Tweets...

Special alert - Markit Economics @MarkitEconomics

Greece ......

*Drum roll* #Greece

Why #Greece is different (Longer version of Daniel Gros's recent oped in Project Syndicate), CEPS Commentary http://aei.pitt.edu/64201/1/DG_Why_Greece_is_different.pdf …

#Syriza's parl group to convence on Thur in order to discuss the progress of negotiations & agreement-text w institutions. via @vimapolitics

GREECE WILL NOT MAKE JUNE IMF PAYMENT IF THERE IS NO PROSPECT OF A DEAL WITH LENDERS - SYRIZA PARLIAMENTARY SPOKESMAN

EU'S MOSCOVICI HOPES FOR GREEK DEAL IN COMING DAYS, CNA REPORTS

German finance minister accuses #Greece's ruling party of misleading voters http://bit.ly/1ddFvdI

The Greek Analyst retweeted

Tspiras heading to Brussels, tells us 2 things - (i) clearly not prepared to take existing offer if face to face talks are needed 1/2

The Greek Analyst retweeted

(ii) both sides now looking for a top level political deal. Detailed staff technical work can follow. 2/2

Morning Note: 1. Blatter out. 2. Tsipras heads to Brussels. 3. Draghi Vs bond market #ECBDay

The Greek Analyst retweeted

Morning thoughts. Greek shuttle diplomacy become frenetic. http://reut.rs/1Qom6n3

The Greek Analyst retweeted

Left Platform keeps posting that it will only accept a deal that is close to #SYRIZA's programme. Minor detail, there is no one to fund it

Austria has Earned More than €100 Mln in Interest from Greek Bailout http://dlvr.it/B4krmh #GreekNews

To Vima: Greece will need a 3rd bailout package worth €55 billion euros in order to cover its financing needs until 2017

REUTERS SOURCE: Euro zone officials have branded the Greek proposal as insufficient and said it was not formally on the table.

Tsipras going to Brussels Wed, taking Greek proposal with him, after invite by Juncker, gov source says. Mtg Wed night

Broader Europe....

