Tweets..... 1/13/15...

Tweets from 1/12/15.....

Excellent chart - energy is the new subprime; and who's got it? - @Eurofaultlines: Those safe haven banks in Canada

Swift Energy cuts 2015 Capex by 70-75%

Suncor Cuts Capex By $1 Billion, Fires 1000 As It Implements Hiring Freeze

GUNDLACH SAYS OIL PRICE DECLINE WILL LEAD TO COLLAPSE IN HIRING

Kyiv Post retweeted

Back to their old tricks? Scandal erupts as #Ukraine MPs claim state budget fiddled after vote http://www.kyivpost.com/content/kyiv-post-plus/scandal-erupts-as-parliamentarians-allege-manipulation-of-state-budget-377333.html …

Moody's has cut #Venezuela to Caa3, two notches above default. Markets already treat Caracas as if in default.

Moody's on #Venezuela: Default risk has increased substantially as finances deteriorate due to lower oil prices. https://www.moodys.com/research/Moodys-downgrades-Venezuelas-rating-to-Caa3-from-Caa1-outlook-stable--PR_315563 …

Futures Rebound, Ignore Continuing Crude Crash, 10 Year Under 1.9% http://www.zerohedge.com/news/2015-01-13/futures-rebound-ignore-continuing-crude-crash-10-year-under-19 …

French central banker Christian Noyer in favour of cap on upcoming ECB bond-buying: http://openeurope.org.uk/daily-shakeup/syriza-hits-greek-finance-ministry-intervention-election-debate/#section-5 …

#Inflation expectations in free fall: Infamous #Eurozone 5y5y forward inflation swap just hist fresh low below 1.5%.

What does Mr Market want to tell us? CRB commodity index drops to lowest level since 2009.

#Oil extends selloff on UAE minister’s comments. WTI below, Brent near $45/bbl. http://on.wsj.com/1Bg8uq5

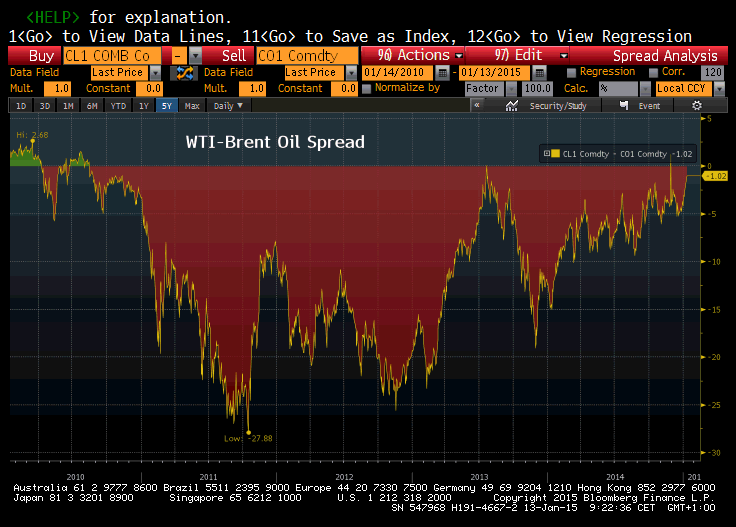

The new world #oil order: The oil premium of Brent crude over WTI has narrowed sharply to lowest level since Jul2013.

Tweets from 1/12/15.....

#BoomBust: @yanisvaroufakis on Ponzi #austerity and fiscal waterboarding in #Greece http://youtu.be/g9UFsBMFSAs @erinade

