Overview ........

Morning Note: 1. Trading pain at JPMorgan. 2. Federal Reserve board divided. 3. China lowflation

Refugee crisis.....

#migration EU setting up 'centres for identification and expulsion'. 'People are not allowed to leave them' - commission official

#Timmermans: To be blunt, the member states will have to do as they've promised on #migrationcrisis in September.

23% of Turkish asylum seekers have their claims recognised in EU countries. Safe?

#Timmermans: High time for the EU MS to match Commission's financial commitments to tackle #migrationcrisis.

#Timmermans: We will assess situation in Greece by end of Nov, so that Dublin can be applied again. #migrationcrisis

#Timmermans: Commission will soon put out a statement on the temporary reintroduction of border controls by some countries. #migrationcrisis

Worked intensively with Italians&Greeks 2 establish hotspots.Fully operational in Lampedusa, next week Lesvos says

@TimmermansEU

#Timmermans: All EU needs to work together - urgently need experts to assist at the 'hotspots' on front line counties. #migrationcrisis

#Timmermans: We need to see a substantial number of relocations take place each month. #migrationcrisis

#Timmermans: First EU relocation of aslyum seekers have taken place, as well as return flights for economic migrants.

#Timmermans: Response to #migrationcrisis cannot be a piecemeal. Measures to be enforced at the EU level, national & local levels.

#Timmermans: Guarding external borders has to be stepped up - COM believes that European Coast guard would be a contribution to that.

#Timmermans: Reform of Dublin necessary - when Dublin came about, the current #migrationcrisis was not envisioned.

Broader Europe.....

German government lowers 2015 #GDP forecast to +1.7% (prev. +1.8%), 2016 prediction unchanged at +1.8%. #Inflation forecast: +0.3% (2015)

2,000 protest in Barcelona over legal action against self-rule vote: Mayor Colau leads demo http://cort.as/YEl-

Notice german debt going negative again ! 5 year bund sold at -0.03 today

HRADF says Fraport, preferred bidder 4 regional airports, renewed its offer, concession agreement expected to be signed by year-end. #Greece

Apart from that..... #Greece

Eurozone August industrial production -0.5%, matching consensus

#Sweden | *SWEDEN DEMOCRATS REQUEST NO CONFIDENCE VOTE IN FINANCE MINISTER

German MPs are standing up to Merkel. I don't recall this happening with the eurocrisis or her failing #energiewende

#Italy | Aug General Government Debt: €2.18T v €2.199T

UK Unemployment 5.4% Vs est 5.5%. Average weekly earnings 3% Vs est 3.1%

Officially confirmed: enough signatures for Dutch referendum on EU-Ukr Treaty (Q1or2 2016) http://www.rtlnieuws.nl/nieuws/binnenland/geenpeil-referendum-over-europees-verdrag-komt-er … http://openeurope.org.uk/blog/what-to-make-of-the-dutch-referendum-on-the-eu-ukraine-association-agreement/ …

#Russia Ruble weakens as recent oil rally turns out to be a 'dead dog bounce,' as Citi puts it.

NBG expects #Greece GDP to contract 2.1% in Q3, 5.3% in Q4 & 1.3% in 2015, sees recession of 1.2% in 2016. #economy #ec #imf #ecb #banking

#Spain | Sept Spanish Banks ECB borrowings at €135.8B

*EU OFFICIAL SAYS ONE-DAY SUMMIT TO FOCUS ON MIGRATION CRISIS.

U.K. ISSUE, FUTURE OF EURO ALSO ON SUMMIT AGENDA

LEADERS TO WORK ON U.K. REF.

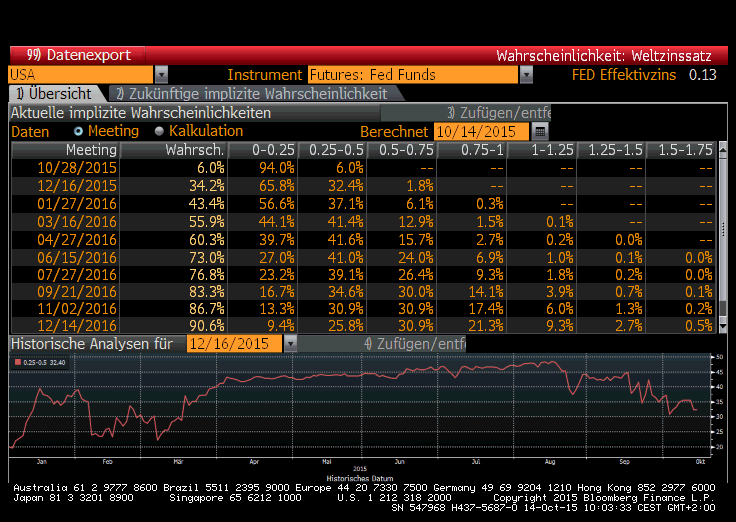

.@GruenbergAngela Euro driven by delayed Fed lift-off expectations. Markets see 1st rate hike by mar2016 meeting.

#Euro creeps up and now trades near session high of 1.1413 w/ no news behind the move.

#EC says @pierremoscovici visit to Athens is postponed due to 'very serious family matters'. #Greece #politics

#Spain | SEPT FINAL CPI M/M: -0.3% V -0.3%E; Y/Y: -0.9% V -0.9%E

#France | SEPT CPI M/M: -0.4% V -0.4%E; Y/Y: 0.0% V 0.1%E

#Finland | Sept CPI M/M: 0.1% v 0.2% prior; Y/Y: -0.6% v -0.2%

Asia , Emerging Markets......

