Kazimir mentions default for Greece and says "Euro members are ready to talk with Greece until last day"

Tweets....

Greece....

DIJSSELBLOEM: TOLD GREECE DEAL CAN'T BE REACHED ON LAST DAY. We'll find out in 13 days

Russian Budget Assumes No Financial Aid for Greece: Siluanov

Clearly governor of Greek Central Bank and government in complete breakdown of confidence. Rare in era of CB primacy #Greece

DIJSSELBLOEM: WE WANT A CREDIBLE GREECE DEAL BUT WE ARE PREPARING FOR ALL EVENTUALITIES

Dude, none of the Greek bailouts have been credible

EU'S DOMBROVSKIS CITES HIGH GREEK DEFENCE SPENDING AS POSSIBLE AREA FOR CUTS ... Turkey is listening now

How about 100% income tax rate?

RT @livesquawk EU’s Dombrovskis EU Ready To Discuss Alternative Greek Measures

Yes, it goes from EUR 300bn to XGD 3,000tn

RT @lemasabachthani *IF A COUNTRY LEAVES EURO ZONE, THE DEBT REMAINS: DIJSSELBLOEM

DIJSSELBLOEM: CHANCE OF REACHING AGREEMENT WITH GREECE BY THURSDAY "VERY SMALL"

Slovak Finance Minister basically saying there is no chance of a deal with Greece ...actually says a "miracle" is now needed

RT @ekathimerini #Greece PM #Tsipras says foreign lenders' insistence on reducing pensions "incomprehensible"

SLOVAK FINMIN KAZIMIR SAYS VERBAL ATTACKS BY GREEK GOVT UNPRECEDENTED

SLOVAK FINMIN KAZIMIR SAYS SLOVAKIA PREPARING, IN COOPERATION WITH OTHERS, FOR SCENARIO OF DEFAULT

GREEK PM TSIPRAS SAYS AFTER MEETING AUSTRIAN CHANCELLOR, FURTHER PENSION CUTS NOT POSSIBLE

SENIOR EU OFFICIAL: NON-PAYMENT TO IMF WOULD NOT AUTOMATICALLY TRIGGER GREEK DEFAULT ON EUROPEAN LOANS ... sure, why not

SENIOR EU OFFICIAL: CYPRUS SHOWS EURO ZONE CAN IMPLEMENT CAPITAL CONTROLS, BUT THEY ARE VERY UNDESIRABLE

UK's Greek contingency plan includes potential impact on firms, banks, financial sector & tourism http://www.theguardian.com/business/live/2015/jun/17/greek-crisis-austria-default-ecb-banks-live#block-55815097e4b0e91d8f40982c … via @rowenamason

The Greek Analyst retweeted

Tsipras says gov't has no intention of seeking new mandate (elections/referendum) from voters regarding negotiations with lenders #Greece

The Greek Analyst retweeted

#Eurogroup’s Dijsselbloem: #Greece changed negotiation process in end-May; process got derailed after June 3 meeting. | #euro

Britain is 'stepping up' preparations in case Greece leaves the euro, says David Cameron's spokeswoman (via Reuters) http://www.theguardian.com/business/live/2015/jun/17/greek-crisis-austria-default-ecb-banks-live#block-55814ac1e4b0e91d8f409801 …

Is EC Juncker undermining the negotiations by misleading Greece with own proposals that IMF… http://goo.gl/fb/RNHI0x

Tsipras: If we reach a compromise, I personally and my associates will carry any political cost as I will do as well if we end up w rupture

"I'm not quite sure what the Austrian chancellor is doing in Athens," says senior #EU official. #Greece

Eleni Varvitsiotis retweeted

Senior #EU official adds to growing feeling nothing on #Greece will be agreed at Thurs #Eurogroup: "I believe this will be pretty short."

* Greek PM tsipras says not thinking of asking Greek people to decide again on crisis - RTRS

The eurozone's demands of #Greece are "petulant, naive, and fundamentally self-destructive" @JeffDSachs @ProSyn http://www.project-syndicate.org/commentary/greece-endgame-eurozone-default-by-jeffrey-d-sachs-2015-06#fAeseyhkpVu3hYAq.99 …

Mehreen retweeted

Greek central bank making wild assertions of no economic precision, that it cannot possibly back up. Astonishing

http://www.bankofgreece.gr/Pages/en/Bank/News/PressReleases/DispItem.aspx?Item_ID=4988&List_ID=1af869f3-57fb-4de6-b9ae-bdfd83c66c95&Filter_by=DT …

Despite that, BoG continues: " it is not possible at present to make any safe projections about the future course of the economy"

Bank of Greece not sitting on fence: Grexit = deep recession, dramatic decline in income levels, exponential rise in UE, al round apocalypse

Institutions have moved very very significantly beyond what was subscribed "not sure that was good but thats where we are" says EU official

Greek parliamentary inquiry "we came to the conclusion that Greece should not pay this debt because it is illegal, illegitimate, and odious"

Katerina Sokou retweeted

Money runs short: Greek Jan-May tax revenue €1.7bn short of target, BBG reports citing Kathimerini. #Greece #Grexit

S&P's Kraemer says Greek contagion manageable in default case b/c of fire walls and ECB QE. (BBG)

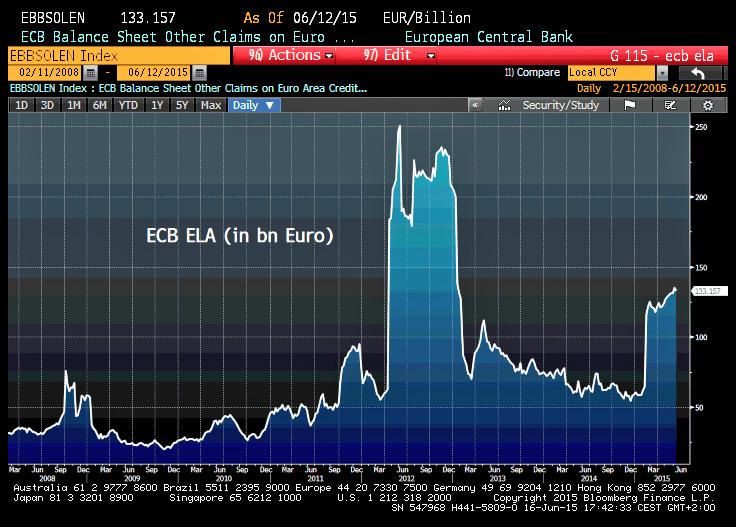

Draghi Rules Tested by Greece as #ECB Mulls Bank Solvency http://bloom.bg/1GXEPac

Nick Malkoutzis

Nick Malkoutzis  Yannis Koutsomitis

Yannis Koutsomitis  Peter Spiegel

Peter Spiegel  A Evans-Pritchard

A Evans-Pritchard  Nektaria Stamouli

Nektaria Stamouli

No comments:

Post a Comment