Tweets......

HEDGE FUND OCH-ZIFF SAID TO HAVE LOST FOUR LONDON EMPLOYEES. they may or may not have traded FX

Deutsche, Interactive Brokers, Barclays Lost Hundreds Of Millions Due To Swiss Franc Volatility http://www.zerohedge.com/news/2015-01-16/deutsche-interactive-brokers-barclays-lost-hundreds-millions-due-swiss-franc-volatil …

Deutsche Bank Lost About $150mln Thurs Due To Swiss Franc Volatility. Barclays Lost Tens Of Millions Of Dollars Thurs. (DJ)

#Greece | NBG & Piraeus Bank request the rest of the state aid they're allowed (€3bn & €1.5bn) under 2008/9 Alogoskoufis Law ~@euro2day_gr

#Greece Athens stock exchange -3%, banks -6.73% (Eurobank -9.29%, Alpha bank -7.04%, NBG -6.29%, Bank of Piraeus -6.02%) /via @EfiEfthimiou

What Does The Swiss National Bank Know That No-One Else Does? http://onforb.es/1KQbFsJ via @forbes

Largest Retail FX Broker Stock Crashes 90% As Swiss Contagion Spreads http://www.zerohedge.com/news/2015-01-16/largest-retail-fx-broker-stock-crashes-90-swiss-contagion-spreads …

As we first reported last night, FXCM was among the first of many retail FX brokers (and the largest) to see its clients suffer massive losses from yesterday's Swiss Franc surge following the SNB decision to unleash market forces. There are now at least 4 retail FX brokers (FXCM, Excel Markets, OANDA, and Alpari) who have announced "issues" but FXCM, being among the largest and publicly traded is the most transparent example of wjust what can go wrong when average joes are allowed 100:1 leverage. FXCM is now stuck chasing clients for money they do not (and will never) have.. and its stock is down 90%, trading a $2 this morning (down from $17 on Wednesday). As Credit Suisse notes, time is running out as regulators "tend to be impatient once capital requirements are breached."

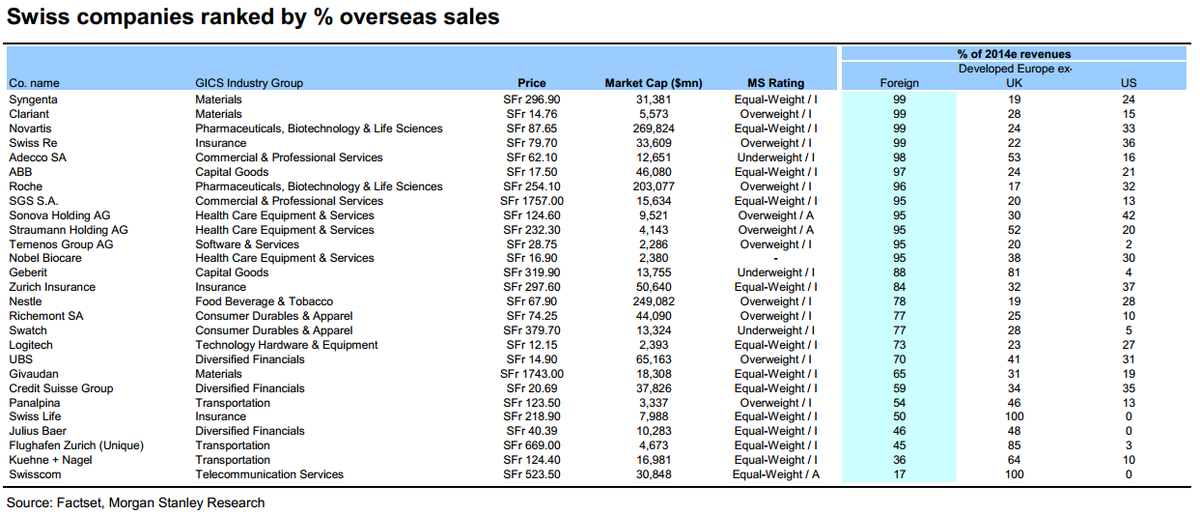

Here's a list from Morgan Stanley of the Swiss companies most exposed to a rocketing franc. http://on.ft.com/1IQmoPR

Don't get this bank run story. Total deposits at Greek banks are 164.3 bil, 3 bil withdrawn in Dec hardly constitutes bank run?

German yields hit lows, Greek debt costs soar after Swiss cap shock http://dlvr.it/877xWC

BullionStar retweeted

Here's the Swiss yield curve. Negative interest rates all the way through through 12 years.

SNB pulls out of global FX war by RGE's Brunello Rosa https://www.roubini.com/analysis/swiss-national-bank-pulls-out-of-global-fx-war … $

Wonder how sudden rise in value of Swiss Franc against euro is going to impact their tourism and exports?

ICE FUTURES EUROPE SETS DAILY VOLUME RECORD IN THREE MONTH EURO SWISS FRANC FUTURES

Swiss National Bank shocks markets by removing currency floor between Swiss Franc and Euro: http://openeurope.org.uk/daily-shakeup/greek-banks-request-emergency-liquidity/#section-2 …

Holger Zschaepitz

Holger Zschaepitz

Teacher Dude

Teacher Dude  Kathimerini English

Kathimerini English  Joseph Weisenthal

Joseph Weisenthal

Nouriel Roubini

Nouriel Roubini  MineForNothing

MineForNothing

No comments:

Post a Comment