#China | One of the big 4 Chinese automakers..FAW CAR EXPECTS 9-MO. NET TO FALL UP TO 96% ON YEAR; 3Q NET LOSS OF UP TO 154.2M YUAN

#Crude | *MAERSK SAID TO SELL DEC. AL-SHAHEEN OIL AT $1.60-$2/B DISCOUNT

#China | PBOC TO EXTEND TRADING HOURS IN DOMESTIC FOREIGN EXCHANGE MARKET TO 15:30 GMT (23:30 CHINA TIME) - RTRS

#India | SEPT WHOLESALE PRICES: -4.5% V -4.4%E

#China | *CHINA JAN.-SEPT. COTTON IMPORTS DROP 42% ON YEAR: REUTERS

#Japan | *JAPAN SAYS ECONOMIC WEAKNESS SEEN, FIRST CUT IN VIEW SINCE 2014

#Singapore | Q3 ADVANCED GDP Q/Q: +0.1% V -0.1%E; Y/Y: 1.4% V 1.3%E

#Japan | SEPT CGPI (PPI) M/M: -0.5% V -0.4%E; Y/Y: -3.9% V -3.9%E

Debt-fueled trading drove boom & bust in #China stocks. Now strategy has shifted to bonds. http://www.wsj.com/articles/debt-fueled-bond-buying-in-china-raises-concerns-1444764862 …

#China | MoF sells 10Y bonds at 2.99% v 3.10%e (lowest yield since Dec 2008)

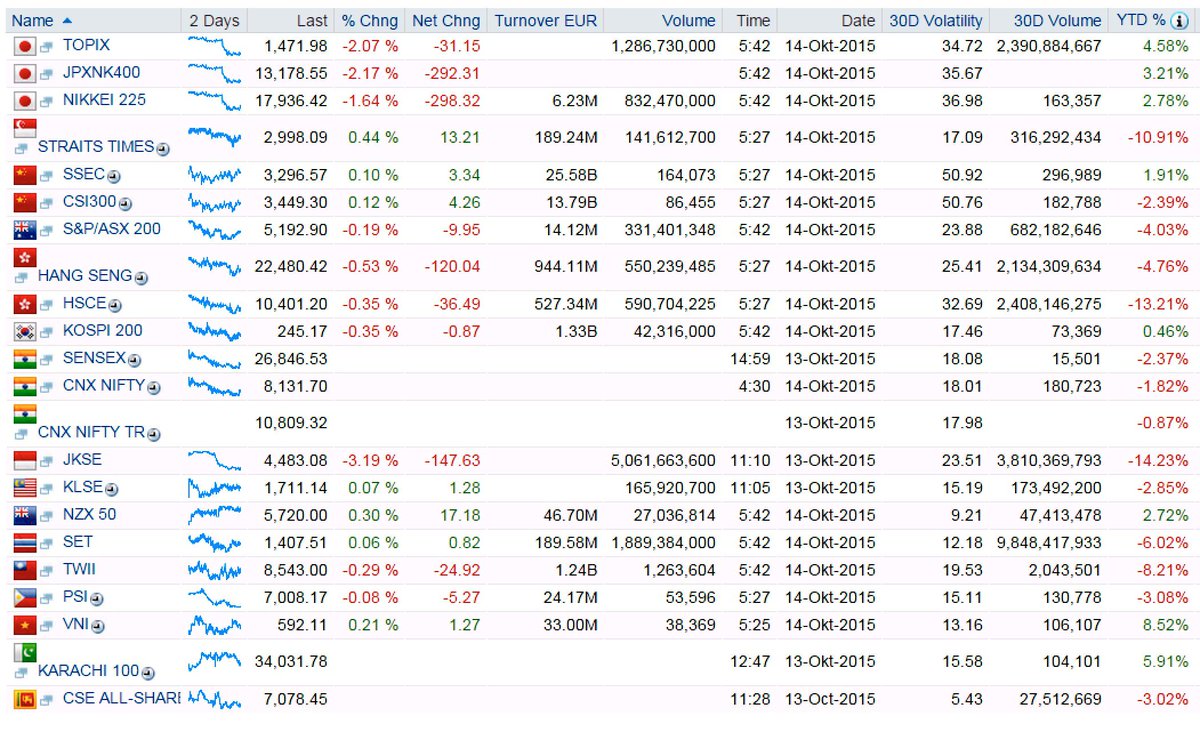

Wednesday session started on a ‘risk off tone” after deflationary numbers from #China. Nikkei ends down 1.9% at 17891

#China | SEPT PPI Y/Y: -5.9% V -5.9%E; (43RD MONTH OF DECLINE)

China September un-inflation, more of the same. Dumpling index (pork/veggies) slowed, PPI contracted for 44th month.

Goldman Sachs Entangled in Scandal at Malaysia Fund 1MDB http://on.wsj.com/1VRL5SJ

#China | SEPT CPI Y/Y: 1.6% V 1.8%E; Rate of growth slowed for first time in 4 months

Brazil's Next Big Crisis Is Scaring Bankers and Wiping Out Jobs http://bloom.bg/1K7Ckgh

The Next China Default Could Be Days Away as Steel Firms Suffer http://bloom.bg/1ZBGAjL

#China remains biggest exporter of deflation. Sep producer prices extend slump for 43rd month http://reut.rs/1ZBJJA8

Good Morning from Berlin. Asia mkts down as deflationary pressure from China rises. Producer prices drop for 43rd mth

#Venezuela says 8 non-OPEC nations have been invited the next OPEC meeting on Oct21in Vienna. http://reut.rs/1Mpflz3

No comments:

Post a Comment