Evening Tweets....

Morning Tweets..... 1/20/15

Evening Tweets...

Morning Tweets.....

Robin Wigglesworth retweeted

zerohedge retweeted

You can't solve the Greek problem with "labour market flexibility" it needs economic policy flexibility (out of the Euro) #newsnight

US Bond yields fall on #oil selloff, #ECB stimulus hope. 30yr treasury bond yield plunges to record low of 2.38%.

Ouch! #Venezuela’s economic collapse owes a debt to #China. Market prices default risk at 99%. http://on.ft.com/1ukETFt

Morning Tweets..... 1/20/15

SYRIZA to ask for 'technical extension' to bailout, says leftist candidate http://dlvr.it/89Fl9D

Turkey's "Independent" Central Bank Is Latest To Leak Policy Decision To Government http://www.zerohedge.com/news/2015-01-20/turkeys-independent-central-bank-latest-leak-policy-decision-government …

Russia's external debt fell by 18% in 2014 — Central Bank http://tass.ru/en/economy/772063 … A likely result of sanctions

Ukraine Central Bank seeks to limit forex exchange outlets - Pysaruk

Why is Europe worrying about SYRIZA? @fsaraceno blogs on whether concerns are exaggerated. http://shar.es/1bCrZ6 #Greece #ekloges2015

QE exclusion a ‘de facto #Grexit’ - Alarm in Athens: ECB excludes Greek bonds from acquire list. http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_20/01/2015_546347 …

At the Finance Ministry they say that a possible exemption of Greece from the program would constitute a “de facto Grexit” for three reasons. The first is that it would be unprecedented for Greece not to benefit from an ECB decision regarding the Eurosystem. If Greece is left out, that would effectively mean the country being excluded from decisions for the other 18 eurozone members.

Secondly, it would put an end to ECB President Mario Draghi’s pledge that as long as Greece is in a program, the ECB will support it; and last but not least, there will be two-speed yields in state bonds within the eurozone: One will concern the Greek bonds that are already hovering around 10 percent – and will likely grow further if Greece is excluded from the QE – while the bonds of all other eurozone states will not exceed 2 percent.

Russia dep CenBank governor says there is ZERO chance of sov default. Mr. Market not convinced http://uk.reuters.com/article/2015/01/20/russia-economy-cenbank-idUKL4N0UZ2M120150120 …

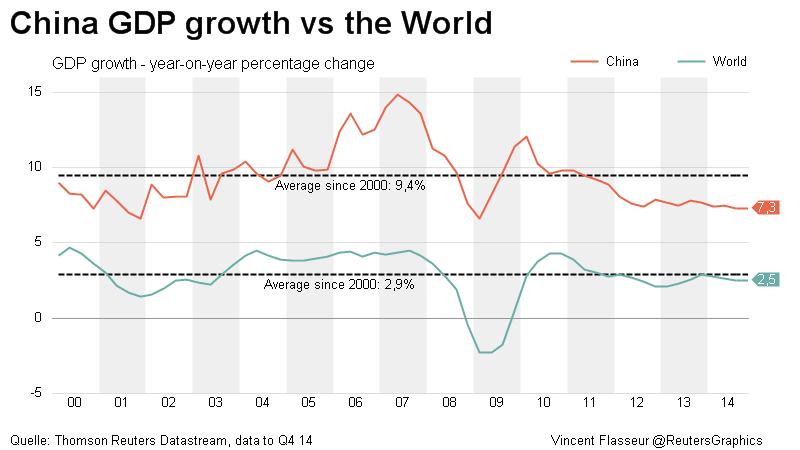

#China rebounded after biggest loss since 2008 and yuan gained as country’s economy expanded more than estimated.

#China posts slowest growth in 24 years, more support measures seen. http://reut.rs/1EjMrOG

Brent crude oil drops as #IMF Lowers Global Growth Forecast by Most in Three Years. http://bloom.bg/150yk4e

Evening Tweets...

SNB Decision Sparks Calls For Polish Mortgage Bailout; Central Bank Against It http://www.zerohedge.com/news/2015-01-19/snb-decision-sparks-calls-polish-mortgage-bailout-central-bank-against-it …

BullionStar retweeted

I

t's just a joke now: TURKEY SEES RATE CUT TOMORROW BY CENTRAL BANK, DEP. PM SAYS. And Hollande agrees?

