRONG WITH GOLD MINING STOCKS ??

Several serious flaws and shortcomings to mining stocks exist. The big hedge funds short them heavily with Wall Street help like credit lines. Other hedge funds short the smaller mining stocks and go long the majors, a spread trade. The majors are working with Wall Street on hedged forward sale programs, a grand collusion. The Goldman Sachs GDX fund shorts the entire group, just to keep them suppressed. The brokerage house Canaccord is involved in naked shorting of mining stocks. After acting as partner to raise cash in a very large number of finance deals for Canadian junior mining firms, they keep selling shares with the collusion of the Alpha Group, far more than they own. The mining firms themselves are in deep trouble, with rising costs, a shortage of engineers, hostile foreign governments, and difficult projects. The mining firms are printing new shares in heavy dilution (like the USGovt on USDollars), which is inflation. Under pressure, the mining firms will soon begin to renege on their covenants, as some will be forced to sell their properties to the banks. Eventually the USGovt and other Western governments might force sale of mining companies for pathetic low prices under law in order to replenish their Gold reserves in the central banks. The recent extreme challenges for the mining firms relates to hostile labor unions and resource nationalism that prompts confiscations. Distress for mining firms will result in continually lower metal output, resulting in supply shortages which favor owners of physical metal, not the mining stocks. The global assault on paper wealth includes mining stocks. The Gold & Silver metal prices have vastly outperformed mining stocks since 2008, when the Hat Trick Letter subscribers were urged to dump the paper and to buy the metal. Expect the trend to persist.

19) WHY ARE BOND YIELDS SO LOW, GIVEN HUGE SUPPLY AND NO BUYERS ??

The JPMorgan war room controls the Interest Rate Swap derivative machinery. The contract is a complex device that matches short-term spreads versus long-term spreads in order to fabricate fresh USTreasury Bond demand for the long maturities. In essence the IRSwap creates artificial demand for USTBonds, and thus creates the illusion of a flight to safety in the USGovt sovereign debt securities. Since 2011, the buyers for the USTBonds have largely been confined to the US Federal Reserve. Since 2011, the supply of USGovt debt sold in securitized bonds has remained at a frenetic $1.0 to $1.3 trillion pace. With huge supply and almost no buyers, the bond yield should have zoomed higher than bonds from Spain and Italy, maybe even Greece. But instead, thanks to the JPMorgan derivative room, the vast USTBond tower is maintained from a brisk demand of totally artificial type from flying IRSwap buttresses. They will all experience seizures. The USTBond yield might be zero when the USGovt debt default occurs. The Weimar replicas of fake toxic money will not halt until the end.

20) DO LOW INTEREST RATES REALLY STIMULATE THE USECONOMY ??

No, low interest rates smother the USEconomy for several reasons. They also create conditions for the banks to convert into speculative houses even more than a decade ago. They are playing the USTBond carry trade, borrowing cheap short-term money and investing in long-term bonds. They cannot earn much profit with low rates in the commercial sector. But the important negatives for low rates work to dampen commercial activity. To begin with, the vast armada of savers, the retirees holding CDs from banks, and the big pension funds, all earn very little on their capital. It is unjust and a perversion. Twice as much savings earn interest as consumer loans pay interest, a net negative that Wall Street harlots prefer to ignore in their promotional harangues to shrinking audiences. The banking sector is suffering for many reasons, one of which is the poor income on their bond portfolios. As much as the mavens and official barkers recite the benefits of low rates and its stimulus, the exact opposite is the case. Worse, the low rates signify low value for capital. They therefore distort the financial markets on valuation of a broad assortment of assets. But the worst effect that renders deep damage to the USEconomy from low interest rates is the encouraged diversion of assets toward investment in commodities in defense, as a hedge for inflation. The migration toward commodities lifts the entire cost structure, and reduces the profit margins for business. The effect is deadly as it forces capital in the form of equipment and machinery into retirement. Business segments shut down. The low rate environment kills capital, reduces the capital base, and smothers the USEconomy. Not one in ten economists comprehends this basic point.

21) WHY HAS THE USDOLLAR NOT BEEN REFORMED IN RECENT YEARS ??

