Tweets....

Updates at blog tweet feed during the day ....

Markit:Output prices in the French private sector fell further in April

Cha Geo retweeted

GERMANY APRIL MANUFACTURING PMI FALLS TO 51.9; FORECAST 53

- But... but cheap Euro?

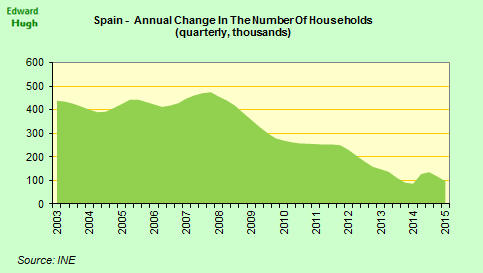

Spain rate of new household formation weakened in Q1 - not good news for home sales.

Greek 2yr yields drop as #Greece may ask Europe to buy bonds to pay for redemptions. https://research.tdwaterhouse.ca/research/public/Markets/NewsArticle/1664-L5N0XK1FM-1 …

European equity movers this morning: Michelin (ML FP) +4.8%, Pernod Ricard (RI FP) +3.3%, Novartis (NOVN VX) +2.3%

European equity movers this morning: Michelin (ML FP) +4.8%, Pernod Ricard (RI FP) +3.3%, Novartis (NOVN VX) +2.3%

Looking ahead, today sees the release of a slew of Eurozone PMIs, UK retail sales and weekly US jobs data

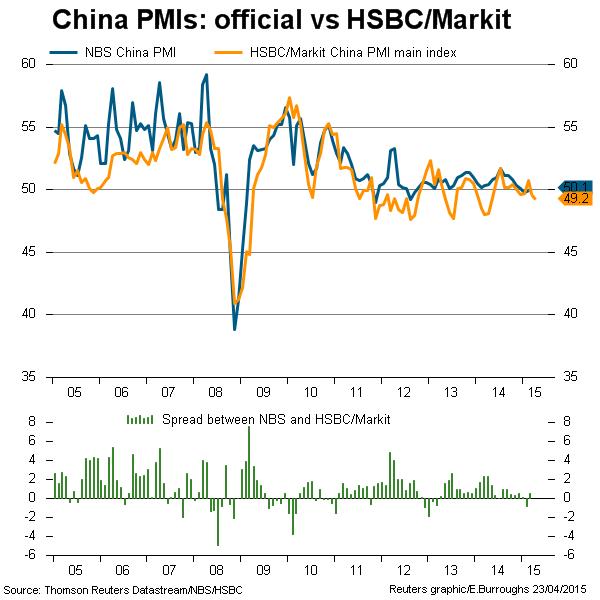

Chinese equities benefitted from further easing hopes in the wake of another contractionary HSBC flash Mfg PMI reading

#Japan sells JPY 0.4trl in 40yr JGBs, bid/cover 2.58, prev. 3.397, High. yield 1.4700% vs. Prev. 1.550%... NO THANKS!

Today --> Greece PM Tsipras to meet German Chancellor Merkel

Europe’s move against Gazprom may defang Russia, but it won’t be easy http://qz.com/388747/europes-move-against-gazprom-may-defang-russia-but-it-wont-be-easy …

Morning Note: 1. China Japan PMI miss. 2. DB poised to settle libor. 3. Greece's 5-year bailout request anniversary

KURODA: TIMING OF REACHING 2% COULD DELAY SLIGHTLY INTO FY16

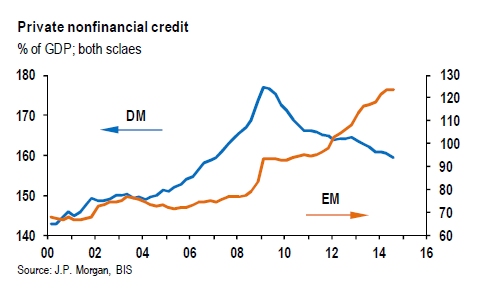

Scary chart of the day: Private sector debt in emerging vs developed markets (via JP Morgan)

Fabrizio Goria retweeted

The IMF’s Harmful Debt Restructuring Proposal by @AngelUbide http://blogs.piie.com/realtime/?p=4968#.VTgZ2oHfaNo.twitter …

KURODA: BOJ BUREAUCRATS ARE STUDYING TECHNICAL DETAILS OF EXIT. It's all good y'all

KURODA: WILL NEED TO DISCUSS EXIT STRATEGY EVENTUALLY. Just after the BoJ holds 150% of Japan's GDP in JGBs

KURODA: NOT CONDUCTING MONETARY POLICY TO TARGET A WEAKER YEN. Just higher nikkei

No Greek deal expected before May, says #EU ~@guardian live updates: http://bit.ly/1yV4ZH7 #Greece #euro

