http://www.zerohedge.com/news/facebook-complete-forensic-post-mortem

http://www.businessinsider.com/morgan-stanley-facebook-ipo-2012-5

NEW YORK (Reuters) - Lead Facebook Inc underwriter Morgan Stanley took a bet earlier this week when it increased the size of the social networking firm's $16 billion initial public offering and it boosted the price.

and....

http://www.businessinsider.com/facebook-earnings-guidance-2012-5

Part way through the Facebook IPO roadshow, scattered reports appeared that Facebook had reduced the earnings guidance it was giving research analysts.

FaceBook: The Complete Forensic Post-Mortem

Submitted by Tyler Durden on 05/19/2012 11:40 -0400

While much has already been written on the topic of peak valuation, social bubbles popping, and the ethical social utility of yesterday's historically overhyped IPO, nobody has done an analysis of the actual stock trading dynamics as in-depth as the following complete forensic post-mortem by Nanex. Because more than anything, those tense 30 minutes between the scheduled open and the actual one (which just happened to coincide with the European close), showed just how reliant any form of public capital raising is on technology and electronic trading. And to think there was a time when an IPO simply allowed a company to raise cash: sadly it has devolved to the point where a public offering is a policy statement in support of a broken capital market, which however is fully in the hands of SkyNet, as yesterday's chain of events, so very humiliating for the Nasdaq, showed. From a delayed opening, to 2 hour trade confirmation delays, virtually everyone was in the dark about what was really happening behind the scenes! As the analysis below shows, what happened was at times sheer chaos, where everything was hanging by a thread, because if FB had gotten the BATS treatment, it was lights out for the stock market. Well, the D-Day was avoided for now, but at what cost? And how much over the greenshoe FaceBook stock overallotment did MS have to buy to prevent it from tumbling below $30 because asReuters reminds us, "had Morgan Stanley bought all of the shares traded around $38 in the final 20 minutes of the day, it would have spent nearly $2 billion." What about the first defense of $38? In other words: in order to make some $67 million for its Investment Banking unit, was MS forced to eat a several hundred million loss in its sales and trading division just to avoid looking like the world's worst underwriter ever? We won't know for a while, but in the meantime, here is a visual summary of the key events during yesterday's far less than historic IPO.

May 18 - The Facebook IPO

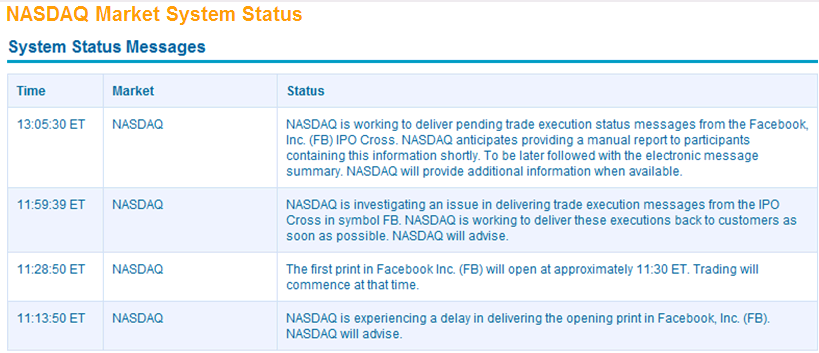

The first warning sign, was the delay in trading. Here's the status messages from Nasdaq for that day.

The first 4 charts are 5 second interval charts of Facebook showing the first hour and 15 minutes of quotes and trades.

Chart 1. NBBO (National Best Bid or Offer) Spread. Black: bid < ask (normal), Yellow: bid = ask (locked), Red: bid > ask (crossed)all bids and offers color coded by exchange.

Chart 2. Best bids and offers (NBBO) color coded by exchange.

Chart 3. All bids and offers color coded by exchange.

Chart 4. All trades color coded by exchange.

The next 4 images are tick charts showing quotes and trades. How to read these charts

Chart 5. The first seconds of trading.

Chart 6. The first seconds of trading, continued.

Chart 7. Suddenly, a vacuum appears and produces a record 12,285 trades in 1 second.

Chart 8. Same as above, showing just Nasdaq.

The next 2 charts (10 second interval) show how Nasdaq's quote stopped, but trades from Nasdaq did not (direct feeds must have been fine, but not the consolidated).

Chart 9. Nasdaq Bids and Offers along with NBBO.

Chart 10. Nasdaq Trades

The next 2 charts (20 millisecond interval) show the effect when Nasdaq's quote returned. There were two significant gaps in quotes (for all exchanges) and 1 significant gap in trades.

Note how the gap in trades is not at the same time as the gaps in quotes.

Note how the gap in trades is not at the same time as the gaps in quotes.

Chart 11. All bids and offers color coded by exchange.

