Evening wrap.....

Citi "Resizes Infrastructure" Post Fed Rate Hike - Slashes 2,000 Jobs http://www.zerohedge.com/news/2015-12-18/citi-resizes-infrastructure-post-fed-rate-hike-slashes-2000-jobs …

Ministry starts confiscating money from debtor accounts http://dlvr.it/D2yPWc

Nugget of secret Norwegian report , which gives credence to prior ISIS - Turkey links regarding oil trade.

Here's the EU summit full communique - migration, terrorism, UK, EMU, Syria, Libya etc http://www.consilium.europa.eu/en/press/press-releases/2015/12/18-euco-conclusions/ …

#BREAKING Argentina stock exchange plunges 6.28 percent - AFP

WTI afternoon swoon drove price down to $34.29 before support at $34.20 held . For now.

Weidmann: Greek debt relief is not urgent http://dlvr.it/D2x9sT

Oil drops to 6y low as rising Rig count seen adding to glut. Crude stockpiles highest for this time of yr since 1930

Previously drillers waited for a price rebound to boost production. Now, they just boost production.

The payback: why Kiev will be forced to pay Russia what it owes http://sptnkne.ws/arXc #UkraineDebt

EU ambassadors has taken the 1st step to extend economic sanctions on #Russia. the decision should be finalized at Monday noon. #Ukraine

Poland’s new government raided NATO counter-intelligence offices in the middle of the night

http://qz.com/577452/polands-new-government-raided-nato-counter-intelligence-offices-in-the-middle-of-the-night/ …

Nice overview on the looming Election...

German Spy Agency BND allegedly cooperating with Syrian Secret Police , sharing Intel on extremist jihadists.

Ukraine halts $3bn Russia debt repayment [In Nov, Russian energy supplier Gazprom halted gas supplies to Ukraine] http://www.bbc.com/news/business-35132258 …

Morning items.....

Overview.......

Morning Note: 1. BoJ wants to buy even more ETFs. 2. Ugly China beige book. 3. WTI sinks below $35

Europe......

And @GoldmanSachs says there are "high risks" that #oil prices may have to drop to $20 a barrel to force production to shut down

Russian Market RTS -3.19%

Crude 34.49

Ukraine default

Oil heading towards $30

Merkel optimistic Turkey will cut migrant flows to Europe http://reut.rs/1RUTG8t via @Reuters

French President Hollande signals readiness for compromise "to take into account UK specificity" http://openeurope.org.uk/daily-shakeup/merkel-raises-prospect-of-eu-treaty-change-at-later-stage-to-accommodate-uk-demands/ … #EUCO

Cameron: Four-year ban on in-work benefits for EU migrants "remains on the table" http://openeurope.org.uk/daily-shakeup/merkel-raises-prospect-of-eu-treaty-change-at-later-stage-to-accommodate-uk-demands/ … #EUCO

Ukraine says it can’t repay debt to Russia http://on.rt.com/6zur

BREAKING: Number of refugees entering Europe for 2015 to exceed a million next week, according to International Organisation for Migration

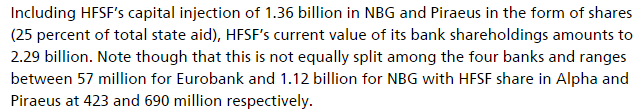

€41b, 22% of GDP, in banks is #Greece's biggest single investment. Currently is worth €2.3b http://www.macropolis.gr/?i=portal.en.economy.3461&itemId=3461 …

Juncker’s top aide under fire over misleading refugee statistics http://openeurope.org.uk/daily-shakeup/merkel-raises-prospect-of-eu-treaty-change-at-later-stage-to-accommodate-uk-demands/#section-6 …

EU summit makes little progress on tackling migration crisis http://openeurope.org.uk/daily-shakeup/merkel-raises-prospect-of-eu-treaty-change-at-later-stage-to-accommodate-uk-demands/#section-5 …

Belgian PM: UK talks were 'step in right direction' https://euobserver.com/tickers/131594

#Switzerland has now discovered the unintended consequences of negative interest rates. http://read.bi/1OyXBCD

A random walk down in the #Euro. Common currency weakens w/ no good reason to explain.