Because the USGovt has no jurisdiction over foreign nations and international contracts. Although the USDollar is widely used in foreign commerce, the USGovt cannot dictate changes and important alterations to past contracts in place. About five years ago, a plan was afoot to replace the USDollar with a newer better version. But all efforts hit an obstacle since the USGovt has no jurisdiction to alter past contracts that involve the USDollar within them. To be sure, the USGovt can control flows of money as a grand gatekeeper and toll taker, but it cannot dictate over external contracts. As the global financial and monetary collapse has continued, the United States has found itself unable to extricate itself from the tightening noose around its own neck. In time, the USDollar will experience a global shun, at which time great new problems will befall the nation.

22) HOW WILL THE USDOLLAR BE ELIMINATED ??

The USDollar will not be reformed replaced or repaired by bankers, since they are too committed and entrenched in fraud and corruption. The USDollar will be eliminated in a series of steps that begins with its isolation. The movement toward trade settlement outside the USDollar, not necessarily in Gold, works to isolate the USDollar turned toxic. Once isolated, the many nations not so firmly aligned to the West will thrive, while the Western core nations continue to crumble and collapse. When the USDollar is no longer in favor in a majority of trade settlement, it will begin to see wholesale dumping of the USTBond as a reserve asset. Then the US-led axis of fascism will be revealed in the United Kingdom, Canada, and most of Western Europe. They will continue to use the USDollar in both trade and banking, but they will ingest toxic paper during their continued unabated collapse. As the stage shrinks and the lights dim, the USDollar will be dealt with by the USGovt itself in brutal fashion. The US will devalue its own currency to survive, just like Third World nations.

23) HOW DOES THE CURRENCY WAR AFFECT THE USDOLLAR POSITION ??

Nations around the world are locked into policies to debase their currencies in a series of competitive devaluations in order to protect their export trades. A lower domestic currency exchange rate protects the trade by keeping the prices down for their exported products. Other nations are affected as they lose trade to the competitor which devalues. Actually all nations lose, since global trade shrinks in aggregate. The USDollar is artificially propped as a result. But pain comes from the devaluations since they increase import costs like crude oil, such as in the case in Japan. Also, nasty effects occur like with Switzerland, whose central bank collected a pile of Japanese Govt Bonds in a diversification program. In competing currency wars, everybody loses in a race to the bottom. Nations are slowly coming to the realization that if they simultaneously rid themselves of the entire batch of fiat paper currencies, and adopt a gold trade finance system, even if they suffer a writedown of USTBonds in the process, they will be better off with a future, after being freed from the toxic tentacles. The USDollar and USTBond are agents of ruin during the ongoing unstoppable collapse of paper assets, paper wealth, and paper money. The next stop is the Gold Standard, which the participants in the currency war are gradually moving to adopt, as they follow the Chinese lead.

24) HOW WILL THE UNITED STATES FALL INTO THE THIRD WORLD ??

The global isolation and rejection of the USDollar will force the USEconomic participants to bid up the currency required for the many supply routes leading into the nation’s factories, offices, stores, and homes. The USDollar will be forced to bid up Chinese Yuan and Gold ultimately. They will be forced to bid for whatever currency is required for the assorted supplies like crude oil, metals, and foodstuffs, as well as for finished products like cars, hardware, home electronics, and clothing. The process will see some shocking events like 30% devaluations, just like seen in Venezuela. My estimate is that the USDollar will eventually see a 50% to 60% devaluation in total over the next few years. That will cut US personal wealth in half. That will open the door to 25% to 30% price inflation suddenly. The process will cause grand shortages, civil disorder, and perhaps chaos. Violence will erupt at the gasoline stations and food supermarkets. The USEconomy will lose its credit line, and become a credit risk. For decades, the USEconomy has been running up deficits, with no enforcement or discipline or controls, in essence shoving the debt paper on foreign nations in lieu of legitimate savings. They resent it. Foreigners will demand hard currency at a time when the USDollar loses its global reserve status and premier position. A sense of retribution will emerge. As the gold trade finance chapter opens, the USDollar severe devaluation will coincide.

25) WHY ARE AMERICANS SO ILL-INFORMED ??