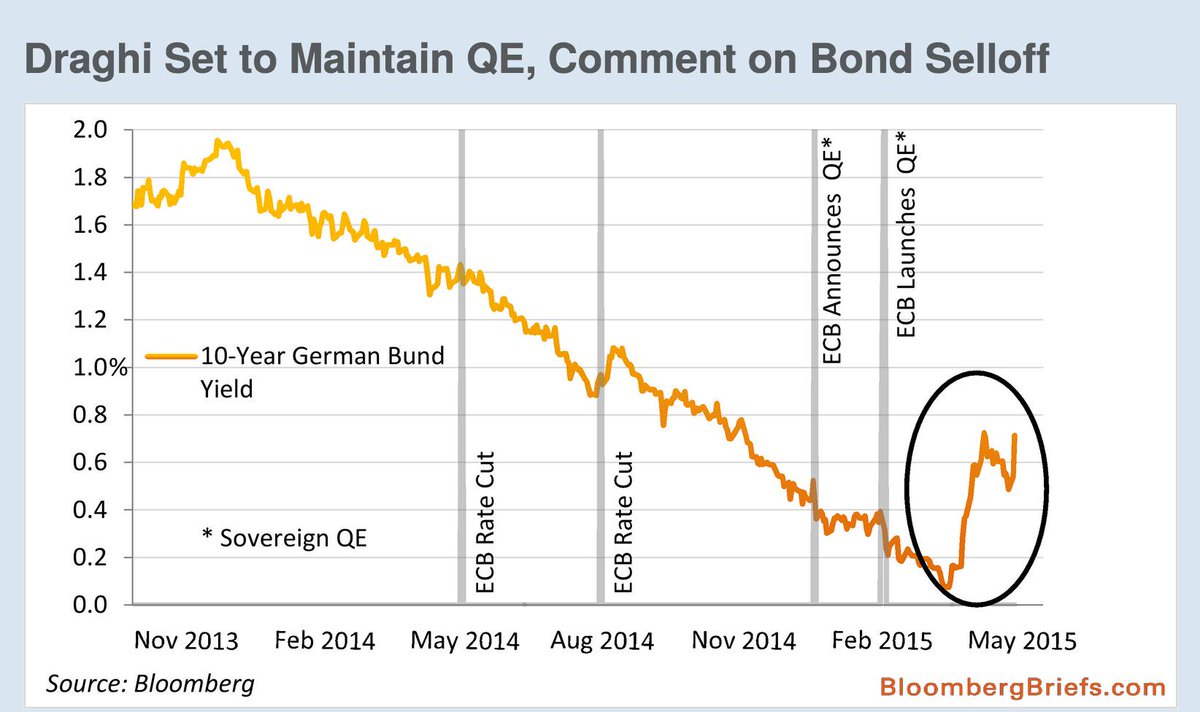

Sell-off in German Bunds continue. 10yr govt bond yields jump to >0.74% ahead of today's #ECB meeting.

Bonds have tumbled, yields spiked ahead of today's ECB meeting. Will Draghi comment recent bond market rout (via BBG)

Bonds Are Tumbling and It’s Not Just Because of the Economy http://bloom.bg/1FSyLfo

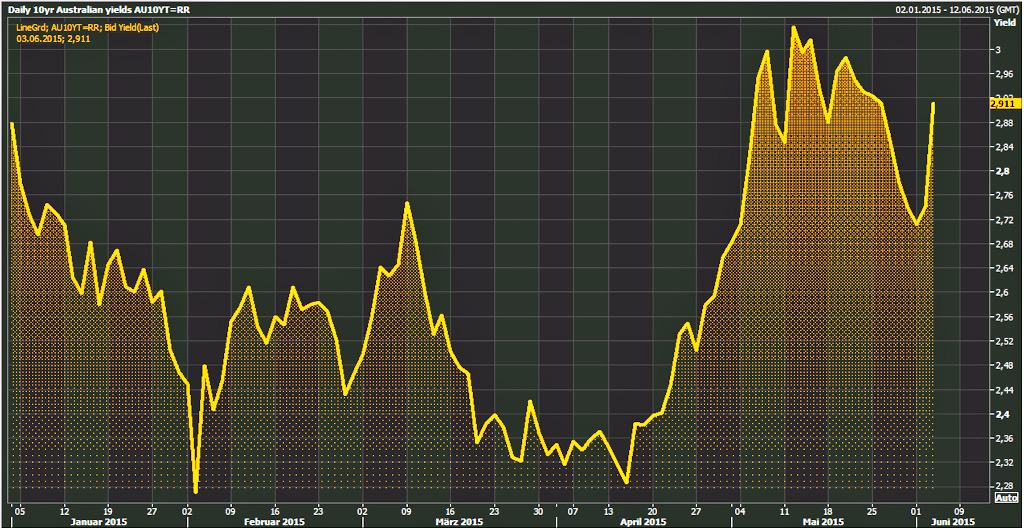

Bond bubble about to pop? Yields on 10yr Australian govt bonds jump by 16bps. http://bloom.bg/1FswJQG

Barclays expects OPEC to leave 30 mb/d target unch on Fri to implement twin objectives (support oil demand&mkt share)

There is also an INTERVIEW with Pablo Iglesias in New Left Review, as well as his article: https://newleftreview.org/II/93/pablo-iglesias-spain-on-edge …

German Composite PMI falls to 5 month low of 52.6 in May

Interesting contrast with the dire DARES data yesterday. #france

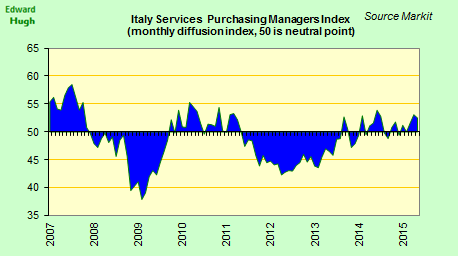

Rate of expansion in Italian services falls back slightly in May. PMI 52.5 vs 53.1 April.

Spanish PMIs toppish, yet details *very* strong:

- rise in employment fastest since Sept-07

- cost inflation strongest in ~4 years

ECB meeting highlights (preview here https://goo.gl/PMGG6y ).

That the Bund can sell-off the day after one of the sharpest move ever tells you a lot about this market.

Duncan Weldon

Duncan Weldon

Mike Peacock

Mike Peacock  Stathis Kalyvas

Stathis Kalyvas

No comments:

Post a Comment