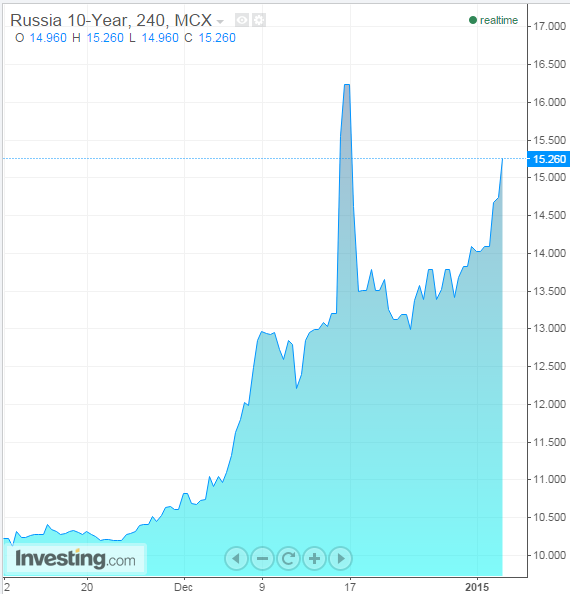

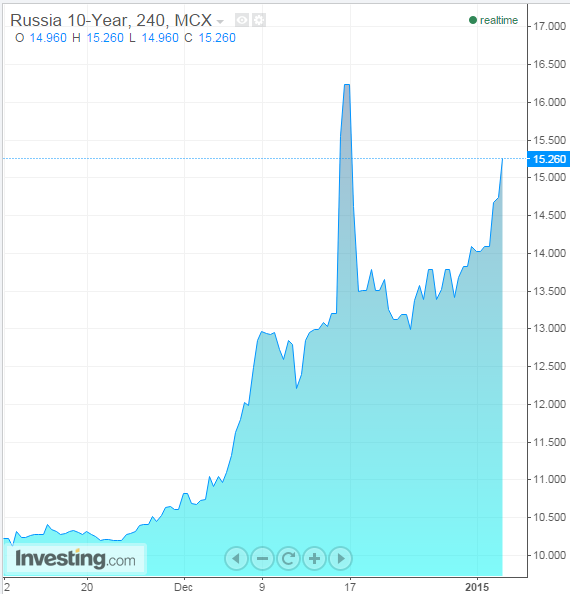

Chart: Russian 10yr government bond yield -

Chart: Russian 10yr government bond yield -

JAPAN'S FIVE-YEAR BOND YIELD DROPS BELOW ZERO FOR FIRST TIME

I

doubt there will be any decision on QE at ECB GC's Jan 22 meeting. Mar 3 mtng in Cyprus looks more likely to bear QE fruits.

#ECB's Nowotny says 'many things still in movement on QE discussion'. ← Jan 22 date for decision on QE starts to fade.

Germany's Sinn Blasts "Deflation Is Just A Pretext To Bailout Southern Europe" http://www.zerohedge.com/news/2015-01-12/germanys-sinn-blasts-deflation-just-pretext-bailout-southern-europe …

PIMCO’S SAUMIL PARIKH LEAVING THE FIRM, ACCORDING TO STATEMENT:BBG

Ukraine Default Risk Soars As Reserves Collapse 63% YoY http://www.zerohedge.com/news/2015-01-12/ukraine-default-risk-soars-reserves-collapse-63-yoy …

BLOOMBERG COMMODITY INDEX DROPS TO 12-YEAR LOW

NOYER SAYS OPEN TO KEEP QE-RISK ON NATL CEN BANKS BALANCE SHEET. And who will bail out national central banks?

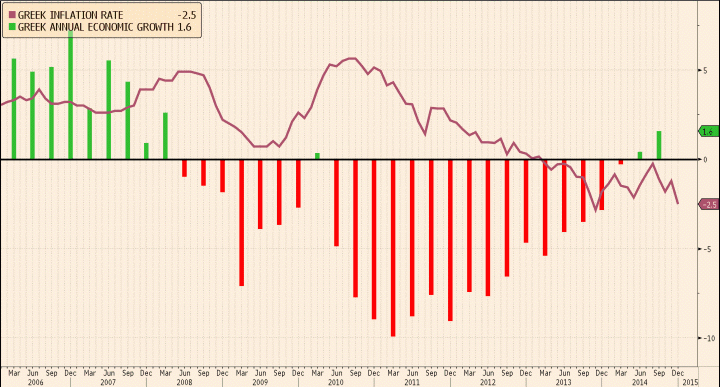

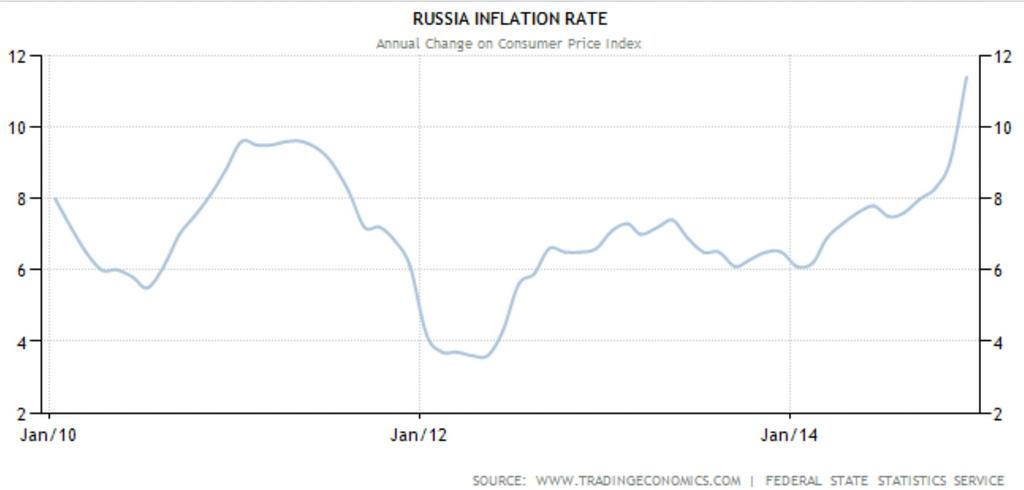

Chart: Russian inflation rate -

BNP Paribas reckons Russian banks will need Rb2.7tn ($45bn) to support lending and absorb loan losses, and Rb690bn ($11.5bn) for FX losses.

#Russia 5y default probability jumps above 34% as oil prices collapse.Energy products account for 50% of govt revenue

#Venezuela's default probability jumps >96% despite Maduro says securing financing from Qatar. http://reut.rs/1FMcG4V

#ECB's Nowotny says Greek exit from #Eurozone would be catastrophe for #Greece, Problem for other Eurozone members. #Grexit

The new world oil order: US crude drops below $46/bbl for first time since Apr2009.

No comments:

Post a Comment