The United States is the home of a vast syndicate that has been in firm control for decades, but only since 911 has it exerted stronger controls. In the process, much greater banker welfare has become the norm, as have tight reins to control the USCongress while integrating and enriching the military contractors, and more quietly the pharmaceutical giants with at times deadly vaccines. In order to maintain the charade of a national directive toward security, complete with all the earmarks of national socialism, the network news has been under very firm control. Dan Rather and Keith Olbermann can attest. Since the 1980 decade, the entire news conglomerates that include television, radio, newspapers, and journals has been subject to strict oversight by the USGovt security agencies. Since 911, the Homeland Security apparatus has exerted its controls. The ownership of the major network conglomerates is a short list, which in the 1970s consisted of 25 firms. Now it consists of a mere five firms. They have been totally woven into the security fold. A branch of Hollywood has also been grown from the security fold. The bias is evident in domestic political stories, international geopolitical stories, bank related stories, money related stories, economics stories, and financial market stories. The US citizens remain the worst informed people of any industrialized nation, and the most subjected to propaganda. The British are a close rival. The Goebbels methods are actively at work in propaganda widely disseminated.

26) WHAT HAS KEPT THE BIG US BANKS AFLOAT FOR THE LAST FOUR YEARS ??

Two flows of funds have kept the big US banks going. The first is the financial derivative trades that grew out of control in the 1990 decade and became vogue. They are totally unregulated, and therefore subject to grand fraud. For instance a big financial firm might have credit default swap contracts against its bond bust that total 200 times the value of the corporate bonds themselves. It like the entire neighborhood owning a fire insurance policy on a single home. To lite the home ablaze can be profitable for some participating investors. The banks have an extremely large volume of both credit default swaps and the more important interest rate swap contracts. In fact, JPMorgan owns $82 trillion in interest rate derivatives, which exceeds the size of the global economy. No regulation in oversight means the big US and London banks can rig the prices, even counterfeit some of the contracts held. Notice the LIBOR banker scandal that emerged in 2012 to shock the world. It will spread, not shrink, as all major financial markets are corrupted. The second very important source of funds is basic narcotics money laundering, the biggest beneficiaries being the New York banks. Few realize that JPMorgan runs the Iraqi Export Bank in Baghdad Iraq, which serves as the clearing house for Afghan narcotics. A ripe 85% of all heroin in the world comes from Afghanistan. Terrorists pale by comparison in importance in the war mission. The United Nations has issued several drug related finance reports that have identified the big US banks as primary centers for money laundering of narcotics funds. Some like Wachovia have pled guilty. In recent months, the Queen of England has been implicated, as have the Vatican bankers. Without the derivatives and money laundering, the big US banks would have folded and gone bust years ago.

27) DOES THE USFED REALLY HAVE AN EXIT PLAN ??

The USFed has no Exit Strategy. It ran a blatantly obvious fake plan in 2009 that the Jackass dismissed immediately and correctly. The Zero Percent Interest Rate Policy will remain in place until the USGovt debt default occurs. Any rate hike would cause a balloon in USGovt borrowing costs and much greater deficits. Any rate hike would cause a sudden implosion of the entire derivative structure, the so-called nuclear event. Any rate hike would break the big US bank carry trade locked into USTBonds, and thus cause bond yields to rise twice as fast as the USFed could control them in a great unwind. Any rate hike would crush the already comatose housing market. Any rate hike would harm badly the USEconomy from higher cost of loans. The Quantitative Easing policy will remain in place until the USGovt debt default occurs. No buyers of any critical mass exist to purchase USTreasury Bonds. The USFed has been purchasing at least 80% of USTBonds in new issuance and rollover supply. Foreign buyers are long gone, aghast at the hyper monetary inflation and toxic effect on their banking reserves. They also possess smaller trade surpluses. If the USFed were to halt the purchases of USTBonds, the pressures on the Interest Rate Swap machinery would break it quickly in a matter of one to two months. The result would be long-term bond yields rising to the 7% to 8% or 9% range. The USFed has no Exit Strategy, never had any Exit Strategy, and will not be granted an Exit Strategy. It is stuck in the monetary corner, totally reliant upon its Weimar printing press, gradually isolated in its USDollar self-fellatio activity.