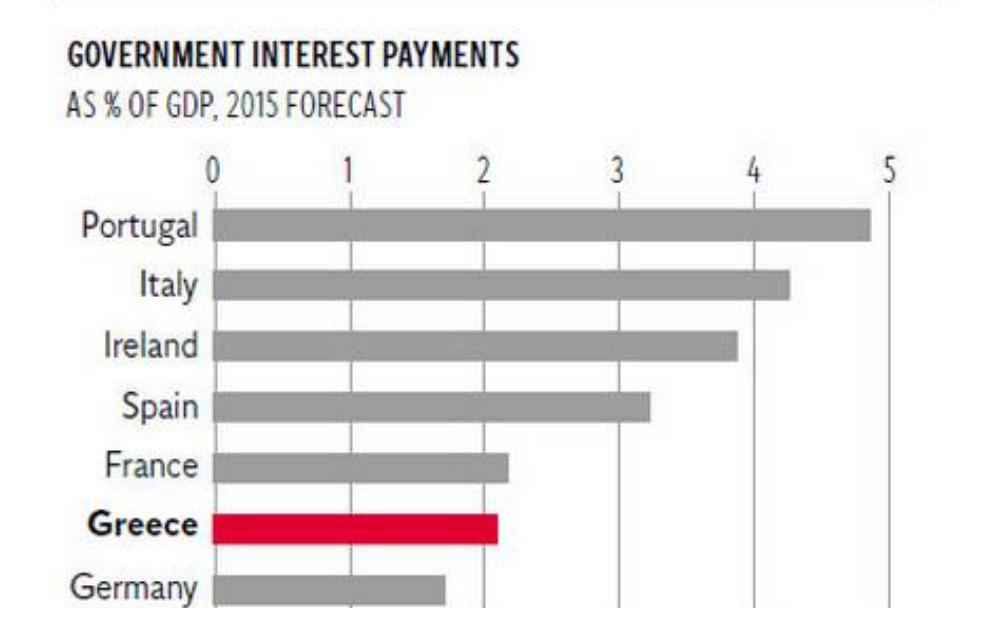

Why #Greece will still default despite govt interest payments are not that large rel to GDP. http://ind.pn/1K62OS7

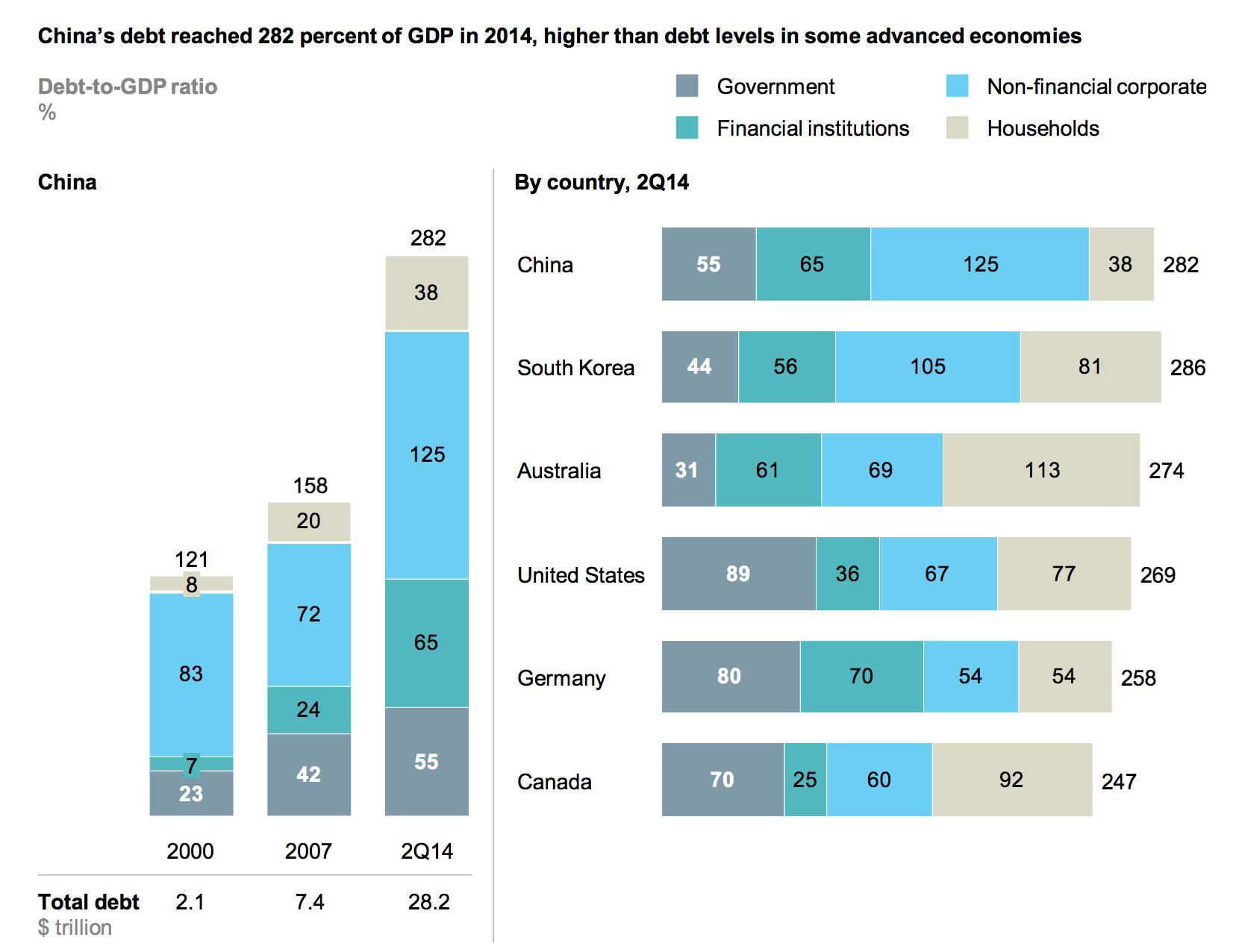

#China has a massive debt problem. Now moving to new model where check is not blank anymore. http://bloom.bg/1EamzqQ

#China industr gauge drops to lowest in 12mths, shows China needs to do more to stabilise econ http://bloom.bg/1yRPM9v

*Russian Market

*Russian Market

No comments:

Post a Comment