Oil in focus....

Late day tweets.....

Early morning tweets....

Bond markets....

Late day tweets.....

Robin Wigglesworth retweeted

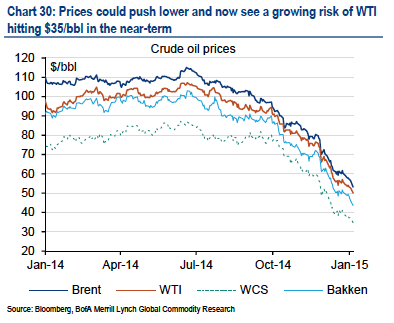

#oil analysts at @BofAML "see a growing risk of WTI hitting $35 a barrel in the near-term" and #Brent at $40 #OPEC

This is about to get worse - US Steel cites low oil prices for idling Ohio, Texas plants and laying off 756 workers http://on.wsj.com/14hFFwk

SoberLook.com retweeted

#Oil analysts at @BofAML see 55m barrels in floating storage by end Q2 as contango makes stockpiling workable #OPEC

This Oil Thing Is The Real Deal http://www.zerohedge.com/news/2015-01-06/oil-thing-real-deal …

API Crude Inventories -4000K, Last +760K, but Distillate inventories +9100K, Last 313K

Showdown looms as North Dakota legislators mull oil levy sharing http://www.reuters.com/article/2015/01/06/us-north-dakota-budget-idUSKBN0KF10Z20150106 …

Canada Heavy Oil Drops Below $35 As Rig Count Hits Record Low For January

Early morning tweets....

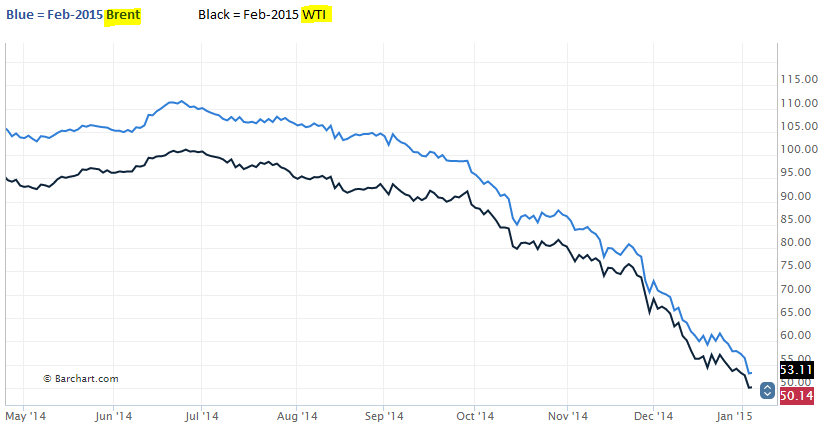

The Crunch Continues: WTI Tumbles Under $49, 10Y Dips Under 2% http://www.zerohedge.com/news/2015-01-06/crunch-continues-wti-tumbles-under-49-10y-dips-under-2 …

Chart: Getting numerous questions on whether these levels on crude oil will hold. Some are jumping in here. Thoughts?

Chart: Brent crude futures down 5%, below $53.5/bbl -

Chart: WTI crude futures dip below $51/bbl; down almost 4% this morning -

Smallest OPEC member #Ecuador cut its 2015 fiscal budget by 4% on Mon due to falling oil. Budget assumes avg oil price of $79.70/bbl this yr

One month ago: "Oil May Drop To $25" http://www.zerohedge.com/news/2014-12-17/russell-napier-oil-may-drop-25-chinese-demand-plunge-supply-glut-ageing-boomers …

BullionStar retweeted

"We couldn't find shampoo, so we washed our hair with soap. Now there's not even soap." #AnaquelesVaciosEnVenezuela

Bond markets....