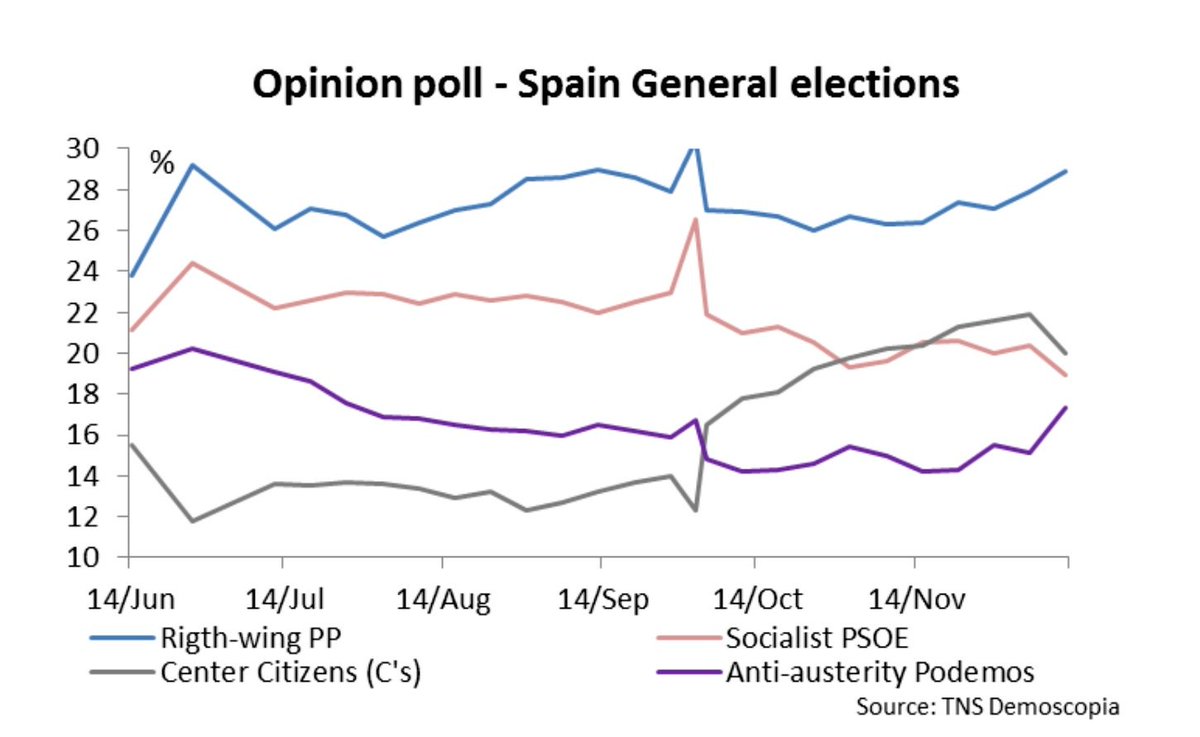

Spain will go to polls this Sun to elect new govt. Markets look relaxed as market friendly parties leading the polls

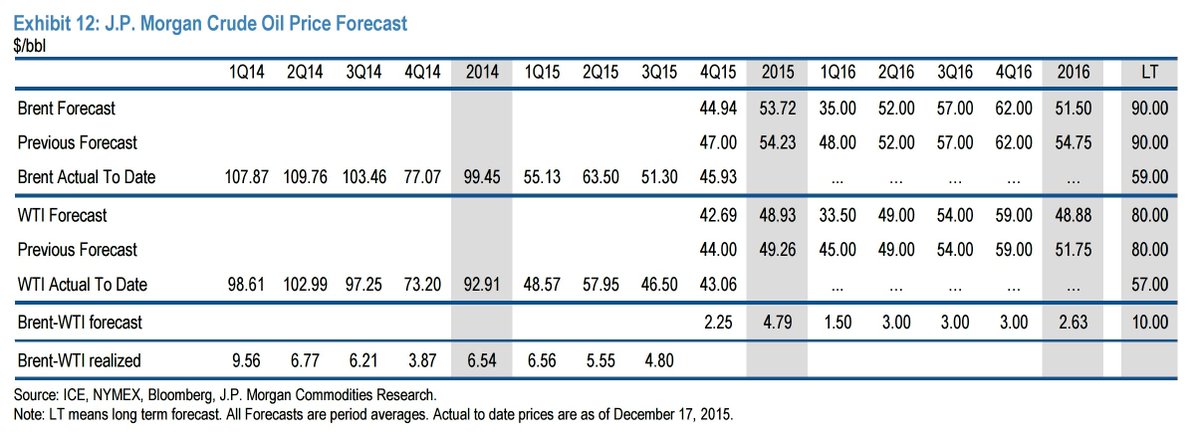

JPMorgan cuts 1Q16 #oil price forecasts significantly: Brent to $35/bbl from $48/bbl, WTI to $33.50/bbl from $49/bbl

Fed euphoria fades: #Germany's Dax trades 0.7% lower after open.

