Evening Tweets...

Early Morning Tweets....

#Germany's 10-year bond yields hit record low of 0.405% ~Tradeweb

Edward Harrison retweeted

This 3-day chart of EURCHF is just just incredible.

One of the substantial risks facing investors is a collapse in faith in central banks’ ability to control events. http://blogs.wsj.com/moneybeat/2015/01/15/on-switzerland-the-floor-and-losing-faith-in-central-banks/ …

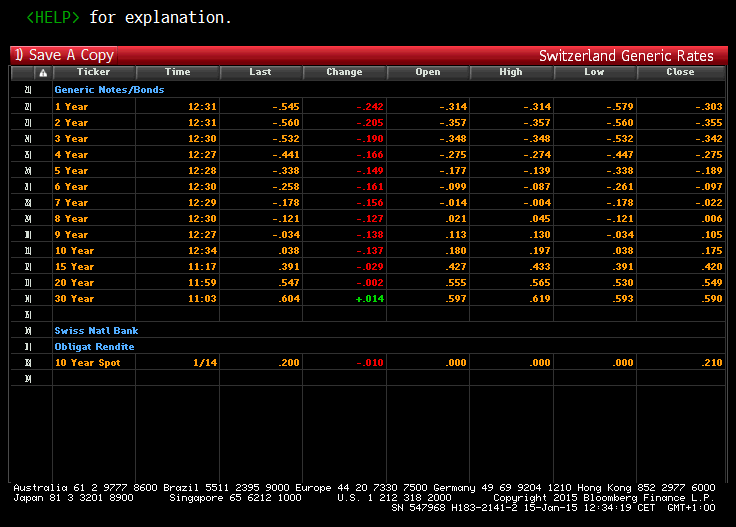

The entire Swiss curve below 9 years has negative interest rates. Highest negative rate is at 3 months for -0.80%

The SNB's balance sheet is 80% of GDP, a level three times the Fed or BoE- @georgemagnus1 #capitulation

If you're a Russian household with a mortgage in Swiss Francs, you're not happy right now http://business.financialpost.com/2015/01/06/mortgage-payments-now-larger-than-salaries-for-some-russians-due-to-rubles-rapid-collapse

“Today’s SNB action is a tsunami; for the export industry and for tourism, and finally for the entire country” - CEO, Swatch

After tripling CHF margins, CME just hiked most other FX margins, as well as copper, natgas, and crack spreads http://www.cmegroup.com/tools-information/lookups/advisories/clearing/files/Chadv15-016.pdf …

CME Just Doubled (And Tripled) Swiss Franc Margins http://www.zerohedge.com/news/2015-01-15/cme-just-doubled-swiss-franc-margins …

SCHLUMBERGER SAYS CUTTING ABOUT 9,000 JOBS

Margin Calls? EURCHF Breaks Back Below Parity http://www.zerohedge.com/news/2015-01-15/margin-calls-eurchf-breaks-back-below-parity …

zerohedge retweeted

Debt to GDP Since 2007, thanks #Fed

China: 140 to 240%

Singapore: 170 to 240%

Hong Kong: 195 to 250%

Malaysia: 150% to 190%

CEIC data

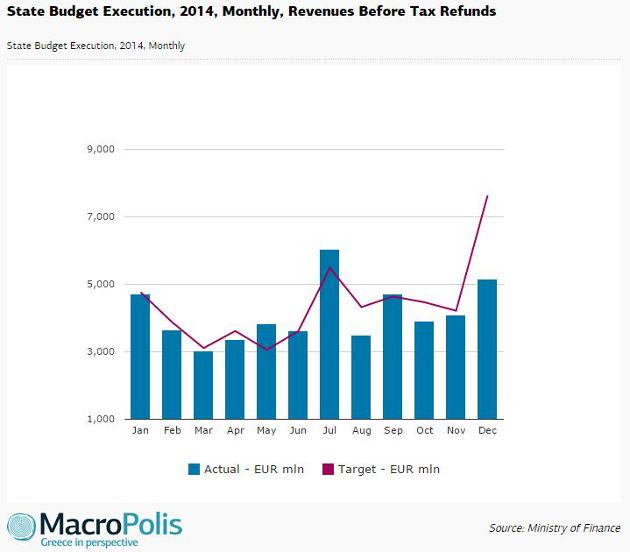

In unretracted Greek news, tax revenues crash 80% Y/Y as Greeks stop paying their taxes http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_14/01/2015_546219 …

Chart: WTI crude futures give up most of yesterday's & last night's gains -

The cult of the bond is alive and kicking. 30-Year U.S. bond yield closes at record low for 2nd day.

