Morning Tweets.......

Broader Europe.....

How Spain halted the flow of migrants from Mauritania to the Canary Islands http://cort.as/XUxY by @fperegil

It seems Britain's EU referendum may not happen before 2017 after all

http://uk.reuters.com/article/2015/09/22/uk-britain-eu-hammond-idUKKCN0RM2KJ20150922 …

#Cataluña election on Sunday. Pro-independence alliance polling @ >38%, while Ciudadanos & Podemos-linked coalition fight for 2d place. #27S

UKRAINE RATINGS CUT TO SD FROM CC BY S&P

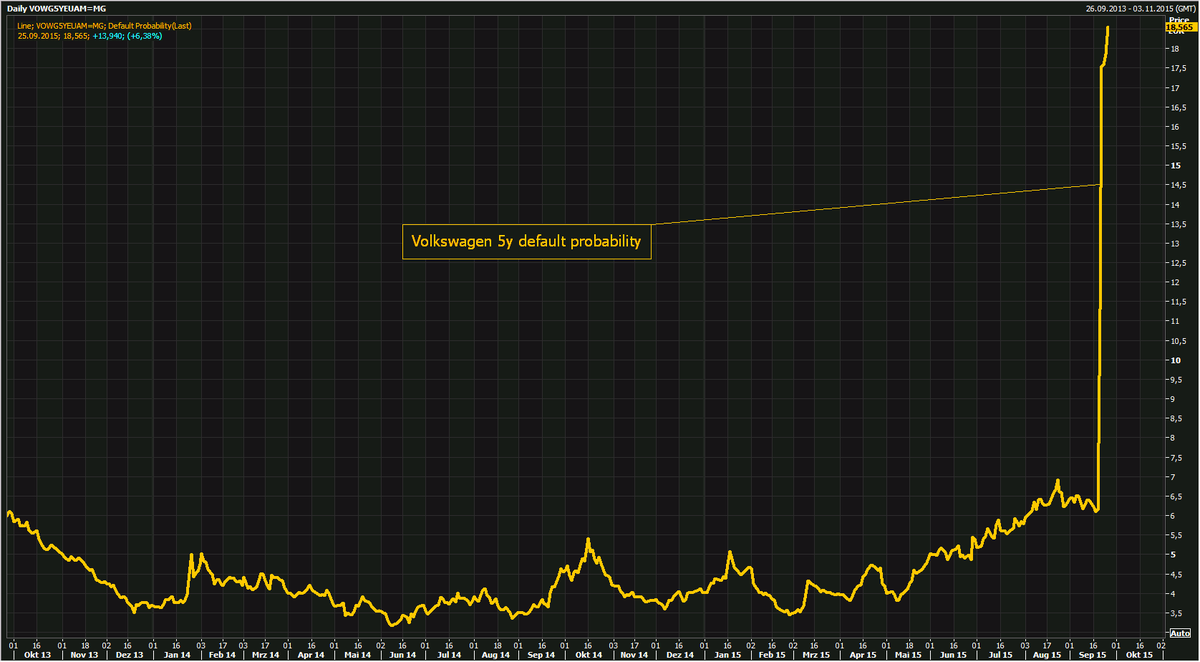

VW ABS said to be cut from Bank of France offer list as VW default probability jumps >18% .http://bloom.bg/1KU3lcq

#Volkswagen Said to Manage Faked Test Results From German Offices, BBG reports citing sources. Shares down >5%.

#BREAKING: Germany's Dobrindt: 2.8 million cars in #Germany affected in #VW scandal http://dw.com/p/1GdcY

BREAKING: Croatia lifts border blockage with Serbia amid #MigrantCrisis http://sptnkne.ws/NC2

Tusk to set terms for next stage of UK negotiations http://www.politico.eu/article/tusk-to-set-terms-for-next-stage-of-uk-negotiations/ … via @POLITICOEurope

Bank of England warns buy-to-let is the next big threat to UK financial stability | via @Telegraph http://www.telegraph.co.uk/finance/bank-of-england/11890392/Buy-to-Let-economic-stability-Carney-Bank-of-England.html …

1m immigrants get permanent lawful resident status annually in US. Could Europe do the same? http://bru.gl/1YEXE83 )

Females in labour force for every 100 males

France: 88

Russia: 87

US: 86

UK: 85

China: 84

Japan: 75

Indonesia: 62

India: 36

Iran: 23

(WEF)

Austerity is a cover story for class war, says Yanis Varoufakis #peoplecull http://www.independent.co.uk/news/uk/politics/austerity-is-being-used-as-a-cover-story-for-class-war-against-the-poor-yanis-varoufakis-says-10516247.html …

VW’s cheating is just the tip of the iceberg http://ow.ly/SEVzP

No ECB Funding for Catalan Banks? Wait a Second http://ow.ly/SEUwo

Hungary erects more border fencing - with what appears to be razor wire.

