Tweets....

Overview......

Morning Note: 1. Greece's midnight deadline. 2. BoE ZZZZzzz 3. China bans major stock holders from selling...

Broader Europe ....

OECD says Italian growth 'timid', youth unemployment 42.7%: GDP rises of 0.6% and 1.5% forecast for 2015, 2016 http://bit.ly/1UDVq6M

Italy stronger than 2012 says Padoan: Minister says reforms, return to growth offer protection http://bit.ly/1KWvyyt

HackingTeam software out of control: Firm says terrorists, extortionists can now use technology http://bit.ly/1HdDkPZ

The Spain Report retweeted

For Spain, Greek risk is political, not economic http://reut.rs/1IJrZM7 via @Reuters

Charging bulls injure five during Pamplona run http://bit.ly/1CqXZTW #Pamplona #SanFermin #SanFermin2015

PP prepares to battle Spanish left for young voters - emerging Ciudadanos also in its sights http://cort.as/UX3I

Greece

If there's an agreement with lenders by Sun, it may be worth more than €65 bln. The bill has soared https://shar.es/1qTe6c #Greece #euro

EU's Tusk says good agreement on Greece should convince parliaments http://dlvr.it/BSwwYz

Moscovici hopeful of a Greek deal http://dlvr.it/BSwxt6

Lafazanis says government will not accept third austerity package http://dlvr.it/BSt79x

ECB chief Draghi says Greece solution is 'really hard' http://dlvr.it/BSsJRT

100 German MPs Gathering Signatures for Grexit http://dlvr.it/BSvscx #Greece

Greek Gov’t: ‘We Believe We Will Have Positive Signs at the Eurogroup’ http://dlvr.it/BSvrBP #Greece

UN would struggle to cope with refugees in Greece if banks fail - @PatrickKingsley http://gu.com/p/4ag2e/stw #Greece #euro #refugeesgr

Juncker will meet Greek opposition leaders from New Democracy and To Potami leaders today and tomorrow

Nick Malkoutzis retweeted

Program of following days:#Greek proposals have to be in by midnight,assesement by 3 institutions til Saturday morning, EWG 10 am and EG 3pm

"Everything is going well. Will all happen very quickly even though some ppl try to sabotage deal," says coalition partner Kammenos #Greece

Manos Giakoumis retweeted

Will there be a deal on Sun or will Schaeuble say "Isch over"? @AntonWSJ & @MMQWalker on his differences with Merkel http://on.wsj.com/1UBEBcF

Manos Giakoumis retweeted

Manos Giakoumis retweeted

Manos Giakoumis retweeted

#Greece Apr seasonally adjusted Unemployment at 25.6% from rev 25.8% in Mar and 27% in Apr 2014 (ELSTAT). #economy #euro

Meeting of #Grece PM #Tsipras w/ Dep PM @YDragasakis, FinMIn @tsakalotos, Econ Min @g_stathakis & FM @NikosKotzias underway (via @amna_news)

What changed between Sunday [https://twitter.com/Reuters/status/616973059577282561 …] and today? More payments into system than expected?

Mehreen retweeted

At conference in Athens, Energy Minister Lafazanis insists gov't will not sign new MoU, says #Greece has other options. #euro

New Democracy, To Potami & PASOK sceptical of Tsipras's ability/commitment to seal an agreement with lenders #Greece #euro

We await #Greece's proposal. French team been sent to aid new Greek FinMin to prepare proposals which will meet w/ creditors’ demands (Citi)

ICBC: Tsipras could still get a deal done, but only after accepting a personally humiliating defeat at hands of Merkel & other EZ hardliners

ICBC's Efstathiou: #Greece’s fate is no longer in its own hands. After failed negotiations of past 6 mths, many EU leaders just want #Grexit

