Evening Wrap ......

Europe In Focus ......

Greek bonds extended losses ahead of Thursday’s Eurogroup meeting http://bloom.bg/1RlzhK0

Excellent missive on Greece's pensions - political third rail & gordian knot.

Greek farmers ramp up motorway blockade over pension reforms http://dlvr.it/KSVxVJ

Greece: NATO migrant patrols in Turkish waters http://dlvr.it/KSTbcj

If this represents thinking at DB re: "Saving The Banks" , you will need "mother of all crisis" to ram this thru.

Liquid or not, Deutsche Bank is in hot water http://bit.ly/1LeShng

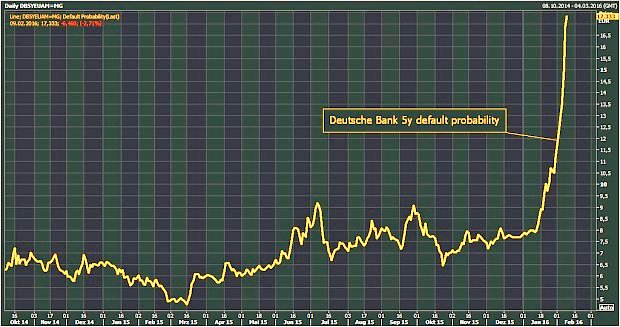

Markets are pricing Deutsche Bank debt already as junk.

Deutsche Bank CDS (credit default swaps) spike to levels not seen since 2008

The CoCo that popped. http://on.ft.com/1nZxvD6

My analysis of Deutsche Bank's reported figures last week does not support Cryan's assertion that it is "rock solid" http://www.forbes.com/sites/francescoppola/2016/02/02/bad-results-foreshadow-a-gloomy-future-for-deutsche-bank/ …

Cameron's debate absence could boost Brexit, pollster warns http://www.express.co.uk/news/politics/642423/Cameron-Brexit-poll-debate …

I'm a Europhile but here's why I'm heading for the #Brexit door http://www.drsarah.org.uk/sarah's-blog/

David Cameron 'asked for too little' on Brexit http://tgr.ph/u0igBw

People are brilliantly mocking David Cameron's Brexit scaremongering http://i100.io/8OKkpbP

A Grexit-Brexit perfect storm? Read Brussels Briefing. http://on.ft.com/20lvHAd @alexebarker

Cameron must not fudge hard-line eu negotiation – yahoo finance uk: The EU is an institution mired in c... http://bit.ly/1T2vr8G #money

"Unsustainable" Debt: S&P Cuts @Chesapeake Credit Rating to CCC http://bloom.bg/1KD6gs3 via @jcarrollchgo @jodixu

API inventory build +2.4MM, Cushing +715K, Gasoline Inventories +3.1MM

Crude Confused After API Reports Across-The-Board Inventory Builds http://www.zerohedge.com/news/2016-02-09/crude-confused-after-api-reports-across-board-inventory-builds …

-- Vitol Predicts Oil Stockpiles Will Keep Growing Amid Surplus

-- Goldman Sachs Says Crude Prices Could Drop `Into the Teens'

March 2016 K for WTI ends lower by $1.75 -at $27.94 ! . 4th consecutive losing session.

#Russia Ruble weakens towards 80 per Dollar as oil drops >6%.

Lavrov: U.S. considering Russian proposal on Syria http://ara.tv/4t3ma

Kuroda, bail-ins and cocos are powering the doom loop of 2016 http://www.telegraph.co.uk/finance/economics/12149114/Europes-doom-loop-returns-as-credit-markets-seize-up.html …

David Stockman: Chart Of The Day: Why Banks Stocks Are Cratering——It’s The 2-10 Spread Going Flat http://ift.tt/20J8m0I

Share price change since start of year.

HSBC: -19%

Barclays: -27%

JP Morgan: -17%

Citigroup: -27%

Bank of America: -28%

Deutsche Bank: -39%

What happens after refugees arrive in Greece? http://econ.st/1nUThHM

"We must now consider the prospect of the end of the EU as we have known it" – Hans-Helmut Kotz http://bit.ly/1VyVVxJ #refugeecrisis

'We can open doors to Greece, Bulgaria, put refugees on buses' - Erdogan quoted telling EU http://on.rt.com/7432

Number of migrants reaching Europe by sea soars 10-fold: migration agency http://bit.ly/1KCK3du

Terrorism fears and refugee crisis secure profits for Swedish security firm http://www.thelocal.se/20160209/terrorism-fears-secure-profits-for-swedens-securitas … #securitas

RT FT : European banks are uneasy over deeper negative interest rates http://on.ft.com/1RnnqLE

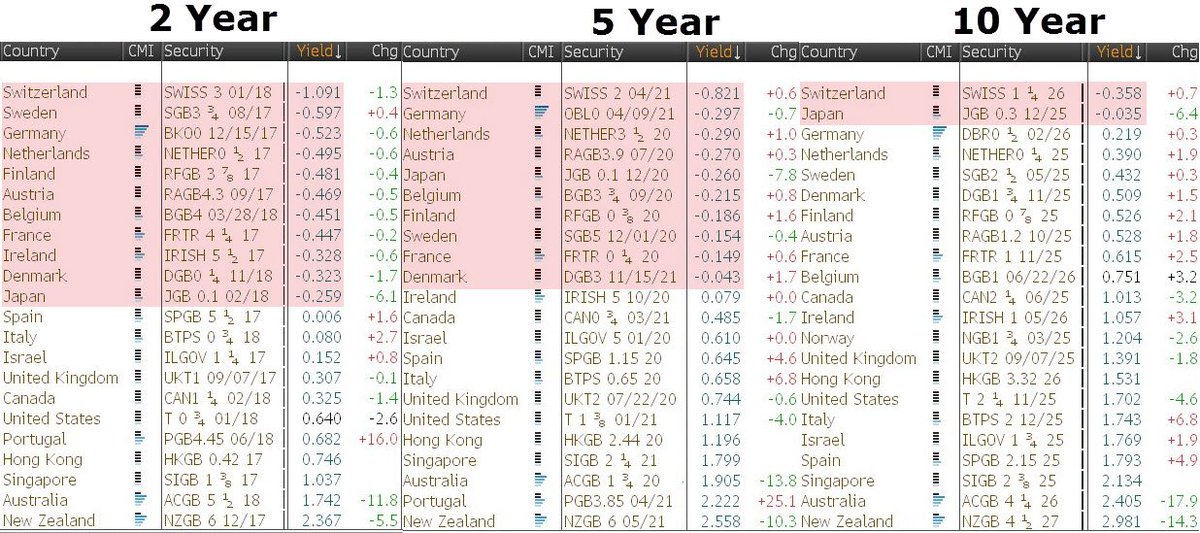

New all-time yield lows today in

Sweden

Germany

Netherlands

Finland

Austria

Belgium

France

Japan

Your move, Yellen

Chart: 10y JGB yield -

NIRP

Japan 10-year yield currently -0.004% #NIRP

Ian Fraser

Ian Fraser

No comments:

Post a Comment