#Greece's Bank Runs Have Begun: 2 Greek Banks Request Emergency Liquidity Assistance (ELA). http://www.zerohedge.com/news/2015-01-15/greek-bank-runs-have-begun-two-greek-banks-request-emergency-liquidity-assistance …

Early Morning Tweets....

UBS' Take On The Swiss Shocker: "The SNB's Standing Is Undermined... There Could Be A Significant Deflationary ... http://www.zerohedge.com/news/2015-01-15/ubs-take-swiss-shocker-snbs-standing-undermined-there-could-be-significant-deflation …

UBS says EURCHF rebounded above 1.00 due to SNB interventions. So the SNB basically just bought EVEN MORE EURCHF today

Edward Harrison retweeted

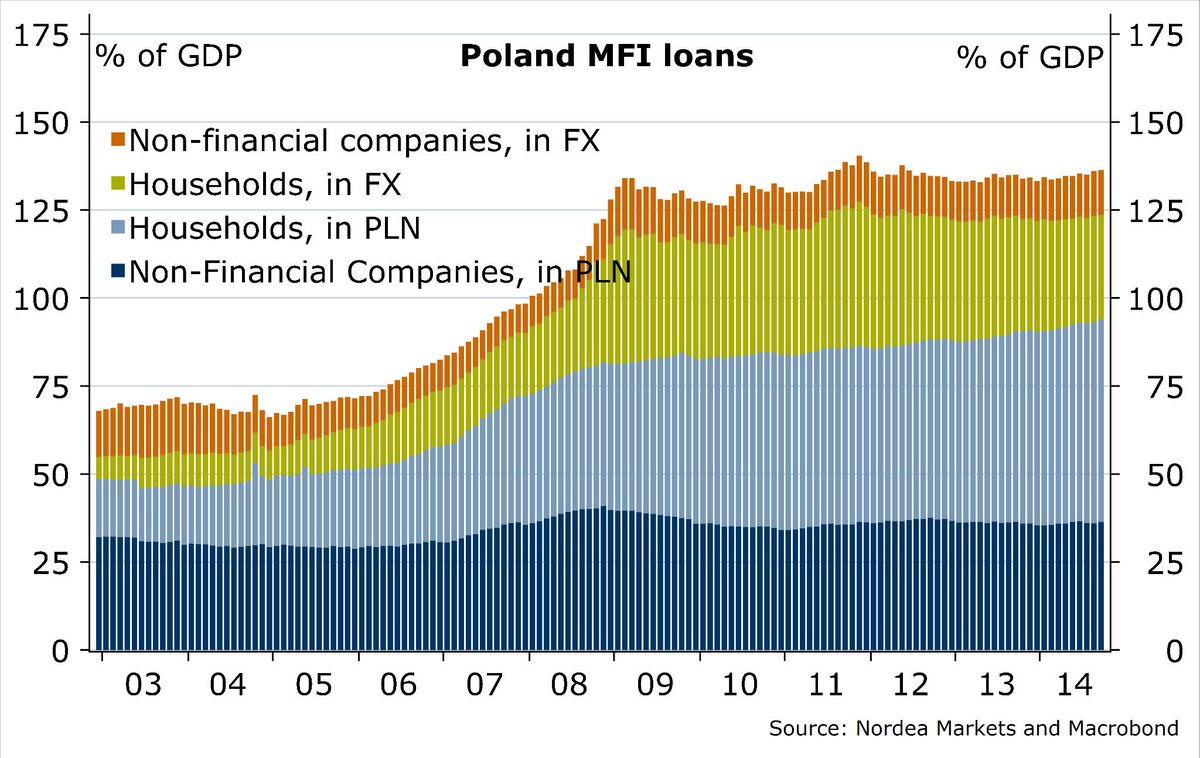

Polish loans in foreign currency has fallen but is still sizeable. Most in CHF, but not all