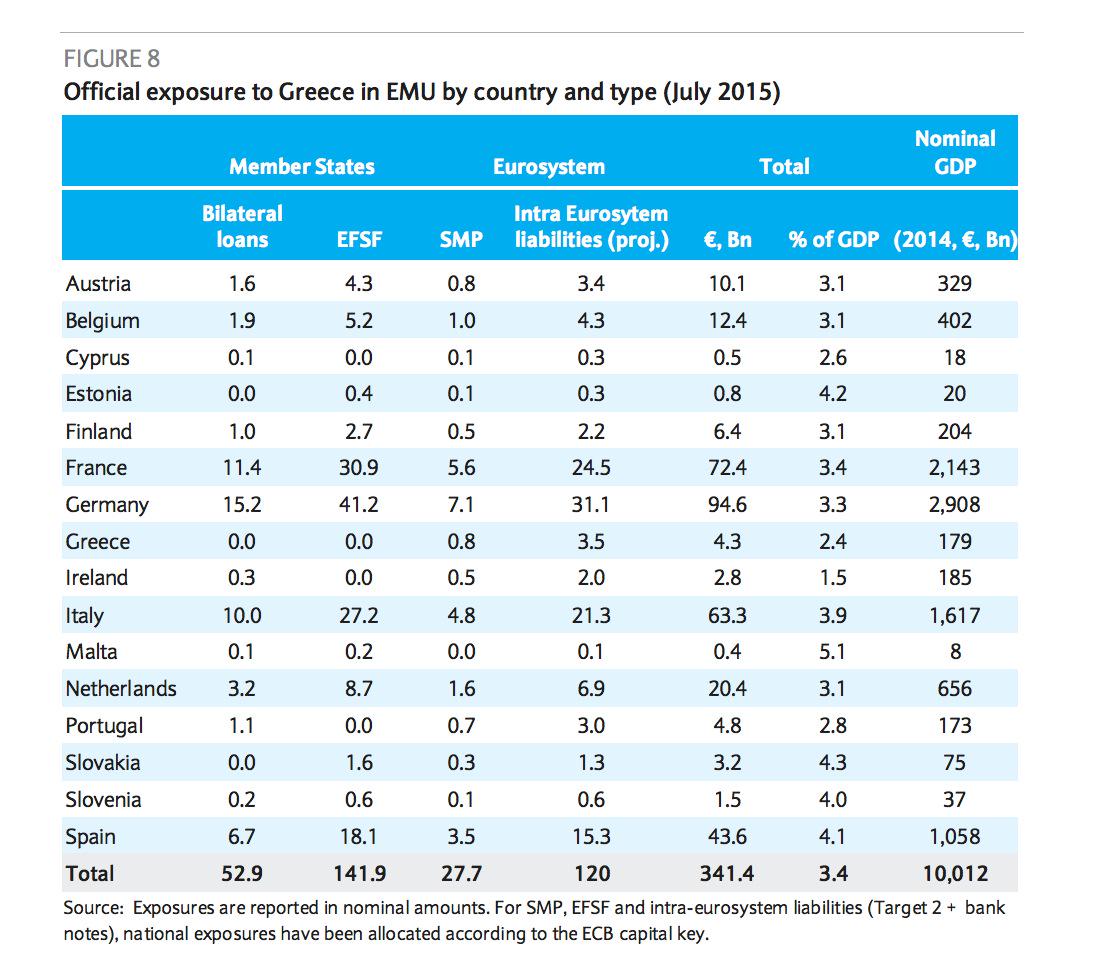

Noonan says #Greece owes #Ireland €350mln. (Lucky Ireland didn't participate in EFSF aid BUT Noonan forgets Target2)

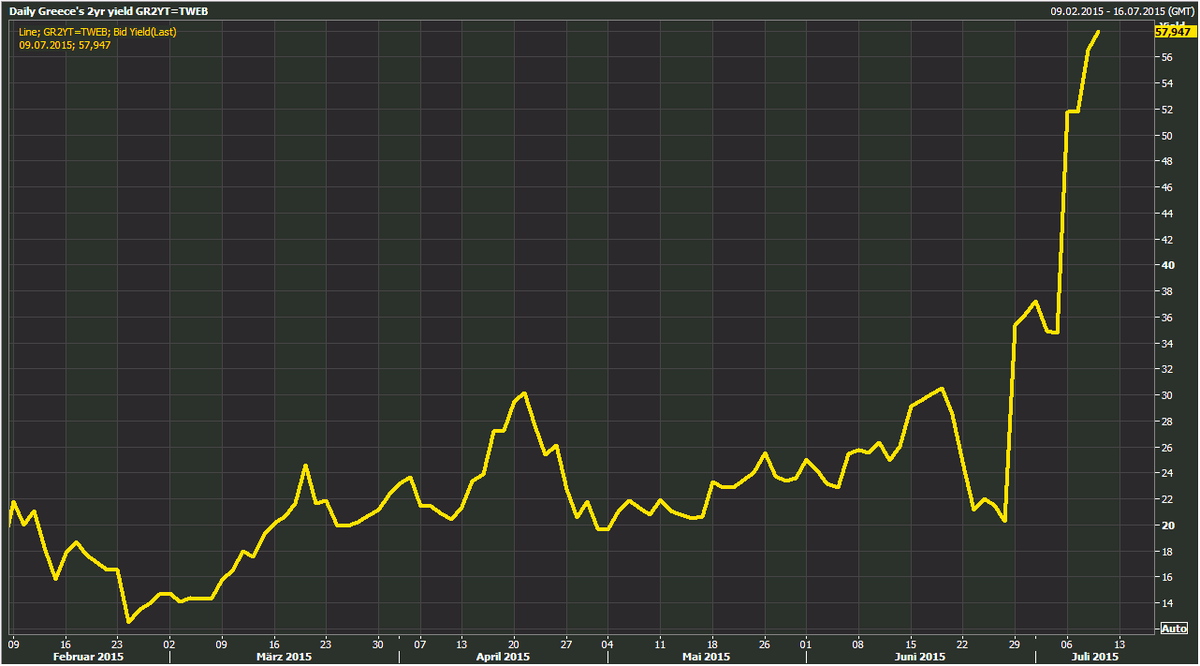

Contagion watch: Periphery yields drop while Bund yields rise. Portugese 10y risk spread over Bunds plunges.

Ratio of govt spending-to-GDP fell by most in Greece out of wider EU. Greek ratio dropped 10.7ppts to 49.3% (via BBG)

Buba's Weidmann: Need Greek Capital Controls Until Deal Reached, Solvency of Government, Banks Ensured.

Buba's Weidmann: Doubts About Solvency of Banks in #Greece 'Legitimate, Rising by the Day.'

Buba's Weidmann: Eurosystem Shouldn't Increase Emergency Lending to #Greece Until Deal Reached.

Julien Toyer

Julien Toyer

Eleni Varvitsiotis

Eleni Varvitsiotis  MacroPolis

MacroPolis  Nick Malkoutzis

Nick Malkoutzis

No comments:

Post a Comment