‘If we cannot solve this, Schengen is over’: Hungarian PM’s insights into EU migrant policy http://on.rt.com/6s8o

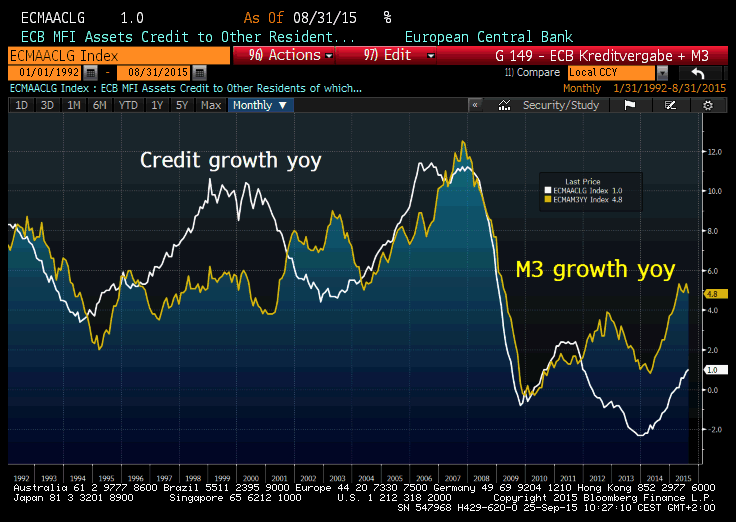

#Eurozone private sector loans nudge forward. Increased by 1% in Aug vs 0.9% in Jul but still lags M3 growth.

Greece......

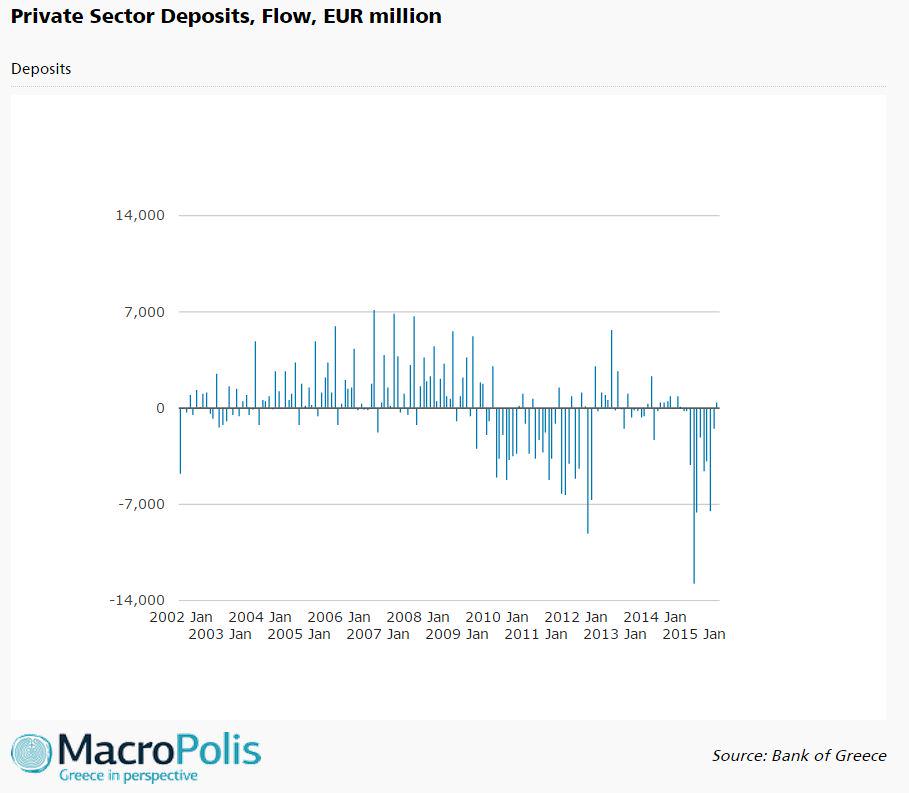

#Greece cap controls halt exodus after banks lose €43bn. Savings rose for 1st time in 11mths. http://bloom.bg/1KGBFEb