SNB governor Jordan says shock franc move "was not a panic reaction, it was a well-considered decision". http://on.ft.com/1INtAfA

JORDAN: EXPECTED BIG MARKET MOVEMENT IN REACTION TO CAP EXIT. That's reassuring for all the hedge funds who have to liquidate today

"A major buyer of the Euro leave the building and opens the way for further/faster EUR weakness.” - @kitjuckes (ht @Schuldensuehner )

For 1st time in yrs, a Greek bank did not participate in T-bill auction yday. Bank of #Greece had to intervene to save auction ~@euro2day_gr

#Russia keeps bleeding: Reserves hit lowest since May2009. Gold, FX Reserves down by $2.3bn to $386.2bn as of Jan9.

Sasha Borovik: #Ukraine should consider default http://www.kyivpost.com/opinion/op-ed/sasha-borovik-ukraine-should-consider-default-377460.html …

First margin call casualty? BOFA HEAD OF FUTURES, OPTIONS UNIT PETER JOHNSON SAID TO RESIGN

Market Wrap: "It's Turmoil" - Overnight Gains Wiped Out, Futures Trade Below 2000 On SNB "Shock And Awe" http://www.zerohedge.com/news/2015-01-15/market-wrap-its-turmoil-overnight-gains-wiped-out-futures-trade-below-2000-snb-shock …

Edward Harrison retweeted

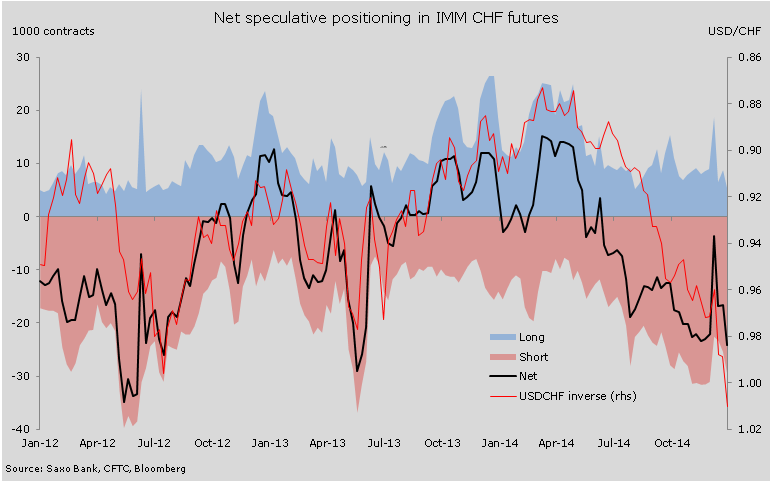

Oh dear RT @Ole_S_Hansen: Hedge funds were short 3.1 billion Swiss francs through IMM futures as of Januar 6.

FTW - EU Calls on Gazprom to Stay Engaged in Europe. But why, the ECB can just print heat and electricity

This is just the first step in unwinding years of central planning and trillions in capital misallocations.

And took many smaller hedge funds with it RT @fxmacro: SNB the biggest hedge fund in history just blew up...