28) HOW WILL THE USGOVT BUDGET DEFICIT BE FINANCED AND COVERED ??

The only exit ramp that might be seen is with the USGovt and its deficit finance. The likelihood grows every month for a major oppressive event, where private US pension funds (IRA, 401k, Keough, managed pension, etc) are forced to cover the USGovt deficit in the form of special USTreasury Bonds which also cover a portion of the USAgency Mortgage Bonds. The US citizenry is captive to the desperate whims of the USGovt and its bankrupt condition, sure to dole out desperate policy actions.

29) ON THE FISCAL CLIFF, ARE SEQUESTERED BUDGET CUTS ALL THAT BAD ??

The Jackass loves the automatic budget cuts, even if across the board in nature. Whatever it takes to reduce the vast USGovt bureaucracy and vast military establishment is wonderful and welcome. The fear tactics have already reached a fever pitch, with recited calls for long airline delays and cuts to the welfare morass that includes Social Security and Medicare. The point must be made that even the first round of cuts will be only $85 billion for the fiscal year ending September 30th. That is minor compared to the overall $3.8 trillion bloated budget, as in $3800 billion. It is a trifling amount in proposed cuts from the sequestered route, only 2.2% of the total bloated budget. The pain comes from the budget cuts arriving at a time of chronic recession that dogs the USEconomy. The marginal effects will be certain, but the movement to reduce the size of the USGovt is in a good direction.

30) WHY ARE AMERICANS SHUNNED ACROSS THE WORLD ??

The USGovt regularly puts out volumes of requirements and onerous rules for foreign entities to follow and abide by, at their own cost. The USGovt has in the past few years forced a burden on the foreign firms. As a result, the foreign firms have decided on an increasing basis not to incur the cost, not to support the staff, and not to deal with the nuisance. They do not hate the US citizen. They despise the USGovt and its sprawling imperial over-reach.

31) WHY DID THE POPE REALLY RESIGN ??

This is difficult to answer with any measure of certainty. But indications have been made by credible parties that the Vatican is soon to be exposed for some truly devious pernicious scummy banking relationships that involve big banks like JPMorgan and various central banks. The big corrupt US bank has managed the Vatican gold account for decades. Imagine the cross traffic from the brisk Afghan narcotics money laundering activity. More clearly, the Vatican is embroiled in narcotics money laundering at its primary bank. It is difficult to confirm, but the Jackass doubts that God approves of any activity on usage or finance related to heroine and cocaine. The Vatican apparently is soon to be subjected to a new financial audit. The recently appointed German lawyer Ernst von Freyberg will be the new president of its bank, filling a post left vacant since May when a financial scandal involving narcotics money laundering with Roman banks tainted the institution for the umpteenth time. The appointment was made by a commission of Cardinals and approved by Pope Benedict before his departure was announced, now final. The bank’s formal name is a total joke, the Institute for Works of Religion. Plenty of other reports swirl about an intolerance for certain sexual rituals by the Vatican bankers that the current pope has no more patience for. Benedict has laid a trap. There are two chambers to the Vatican, the College of Cardinals and the Jesuit Bankers. The former pledges fealty and devotion to the Prince of Light with active ceremonies. The latter pledges fealty and devotion to the Prince of Darkness with active rituals.

32) ARE THE ANGLO AMERICAN BANKERS STILL IN CONTROL ??

In no way are the London and New York bankers in control. They are reacting to events. Their many structures are fast crumbling. Their bond markets are held up by paper emissions in ever increasing volumes. Their currencies are at war with each other, not simply competition. Their banks are grotesquely insolvent, kept afloat by direct monetary inflation, open state welfare, and oppressive taxes. The central banks are stuck in the ZIRP corner with only QE as an option, otherwise known as dead money and hyper monetary inflation. Weimar is alive and vigorous on its destructive rampage. The global trade settlement system is making steady progress in a non-USDollar alternative, which will strip the United States of the global currency reserve privilege, abused to the hilt. The trade finance structure will gradually revert to the Gold Standard, and from that firm position, dictate banking policy. The bankers of the future will be those who own Gold & Silver, which will rise to $5000 per ounce and $250 per ounce respectively, probably more suddenly than even the gold community comprehends or anticipates.

- 1

By

By