Renzi urged European socialists to unite against German power ~@Reuters source http://reut.rs/1Zfl7w3

EU Socialists against SPD? Huh.. Never!

Asia and Emerging Nations.........

China Beige Book makes for grim reading. Is done in NYC but is also 2100 Ch company survey. So there. http://www.bloomberg.com/news/articles/2015-12-17/china-beige-book-shows-disturbing-deterioration-on-all-fronts-iiaunzjp …

- China Beige Book: never been worse

- MNI China Business Indicator: 5.6% rebound in December from 49.9 to 52.7

Ok then

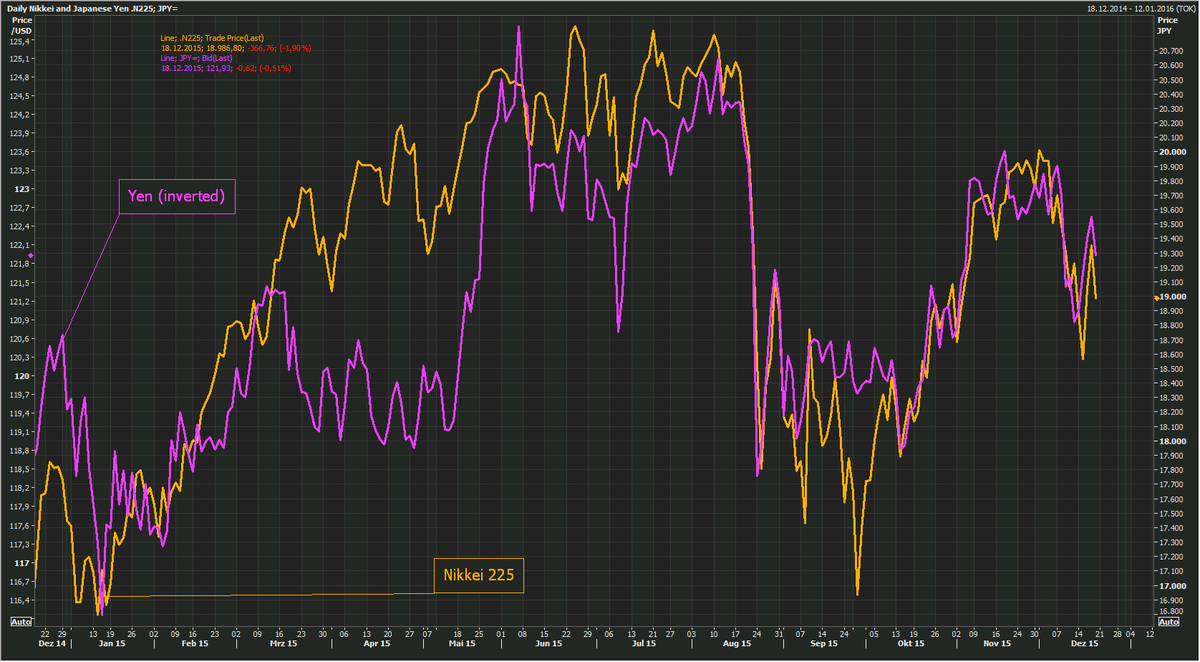

Nikkei ends down 1.9% at 18986.80 and Yen strengthens despite BoJ announcing plans to increase ETF purchases.

Bank of Japan's $2.5bn ETF boost seen having little impact on stocks. Nikkei returned to neg http://bloom.bg/1Pa65D0

Good morning. Asia stocks took their cue from Wall St & slipped. Nikkei returned to neg despite BoJ stimulus expan.

Venezuela Vs Reality

Downgrade Points To Continued Brazil Underperformance

China Just Ended the Dollar Peg (…For The Most Part)

Meet The Press: Vladimir Putin’s Annual News

Conference http://emergingequity.org/2015/12/18/meet-the-press-vladimir-putins-annual-news-conference/ …

The Fed Hikes Rates — What Next For Emerging

Javier Blas

Javier Blas

No comments:

Post a Comment