Chart 12. All trades color coded by exchange.

The next chart (5 millisecond interval) shows the result of the blast in trades and quotes when Nasdaq's quote returned. Trades printed at least 900 milliseconds before quotes, an impossibility if orders are being routed according to regulations. We have jokingly referred to this anomaly asfantaseconds.

Chart 13. Nasdaq bids and offers (triangles), Nasdaq trades (circles) and NBBO (gray/yellow/red shading).

The next 2 charts (500 millisecond interval) detail the HFT Tractor Beam area where coincidentally or not, Nasdaq quotes began "sputtering" right before stopping for about 2 hours.

Chart 14. NBBO Spread and quote rate from all exchanges. Note the flat lines at the bottom. Also note how the quote rate (lower panel) surges when prices rise above the flat line, which is what we would expect. However, on Nasdaq (next chart)..

Chart 15. NBBO Spread and quote rate from just Nasdaq. When prices rise above the flat line, quotes from Nasdaq stop, exactly opposite of expected behavior and what we see from other exchanges at that time (see chart above).

http://www.businessinsider.com/morgan-stanley-facebook-ipo-2012-5

NEW YORK (Reuters) - Lead Facebook Inc underwriter Morgan Stanley took a bet earlier this week when it increased the size of the social networking firm's $16 billion initial public offering and it boosted the price.

Thanks to massive hype surrounding Facebook's historic public offering, the wager looked safe. But a rocky first day of trading has raised questions about whether it paid off.

After a delayed start to trading, Facebook's shares spent much of the day struggling to stay above the $38 IPO price - and ended with just a 23-cent gain.

As a result, Morgan Stanley may have spent billions of dollars to support the stock price by buying shares in the market. Some market participants said that the underwriters had to absorb mountains of stock to defend the $38 level and keep the market from dipping below it.

The firm did this by tapping into a 63 million share over-allotment option, or greenshoe, according to sources familiar with the deal.

As an indication of the cost, had Morgan Stanley bought all of the shares traded around $38 in the final 20 minutes of the day, it would have spent nearly $2 billion. Underwriters are not obligated to prop up a stock on debut, but typically do.

Morgan Stanley declined to comment.

The debut marks a rare stumble for a high-profile IPO. Facebook is the only recent U.S. internet listing not to enjoy a large price jump on its first day of trading. LinkedIn <LNKD.N>, Groupon <GRPN.O> and Pandora Media <P.N> all saw significant gains at their public debuts.

The debut also underscores Morgan Stanley's go-it-alone handling of the offering process. Though 32 other underwriters signed on to the deal, Morgan Stanley retained tight control over information, decisions and allocations of shares, according to other underwriters.

To be sure, Morgan Stanley's strong approach may have been crucial to managing such a large, high-profile offering with so many underwriters. And the fact that the stock didn't soar on its first day means they achieved full value for their client.

Some issues were beyond Morgan Stanley's control. Glitches at the Nasdaq stock exchange delayed the start of trading by 45 minutes, and throughout the day many investors did not receive confirmations that their orders had been completed, brokers at Morgan Stanley, Raymond James & Associates and others said. That uncertainty about their positions may have prompted some investors to sell, worsening the downward pressure on the stock.

Nasdaq posted a notice late in the day saying that orders entered for the stock before trading started "resulted in nothing being done" and offering to match orders if customers send in requests by Monday. Sources said the exchange was working through the weekend to deal with the botched trades.

Facebook also altered its guidance for research earnings last week, during the road show, a rare and disruptive move.

In many ways, the deal is a crowning moment for Morgan Stanley. When it won the coveted role as Facebook's primary underwriter for its IPO, veteran technology banker Michael Grimes managed to convince executives at the social media giant that his bank would single-handedly control the process.

And as Grimes, co-head of global technology investment banking, boarded a Bombardier Global Express jet at Mineta San Jose International Airport with Facebook executives last week along with Morgan Stanley Internet banker Marcie Vu -- according to documents obtained by Reuters -- he had effectively accomplished his goal.

Successfully pulling off one of the largest IPOs in U.S. history would underscore Morgan Stanley's status as the top underwriter for tech offerings and set it above arch rival Goldman Sachs <GS.N>, with total global proceeds last year of $2.2 billion, according to Thomson Reuters data. But even with high profile deals like LinkedIn and Zynga<ZNGA.O> under its belt, Morgan Stanley had to be careful.

And so the bank led a highly secretive, tightly controlled process in which other institutions -- including top underwriters JPMorgan Chase & Co <JPM.N> and Goldman -- were effectively shut out.

"There was some frustration by JPMorgan and Goldman, as they were getting limited information. They thought they would be more inside the process," one source close to the matter said.

Goldman Sachs declined to comment. JPMorgan did not return calls seeking comment.