Ukraine Bonds at 60 Cents Seen Signaling Risk of Default http://www.bloomberg.com/news/2015-01-05/ukraine-bonds-at-60-cents-seen-signaling-risk-of-default.html …

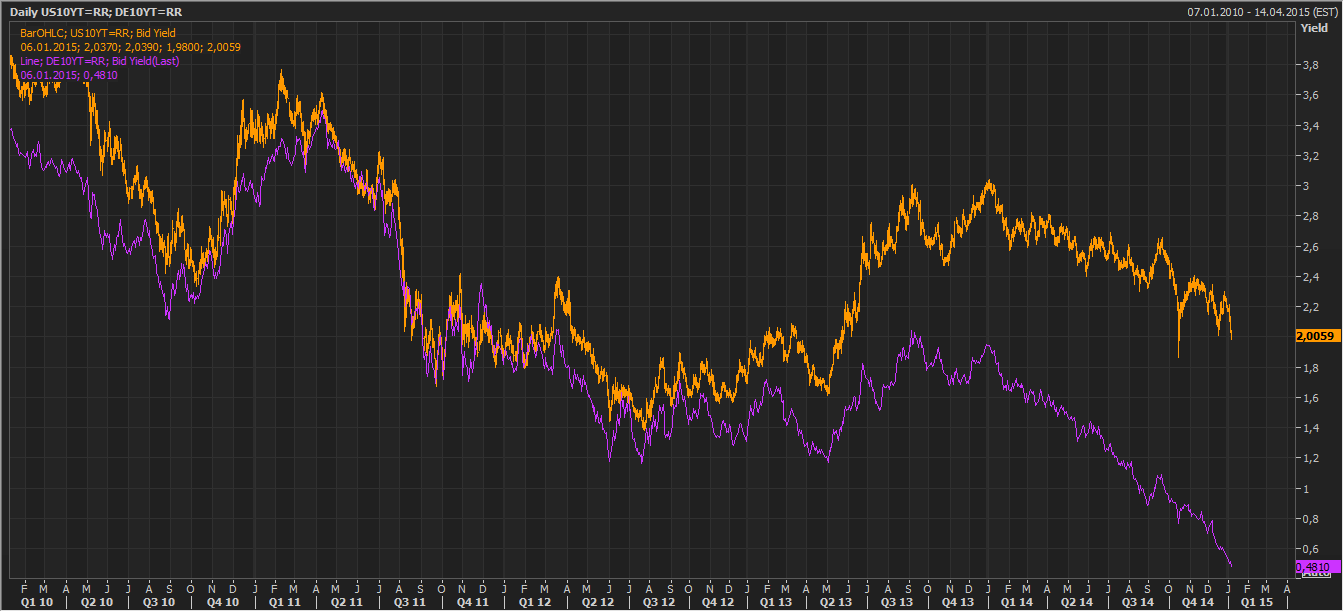

Record low yields (not exhaustive list): Japan, Germany, Austria, Belgium, Netherlands, Finland, France

BullionStar retweeted

Japan's 20-year yield falls below 1%:

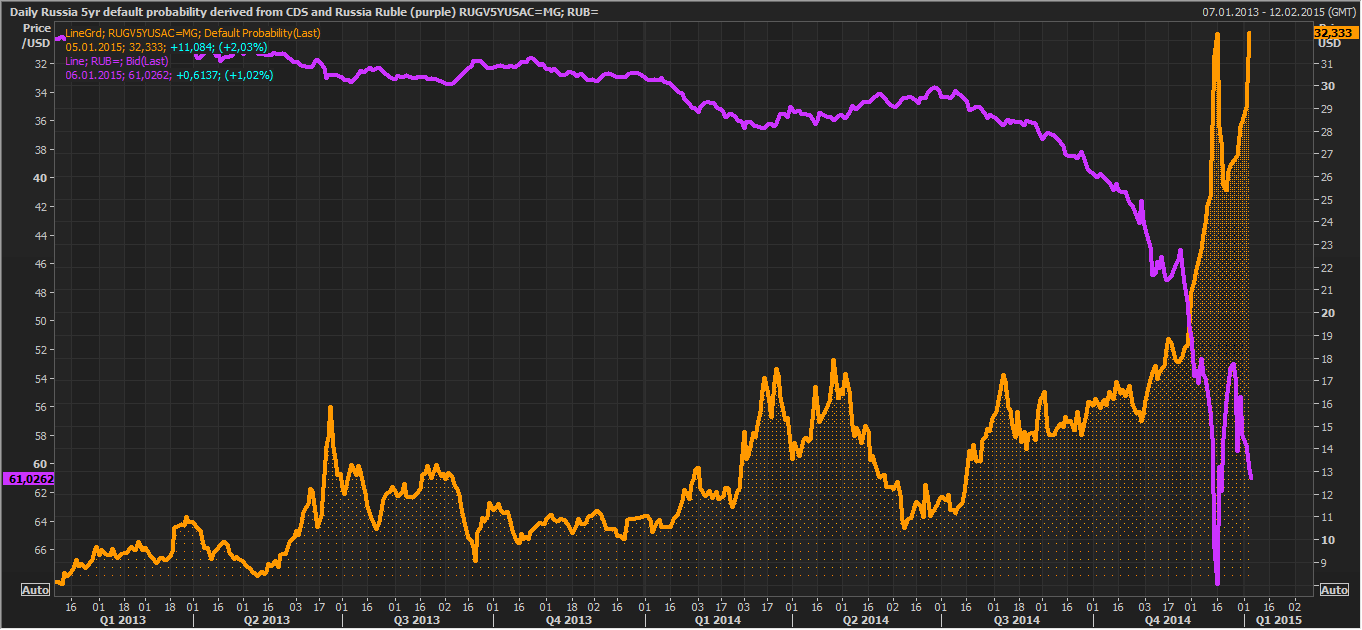

#Russia 5yr default probability rises >32%, highest since 2009 as Ruble weakens beyond 61 per Dollar.

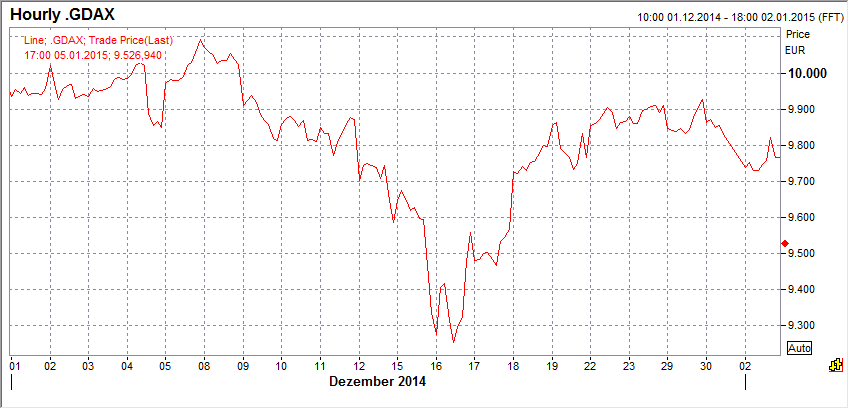

The global #Japanification continues. German 10yr yields falls to fresh life-time low, 10yr US ylds drops briefly <2%

10-y US Treasury yield dips below 2%. Aside from October "flash crash", lowest since 2013. http://on.ft.com/1IjBT2s

JAPAN’S 10-YEAR YIELD FALLS TO RECORD 0.295%.

The average 10-year bond yields of the G3 countries below 1%, probably for first time ever says Citi.

Scotiabank's Haselmann: "The 30 Year Will Trade With A One Handle In 2015" http://www.zerohedge.com/news/2015-01-05/scotiabanks-haselmann-30-year-will-trade-one-handle-2015 …