ICYMI: Germany Repatriated 120 Tonnes Of Gold In 2014 https://www.bullionstar.com/blog/koos-jansen/germany-repatriates-120-tonnes-of-gold-in-2014/ …

Peter Boehringer Comments re Bundesbank´s Announcement of 2014 gold repatriations to Germany (120 tonnes)

http://www.goldseitenblog.com/peter_boehringer/index.php/2015/01/19/comments-re-bundesbankas-announcement-of …

This is the Swiss curve. Negative to 10 years versus negative out to 8 years on the 15th https://twitter.com/edwardnh/status/555820946523566080 …

Fitch on liquidity risks for #Greece: Greek banks have currency swaps on their Swiss franc-denom assets (largely mortgages),totalled €12.5bn

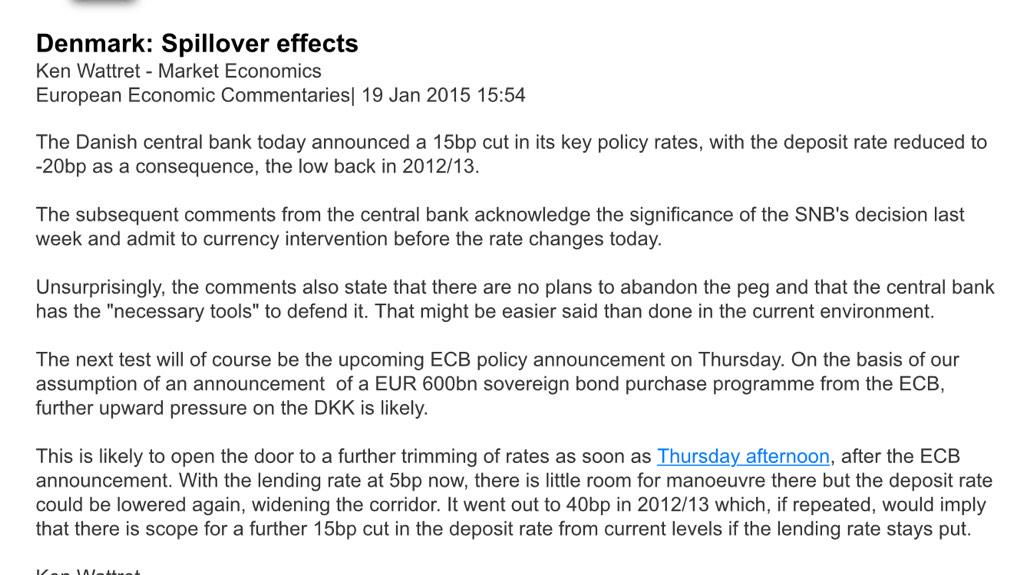

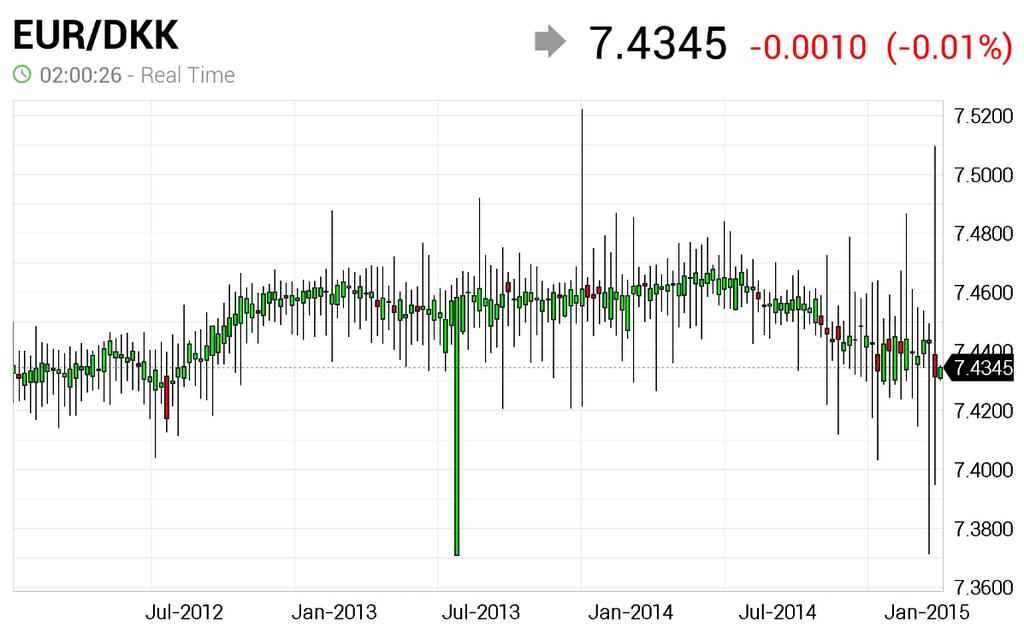

BNP Paribas on Danish central bank's surprise rate cut. Expects deeper negative rates after ECB meeting Thursday.