Lagarde list probe has yielded 80 million euros for the state #Greece http://www.ekathimerini.com/201912

Greek bank credit eases 1.6 pct in August on slightly accelerating negative flow https://shar.es/17eAnQ #Greece

Greece sees deposit inflows of 449 mln in August for first time since Sept 2014 https://shar.es/17edbK #Greece #euro

Greece's Tsipras says reforms, debt relief are priority http://feeds.reuters.com/~r/Reuters/worldNews/~3/rgtr7pVTps0/story01.htm …

#Greece Putin to call Tsipras Friday evening. Will talk "congrats 2 elections", bilateral issues & check option for a meeting at UNGenAssmbl

Deadline for release of #Greece banks Q2 results extended by another month until end-Oct. #economy #banking #markets

Greek Islands To Be Stripped of Special VAT Status Beginning October 1st http://dlvr.it/CGKNvq #Greece

Asia and Emerging Markets....

Mish's Global Economic Trend Analysis: Tracking the Implosion of Brazil; Be Careful of What You Wish; Perf http://po.st/xzkg3K via @po_st

Rousseff tries to shore up position with offer to coalition ally - http://FT.com http://on.ft.com/1LC0p4J via @FT Deep trouble

Sur"real": Brazil's Currency Stages Largest Rally In Seven Years On Central Bank "Whatever It Takes" Moment http://www.zerohedge.com/news/2015-09-25/surreal-brazils-currency-stages-largest-rally-seven-years-central-bank-whatever-it-t …

This is a very, very unusual signal: when did you see a state-owned Chinese fund manager dumped a large domestic brokerage like this crazy?

State-owned Cinda raised over HK$1.5B from stock sale of CITIC, following Beijing's arrests of senior CITIC execs amid insider trading probe

BREAKING: China state asset manager Cinda dumps HK-listed stock of top brokerage CITIC, cutting its holdings to 5.94% from 10.36% originally

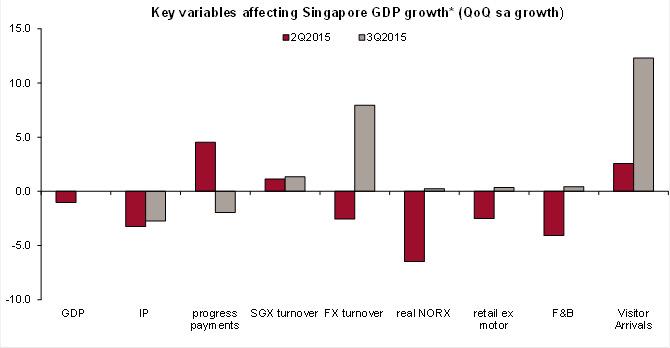

Components making up Singapore GDP growth- relatively strong services won't offset manufacturing slump- Credit Suisse

Singapore industrial production miss -7% y/y, broad-base weakness. CS: Q3 technical recession, Oct MAS easing likely.

Looking for some yield? Malaysia state comp Dollar Bonds slump to record, Yields jump to 9%. http://bloom.bg/1OxIGgJ

#Malaysia 5y default probability jumps >17% as fallout from investigation into state company spreads.

Nikkei closes up 1.8% at 17880.51 despite #Japan core CPI turned to negative for the 1st time since Apr2013.

#Japan PM Abe has pledged to expand econ by >20%. That looks fanciful w/ prices falling again http://www.breakingviews.com/21217801.article?h=0b2173149f326e9d30de68c1fe40b46d&s=2 …

The US’s tech elite assembled to meet China’s president—and posed for an amazing class photo http://qz.com/509654/tech-elite-assemble-to-meet-chinas-president-and-pose-for-an-amazing-class-photo/ …

Hours after President Xi began his state visit to USA in Washington DC, Chinese stock market began to sink nearly 2%, now below 3,100 points

No comments:

Post a Comment