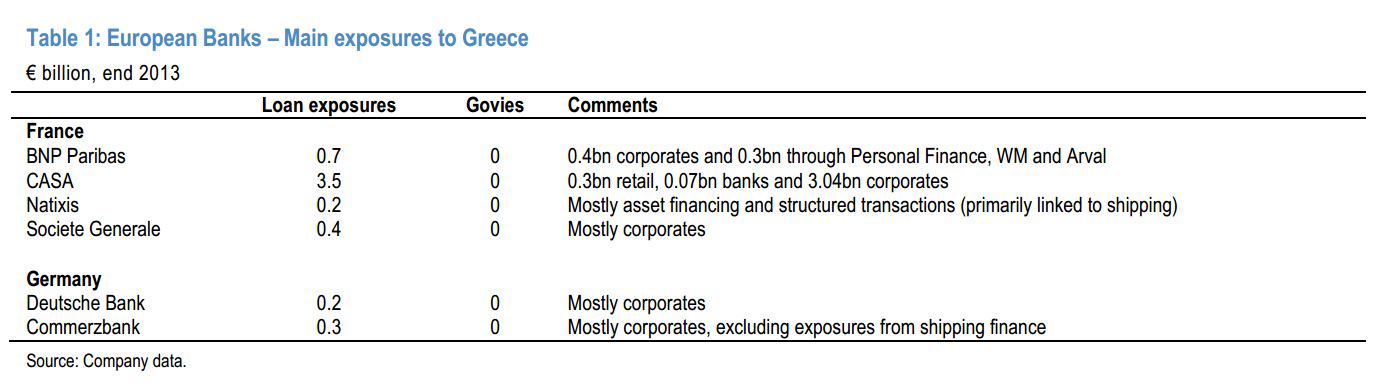

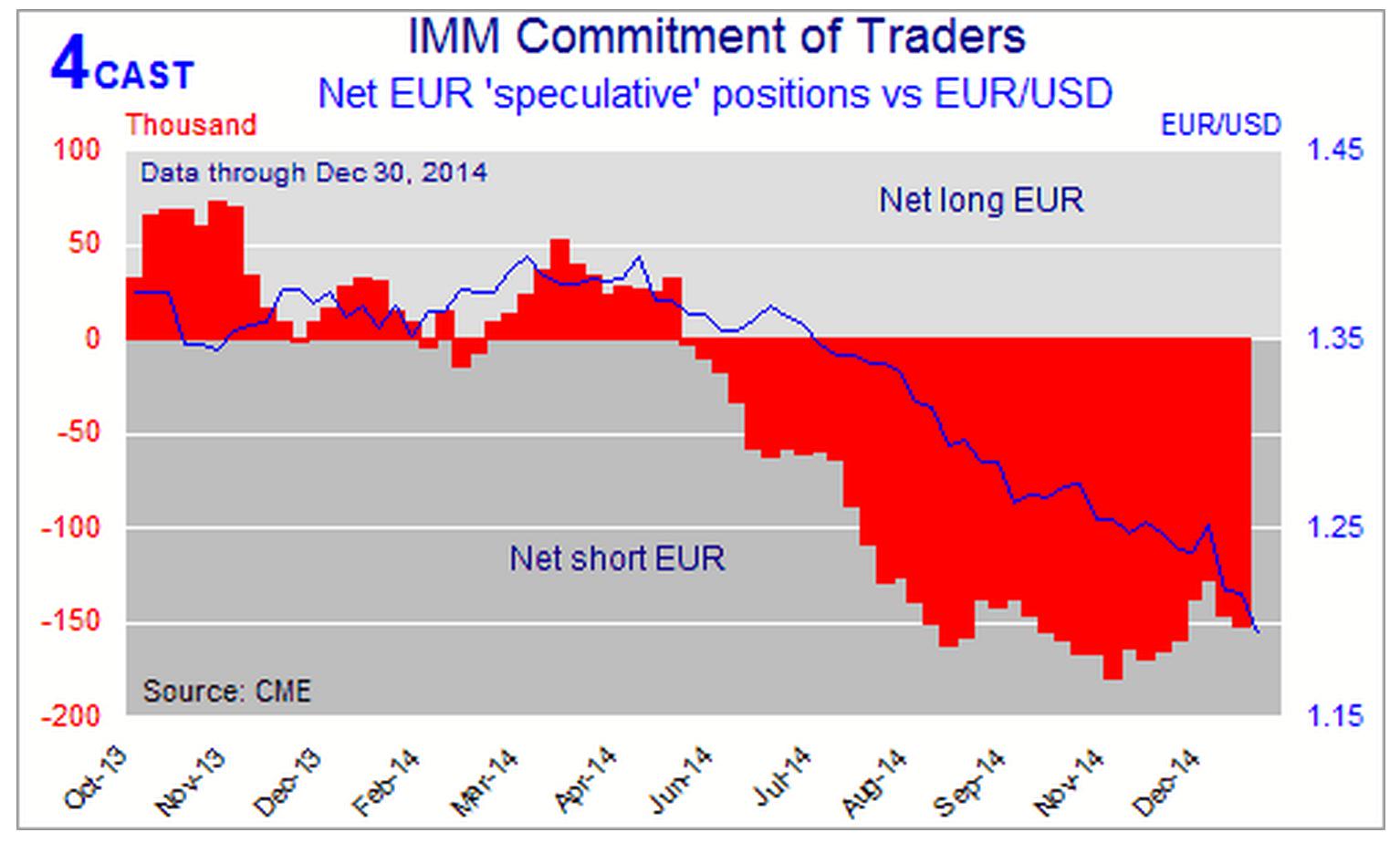

Euro hits 9yr low against USD after reports that German officials believe Euro wouldn't suffer too much if Greece exited Euro #fx ^JR

zerohedge

zerohedge

fred walton

fred walton

Christopher Mims

Christopher Mims

Live Squawk

Live Squawk  Ashraf Laidi

Ashraf Laidi

No comments:

Post a Comment