SMI -13%

Financial tsunami: Swiss govt bond yields out to 9years now negative. 10yr Swiss yield at 0.038%

Euro tumbles as Swiss central bank abandons cap – business live http://trib.al/ouc0YaT

NY GOLD FUTURES RISE 1.7% TO $1,256/OZ; TOUCHES 200-DMA

WOW! "@ReutersJamie: All Swiss government bill and bond yields out to 7 years are negative: "

"The central bank didn't prepare the market for it. It's sparking panic across all asset classes." - Akexandre Baradez, IG France

Russian government to cut #budget by 10% due to #oil price fall http://openeurope.org.uk/daily-shakeup/ecj-opinion-ecb-bond-buying-bad-day-eurozone-taxpayers/#section-7 … #Russia

"Major losses in EURCHF trades are causing panic selling and deleveraging across the board." - Lex van Dam, Hampstead Capital

"They’ve stopped defending the 1.20 floor. It’s carnage." Darren Courtney-Cook, head of trading at Ctrl Markets Invst management

Finnish PM rules out write downs on loans to #Greece http://openeurope.org.uk/daily-shakeup/ecj-opinion-ecb-bond-buying-bad-day-eurozone-taxpayers/#section-4 … #Stubb

Total chaos: EUROPEAN STOCKS REBOUND; STOXX 600 RALLIES 3.9%

Swiss franc rockets almost 30% as currency ceiling scrapped http://on.ft.com/1C3vokr An absolute monster move...

#Euro in free fall vs Franc after SNB has ended minimum exchange rate. Drops 23%, below parity.

morning

That was fun: BRENT CRUDE EXTENDS DROP, FALLING AS MUCH AS 3.3% TO $47.07

BOOM: SNB SWISS NATIONAL BANK DISCONTINUES MINIMUM EXCHANGE RATE, SNB LOWERS INTEREST RATE TO –0.75%

Robin Wigglesworth retweeted

Anyone long EURCHF, it's been swell...

The SNB just blew up countless macro hedge funds

#Germany GDP grows at 1.5%, strongest rate in three years http://on.ft.com/1C3pa4f /via @fastFT #euro

'Why Draghi will watch #Greece as he launches eurozone QE' http://on.ft.com/1sBnhd0 /by @RalphAtkins /via @FT

#Germany should leave #Euro after ECJ backed ECB's bond buying program, says AfD’s Henkel. Means german govt has lost control over spending.

Brent has even dropped in Ruble terms: The new problem #Russia's Putin has as Ruble rout eases http://bloom.bg/1541y2G

#India shares rally on surprise RBI rate cut. S&P Sensex up 1.7%. Rupee weakens 0.5% vs Dollar http://bloom.bg/1554k7O

Greece gov. revenues below budget - RT @NickMalkoutzis: ...3.2 bln short of 2014

target. Welcome gift for new gov't

target. Welcome gift for new gov't

Tax revenues dry up as polls near http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_14/01/2015_546219 … #greece

Tourism losses will dwarf state collections from a VAT hike on hotel services http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_14/01/2015_546220 … #greece

More negative inflation: Spain Dec. Harmonized CPI -1.1% Y/y; Prel. -1.1% Y/y.

Austrian Budget Has ‘Big Problems,’ Finance Minister Tells News:BBG

There go durable goods: AIR FRANCE TO DELAY BOEING 777 DELIVERIES TO CUT COSTS: ECHOS

"Russian Buyer Is A Thing Of The Past" - Oligarchs Rush To Sell US Real Estate http://www.zerohedge.com/news/2015-01-14/russian-buyer-thing-past-oligarchs-rush-sell-us-real-estate …

Russia Cuts Off Ukraine Gas Supply To 6 European Countries http://www.zerohedge.com/news/2015-01-14/russia-cuts-ukraine-gas-supply-6-european-countries …

Goldman Sachs Warn Oil Prices May "Undershoot" $39 http://www.zerohedge.com/news/2015-01-14/goldman-sachs-warn-oil-prices-may-undershoot-39 …

Surprise!! Japanese Stocks Surge After Machinery Orders Crash 14.6% - Worst In 5 Years http://www.zerohedge.com/news/2015-01-14/surprise-japanese-stocks-surge-after-machinery-orders-crash-146-worst-5-years …

zerohedge

zerohedge  Anders Svendsen

Anders Svendsen

Robin Wigglesworth

Robin Wigglesworth  Edward Harrison

Edward Harrison  Yannis Koutsomitis

Yannis Koutsomitis

Scott Barlow

Scott Barlow

Open Europe

Open Europe

Credit Macro PM

Credit Macro PM

No comments:

Post a Comment