For its efforts, Morgan Stanley will receive 38 percent of the overall IPO fees, about $67 million, which is more than JPMorgan and Goldman combined, according to regulatory filings.

But more importantly, Morgan Stanley was the only bank actively talking to investors on the deal and able to pull the order book together, a rare feature for IPOs where top underwriters typically split the work more evenly.

At one of the venues during the investor roadshow, dozens of fund managers congregated at the St. Regis Hotel in New York including Neuberger Berman, SAC Capital Advisors LP, Soros Fund Management LLC, Tiger Global Management LLC and Och Ziff Capital Management Group LLC, trying to get a piece of the pie, according to the sources.

Representatives for Neuberger Berman, Tiger Global and Och Ziff declined to comment. The other funds were not immediately available for comment.

With almost all 33 Facebook underwriters kept in the dark about the deal, including additional changes to terms such as pricing range and IPO size, one underwriter called the process the "Morgan Stanley show" while another underwriter said the bank is "essentially running it by themselves."

JPMorgan pulled out all the stops when Facebook executives visited its New York headquarters. A Facebook-branded flag adorned the building and the bank gave out Facebook baseball hats and coffee cup holders. But the moves "mostly attracted press," said one source.

Facebook Chief Financial Officer David Ebersman and VP of Finance & Treasurer Cipora Herman were the primary executives working with underwriters, a separate source close to the matter said. Facebook Chief Operating Officer Sheryl Sandberg also remained actively involved.

Ebersman had been very thorough in his thinking throughout the process, one of the sources close to the matter said, considering everything from the more transparent Dutch Auction process that Google Inc <GOOG.O> used to a directed shares program. In the end, Facebook decided it wanted a traditional IPO process.

Their thought was to "bring in the right shareholders" as part of the IPO process and not get tangled up in other strategies that would be disruptive to the running of Facebook's business, the source said.

Zuckerberg was less involved, and also chose not to attend a majority of the roadshow stops last week, other than a brief appearance in his trademark hooded sweatshirt on May 7 at the Sheraton Hotel in New York and then again in Palo Alto that Friday.

The roadshow -- in which Zuckerberg was treated less as CEO and more as rockstar -- only lasted nine days rather than the typical 12.

Security was so tight that in New York attendees were asked for multiple forms of identification and were cross- checked against a list of names. According to one source, even one of Morgan Stanley's equity sales heads had difficulty entering the roadshow lunch because his name was accidentally left off of the list.

Until late Thursday night, co-managers were still left in the dark about their allotments and if they were even going to get shares, said one underwriter who preferred anonymity because the talks are private.

"Everything was very hush hush," he said.

and....

http://www.businessinsider.com/facebook-earnings-guidance-2012-5

Part way through the Facebook IPO roadshow, scattered reports appeared that Facebook had reduced the earnings guidance it was giving research analysts.

This seemed bizarre on a number of levels.

First, I was unaware that Facebook had ever issued any earnings guidance--to research analysts or anyone else.

Earnings guidance is highly material information (meaning that any investor considering an investment decision would want to know it). It represents a future forecast made by the company. Any time any company gives any sort of forecast, stocks move--because the forecast offers a very well informed view of the future by those who have the most up-to-date information about a company's business.

So if Facebook had issued any sort of guidance, even quietly, this should have been made very public by the company and its bankers--especially because millions of individual investors were thinking of buying the stock.

Second, if Facebook really had "reduced guidance" mid-way through a series of meetings designed for the sole purpose of selling the stock this would have been even more highly material information.

Why?

Because such a late change in guidance would mean that Facebook's business was deteriorating rapidly--between the start of the roadshow and the middle of the roadshow.

Any time a business outlook deteriorates that rapidly, alarm bells start going off on Wall Street, and stocks plunge.

So the report that Facebook had "reduced earnings guidance" during the roadshow just seemed like a typical misunderstanding between Wall Street and the public--something lost in translation between what a reporter was hearing from sources and what actually made it into print.

But now Reuters has just reported the same thing again. Here's a sentence from a story Reuters just published on the IPO:

Facebook also altered its guidance for research earnings last week, during the road show, a rare and disruptive move.

Hmmm.

If this really happened, anyone who placed an order for Facebook who was unaware that 1) Facebook had issued any sort of earnings guidance, and 2) reduced that guidance during the roadshow, has every right to be furious.

Because this would have been highly material information that some investors had and others didn't--the exact sort of unfair asymmetry that securities laws are designed to prevent.

This seems so obvious that I'm still very skeptical of the report. I'll now look into it. In the meantime, if anyone knows what Facebook did and didn't tell analysts, I'd be grateful for your help. (hblodget@businessinsider.com).

No comments:

Post a Comment