Robin Wigglesworth retweeted

Hartnett: "there is now $7.3 trillion of negatively-yielding government debt in the Eurozone, Switzerland & Japan"

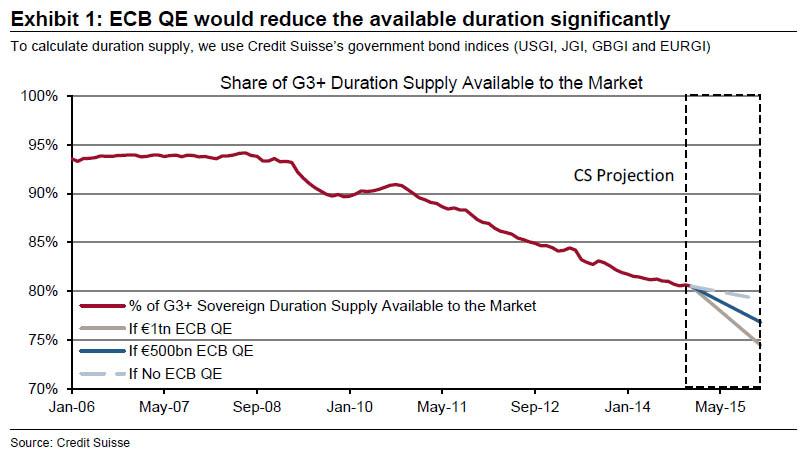

Unprecedented collapse in global collateral once ECB launches QE: negative 10Y everywhere http://www.zerohedge.com/news/2015-01-19/how-ecbs-qe-about-send-most-deflationary-signal-ever …

Morning Tweets.....

GERMANY SAYS ECB IS INDEPENDENT, MERKEL’S SPOKESMAN SAYS. And Mario Draghi will repeat this as soon as he gets German permission

I

raq Pumps Crude at Record Level Amid Plummeting Prices http://www.bloomberg.com/news/2015-01-18/iraq-pumps-crude-at-record-level-amid-plummeting-prices.html …

CHINA ECONOMY FACES RELATIVELY BIG DOWNWARD PRESSURE, LI SAYS. Brent +5%

GERMAN 10-YEAR BUNDS RISE; YIELD FALLS 2 BASIS POINTS TO 0.43%. Only 23 bps wider then Japan

Chinese Stocks Crash Most Since Feb 2007, Futures Limit-Down After Regulatory Crackdown On Margin-Trading http://www.zerohedge.com/news/2015-01-18/chinese-stocks-crash-following-renewed-crackdown-margin-accounts …

Chinese Stocks Crash Following Renewed Crackdown On Margin Accounts http://www.zerohedge.com/news/2015-01-18/chinese-stocks-crash-following-renewed-crackdown-margin-accounts …

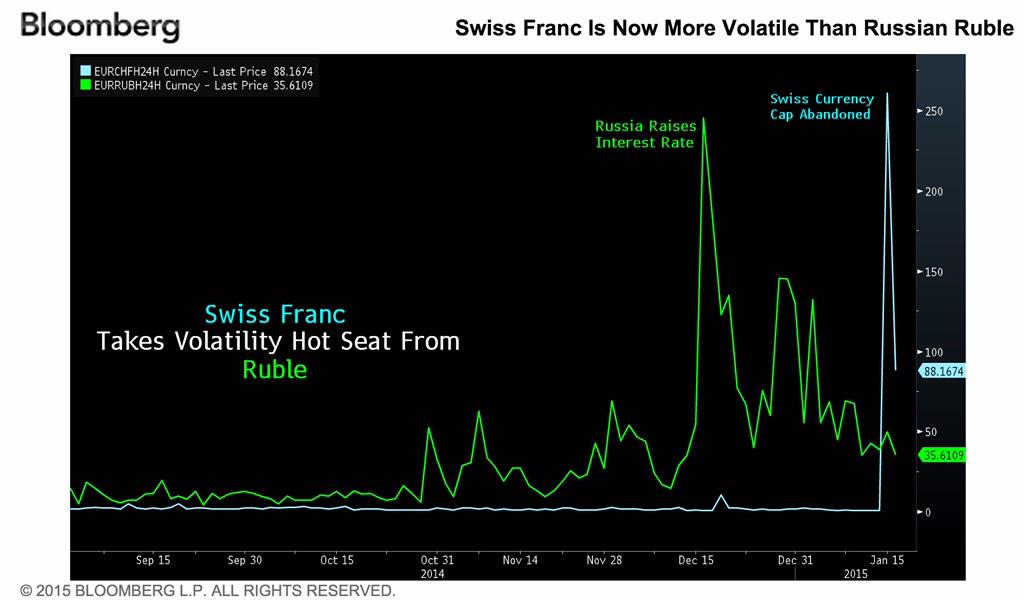

#Swiss Franc Eclipses #Ruble on Volatility Scale. http://www.bloomberg.com/news/2015-01-19/swiss-franc-eclipses-ruble-on-volatility-scale-chart-of-the-day.html …

Is the Danish Krone the next currency peg to fall?

EU Council not to decide on anti-Russian sanctions on Jan 19 — EU foreign policy chief http://tass.ru/en/world/771889

New Democracy will do 'whatever it takes' to prevent SYRIZA win, says minister http://dlvr.it/88cDMY

fred walton

fred walton  Russian Market

Russian Market  BullionStar

BullionStar  MacroPolis

MacroPolis

No comments:

Post a Comment