Tweets....

Greece....

Check the numbers in poll against pension cuts and mass layoffs !

According to reports, creditors are demanding further budget cuts worth 5 billion euros including pension cuts and mass lay-offs

I just translated #Syriza's Left Platform doc distributed in Central Committee, calling not to pay next IMF tranche. http://wp.me/p5BCK1-58

Greek Enterprises: Prolonged Uncertainty Is Freezing Investments, Employment http://dlvr.it/9xqf5v #GreekNews

FinMin #Varoufakis said #Greece has covered 3/4 of the distance, institutions must cover the remaining 1/4 (via @MegaGegonota) #ec #imf #ecb

.

@Elena_Kappa This is the official 4 cen gov. Gen gov debt is even lower close to €305 bln, as part of cen gov debt is held within gg bodies

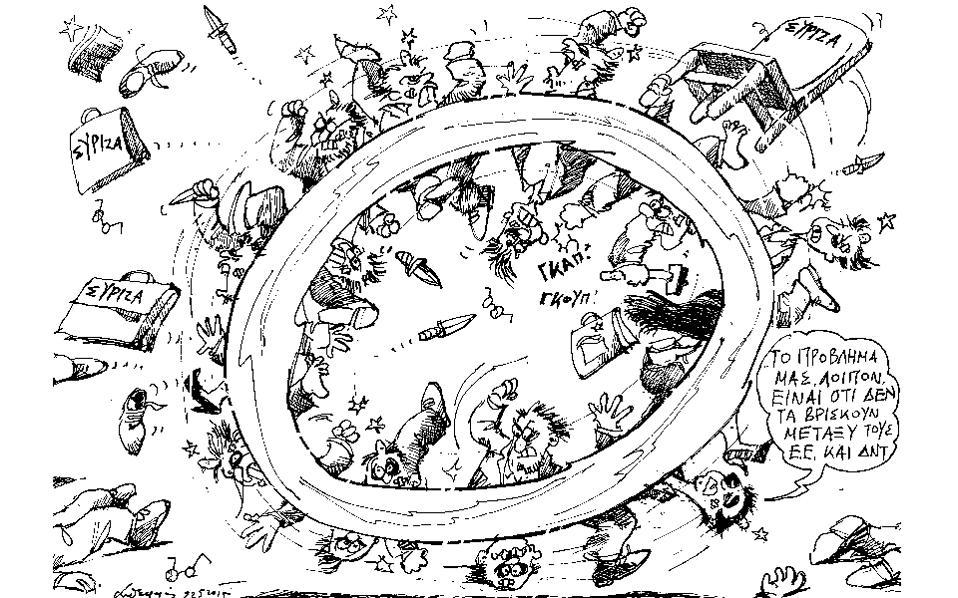

#Syriza Tsipras: "Our problem is that the EU & IMF cannot find common ground."

(Sketch by Petroulakis @ekathimerini)

GR media report that #Syriza's Left Faction is asking from the govt *not* to pay the next tranche to the IMF if the "blackmail" continues.

Great debut by @joannakakissis in @newyorker on the migrant crisis on the Greek islands. With photos by @moutafis77 http://www.newyorker.com/news/news-desk/the-migrant-crisis-on-greeces-islands …”

Listen to Varoufakis' response to the question at 1min50 - does not rule out leaving Eurozone http://www.bbc.co.uk/news/world-europe-32863988 …

Varoufakis says investors should be prepared for the Eurozone to unravel if Greece is forced out http://www.telegraph.co.uk/finance/economics/11626969/Greece-to-miss-IMF-payments-amid-fears-of-catastrophic-eurozone-rupture.html …

Broader Europe.....

#Russia not planning to restructure Ukrainian debt. #Ukraine's 5yr default probability >94%. http://rt.com/business/261513-medvedev-russia-ukraine-debt/#.VWFy7ta0TGU.twitter …

Today’s elections – in figures. Polls opened this morning at 9am, and will close at 8pm. Results due at 10.30pm. http://elpais.com/elpais/2015/05/24/inenglish/1432455721_342870.html …

Head to this page to download the EL PAÍS widget, which will deliver the results of today's elections as they come in http://resultados.elpais.com/elecciones/widget/autonomicas-municipales/?id_externo_rsoc=TW_CM …

Spain’s two-party system at play as voting gets underway at today’s municipal, regional polls http://elpais.com/elpais/2015/05/24/inenglish/1432454171_032874.html …

#Interconnectedness: "roughly half (53 percent) of banks’ derivatives exposure(...)to other banks and security firms" http://www.treasury.gov/initiatives/fsoc

Big investment banks still "too big and too interconnected to be allowed to fail (...)"? http://www.gsb.stanford.edu/insights/anat-admati-are-banks-safe-now … ht @tordizuin @JFlat24

Over last 15 years, "global bond markets have grown from around $30 trillion in 2000 to nearly $90 trillion today" http://www.bankofengland.co.uk/publications/Documents/speeches/2015/speech814.pdf#page=4 …

Agenzia Italia

Agenzia Italia

No comments:

Post a Comment